Powerpoint Templates and Google slides for Merging

Save Your Time and attract your audience with our fully editable PPT Templates and Slides.

-

Advantages And Disadvantages Of Forward Merger And Acquisition For Horizontal Strategy SS V

Advantages And Disadvantages Of Forward Merger And Acquisition For Horizontal Strategy SS VThis slide showcases advantages and disadvantages of integrating business using forward vertical integration strategy. Its key advantages are limiting competitors, reduced uncertainty, independent distribution and disadvantages are higher costs, increased workload and bureaucratic inefficiencies. Introducing Advantages And Disadvantages Of Forward Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with two stages, this template is a great option to educate and entice your audience. Dispence information on Competitors, Uncertainty, Inefficiencies, using this template. Grab it now to reap its full benefits.

-

Agenda For Merger And Acquisition For Horizontal Integration Strategy SS V

Agenda For Merger And Acquisition For Horizontal Integration Strategy SS VIncrease audience engagement and knowledge by dispensing information using Agenda For Merger And Acquisition For Horizontal Integration Strategy SS V. This template helps you present information on four stages. You can also present information on Executing, Strategies, Horizontal using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Analyzing Different Type Of Vertical Integration Merger And Acquisition For Horizontal Strategy SS V

Analyzing Different Type Of Vertical Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases different types of business integration strategies that can be implemented by organization for market expansion and increase the profits. Different types of integration are backward, forward and balanced vertical integration Introducing Analyzing Different Type Of Vertical Integration Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Integration, Vertical, Purpose, using this template. Grab it now to reap its full benefits.

-

Analyzing Reasons For Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS V

Analyzing Reasons For Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS VThis slide showcases different reasons that results in failure of merger and acquisition strategy. Reasons are insufficient due diligence, lack of management involvement, poor integration process, overestimating synergies and valuation mistakes Increase audience engagement and knowledge by dispensing information using Analyzing Reasons For Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on five stages. You can also present information on Diligence, Management, Process using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Best Practices For Communication During Merger And Acquisition For Horizontal Strategy SS V

Best Practices For Communication During Merger And Acquisition For Horizontal Strategy SS VThis slide showcases best practices that should be adopted by organization to increase the effectiveness and success probability of merger and acquisition process. Its key elements are frequency, consistency, honesty and transparency Introducing Best Practices For Communication During Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Frequency, Consistency, Honesty, using this template. Grab it now to reap its full benefits.

-

Case Study Of Backward Vertical Integration Merger And Acquisition For Horizontal Strategy SS V

Case Study Of Backward Vertical Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases case study that can help organization to understand and evaluate the implementation of backward vertical integration strategy. Its key elements are company overview, strategies implemented by organization and impact of forward vertical integration Increase audience engagement and knowledge by dispensing information using Case Study Of Backward Vertical Integration Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on three stages. You can also present information on Material, Manufacturer, Distributors using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Case Study Of Balanced Vertical Integration Merger And Acquisition For Horizontal Strategy SS V

Case Study Of Balanced Vertical Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases case study that can help organization to understand and evaluate the implementation of balanced vertical integration strategy. Its key elements are company overview, strategies implemented by organization and impact of forward vertical integration. Introducing Case Study Of Balanced Vertical Integration Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Production, Profitability, Increase, using this template. Grab it now to reap its full benefits.

-

Case Study Of Forward Vertical Integration Merger And Acquisition For Horizontal Strategy SS V

Case Study Of Forward Vertical Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases case study that can help organization to understand and evaluate the implementation of forward vertical integration strategy. Its key elements are company overview, strategies implemented by organization and impact of forward vertical integration Increase audience engagement and knowledge by dispensing information using Case Study Of Forward Vertical Integration Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on three stages. You can also present information on Average, Company, Revenue using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Comparing Backward And Forward Integration Merger And Acquisition For Horizontal Strategy SS V

Comparing Backward And Forward Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases table that can help to evaluate the difference between backward and forward vertical integration strategy. It compares two types of integration on parameters like control over, eliminates profit margins, specialization, objectives and examples Introducing Comparing Backward And Forward Integration Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Forward, Backward, Integration, using this template. Grab it now to reap its full benefits.

