Key Cryptocurrencies To Know Training Module On Blockchain Technology Application Training Ppt

This PPT training module in-depth covers the multiple types of cryptocurrencies Bitcoin, Ethereum, Litecoin, Monero, Ripple, Dash, Solana, Neo, Stellar, Tether, Cardano, Zcash, Dogecoin, Vechain, and Binance. The PowerPoint deck also contains discussion questions and MCQs related to the topic to make the training session interactive. It also includes additional slides on about us, vision, mission, goal, 30-60-90 days plan, timeline, roadmap, training completion certificate, energizer activities, detailed client proposal, and training assessment form.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

Presenting Training Session on Key Cryptocurrencies to Know . This deck comprises of 118 slides. Each slide is well crafted and designed by our PowerPoint experts. This PPT presentation is thoroughly researched by the experts and every slide consists of an appropriate content. All slides are customizable. You can add or delete the content as per your need. Not just this, you can also make the required changes in the charts and graphs. Download this professionally designed business presentation, add your content and present it with confidence.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 4

This slide states that Bitcoin is a cryptocurrency, or virtual currency, that acts as money and a payment method independent of any one person, organization, or entity, thus eliminating the need for third-party involvement in financial transactions.

Slide 5

This slide is a primer on the history of bitcoin, a global cryptocurrency today. We trace it to Satoshi Nakamoto inventing it in 2008 to its ascendance as the major talking point in financial services market. Overtime, its use has gained currency.

Slide 6

This slide showcases statistics related to bitcoin. Satoshi Nakamoto is the pseudonym of the mysterious person or individuals who invented the bitcoin.

Slide 7

This slide lists four important steps for buying bitcoin. This starts with choosing a cryptocurrency exchange; deciding on a payment option. Then, you place your order, and finally storing your purchased bitcoins.

Slide 8

This slide lists multiple steps involved in selling bitcoin. Starting from the seller giving the buyer an address to the transaction being broadcast over the entire bitcoin network.

Slide 9

This slide states advantages of using bitcoin: Bitcoin transactions are peer-to-peer, anonymous, cannot be reversed, safe and secure, and much more.

Slide 10

This slide describes that while bitcoin technology is primarily safe, there are concerns one should know about before investing. Bitcoin is not anonymous, its prices may be volatile, its extreme dependence on password is inconvenient, and cryptocurrency wallets are vulnerable to theft.

Slide 11

This slide states the carbon footprint resulting from power plants producing the electricity needed to mine a single bitcoin is emerging as a major environmental concern. A single bitcoin transaction consumes 2,292.5 kilowatt-hours of electricity; this can run an average US household for over 78 days.

Slide 12

This slide lists the real-world use cases of bitcoin, such as purchasing items, financial services, online trading and medium of exchange.

Instructor Notes:

- Purchasing Items: Bitcoins may be used to buy practically anything and everything (products or services) in the real world, from real estate to fast food. Several firms, like Subway, Microsoft, and Starbucks, accept bitcoins

- Financial Services: Cryptocurrencies may also be used as wallets to store and track money in many currencies. Aside from keeping money, bitcoin may be used to track financial activities and, ensure compliance and lower the risk of fraud or theft

- Online Trading: Online trading platforms allow you to purchase or sell bitcoins, trade these for any denomination, and exchange it for other cryptocurrencies. Investing in bitcoin may be viewed as a great chance to boost the investor's or company's returns

Slide 14

This slide states that Ethereum is a worldwide decentralized software platform based on blockchain technology. It is well known for its native cryptocurrency, Ether, abbreviated as ETH.

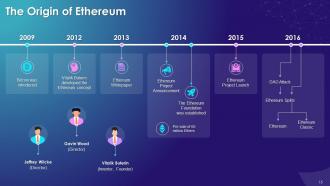

Slide 15

This slide lists that in 2012, Vitalik Buterin developed the Ethereum concept, and in 2015 the Ethereum project was launched. In 2016, a Decentralized Autonomous Organization (DAO) attack was launched on Ethereum, and it was split into Ethereum and Ethereum Classic.

Slide 16

This slide lists how Ethereum works—starting from a developer constructing a decentralized application on the Ethereum blockchain to a new block being added to the blockchain and a miner fee being awarded to the winning miner.

Slide 17

This slide describes benefits of Ethereum, such as: autonomy, transparency, backup, savings, and accuracy.

Slide 18

This slide describes how to get started with Ethereum. As the first step, create an Ethereum wallet and transfer funds to it. Then you can either purchase or sell ether, or use it for smart contracts

Slide 19

This slide lists who all can make use of ether. Developers planning to create decentralized applications on the Ethereum blockchain, investors and traders, and Users who want to view and interact with smart contracts on the Ethereum network are willing to be the major stakeholders.

