Powerpoint Templates and Google slides for Merger

Save Your Time and attract your audience with our fully editable PPT Templates and Slides.

-

Supply Chain Integration Costs Incurred During Merger And Acquisition Process Strategy SS V

Supply Chain Integration Costs Incurred During Merger And Acquisition Process Strategy SS VThis slide showcases percentage of costs involved in different stages of merger and acquisition process. Key stages are - strategy, screening of partners, negotiations, due diligence, transaction execution and post merger integration of business. Present the topic in a bit more detail with this Supply Chain Integration Costs Incurred During Merger And Acquisition Process Strategy SS V. Use it as a tool for discussion and navigation on Market Analysis Expenses, Transaction Execution Stage, Merger And Acquisition Process. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Costs Incurred During Merger And Forward And Backward Integration Strategy SS V

Costs Incurred During Merger And Forward And Backward Integration Strategy SS VThis slide showcases percentage of costs involved in different stages of merger and acquisition process. Key stages are strategy, screening of partners, negotiations, due diligence, transaction execution and post merger integration of business Deliver an outstanding presentation on the topic using this Costs Incurred During Merger And Forward And Backward Integration Strategy SS V. Dispense information and present a thorough explanation of Execution, Amount, Analysis using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Integration Activities For Post Merger Forward And Backward Integration Strategy SS V

Integration Activities For Post Merger Forward And Backward Integration Strategy SS VThis slide showcases key integration activities that should be conducted in different areas of business for effective implementation of merger and acquisition. Key areas for integration are governance, legal, finance, human resource, communication plus technology and IT Present the topic in a bit more detail with this Integration Activities For Post Merger Forward And Backward Integration Strategy SS V. Use it as a tool for discussion and navigation on Governance, Finance, Communication. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Step By Step Process Of Mergers And Acquisitions Comprehensive Guide On Investment Banking Concepts Fin SS

Step By Step Process Of Mergers And Acquisitions Comprehensive Guide On Investment Banking Concepts Fin SSThis slide shows multiple stages of mergers and acquisition process conducted by investment banks. It includes steps such as preliminary analysis, target identification, valuation, due diligence, etc. Increase audience engagement and knowledge by dispensing information using Step By Step Process Of Mergers And Acquisitions Comprehensive Guide On Investment Banking Concepts Fin SS. This template helps you present information on five stages. You can also present information on Preliminary Analysis, Valuation, Due Diligence using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Decoding FDI Opportunities Effective Statistics Associated With FDI Mergers Fin SS

Decoding FDI Opportunities Effective Statistics Associated With FDI Mergers Fin SSThis slide presents statistical data illustrating the impact of mergers and acquisitions in the field of foreign direct investment. The statistics relate to technology, renewable energy, global deal value, etc. Present the topic in a bit more detail with this Decoding FDI Opportunities Effective Statistics Associated With FDI Mergers Fin SS. Use it as a tool for discussion and navigation on Global Deal Value, M And A Transactions, Healthcare Sector, Change In Landscape. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Major Merger And Acquisitions Deals By Top Companies Fashion And Apparel Industry Report IR SS

Major Merger And Acquisitions Deals By Top Companies Fashion And Apparel Industry Report IR SSThis slide presents an overview of major merger and acquisition deals by top companies in the fashion and apparel industry. The purpose is to highlight strategic moves and partnerships that have significantly impacted the market landscape.Present the topic in a bit more detail with this Major Merger And Acquisitions Deals By Top Companies Fashion And Apparel Industry Report IR SS. Use it as a tool for discussion and navigation on Quarterly Highlights, Geographical Insights, Deal Value, Top Region. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Financial Transformation Focus Area Post Merger Financial Integration CRP DK SS

Financial Transformation Focus Area Post Merger Financial Integration CRP DK SSThis slide showcases focus areas for successful financial integration with new entity which include financial reporting, budgeting andforecast, cash flow management etc. Introducing Financial Transformation Focus Area Post Merger Financial Integration CRP DK SS to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Financial Reporting And Planning, Budgeting And Forecasting, Cash Flow Management, using this template. Grab it now to reap its full benefits.