-

Comparing Vertical And Horizontal Integration Merger And Acquisition For Horizontal Strategy SS V

Comparing Vertical And Horizontal Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases table that can help to evaluate the different between horizontal and vertical integration strategy. It compares two types of integration on parameters like overview, objective, scaling, risk factor, number of competitors and advantages. Deliver an outstanding presentation on the topic using this Comparing Vertical And Horizontal Integration Merger And Acquisition For Horizontal Strategy SS V. Dispense information and present a thorough explanation of Integration, Horizontal, Vertical using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Critical Roles Involved In Merger And Merger And Acquisition For Horizontal Strategy SS V

Critical Roles Involved In Merger And Merger And Acquisition For Horizontal Strategy SS VThis slide showcases critical roles involved in implementation plus management of merger and acquisition strategy. Key roles involved are C suite, investment committee, business unit leadership, corporate development tea, transaction lead and external advisors. Deliver an outstanding presentation on the topic using this Critical Roles Involved In Merger And Merger And Acquisition For Horizontal Strategy SS V. Dispense information and present a thorough explanation of Committee, Business, Development using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Defining Responsibilities For Merger And Merger And Acquisition For Horizontal Strategy SS V

Defining Responsibilities For Merger And Merger And Acquisition For Horizontal Strategy SS VThis slide showcases responsibilities of different members for management plus implementation of merger and acquisition process. Key roles involved are C-suite, investment committee, business unit leadership, corporate development team, transaction lead and external advisors Introducing Defining Responsibilities For Merger And Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Investment, Leadership, Lead, using this template. Grab it now to reap its full benefits.

-

Different Alternatives For Vertical Integration Merger And Acquisition For Horizontal Strategy SS V

Different Alternatives For Vertical Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases alternatives that can be leveraged by organization instead of implementing vertical integration strategy. Alternatives available for vertical integration are - joint venture licensing, franchising and short term contracts Present the topic in a bit more detail with this Different Alternatives For Vertical Integration Merger And Acquisition For Horizontal Strategy SS V. Use it as a tool for discussion and navigation on Venture, Licensing, Franchising. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Different Methods For Horizontal Business Merger And Acquisition For Horizontal Strategy SS V

Different Methods For Horizontal Business Merger And Acquisition For Horizontal Strategy SS VThis slide showcases different types of methods that can help organization to implement horizontal integration strategy and expand the market share. Different methods for vertical integration are merger, acquisition and internal expansion of business Introducing Different Methods For Horizontal Business Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Merger, Acquisition, Internal, using this template. Grab it now to reap its full benefits.

-

Examples Of Companies With Vertical Merger And Acquisition For Horizontal Strategy SS V

Examples Of Companies With Vertical Merger And Acquisition For Horizontal Strategy SS VThis slide showcases case study of companies that have implemented vertical integration strategy in their business for market expansion. It showcases examples of three different type of integration that are forward, backward and balanced vertical integration Increase audience engagement and knowledge by dispensing information using Examples Of Companies With Vertical Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on three stages. You can also present information on Integration, Balanced, Forward using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Factors Impacting Vertical Integration Decision Merger And Acquisition For Horizontal Strategy SS V

Factors Impacting Vertical Integration Decision Merger And Acquisition For Horizontal Strategy SS VThis slide showcases factors that should be considered and evaluated by organization before implementing vertical integration strategy. Its key elements are setups costs, transaction costs, transaction risks and coordination effectiveness Deliver an outstanding presentation on the topic using this Factors Impacting Vertical Integration Decision Merger And Acquisition For Horizontal Strategy SS V. Dispense information and present a thorough explanation of Costs, Transaction, Coordination using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