Slide 20

This slide differentiates between Bitcoin and Ethereum. Bitcoin is the first decentralized cryptocurrency founded in 2009 by an anonymous individual known as Satoshi Nakamoto, whereas Ethereum was developed by Vitalik Buterin, a cryptocurrency analyst and programmer, in 2015.

Slide 21

This slide lists the comparison between Bitcoin and Ethereum. Bitcoin has a Proof-of-Work (PoW) consensus algorithm, whereas Ethereum has a Proof-of-Stake (PoS) consensus algorithm. In PoS, block validators do not earn block rewards; instead, they collect network fees, known as gas, as their reward.

Slide 23

This slide introduces one of the key cryptocurrencies, Litecoin. Litecoin is a cryptocurrency founded in 2011 from a fork in the Bitcoin blockchain. It was created to address developers' concerns that Bitcoin was becoming too centralized. Litecoin was designed to make it more difficult for large-scale mining companies to obtain an advantage in mining.

Slide 24

This slide talks about the maximum supply of Litecoin. It was launched with 150 pre-mined coins and has a 84 million cap on coin supply. Every 2.5 minutes, a new block is generated on the cryptocurrency's blockchain. The litecoin supply is intended to decrease over time to maintain its value.

Slide 25

This slide highlights the difference between Litecoin and Bitcoin. Bitcoin's supply is limited to 21 million coins, while Litecoin's is 84 million. To produce coins, Bitcoin utilizes SHA-256, while Litecoin uses a modified version of Scrypt.

Instructor’s Notes:

With fewer rounds of transaction verification, transaction processing speed can come at the expense of security. Small merchants who do not want or require their transactions to be very secure would appreciate litecoin's 2.5-minute confirmation time (as opposed to bitcoin's around 10-minute confirmation period).

Slide 26

This slide gives an overview of one of the key cryptocurrencies, Monero. Monero is an open-source, privacy-focused cryptocurrency that debuted in 2014. Its blockchain is opaque, which lends anonymity to transaction information and amounts by masking users' addresses.

Slide 27

This slide highlights the difference between Monero and Bitcoin. BTC presently has a circulating quantity of roughly 19.03 million coins, which means there are around 1.97 million more to be discovered. In contrast, Monero has over 18.1 million tokens in circulation and has almost reached its entire supply, but it has no maximum supply limit.

Instructor Notes:

Monero features an untraceable transaction history, providing members with a safer network in which they do not fear anybody, or any authority, refusing to accept or banning their stored coins.

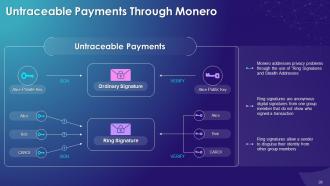

Slide 28

This slide states that Monero addresses privacy concerns through the use of “Ring Signatures and Stealth Addresses”. Ring signatures allow a sender to disguise their identity from other group members. Ring signatures are anonymous digital signatures from one group member that do not show who signed a transaction.

Instructor Notes:

The Monero platform generates a ring signature by combining a sender's account keys with public keys on the blockchain. This makes it both distinctive and private. It conceals the sender's identity since it is computationally infeasible to determine which group members' keys were used to generate the complicated signature.

Slide 29

This slide gives an overview of one of the key cryptocurrencies, Ripple. Ripple is a blockchain-based digital payment network and system that produces its cryptocurrency, XRP. Chris Larsen and Jed McCaleb co-founded it, and launched it in 2012. Ripple transactions use lower energy than bitcoin transactions, are confirmed in seconds. It also has extremely low transaction costs.

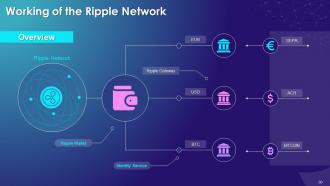

Slide 30

This slide states that the Ripple Network may be used to transfer ANY currency or asset that Ripple gateways accept. The Ripple system's native currency is XRP.

Slide 31

This slide highlights the difference between Ripple and Bitcoin. Bitcoin transaction verifications can take many minutes and are linked with significant transaction charges due to the intricate and expensive mining process. XRP transactions are often verified in seconds and at extremely low prices.

Slide 33

This slide gives an overview of one of the key cryptocurrencies, Dash. Dash, a 2014 cryptocurrency, was originally known as Xcoin. After being reintroduced as Darkcoin in March 2015, it was renamed Dash. When launched the first time, it was supposed to safeguard users' privacy and anonymity.

Instructor Notes:

A subset of its users, known as 'masternodes', administer Dash. Every masternode has a starting stake of 1,000 DASH in their systems.

Slide 34

This slide highlights the difference between Dash and Bitcoin. The cost of transactions is one significant distinction between Dash and Bitcoin. Bitcoin transaction fees vary depending on several parameters, including block size and time of the day. Dash transaction costs are substantially smaller – generally in cents rather than dollars.