-

KPIs For Measuring New Entity Financial Performance Post Merger Financial Integration CRP DK SS

KPIs For Measuring New Entity Financial Performance Post Merger Financial Integration CRP DK SSThis slide showcases KPIs used to measure merged businesses financial performance which includes revenue growth, synergy achievement, free cash flow with target and financial drivers. Deliver an outstanding presentation on the topic using this KPIs For Measuring New Entity Financial Performance Post Merger Financial Integration CRP DK SS. Dispense information and present a thorough explanation of Financial Drivers, Synergy Achievement, Free Cash Flow using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Post M And A Financial Integration P And L Assessment Post Merger Financial Integration CRP DK SS

Post M And A Financial Integration P And L Assessment Post Merger Financial Integration CRP DK SSThis slide illustrates dashboard showcasing post merger deal performance which helps in assessing post and loss and revenue generated using KPIs overall profit margin, revenue, expenses etc. Present the topic in a bit more detail with this Post M And A Financial Integration P And L Assessment Post Merger Financial Integration CRP DK SS. Use it as a tool for discussion and navigation on Gross Profit Margin, Overall Profit Margin, Net Profit Margin. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Post M And A Financial Performance Tracking Dashboard Post Merger Financial Integration CRP DK SS

Post M And A Financial Performance Tracking Dashboard Post Merger Financial Integration CRP DK SSThis slide showcases dashboard to monitor post merger deal financial performance which includes KPIs such as current ratio, quick ratio, cash balance. AR vs AP turnover, short term assets etc. Deliver an outstanding presentation on the topic using this Post M And A Financial Performance Tracking Dashboard Post Merger Financial Integration CRP DK SS. Dispense information and present a thorough explanation of Days Sales Outstanding, Cash Balance, Quick Ratio using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Post M And A Financial Transformation Best Practices Post Merger Financial Integration CRP DK SS

Post M And A Financial Transformation Best Practices Post Merger Financial Integration CRP DK SSThis slide showcases tips which can be adopted by businesses to effectively integration companys financial operations post MandA deal which includes value creation, leveraging change management and optimizing performance. Present the topic in a bit more detail with this Post M And A Financial Transformation Best Practices Post Merger Financial Integration CRP DK SS. Use it as a tool for discussion and navigation on Improve Cash Liquidity, Improve Business Profitability, Increase Financial Operations Efficiency. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Tax Efficient Structure Adopted For Combined Entity Post Merger Financial Integration CRP DK SS

Tax Efficient Structure Adopted For Combined Entity Post Merger Financial Integration CRP DK SSThis slide showcases tax efficient structure adopted by merged business with strategies adopted such as tax loss carryforward, using transfer pricing agreements, debt financing with its potential impacts. Deliver an outstanding presentation on the topic using this Tax Efficient Structure Adopted For Combined Entity Post Merger Financial Integration CRP DK SS. Dispense information and present a thorough explanation of Consolidated Entity, Hybrid Structure, Spin Off Structure using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Mergers acquisitions difference ppt powerpoint presentation file inspiration cpb

Mergers acquisitions difference ppt powerpoint presentation file inspiration cpbPresenting our Mergers Acquisitions Difference Ppt Powerpoint Presentation File Inspiration Cpb PowerPoint template design. This PowerPoint slide showcases five stages. It is useful to share insightful information on Mergers Acquisitions Difference This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

-

Mergers Acquisitions List In Powerpoint And Google Slides Cpb

Mergers Acquisitions List In Powerpoint And Google Slides CpbPresenting Mergers Acquisitions List In Powerpoint And Google Slides Cpb slide which is completely adaptable. The graphics in this PowerPoint slide showcase three stages that will help you succinctly convey the information. In addition, you can alternate the color, font size, font type, and shapes of this PPT layout according to your content. This PPT presentation can be accessed with Google Slides and is available in both standard screen and widescreen aspect ratios. It is also a useful set to elucidate topics like Mergers Acquisitions List. This well structured design can be downloaded in different formats like PDF, JPG, and PNG. So, without any delay, click on the download button now.

-

List Successful Mergers Acquisitions In Powerpoint And Google Slides Cpb

List Successful Mergers Acquisitions In Powerpoint And Google Slides CpbPresenting List Successful Mergers Acquisitions In Powerpoint And Google Slides Cpb slide which is completely adaptable. The graphics in this PowerPoint slide showcase three stages that will help you succinctly convey the information. In addition, you can alternate the color, font size, font type, and shapes of this PPT layout according to your content. This PPT presentation can be accessed with Google Slides and is available in both standard screen and widescreen aspect ratios. It is also a useful set to elucidate topics like List Successful Mergers Acquisitions. This well structured design can be downloaded in different formats like PDF, JPG, and PNG. So, without any delay, click on the download button now.