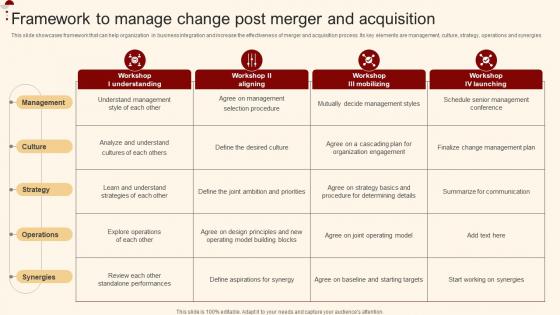

Framework To Manage Change Post Merger And Merger And Acquisition For Horizontal Strategy SS V

Framework To Manage Change Post Merger And Merger And Acquisition For Horizontal Strategy SS VThis slide showcases framework that can help organization in business integration and increase the effectiveness of merger and acquisition process. Its key elements are management, culture, strategy, operations and synergies Present the topic in a bit more detail with this Framework To Manage Change Post Merger And Merger And Acquisition For Horizontal Strategy SS V. Use it as a tool for discussion and navigation on Strategy, Culture, Management. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Framework To Restructure Business Vertical Merger And Acquisition For Horizontal Strategy SS V

Framework To Restructure Business Vertical Merger And Acquisition For Horizontal Strategy SS VThis slide showcases framework that can help organization to restructure the vertical integration and implement other strategies for business. It can help to evaluate the probability of vertical market failure and analyze the business strength to defend against market power Deliver an outstanding presentation on the topic using this Framework To Restructure Business Vertical Merger And Acquisition For Horizontal Strategy SS V. Dispense information and present a thorough explanation of Organization, Market, Arrangements using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Icons Slide For Merger And Acquisition For Horizontal Integration Strategy SS V

Icons Slide For Merger And Acquisition For Horizontal Integration Strategy SS VIntroducing our well researched set of slides titled Icons Slide For Merger And Acquisition For Horizontal Integration Strategy SS V. It displays a hundred percent editable icons. You can use these icons in your presentation to captivate your audiences attention. Download now and use it multiple times.

-

Key Areas For Post Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS V

Key Areas For Post Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS VThis slide showcases key areas that should be evaluated by organization for conduct integration activities for merger and acquisition. Its key elements are sales and marketing, production, after sales service, synergies, corporate communications, technology, legal, information technology etc Increase audience engagement and knowledge by dispensing information using Key Areas For Post Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on five stages. You can also present information on Policies, Procedures, Culture using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Key Levels Of Business Vertical Integration Merger And Acquisition For Horizontal Strategy SS V

Key Levels Of Business Vertical Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases different levels of business integration that can help organization to integrate vertically and expand the market share plus profitability. Different levels include- quasi, taper and full scale vertical business integration. Introducing Key Levels Of Business Vertical Integration Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Integration, Vertical, Quasi, using this template. Grab it now to reap its full benefits.

-

Level Of Communication During Integration Merger And Acquisition For Horizontal Strategy SS V

Level Of Communication During Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases activities plus key levels of communication with employees, stakeholders etc for merger and acquisition integration. Its key elements are due diligence, ramp up, announcement, pre close planning, integration implementation and transformation Deliver an outstanding presentation on the topic using this Level Of Communication During Integration Merger And Acquisition For Horizontal Strategy SS V. Dispense information and present a thorough explanation of Diligence, Announcement, Implementation using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Matrix To Identify Vertical Integration Decision Merger And Acquisition For Horizontal Strategy SS V