Slide 35

This slide gives an overview of one of the key cryptocurrencies, Solana. Solana is a blockchain platform for hosting decentralized smart contracts and scalable apps. Solana can execute more transactions per second and has far lower transaction costs than competitors like Ethereum.

Slide 36

This slide highlights the difference between Solana and Ethereum.

Instructor Notes:

- Higher TPS (Transactions Per Second): Solana easily outperforms Ethereum in transactions per second (TPS). The Ethereum network is very busy, and it takes 10-15 seconds to process a single transaction (mine a block) and can handle 15-45 transactions per second. Solana, however, is focused on speed, requiring only 400 milliseconds to mine a block. It has a capacity of 50,000 TPS and can scale up to 65,000 TPS.

- Lower Transaction Fees: Every transaction has a price paid to the machines that process it, and this charge changes depending on the blockchain. Solana is significantly less expensive than Ethereum, with an average transaction cost of $0.00025. The gas fees for Ethereum varies greatly, and it ranges from a few pennies to over $100. And this is only for basic transactions. There is no upper limit while using a smart contract

- Doesn't Have a Mempool Issue: A mempool is a waiting space where a completed transaction awaits for the blockchain to accept it. Solana's main benefit over Ethereum is that there is no waiting period between executing a transaction and uploading it to the blockchain. Essentially, it lacks a mempool. Instead, transactions are accepted instantly; one transaction on Ethereum takes roughly four minutes to be validated and approved

- Solana is simpler to program: Ethereum is powered by Solidity, a program designed exclusively for Ethereum. Solana is powered by Rust, a popular programming language. Rust, which is easier to use and more familiar, can develop many applications, including games and blockchains. This makes Solana a more flexible platform for creating apps than Ethereum, resulting in exponential development of the Solana ecosystem

- Faster-growing ecosystem: Ethereum remains the preferred platform for developing and hosting decentralized apps (DApps) and implementing smart contracts, it faces several hurdles in cost, performance, and other factors. Solana does not face these issues (yet!) and is hosting a growing array of DApps and smart contracts. Solana may be able to support more currencies than Ethereum. Solana's ecosystem will, someday, outnumber Ethereum's in terms of both diversity and size at the present rate of growth

- Solana consumes less bandwidth and is more robust: All blockchains face the same problem: how to distribute data inside the network. Consider a blockchain with 10,000 linked computers. When a block is mined, the information must be independently shared 10,000 times with all machines. This causes bandwidth issues, slowing down the blockchain. Solana tackles this problem with the Turbine protocol, which divides each block into distinct packets, sends each packet to a group of computers, which retransmits the data to the next group, etc. This spreads the load to result in lower bandwidth consumption, shorter processing times, and a more durable network that resists outages

- Solana is more environment-friendly: The technique of mining Ethereum blocks is known as Proof of Work (PoW), and it requires a lot of computational power and uses a lot of electricity. Ethereum consumes more energy each year than countries like Belgium, contributing to global warming. Solana employs Proof of Stake (PoS) and Proof of History (PoH) algorithms, which consume 99.9% less energy than PoW. Solana is just better for the environment, making it a far more tempting option for its users and environmental groups

Slide 37

This slide gives an overview of one of the key cryptocurrencies, NEO. NEO's goal is to employ smart contracts to automate the administration of digital assets leading to the creation of a distributed network-based smart economy system.

Slide 38

This slide gives an overview of one of the key cryptocurrencies, Stellar. It is a blockchain-based distributed ledger network that connects banks, payment systems, and individuals to support low-cost, cross-asset value transfers, including payments.

Slide 39

This slide gives an overview of one of the key cryptocurrencies, Tether. It is a stablecoin or cryptocurrency with a fixed value. Tether is the choice of investors who wish to avoid the volatility of cryptocurrencies while keeping their money within the cryptosystem.

Slide 40

This slide lists the use cases of Tether. Cryptocurrency trading combinations priced in USDT and other stable coins currently outweigh those priced in US dollars. Tether's three most typical use cases are cross-border payments, trading and lending.

Slide 41

This slide states the unique features of Tether that makes it special. Stablecoins help traders and investors reduce the risks associated with the extreme volatility expected in cryptocurrency markets. A trader can reduce their exposure to a fast decline in cryptocurrency prices by converting the value to USDT.

Slide 42

This slide gives an overview of one of the key cryptocurrencies, Cardano (ADA). Cardano is a blockchain medium featuring a multi-asset ledger and verifiable smart contracts, which plans to be a decentralized application (DApp) development platform. Cardano's principal cryptocurrency is known as "ADA."