-

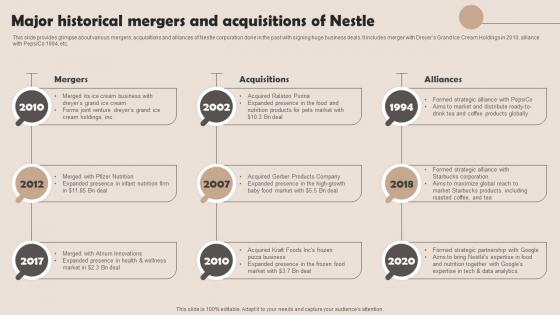

Major Historical Mergers And Acquisitions Of Nestle Internal And External Environmental Strategy SS V

Major Historical Mergers And Acquisitions Of Nestle Internal And External Environmental Strategy SS VThis slide provides glimpse about various mergers, acquisitions and alliances of Nestle corporation done in the past with signing huge business deals. It includes merger with Dreyers Grand Ice Cream Holdings in 2010, alliance with PepsiCo 1994, etc. Introducing Major Historical Mergers And Acquisitions Of Nestle Internal And External Environmental Strategy SS V to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Mergers, Acquisitions, Alliances, using this template. Grab it now to reap its full benefits.

-

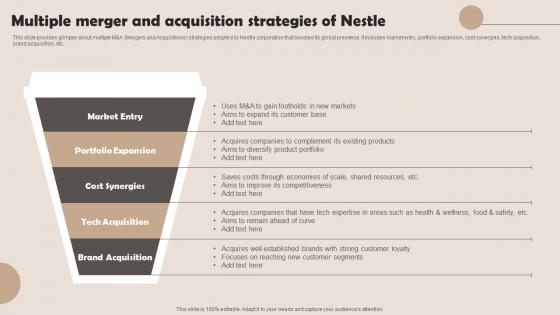

Multiple Merger And Acquisition Strategies Of Nestle Internal And External Environmental Strategy SS V

Multiple Merger And Acquisition Strategies Of Nestle Internal And External Environmental Strategy SS VThis slide provides glimpse about multiple M and A Mergers and Acquisitions strategies adopted by Nestle corporation that boosted its global presence. It includes market entry, portfolio expansion, cost synergies, tech acquisition, brand acquisition, etc. Introducing Multiple Merger And Acquisition Strategies Of Nestle Internal And External Environmental Strategy SS V to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Market, Expansion, Cost, using this template. Grab it now to reap its full benefits.

-

Major Historical Mergers And Acquisitions Of Nestle Management Strategies Overview Strategy SS V

Major Historical Mergers And Acquisitions Of Nestle Management Strategies Overview Strategy SS VThis slide provides glimpse about various mergers, acquisitions and alliances of Nestle corporation done in the past with signing huge business deals. It includes merger with Dreyers Grand Ice Cream Holdings in 2010, alliance with PepsiCo 1994, etc. Increase audience engagement and knowledge by dispensing information using Major Historical Mergers And Acquisitions Of Nestle Management Strategies Overview Strategy SS V. This template helps you present information on nine stages. You can also present information on Mergers, Acquisitions, Alliances using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Multiple Merger And Acquisition Strategies Of Nestle Management Strategies Overview Strategy SS V

Multiple Merger And Acquisition Strategies Of Nestle Management Strategies Overview Strategy SS VThis slide provides glimpse about multiple M and A Mergers and Acquisitions strategies adopted by Nestle corporation that boosted its global presence. It includes market entry, portfolio expansion, cost synergies, tech acquisition, brand acquisition, etc. Deliver an outstanding presentation on the topic using this Multiple Merger And Acquisition Strategies Of Nestle Management Strategies Overview Strategy SS V. Dispense information and present a thorough explanation of Market, Acquisition, Brand using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Nestle Company Overview Major Historical Mergers And Acquisitions Of Nestle Strategy SS V