Matrix To Identify Vertical Integration Decision Merger And Acquisition For Horizontal Strategy SS VThis slide showcases matrix that can help organization to take decision regarding vertical integration strategy implementation in business. It evaluates implementation of vertical integration on the basis of number of buyers and sellers Present the topic in a bit more detail with this Matrix To Identify Vertical Integration Decision Merger And Acquisition For Horizontal Strategy SS V. Use it as a tool for discussion and navigation on Integration, Vertical, Identify. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Merger And Acquisition For Horizontal Integration Table Of Contents Strategy SS V

Merger And Acquisition For Horizontal Integration Table Of Contents Strategy SS VIncrease audience engagement and knowledge by dispensing information using Merger And Acquisition For Horizontal Integration Table Of Contents Strategy SS V. This template helps you present information on one stages. You can also present information on Case, Forward, Strategy using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Overview And Advantages Of Balanced Merger And Acquisition For Horizontal Strategy SS V

Overview And Advantages Of Balanced Merger And Acquisition For Horizontal Strategy SS VThis slide showcases balanced vertical integration strategy that can help organization to increase the market share or expand overseas. It also showcases key advantages of strategy that are elimination of competition, increase in profitability, better supply chain control etc Introducing Overview And Advantages Of Balanced Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with two stages, this template is a great option to educate and entice your audience. Dispence information on Integration, Advantages, Balanced, using this template. Grab it now to reap its full benefits.

-

Overview And Advantages Of Business Merger And Acquisition For Horizontal Strategy SS V

Overview And Advantages Of Business Merger And Acquisition For Horizontal Strategy SS VThis slide showcases overview of business integration that can help organization to take control over different areas of supply chain and reduce reliance on third party suppliers. It also showcases benefits of business integration that are increased profit margins, smooth raw material supply and gain competitiveness. Increase audience engagement and knowledge by dispensing information using Overview And Advantages Of Business Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on three stages. You can also present information on Margins, Competitiveness, Material using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Overview And Advantages Of Horizontal Merger And Acquisition For Horizontal Strategy SS V

Overview And Advantages Of Horizontal Merger And Acquisition For Horizontal Strategy SS VThis slide showcases horizontal integration that can help organization to acquire other firm and increase the market share. It also highlights key benefits of horizontal integration that are economies of scale, increased differentiation and reduced competition. Introducing Overview And Advantages Of Horizontal Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Involve, Integration, Market, using this template. Grab it now to reap its full benefits.

-

Overview And Advantages Of Merger Plus Merger And Acquisition For Horizontal Strategy SS V

Overview And Advantages Of Merger Plus Merger And Acquisition For Horizontal Strategy SS VThis slide showcases merger and acquisition overview that can help organization to combine with other company for market expansion. It also highlights benefits of merger and acquisition that are enhanced distribution capabilities, increased market share, access to financial resources etc Increase audience engagement and knowledge by dispensing information using Overview And Advantages Of Merger Plus Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on four stages. You can also present information on Merger, Benefits, Acquisition using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Overview And Advantages Of Vertical Integration Merger And Acquisition For Horizontal Strategy SS V

Overview And Advantages Of Vertical Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases vertical integration strategy overview that can help organization to expand operations within supply chain. It also showcases key advantages of strategy that are economies of scale, increase profitability, less reliance on suppliers and eliminates supply chain disruption. Introducing Overview And Advantages Of Vertical Integration Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with two stages, this template is a great option to educate and entice your audience. Dispence information on Advantages, Integration, Investment, using this template. Grab it now to reap its full benefits.

-

Overview And Suitability Of Backward Vertical Merger And Acquisition For Horizontal Strategy SS V

Overview And Suitability Of Backward Vertical Merger And Acquisition For Horizontal Strategy SS VThis slide showcases backward vertical integration strategy that can help organization to increase the market share or expand overseas. This strategy takes control of upstream suppliers along the supply chain like raw material providers, manufacturers etc Increase audience engagement and knowledge by dispensing information using Overview And Suitability Of Backward Vertical Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on four stages. You can also present information on Company, Integration, Merger using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Overview And Suitability Of Forward Vertical Merger And Acquisition For Horizontal Strategy SS V

Overview And Suitability Of Forward Vertical Merger And Acquisition For Horizontal Strategy SS VThis slide showcases forward vertical integration strategy that can help organization to increase the market share or expand overseas. This strategy takes control of downstream suppliers along the supply chain like distributors, retailers etc Introducing Overview And Suitability Of Forward Vertical Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Distributors, Market, Expenses, using this template. Grab it now to reap its full benefits.