Slide 43

This slide highlights the difference between Cardano and Bitcoin. Cardano claims to process at least 257 transactions per second, compared to Bitcoin's 5 TPS. This is already rather remarkable, but a new scaling solution known as Hydra 2 promises to considerably boost Cardano's transaction processing speed to over one million transactions per second.

Slide 45

This slide gives an overview of one of the key cryptocurrencies, ZCash. ZCash is a Bitcoin fork that uses a different hashing algorithm and security procedures than Bitcoin. ZCash validates currency ownership and transactions more anonymously than bitcoin, giving users with more privacy.

Slide 46

This slide talks about the maximum supply of ZCash. The maximum quantity of ZCash coins is 21 million, with 12 million circulating as on June 2021. Once there are 21 million ZCash in circulation, no more can be mined, and they could only be obtained through an exchange.

Slide 47

This slide highlights the difference between ZCash and Bitcoin. Bitcoin employs the SHA-256 hashing algorithm, and ZCash uses Equihash, which is incompatible with Bitcoin mining gear and software. It also features larger blocks and faster hashing times, which enhances the network's hash rate.

Slide 48

This slide gives an overview of one of the key cryptocurrencies, Dogecoin. Dogecoin, an open-source cryptocurrency, was founded in 2013 by Jackson Palmer and Billy Markus. Dogecoin originated as a joke based on a popular meme depicting a Shiba Inu (a Japanese dog breed). It is based on litecoin and employs the same proof-of-work algorithm.

Slide 49

This slide lists multiple interesting facts about Dogecoin (DOGE). Dogecoin's price is impacted by the same variables that affect the broader cryptocurrency market. Changes in regulatory frameworks, an increase in the number of merchants accepting cryptocurrencies as payment for goods, and demand for a cryptocurrency influence its value.

Slide 50

This slide gives multiple advantages and disadvantages of Dogecoin (DOGE). Dogecoin's benefits include faster confirmation of completed transactions, low transaction cost, a dedicated and amicable community of creators and fans, etc. In disadvantages, its mining is unprofitable since its value is low and involves a large number of coins; its functionality is also limited with no smart contracts on offer.

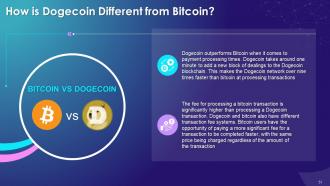

Slide 51

This slide highlights the difference between Dogecoin and Bitcoin. The fee for processing a bitcoin transaction is significantly higher than processing a Dogecoin transaction. Dogecoin and Bitcoin also have different transaction fee systems. Bitcoin users have the opportunity of paying a more significant fee for a transaction to be completed faster, with the same price being charged regardless of the amount of the transaction.

Instructor Notes:

Bitcoin was designed as a "purely peer-to-peer version of electronic cash" that permits financial transactions without a middleman or centralized administration. Dogecoin is the "fun and friendly online money" that is "liked by Shiba Inus worldwide."

Slide 52

This slide gives an overview of one of the key cryptocurrencies, VeChain. VeChain was founded in 2015 by Sunny Lu, the former chief information officer (CIO) of Louis Vuitton China. VeChain is an enterprise blockchain platform that seeks to remove information silos to enable stakeholders to gain a comprehensive perspective about a business. Vechain's primary target is to disrupt the supply chain industry by making data actionable and transparent.

Slide 53

This slide gives an overview of one of the key cryptocurrencies, Binance Coin (BNB). Binance Coin is a cryptocurrency that the Binance Exchnage has introduced; it trades under the BNB symbol. BNB was originally built on the Ethereum network but is now the native cryptocurrency of Binance's blockchain, the Binance chain. Binance spends one-fifth of its revenues each quarter to repurchase and permanently destroy, or "burn," Binance tokens held in its treasury.

Slide 54

This slide states that Binance Coin has multiple use cases outside of the Binance exchange, including the power to pay with a credit card, make travel bookings (on select websites), purchase virtual presents, process payments, etc.

Slide 73 to 87

These slides depict energizer activities to engage the audience of the training session.

Slide 89 to 115

These slides include training proposal highlighting what the company providing corporate training can accomplish for the client.

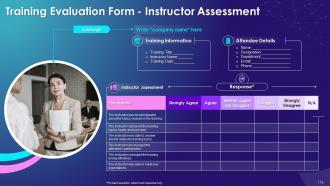

Slide 116 to 118

These slides contain the training evaluation form for instructor, content, and course assessment.

Key Cryptocurrencies To Know Training Module On Blockchain Technology Application Training Ppt with all 123 slides:

Use our Key Cryptocurrencies To Know Training Module On Blockchain Technology Application Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Keep doing the good work guys. Surpass the needs and expectations always!!

-

The designs by SlideTeam are honestly the best I have seen so far. Will be definitely coming back for more.