Nestle Company Overview Major Historical Mergers And Acquisitions Of Nestle Strategy SS VThis slide provides glimpse about various mergers, acquisitions and alliances of Nestle corporation done in the past with signing huge business deals. It includes merger with Dreyers Grand Ice Cream Holdings in 2010, alliance with PepsiCo 1994, etc. Present the topic in a bit more detail with this Nestle Company Overview Major Historical Mergers And Acquisitions Of Nestle Strategy SS V. Use it as a tool for discussion and navigation on Mergers, Acquisitions, Alliances. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Nestle Company Overview Multiple Merger And Acquisition Strategies Of Nestle Strategy SS V

Nestle Company Overview Multiple Merger And Acquisition Strategies Of Nestle Strategy SS VThis slide provides glimpse about multiple MAndA Mergers and Acquisitions strategies adopted by Nestle corporation that boosted its global presence. It includes market entry, portfolio expansion, cost synergies, tech acquisition, brand acquisition, etc. Increase audience engagement and knowledge by dispensing information using Nestle Company Overview Multiple Merger And Acquisition Strategies Of Nestle Strategy SS V. This template helps you present information on Five stages. You can also present information on Market Entry, Portfolio Expansion, Cost Synergies, Tech Acquisition using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Benefits Merger In Powerpoint And Google Slides Cpb

Benefits Merger In Powerpoint And Google Slides CpbPresenting our Benefits Merger In Powerpoint And Google Slides Cpb PowerPoint template design. This PowerPoint slide showcases three stages. It is useful to share insightful information on Benefits Merger This PPT slide can be easily accessed in standard screen and widescreen aspect ratios. It is also available in various formats like PDF, PNG, and JPG. Not only this, the PowerPoint slideshow is completely editable and you can effortlessly modify the font size, font type, and shapes according to your wish. Our PPT layout is compatible with Google Slides as well, so download and edit it as per your knowledge.

-

Horizontal And Vertical Business Examples Of Companies With Conglomerate Merger Strategy SS V

Horizontal And Vertical Business Examples Of Companies With Conglomerate Merger Strategy SS VThis slide showcases examples of conglomerate merger that have helped companies to diversify business risk and increase brand presence. It highlights example of various companies like Walt Disney, American Broadcasting, Ebay and PayPal Increase audience engagement and knowledge by dispensing information using Horizontal And Vertical Business Examples Of Companies With Conglomerate Merger Strategy SS V. This template helps you present information on two stages. You can also present information on American Broadcasting, Merger Details using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Analyzing Reasons For Merger And Acquisition Failure Business Integration Strategy Strategy SS V

Analyzing Reasons For Merger And Acquisition Failure Business Integration Strategy Strategy SS VThis slide showcases different reasons that results in failure of merger and acquisition strategy. Reasons are insufficient due diligence, lack of management involvement, poor integration process, overestimating synergies and valuation mistakes Introducing Analyzing Reasons For Merger And Acquisition Failure Business Integration Strategy Strategy SS V to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Insufficient Due Diligence, Poor Integration Process, using this template. Grab it now to reap its full benefits.

-

Best Practices For Communication During Merger And Business Integration Strategy Strategy SS V

Best Practices For Communication During Merger And Business Integration Strategy Strategy SS VThis slide showcases best practices that should be adopted by organization to increase the effectiveness and success probability of merger and acquisition process. Its key elements are frequency, consistency, honesty and transparency Increase audience engagement and knowledge by dispensing information using Best Practices For Communication During Merger And Business Integration Strategy Strategy SS V. This template helps you present information on four stages. You can also present information on Frequency, Consistency, Honesty using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Critical Roles Involved In Merger And Acquisition Business Integration Strategy Strategy SS V

Critical Roles Involved In Merger And Acquisition Business Integration Strategy Strategy SS VThis slide showcases critical roles involved in implementation plus management of merger and acquisition strategy. Key roles involved are C suite, investment committee, business unit leadership, corporate development tea, transaction lead and external advisors Present the topic in a bit more detail with this Critical Roles Involved In Merger And Acquisition Business Integration Strategy Strategy SS V. Use it as a tool for discussion and navigation on Business Unit Leadership, Transaction Lead. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Defining Responsibilities For Merger And Acquisition Business Integration Strategy Strategy SS V

Defining Responsibilities For Merger And Acquisition Business Integration Strategy Strategy SS VThis slide showcases responsibilities of different members for management plus implementation of merger and acquisition process. Key roles involved are C suite, investment committee, business unit leadership, corporate development team, transaction lead and external advisors Introducing Defining Responsibilities For Merger And Acquisition Business Integration Strategy Strategy SS V to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Business Unit Leadership, Transaction Lead, using this template. Grab it now to reap its full benefits.