-

Parties Involved In M And A Due Diligence Process Merger And Acquisition For Horizontal Strategy SS V

Parties Involved In M And A Due Diligence Process Merger And Acquisition For Horizontal Strategy SS VThis slide showcases process of detailed due diligence of business in merger and acquisition and parties involved for implementation of strategy. Its key elements are strategic analysis, commercial, operational, financial and legal due diligence of business Deliver an outstanding presentation on the topic using this Parties Involved In M And A Due Diligence Process Merger And Acquisition For Horizontal Strategy SS V. Dispense information and present a thorough explanation of Analysis, Parties, Involved using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Process To Conduct Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS V

Process To Conduct Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS VThis slide showcases steps that can help organization to implement merger and acquisition to increase market share plus profitability. Key steps involved in merger and acquisition are pre deal, deal preparation, integration and optimization Introducing Process To Conduct Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Conduct, Preparation, Merger, using this template. Grab it now to reap its full benefits.

-

Questions To Ask During M And A Due Diligence Merger And Acquisition For Horizontal Strategy SS V

Questions To Ask During M And A Due Diligence Merger And Acquisition For Horizontal Strategy SS VThis slide showcases questions that should be asked by organization during due diligence process of merger and acquisition. Its key elements are financial details, company overview, product information, employee information, customer data, legalities and intellectual property. Increase audience engagement and knowledge by dispensing information using Questions To Ask During M And A Due Diligence Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on seven stages. You can also present information on Information, Product, Customer using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Selecting Partner For Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS V

Selecting Partner For Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS VThis slide showcases partner selection on basis of different criteria for implementing merger and acquisition strategy. Key parameters for merger and acquisition partner selection are industry, annual revenue generated, country and operations Present the topic in a bit more detail with this Selecting Partner For Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS V. Use it as a tool for discussion and navigation on Industry, Revenue, Country. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Setting Criteria For Selecting Merger And Merger And Acquisition For Horizontal Strategy SS V

Setting Criteria For Selecting Merger And Merger And Acquisition For Horizontal Strategy SS VThis slide showcases different criteria that can be set by organization to select partner for merger and acquisition process. Criteria for partner selection are strategic combination, target approach, revenue generation, value chain and target country Increase audience engagement and knowledge by dispensing information using Setting Criteria For Selecting Merger And Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on five stages. You can also present information on Combination, Approach, Generation using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Solutions To Tackle Key Challenges In Merger And Acquisition For Horizontal Strategy SS V

Solutions To Tackle Key Challenges In Merger And Acquisition For Horizontal Strategy SS VThis slide showcases key challenges faced by organization during merger and acquisition process that are employee retention, security threats, unexpected costs and wrong valuation. It also highlights solutions to tackle these hindrances during implementing of strategy Deliver an outstanding presentation on the topic using this Solutions To Tackle Key Challenges In Merger And Acquisition For Horizontal Strategy SS V. Dispense information and present a thorough explanation of Acquisition, Merger, Tackle using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Table Of Contents Merger And Acquisition For Horizontal Integration Strategy SS V

Table Of Contents Merger And Acquisition For Horizontal Integration Strategy SS VIncrease audience engagement and knowledge by dispensing information using Table Of Contents Merger And Acquisition For Horizontal Integration Strategy SS V. This template helps you present information on two stages. You can also present information on Strategy, Business, Horizontal using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Timeline For Post Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS V

