Investing In Cryptocurrencies Training Module On Blockchain Technology Application Training Ppt

This PowerPoint training deck covers how to invest in cryptocurrencies. It contains PPT slides on understanding cryptocurrency markets, risks of investing in cryptocurrencies, and factors for evaluating the cryptocurrency market. The module also covers the concept of active trading day trading, position trading, swing trading, scalping and the factors determining a cryptocurrencys value. Further, it includes tips for investing in cryptocurrency, which are preparing for volatile markets, purchasing the dip, choosing a legitimate trading platform, beware of the risks associated with ALT coins, being wary of fraudsters, investing in more than one cryptocurrency, and start small and scale up. The PowerPoint deck also includes additional slides on about us, vision, mission, goal, 30-60-90 days plan, timeline, roadmap, training completion certificate, energizer activities, detailed client proposal, and training assessment form.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

Presenting Training Session on Investing in Cryptocurrencies. This deck contains 95 uniquely designed slides. Our PowerPoint experts have included all the necessary templates, designs, icons, graphs and other essential material. This deck is well crafted by extensive research. Slides consists of amazing visuals and appropriate content. These PPT slides can be instantly downloaded with just a click. Compatible with all screen types and monitors. Supports Google Slides. Premium Customer Support available. Suitable for use by managers, employees and organizations. These slides are easily customizable. You can edit the color, text, icon and font size to suit your requirement.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 4

This slide gives the ins and outs of the cryptocurrency market. The journey starts with understanding the relationship between market capitalization and circulation supply, to being prepared for volatility.

Slide 5

This slide highlights the difference between stocks and cryptocurrency. The stock market is slow, whereas the cryptocurrency market acts nearly ten times faster.

Slide 6

This slide states the risks of investing in cryptocurrencies. Cyberattacks on cryptocurrency exchanges are common. Thousands of blockchain initiatives compete for attention. With the entire concept in its nascent stage, regulators may also catch up with it; a potential danger to any kind on investment in cryptocurrencies.

Slide 7

This slide showcases that cryptocurrencies may be used to diversify company's investing portfolio. Use cryptocurrency payments to save on transaction costs besides other uses, such a collateral for loans etc.

Slide 8

This slide states factors to consider when evaluating cryptocurrency markets. Check for the most valuable currencies and be curious about what is the source for this value? Remember, cryptocurrency market is extremely volatile, and the currency value varies dramatically; drama is normal in the cryptocurrency world. Be wary of short-term enthusiasm or hype.

Slide 10

This slide describes that purchasing and selling assets based on short-term changes to profit from price movements on a short-term price graph is known as active trading. An active trading strategy requires a different mindset than a long-term, buy-and-hold approach that passive or indexing investors use.

Slide 11

This slide states that the most well-known popular active trading technique is day trading, and it's frequently used as an alias for aggressive trading. It is the practice of purchasing and selling securities on the same day.

Slide 12

This slide describes that some people regard position trading as a buy-and-hold technique rather than active trading. In the hands of an experienced trader, even position trading might be considered active trading.

Slide 13

This slide explains that swing trading seeks to capture short- to medium-term profits in stock (or other financial investments) over a few days to several weeks. Swing traders hunt for trading chances primarily through technical analysis.

Slide 14

This slide showcases that scalping is one of the most rapid tactics that active traders use. It comprises recognizing and exploiting bid-ask spreads that are somewhat larger or narrower than typical due to transient supply and demand mismatches.

Slide 16

This slide illustrates that even as cryptocurrencies are generally decentralized; their value is derived from sources, such as supply and demand, production costs, exchange availability, competition, governance, regulations, and the team & the community behind it.

Slide 17

This slide lists that the value of cryptocurrencies is determined by supply and demand. In its simple and most universal form. When demand exceeds supply, cryptocurrency increase in value.

Slide 18

This slide highlights that mining is the process through which new cryptocurrency tokens are created. Verifying the blockchain necessitates the use of computing power. To mine bitcoin, participants invest in pricey equipment and power. As mining expenses rise, the value of the cryptocurrency increases as well. Miners will not mine if the value of the money they are mining is insufficient to cover their costs.

Slide 19

This slide states that when a cryptocurrency gets listed on additional exchanges, it increases the number of investors ready and able to purchase it, raising demand. Everything else being equal, when demand rises, so will the price

Slide 20

This slide highlights that there are dozens of cryptocurrencies, with new projects and tokens being launched daily. The barrier to entry is low for “newbies”, but producing a sustainable cryptocurrency also requires growing a network of cryptocurrency users

Slide 21

This slide states that cryptocurrency networks seldom follow a rigid set of rules. Developers modify projects in response to the community that utilizes them. Some tokens, known as governance tokens, allow holders to vote on how a token is mined or used in the future. To make any modifications to the governance of a token, stakeholders must reach an agreement.