-

Framework To Manage Change Post Merger And Business Integration Strategy Strategy SS V

Framework To Manage Change Post Merger And Business Integration Strategy Strategy SS VThis slide showcases framework that can help organization in business integration and increase the effectiveness of merger and acquisition process. Its key elements are management, culture, strategy, operations and synergies Deliver an outstanding presentation on the topic using this Framework To Manage Change Post Merger And Business Integration Strategy Strategy SS V. Dispense information and present a thorough explanation of Management, Strategy using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Key Areas For Post Merger And Acquisition Integration Business Integration Strategy Strategy SS V

Key Areas For Post Merger And Acquisition Integration Business Integration Strategy Strategy SS VThis slide showcases key areas that should be evaluated by organization for conduct integration activities for merger and acquisition. Its key elements are sales and marketing, production, after sales service, synergies, corporate communications, technology, legal, information technology etc Introducing Key Areas For Post Merger And Acquisition Integration Business Integration Strategy Strategy SS V to increase your presentation threshold. Encompassed with twelve stages, this template is a great option to educate and entice your audience. Dispence information on Production, Synergies, Corporate Culture, using this template. Grab it now to reap its full benefits.

-

Overview And Advantages Of Merger Plus Acquisition Business Integration Strategy Strategy SS V

Overview And Advantages Of Merger Plus Acquisition Business Integration Strategy Strategy SS VThis slide showcases merger and acquisition overview that can help organization to combine with other company for market expansion. It also highlights benefits of merger and acquisition that are enhanced distribution capabilities, increased market share, access to financial resources etc Introducing Overview And Advantages Of Merger Plus Acquisition Business Integration Strategy Strategy SS V to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Acquisition, Merger, using this template. Grab it now to reap its full benefits.

-

Process To Conduct Merger And Acquisition Business Integration Strategy Strategy SS V

Process To Conduct Merger And Acquisition Business Integration Strategy Strategy SS VThis slide showcases steps that can help organization to implement merger and acquisition to increase market share plus profitability. Key steps involved in merger and acquisition are pre deal, deal preparation, integration and optimization Introducing Process To Conduct Merger And Acquisition Business Integration Strategy Strategy SS V to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Conduct Due Diligence, Integrate Post Merger, using this template. Grab it now to reap its full benefits.

-

Selecting Partner For Merger And Acquisition Strategy Business Integration Strategy Strategy SS V

Selecting Partner For Merger And Acquisition Strategy Business Integration Strategy Strategy SS VThis slide showcases partner selection on basis of different criteria for implementing merger and acquisition strategy. Key parameters for merger and acquisition partner selection are industry, annual revenue generated, country and operations Present the topic in a bit more detail with this Selecting Partner For Merger And Acquisition Strategy Business Integration Strategy Strategy SS V. Use it as a tool for discussion and navigation on Ownership, Partnership. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Setting Criteria For Selecting Merger And Acquisition Partner Business Integration Strategy Strategy SS V

Setting Criteria For Selecting Merger And Acquisition Partner Business Integration Strategy Strategy SS VThis slide showcases different criteria that can be set by organization to select partner for merger and acquisition process. Criteria for partner selection are strategic combination, target approach, revenue generation, value chain and target countr Deliver an outstanding presentation on the topic using this Setting Criteria For Selecting Merger And Acquisition Partner Business Integration Strategy Strategy SS V. Dispense information and present a thorough explanation of Strategic Combination, Target Approach using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Solutions To Tackle Key Challenges In Merger And Acquisition Business Integration Strategy Strategy SS V

Solutions To Tackle Key Challenges In Merger And Acquisition Business Integration Strategy Strategy SS VThis slide showcases key challenges faced by organization during merger and acquisition process that are employee retention, security threats, unexpected costs and wrong valuation. It also highlights solutions to tackle these hindrances during implementing of strategy Present the topic in a bit more detail with this Solutions To Tackle Key Challenges In Merger And Acquisition Business Integration Strategy Strategy SS V. Use it as a tool for discussion and navigation on Employee Retention Challenges, Security Threats. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Timeline For Post Merger And Acquisition Integration Business Integration Strategy Strategy SS V