Timeline For Post Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS VThis slide showcases timeline that can help organization to conduct plus manage integration after implementing merger and acquisition process. Key areas for integration are organizational, brand, system, product and facilities integration Present the topic in a bit more detail with this Timeline For Post Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS V. Use it as a tool for discussion and navigation on Timeline, Post, Acquisition. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Timeline For Sell Side Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS V

Timeline For Sell Side Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS VThis slide showcases sell side timeline that can help organization to manage plus implement the merger plus acquisition process for market expansion. Its key elements are process preparation, marketing activities and due diligence of buyer Deliver an outstanding presentation on the topic using this Timeline For Sell Side Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS V. Dispense information and present a thorough explanation of Merger, Side, Timeline using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Acquisition Planning To Enhance Due Diligence Guide Of Business Merger And Acquisition Plan Strategy Ss V

Acquisition Planning To Enhance Due Diligence Guide Of Business Merger And Acquisition Plan Strategy Ss VThis slide covers acquisition planning to enhance process. It involves key activities such as negotiation, build teams, create master plan and maintain project control and prioritize tasks. Introducing Acquisition Planning To Enhance Due Diligence Guide Of Business Merger And Acquisition Plan Strategy Ss V to increase your presentation threshold. Encompassed with Four stages, this template is a great option to educate and entice your audience. Dispence information on Deal Making, Day One, Post Merger Alliance, using this template. Grab it now to reap its full benefits.

-

Agenda For Guide Of Business Merger And Acquisition Plan To Expand Market Share Strategy SS V

Agenda For Guide Of Business Merger And Acquisition Plan To Expand Market Share Strategy SS VIncrease audience engagement and knowledge by dispensing information using Agenda For Guide Of Business Merger And Acquisition Plan To Expand Market Share Strategy SS V. This template helps you present information on Four stages. You can also present information on Growth And Development, Tax Benefits, Business Effectively using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

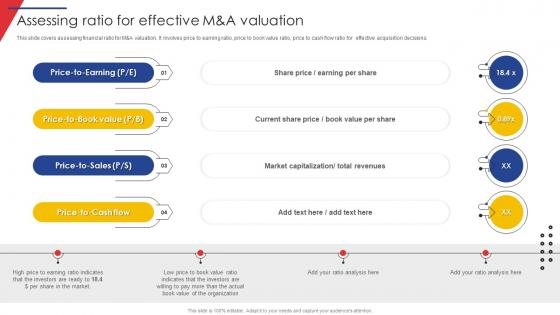

Assessing Ratio For Effective M And A Valuation Guide Of Business Merger And Acquisition Plan Strategy SS V

Assessing Ratio For Effective M And A Valuation Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers assessing financial ratio for MAndA valuation. It involves price to earning ratio, price to book value ratio, price to cash flow ratio for effective acquisition decisions. Introducing Assessing Ratio For Effective M And A Valuation Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Four stages, this template is a great option to educate and entice your audience. Dispence information on Price To Earning, Price To Sale, Price To Cash Flow, using this template. Grab it now to reap its full benefits.

-

Best Practices For Implementing M And A Process Guide Of Business Merger And Acquisition Plan Strategy SS V

Best Practices For Implementing M And A Process Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers best practices for successful and effective implementation of MAndA process. It Involves best practices such as develop clear strategy, conduct due diligence and monitor progress. Increase audience engagement and knowledge by dispensing information using Best Practices For Implementing M And A Process Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Three stages. You can also present information on Develop Clear Strategy, Conduct Due Diligence, Monitor Progress using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Communication Levels During M And A Integration Guide Of Business Merger And Acquisition Plan Strategy SS V

Communication Levels During M And A Integration Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers communication levels during MAndA integration. It involves key stages such as due diligence, design and ramp up, merger announcements and integration implementation. Introducing Communication Levels During M And A Integration Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Five stages, this template is a great option to educate and entice your audience. Dispence information on Announcement, Planning And Implementation, Integration Implementation, using this template. Grab it now to reap its full benefits.