Slide 22

This slide explains how regulation is essential to facilitate cryptocurrency trading. ETFs and futures contracts provide investors broader access to cryptocurrencies, enhancing their value. Regulation may also allow investors to take short positions or gamble against the price of cryptocurrencies via futures contracts or options. This should result in improved price discovery and lower volatility in cryptocurrency prices.

Slide 23

This slide highlights that the reputation and experience of a project's team can substantially impact its success or failure. A red flag is if the team is not freely disclosed (bitcoin is the exception). You should also consider the team's previous expertise in the crypto sector and other projects they've worked on. Projects with well-regarded ceos or collaborations with established businesses are other signs of success.

Slide 24

This slide states that the community that supports the initiative determines many crypto projects' viability. The passion and the size of the community play a big part in the project's early and ongoing success, yet you should be cautious while evaluating a currency or token.

Slide 26

This slide lists tips for investing in cryptocurrency. These are: educate yourself, prepare for volatile markets, purchase the dip, choose a legitimate trading platform, secure your accounts, be aware of the risks associated with alt coins, avoid fomo, be wary of fraudsters, invest in more than one cryptocurrency and start small and scale your way up.

Slide 27

This slide states that to benefit from cryptocurrency investment, you must first understand what you are entering into. Blockchain technology powers bitcoin, the most valuable cryptocurrency, by market capitalization. The underlying technology here is blockchain, which has real-world applications.

Slide 28

This slide highlights that extreme volatility distinguishes the cryptocurrency market from other markets. Due to the rapid changes, cryptocurrency is a 'high-risk, high-reward market. In May 2021, the value of bitcoin fell about 30% in a single day. As an investor, you must be prepared for both pump and dump scenarios. Focus on cryptos with solid fundamentals to avoid confusion based on the eye-popping volatility that marks these markets.

Slide 29

This slide describes that purchasing the dip is critical to increasing your profits. Avoid investing in cryptocurrencies that are already on the rise. Put some money in once and concentrate on DCA (dollar-cost averaging) when the price falls further. DCA is a straightforward investing method in which the total money invested is divided over multiple entry points.

Slide 30

This slide states that cryptocurrency exchange is a platform for buying and selling cryptocurrencies. The industry is inundated with crypto exchanges claiming to deliver the best services. Determining the authenticity of a trading platform is critical. Visit their website, look at their team structure, and double-check the information on the internet. Check the exchange's trade volume as well.

Instructor notes:

Some of the most trustworthy and extensively used exchanges include BINANCE (28.5m+ users), FTX (10b+ daily trading volume), HUBOI (running in 170+ countries), KUCOIN (10m+ users, 207+ countries), and WAZIRX (10m+ users, India-based, supported by BINANCE).

Slide 31

This slide highlights that you are responsible for protecting your money when you join any crypto exchange. Enabling 2fa will help secure your account. Never give anybody your private keys, or verification code. Stay away from signing in to your account from a public network, such as an office or a hotel.

Slide 32

This slide describes that there are 10,000-odd cryptocurrencies in circulation, but only a few have real-world applications and a considerable trading volume. For a start, you should concentrate on token utility, real-world acceptance, large trading volume, and consistent growth over time.

Slide 33

This slide highlights that fomo is an abbreviation for "fear of missing out." the cryptocurrency market is packed with chances, and unexpected price increases are common. Instead of following every pumping token, concentrate on some solid investing prospects. Keep a safe distance from people forecasting the future of tokens.

Slide 34

This slide highlights that scammers are constantly looking for opportunities to steal investors of their investments. Be wary of false airdrops, pump and dump scams, and indications from social media handles. Scammers have also taken to setting up fake websites to defraud investors.

Slide 35

This slide lists that it is not good to put all of your money into a single digital currency. Even if you a bit in some of your cryptocurrencies, you may still profit from the others. A well-diversified portfolio is less risky.

Slide 36

This slide states that many individuals believe that investing in crypto can quickly make you wealthy. This is not true; there is always a plan and a learning curve involved. There should be no fomo (fear of missing out).

Slide 50 to 64

These slides depict energizer activities to engage the audience of the training session.

Slide 66 to 92

These slides showcase the client training proposal covering details regarding what the company providing corporate training can accomplish for the client.

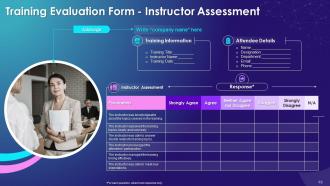

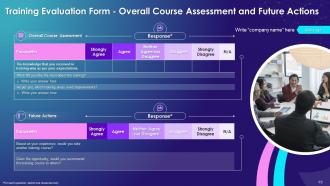

Slide 93 to 95

These slides highlight the training evaluation form for instructor, content, and course assessment.

Investing In Cryptocurrencies Training Module On Blockchain Technology Application Training Ppt with all 100 slides:

Use our Investing In Cryptocurrencies Training Module On Blockchain Technology Application Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Graphics are very appealing to eyes.

-

Really like the color and design of the presentation.