Timeline For Post Merger And Acquisition Integration Business Integration Strategy Strategy SS VThis slide showcases timeline that can help organization to conduct plus manage integration after implementing merger and acquisition process. Key areas for integration are organizational, brand, system, product and facilities integration Present the topic in a bit more detail with this Timeline For Post Merger And Acquisition Integration Business Integration Strategy Strategy SS V. Use it as a tool for discussion and navigation on Organizational Integration, Brand Integration. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Timeline For Sell Side Merger And Acquisition Business Integration Strategy Strategy SS V

Timeline For Sell Side Merger And Acquisition Business Integration Strategy Strategy SS VThis slide showcases sell side timeline that can help organization to manage plus implement the merger plus acquisition process for market expansion. Its key elements are process preparation, marketing activities and due diligence of buyer Deliver an outstanding presentation on the topic using this Timeline For Sell Side Merger And Acquisition Business Integration Strategy Strategy SS V. Dispense information and present a thorough explanation of Contact Potential Buyers, Formulate Data Room using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Major Historical Mergers And Acquisitions Of Nestle Corporate And Business Level Strategy SS V

Major Historical Mergers And Acquisitions Of Nestle Corporate And Business Level Strategy SS VThis slide provides glimpse about various mergers, acquisitions and alliances of Nestle corporation done in the past with signing huge business deals. It includes merger with Dreyers Grand Ice Cream Holdings in 2010, alliance with PepsiCo 1994, etc. Increase audience engagement and knowledge by dispensing information using Major Historical Mergers And Acquisitions Of Nestle Corporate And Business Level Strategy SS V. This template helps you present information on nine stages. You can also present information on Mergers, Acquisitions, Alliances using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Multiple Merger And Acquisition Strategies Of Nestle Corporate And Business Level Strategy SS V

Multiple Merger And Acquisition Strategies Of Nestle Corporate And Business Level Strategy SS VThis slide provides glimpse about multiple M and A Mergers and Acquisitions strategies adopted by Nestle corporation that boosted its global presence. It includes market entry, portfolio expansion, cost synergies, tech acquisition, brand acquisition, etc. Increase audience engagement and knowledge by dispensing information using Multiple Merger And Acquisition Strategies Of Nestle Corporate And Business Level Strategy SS V. This template helps you present information on five stages. You can also present information on Acquisition, Synergies, Portfolio using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Mergers And Acquisition Strategy Of Microsoft Strategy Analysis To Understand Strategy Ss V

Mergers And Acquisition Strategy Of Microsoft Strategy Analysis To Understand Strategy Ss VThis slide shows how microsoft used mergers and acquisition to stay ahead and generate huge in the business. It includes information about key acquisitions by microsoft over the past years. Present the topic in a bit more detail with this Mergers And Acquisition Strategy Of Microsoft Strategy Analysis To Understand Strategy SS V. Use it as a tool for discussion and navigation on Company, Amount, Company. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Company Merger Employee Rights In Powerpoint And Google Slides Cpb

Company Merger Employee Rights In Powerpoint And Google Slides CpbPresenting Company Merger Employee Rights In Powerpoint And Google Slides Cpb slide which is completely adaptable. The graphics in this PowerPoint slide showcase four stages that will help you succinctly convey the information. In addition, you can alternate the color, font size, font type, and shapes of this PPT layout according to your content. This PPT presentation can be accessed with Google Slides and is available in both standard screen and widescreen aspect ratios. It is also a useful set to elucidate topics like Company Merger Employee Rights. This well structured design can be downloaded in different formats like PDF, JPG, and PNG. So, without any delay, click on the download button now.

-

Comprehensive Strategic Governance Major Historical Mergers And Acquisitions Of Nestle Strategy SS V

Comprehensive Strategic Governance Major Historical Mergers And Acquisitions Of Nestle Strategy SS VThis slide provides glimpse about various mergers, acquisitions and alliances of Nestle corporation done in the past with signing huge business deals. It includes merger with Dreyers Grand Ice Cream Holdings in 2010, alliance with PepsiCo 1994, etc. Increase audience engagement and knowledge by dispensing information using Comprehensive Strategic Governance Major Historical Mergers And Acquisitions Of Nestle Strategy SS V. This template helps you present information on three stages. You can also present information on Mergers, Acquisitions, Alliances using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Comprehensive Strategic Governance Multiple Merger And Acquisition Strategies Of Nestle Strategy SS V