-

Comparative Analysis Of Revenue Criteria For M Guide Of Business Merger And Acquisition Plan Strategy SS V

Comparative Analysis Of Revenue Criteria For M Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers comparative analysis on basis of revenue criteria for selecting company for MAndA deal. It involves key reasons such as company liquidity ratio is stable and net profit margin is higher. Present the topic in a bit more detail with this Comparative Analysis Of Revenue Criteria For M Guide Of Business Merger And Acquisition Plan Strategy SS V. Use it as a tool for discussion and navigation on Criteria, Company. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Concentric Merger Strategy To Reduce Risks Guide Of Business Merger And Acquisition Plan Strategy SS V

Concentric Merger Strategy To Reduce Risks Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers implementing concentric merger strategy to improve financial profits. It involves key benefits such as reduced risks, increases new customer and market share. Introducing Concentric Merger Strategy To Reduce Risks Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Three stages, this template is a great option to educate and entice your audience. Dispence information on Business, Concentric Integration, using this template. Grab it now to reap its full benefits.

-

Conglomerate Merger Strategy For Financial Gain Guide Of Business Merger And Acquisition Plan Strategy SS V

Conglomerate Merger Strategy For Financial Gain Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers conglomerate merger strategy to optimize financial benefits. It involves best practices such as effective integration analysis, assess talent requirements to help in capturing revenue synergies. Increase audience engagement and knowledge by dispensing information using Conglomerate Merger Strategy For Financial Gain Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Three stages. You can also present information on Business, Conglomerate Integration using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Developing Strategies To Identify Right Target Guide Of Business Merger And Acquisition Plan Strategy SS V

Developing Strategies To Identify Right Target Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers key strategies to identify right target acquisition to enhance market share and enhance credibility. It involves approaches such as determine acquisition criteria, conduct market research and evaluate financial performance. Increase audience engagement and knowledge by dispensing information using Developing Strategies To Identify Right Target Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Five stages. You can also present information on Determine Acquisition Criteria, Conduct Market Research, Monitor Industry Trends using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Due Diligence Checklist For Successful M And A Guide Of Business Merger And Acquisition Plan Strategy SS V

Due Diligence Checklist For Successful M And A Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers checklist for effective due diligence process for successful merger and acquisition implementation. It involves financial matters, intellectual property, material contracts, litigation and tax matters. Present the topic in a bit more detail with this Due Diligence Checklist For Successful M And A Guide Of Business Merger And Acquisition Plan Strategy SS V. Use it as a tool for discussion and navigation on Particulars, Owner, Priority. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Due Diligence Process In M And A To Enhance Guide Of Business Merger And Acquisition Plan Strategy SS V

Due Diligence Process In M And A To Enhance Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers due diligence process in merger And acquisition to enhance its effectiveness. It involves key steps such as prepare documents, share And review, due diligence Q A and post diligence reporting. Increase audience engagement and knowledge by dispensing information using Due Diligence Process In M And A To Enhance Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Four stages. You can also present information on Prepare Documents, Review Documents, Post Diligence Reporting using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Essential M And A Valuation Methods To Enhance Guide Of Business Merger And Acquisition Plan Strategy SS V

Essential M And A Valuation Methods To Enhance Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers essential merger And acquisition valuation methods to determine value of acquiring. It involves four methods such as net assets, EBITDA, price earning ratio and revenue multiple. Introducing Essential M And A Valuation Methods To Enhance Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Four stages, this template is a great option to educate and entice your audience. Dispence information on Net Assets, Price Earning Ratio, Revenue Multiple, using this template. Grab it now to reap its full benefits.

