Syndicated Loans With Blockchain Technology Training Ppt

These slides provide information about the problems of the current state of the syndicated loan issuance procedure,such as the time consuming,the danger of default,and costly intermediaries. It also covers the benefits of blockchain-based future state processes,such as embedded controllers,reduced closure time,and decreased counterparty risk.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

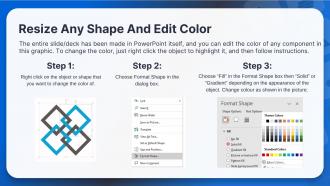

Presenting Syndicated Loans with Blockchain Technology. These slides are 100 percent made in PowerPoint and are compatible with all screen types and monitors. They also support Google Slides. Premium Customer Support is available. Suitable for use by managers,employees,and organizations. These slides are easily customizable. You can edit the color,text,icon,and font size to suit your requirements.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1

This slide demonstrates provides an overview of syndicated loan as a blockchain application in finance. Syndicated loans enable clients to get large-scale, diverse funding at current market rates. These loans are funded by a group of investors (a Syndicate), with one investor acting as the lead arranger.

Slide 2

This slide depicts the present condition of the syndicate loan procedure. We go through the six steps which start with a company seeking a loan from a financial institution and culminates at a lead arranger assuming administrative responsibility during the loan lifespan.

Slide 3

This slide lists the issues with the present state of syndicated loan.

Instructor Notes:

- Time-consuming procedure: Selecting syndicate members based on financial health and industry experience is time-consuming and inefficient due to the manual assessment procedure

- Inadequate integration of technologies: Team members use tools and data sources, which adds time and increases the possibility of mistakes

- Labor-intensive process: Documenting syndicate member pledges is labor-intensive and inefficient , with manual processes a huge pain-point

- Inefficient money distribution: The lead arranger facilitates principal and interest disbursement, incurring additional fees for investors

- Danger of default: Throughout the loan lifespan, the lead arranger lives under the fear of loan default

- Delayed settlement time: Payments settle in transaction date plus three days, delaying investors' access to funds

- Costly intermediaries: Third-party companies make servicing operations more accessible but at a higher cost to investors

- Siloed systems: Systems of all lenders do not interact, leading to duplication of activities

Slide 4

This slide illustrates how blockchain technology can overcome the current syndicate loan process — starting from a corporation seeking a loan from a FI serving as the lead arranger to embedding regulation. This makes it easier to check financial records to ensure anti-money laundering measures are followed correctly.

Slide 5

This slide expands upon the benefits of blockchain technology implementation in syndicated loan.

Instructor Notes:

- The formation of syndicates is automated: Syndicate creation is automated using programmable selection criteria within a smart contract, shortening the time it takes for a corporation’s loan to be financed

- Embedded controller: Regulators are supplied real-time financial facts throughout the syndicated loan lifecycle to enable Anti-Money Laundering (AML)/ Know Your Customer (KYC) actions

- Due diligence and underwriting automation: Corporation’s financial data assessment and risk screening are automated, lowering execution time and the number of resources necessary to accomplish these tasks

- Integration of technology: Due diligence systems provide relevant financial information to underwriting systems, optimizing process execution and lowering the time taken for the underwriting process

- Reduces closure time: Loan money is made available in real-time, eliminating the need for traditional settlement and centralized lead arranger processes

- Disintermediation of services: Smart contracts are utilized to carry out pre-fed actions, removing the requirement for third-party intermediaries

- Decreased counterparty risk: The disbursement of principal and interest payments is automated throughout the lifespan, eliminating operational risk.

Syndicated Loans With Blockchain Technology Training Ppt with all 21 slides:

Use our Syndicated Loans With Blockchain Technology Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

SlideTeam is very efficient when it comes to saving time. I am happy that I chose them for my presentation.

-

I’ve been your client for a few years now. Couldn’t be more than happy after using your templates. Thank you!