Comprehensive Strategic Governance Multiple Merger And Acquisition Strategies Of Nestle Strategy SS VThis slide provides glimpse about multiple MandA Mergers and Acquisitions strategies adopted by Nestle corporation that boosted its global presence. It includes market entry, portfolio expansion, cost synergies, tech acquisition, brand acquisition, etc. Increase audience engagement and knowledge by dispensing information using Comprehensive Strategic Governance Multiple Merger And Acquisition Strategies Of Nestle Strategy SS V. This template helps you present information on five stages. You can also present information on Market Entry, Tech Acquisition, Brand Acquisition using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Mergers And Acquisition Strategy Of Microsoft Business Strategy To Stay Ahead Strategy SS V

Mergers And Acquisition Strategy Of Microsoft Business Strategy To Stay Ahead Strategy SS VThis slide shows how Microsoft used mergers and acquisition to stay ahead and generate huge in the business. It includes information about key acquisitions by Microsoft over the past years. Increase audience engagement and knowledge by dispensing information using Mergers And Acquisition Strategy Of Microsoft Business Strategy To Stay Ahead Strategy SS V. This template helps you present information on three stages. You can also present information on Organization, Strategy, Corporations using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Activities During Different Stages Of Due Merger And Acquisition For Horizontal Strategy SS V

Activities During Different Stages Of Due Merger And Acquisition For Horizontal Strategy SS VThis slide showcases activities that should be conducted by organization during different stages of merger and acquisition due diligence process. It highlights objectives, activities, outputs in different stages of due diligence that are preliminary, detailed and final due diligence Present the topic in a bit more detail with this Activities During Different Stages Of Due Merger And Acquisition For Horizontal Strategy SS V. Use it as a tool for discussion and navigation on Objectives, General, Expansion. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

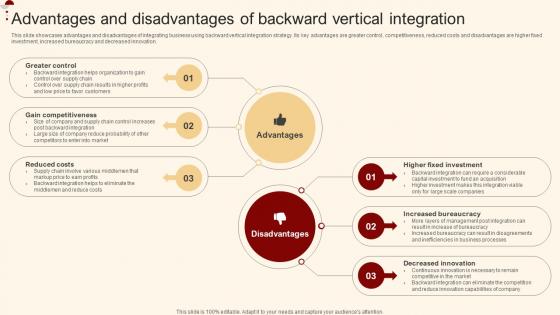

Advantages And Disadvantages Of Backward Merger And Acquisition For Horizontal Strategy SS V

Advantages And Disadvantages Of Backward Merger And Acquisition For Horizontal Strategy SS VThis slide showcases advantages and disadvantages of integrating business using backward vertical integration strategy. Its key advantages are greater control, competitiveness, reduced costs and disadvantages are higher fixed investment, increased bureaucracy and decreased innovation. Increase audience engagement and knowledge by dispensing information using Advantages And Disadvantages Of Backward Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on two stages. You can also present information on Increased, Innovation, Investment using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Advantages And Disadvantages Of Forward Merger And Acquisition For Horizontal Strategy SS V

Advantages And Disadvantages Of Forward Merger And Acquisition For Horizontal Strategy SS VThis slide showcases advantages and disadvantages of integrating business using forward vertical integration strategy. Its key advantages are limiting competitors, reduced uncertainty, independent distribution and disadvantages are higher costs, increased workload and bureaucratic inefficiencies. Introducing Advantages And Disadvantages Of Forward Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with two stages, this template is a great option to educate and entice your audience. Dispence information on Competitors, Uncertainty, Inefficiencies, using this template. Grab it now to reap its full benefits.

-

Agenda For Merger And Acquisition For Horizontal Integration Strategy SS V

Agenda For Merger And Acquisition For Horizontal Integration Strategy SS VIncrease audience engagement and knowledge by dispensing information using Agenda For Merger And Acquisition For Horizontal Integration Strategy SS V. This template helps you present information on four stages. You can also present information on Executing, Strategies, Horizontal using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Analyzing Different Type Of Vertical Integration Merger And Acquisition For Horizontal Strategy SS V

Analyzing Different Type Of Vertical Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases different types of business integration strategies that can be implemented by organization for market expansion and increase the profits. Different types of integration are backward, forward and balanced vertical integration Introducing Analyzing Different Type Of Vertical Integration Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Integration, Vertical, Purpose, using this template. Grab it now to reap its full benefits.