-

Five Phases Of Due Diligence Process To Increase Guide Of Business Merger And Acquisition Plan Strategy SS V

Five Phases Of Due Diligence Process To Increase Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers five phases of due diligence for gaining competitive advantage to increase market share. It involves five key phases such as developing MAndA strategy, target screening, due dillligence, transaction execution And integration. Increase audience engagement and knowledge by dispensing information using Five Phases Of Due Diligence Process To Increase Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Five stages. You can also present information on Target Screening, Due Diligence, Transaction Execution using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Hierarchy Chart For Integrating Merger Guide Of Business Merger And Acquisition Plan Strategy SS V

Hierarchy Chart For Integrating Merger Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers hierarchy chart for merger And acquisition process. It involves key activities such as product strategy, product technology And operations, sales and client retention, treasury And tax and internal audit. Increase audience engagement and knowledge by dispensing information using Hierarchy Chart For Integrating Merger Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on One stages. You can also present information on Product Strategy, Information Technology, Legal using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Horizontal Merger To Reduce Supply Chain Cost Guide Of Business Merger And Acquisition Plan Strategy SS V

Horizontal Merger To Reduce Supply Chain Cost Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers implementing horizontal merger strategy to expand customer base and reduce supply chain cost. It involves key reasons such as reduced competition, gain ideas And products and economies of scale. Introducing Horizontal Merger To Reduce Supply Chain Cost Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Three stages, this template is a great option to educate and entice your audience. Dispence information on HP And Compaq, Exon And Mobil, Amazon And Whole Foods, using this template. Grab it now to reap its full benefits.

-

Icons Slide For Guide Of Business Merge And Acquisition Plan To Expand Market Share Strategy SS V

Icons Slide For Guide Of Business Merge And Acquisition Plan To Expand Market Share Strategy SS VIntroducing our well researched set of slides titled Icons Slide For Guide Of Business Merge And Acquisition Plan To Expand Market Share Strategy SS V. It displays a hundred percent editable icons. You can use these icons in your presentation to captivate your audiences attention. Download now and use it multiple times.

-

Introduction To Business Acquisition Overview Guide Of Business Merger And Acquisition Plan Strategy SS V

Introduction To Business Acquisition Overview Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers overview to business acquisition strategy to gain control and expand business. It involves four types of acquisition strategies such as horizontal, vertical, congeneric and conglomerate acquisition. Introducing Introduction To Business Acquisition Overview Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Two stages, this template is a great option to educate and entice your audience. Dispence information on Introduction, Business Acquisition, using this template. Grab it now to reap its full benefits.

-

Introduction To Financing Acquisition Overview Guide Of Business Merger And Acquisition Plan Strategy SS V

Introduction To Financing Acquisition Overview Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers overview to acquisition financing to enhance market share. It involves sources of financing such as cash transaction, stock swaps, debt financing, equity investment And leveraged buy out. Increase audience engagement and knowledge by dispensing information using Introduction To Financing Acquisition Overview Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Two stages. You can also present information on Overview, Sources Of Business Acquisition using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Introduction To M And A Due Diligence Overview Guide Of Business Merger And Acquisition Plan Strategy SS V

Introduction To M And A Due Diligence Overview Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers overview to merger And acquisition due diligence to identify risk involved in transaction. It involves key benefits such as reduces buyer risks, enables effective valuation and decision making. Introducing Introduction To M And A Due Diligence Overview Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Three stages, this template is a great option to educate and entice your audience. Dispence information on Reduces Buyer, Enables Effective, Making For Implementing, using this template. Grab it now to reap its full benefits.

-

Introduction To Manda Communication Strategy Guide Of Business Merger And Acquisition Plan Strategy SS V

Introduction To Manda Communication Strategy Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers overview to MAndA communication strategy to align and communicate new strategies to concerned stakeholders of company. It involves acquisition design, internal and external announcements and HR updates. Increase audience engagement and knowledge by dispensing information using Introduction To Manda Communication Strategy Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Two stages. You can also present information on Overview, Involves using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.