-

Analyzing Reasons For Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS V

Analyzing Reasons For Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS VThis slide showcases different reasons that results in failure of merger and acquisition strategy. Reasons are insufficient due diligence, lack of management involvement, poor integration process, overestimating synergies and valuation mistakes Increase audience engagement and knowledge by dispensing information using Analyzing Reasons For Merger And Acquisition Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on five stages. You can also present information on Diligence, Management, Process using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Best Practices For Communication During Merger And Acquisition For Horizontal Strategy SS V

Best Practices For Communication During Merger And Acquisition For Horizontal Strategy SS VThis slide showcases best practices that should be adopted by organization to increase the effectiveness and success probability of merger and acquisition process. Its key elements are frequency, consistency, honesty and transparency Introducing Best Practices For Communication During Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Frequency, Consistency, Honesty, using this template. Grab it now to reap its full benefits.

-

Case Study Of Backward Vertical Integration Merger And Acquisition For Horizontal Strategy SS V

Case Study Of Backward Vertical Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases case study that can help organization to understand and evaluate the implementation of backward vertical integration strategy. Its key elements are company overview, strategies implemented by organization and impact of forward vertical integration Increase audience engagement and knowledge by dispensing information using Case Study Of Backward Vertical Integration Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on three stages. You can also present information on Material, Manufacturer, Distributors using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Case Study Of Balanced Vertical Integration Merger And Acquisition For Horizontal Strategy SS V

Case Study Of Balanced Vertical Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases case study that can help organization to understand and evaluate the implementation of balanced vertical integration strategy. Its key elements are company overview, strategies implemented by organization and impact of forward vertical integration. Introducing Case Study Of Balanced Vertical Integration Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Production, Profitability, Increase, using this template. Grab it now to reap its full benefits.

-

Case Study Of Forward Vertical Integration Merger And Acquisition For Horizontal Strategy SS V

Case Study Of Forward Vertical Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases case study that can help organization to understand and evaluate the implementation of forward vertical integration strategy. Its key elements are company overview, strategies implemented by organization and impact of forward vertical integration Increase audience engagement and knowledge by dispensing information using Case Study Of Forward Vertical Integration Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on three stages. You can also present information on Average, Company, Revenue using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Comparing Backward And Forward Integration Merger And Acquisition For Horizontal Strategy SS V

Comparing Backward And Forward Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases table that can help to evaluate the difference between backward and forward vertical integration strategy. It compares two types of integration on parameters like control over, eliminates profit margins, specialization, objectives and examples Introducing Comparing Backward And Forward Integration Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Forward, Backward, Integration, using this template. Grab it now to reap its full benefits.

-

Comparing Vertical And Horizontal Integration Merger And Acquisition For Horizontal Strategy SS V

Comparing Vertical And Horizontal Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases table that can help to evaluate the different between horizontal and vertical integration strategy. It compares two types of integration on parameters like overview, objective, scaling, risk factor, number of competitors and advantages. Deliver an outstanding presentation on the topic using this Comparing Vertical And Horizontal Integration Merger And Acquisition For Horizontal Strategy SS V. Dispense information and present a thorough explanation of Integration, Horizontal, Vertical using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Critical Roles Involved In Merger And Merger And Acquisition For Horizontal Strategy SS V

Critical Roles Involved In Merger And Merger And Acquisition For Horizontal Strategy SS VThis slide showcases critical roles involved in implementation plus management of merger and acquisition strategy. Key roles involved are C suite, investment committee, business unit leadership, corporate development tea, transaction lead and external advisors. Deliver an outstanding presentation on the topic using this Critical Roles Involved In Merger And Merger And Acquisition For Horizontal Strategy SS V. Dispense information and present a thorough explanation of Committee, Business, Development using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Defining Responsibilities For Merger And Merger And Acquisition For Horizontal Strategy SS V

Defining Responsibilities For Merger And Merger And Acquisition For Horizontal Strategy SS VThis slide showcases responsibilities of different members for management plus implementation of merger and acquisition process. Key roles involved are C-suite, investment committee, business unit leadership, corporate development team, transaction lead and external advisors Introducing Defining Responsibilities For Merger And Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Investment, Leadership, Lead, using this template. Grab it now to reap its full benefits.

-

Different Alternatives For Vertical Integration Merger And Acquisition For Horizontal Strategy SS V

Different Alternatives For Vertical Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases alternatives that can be leveraged by organization instead of implementing vertical integration strategy. Alternatives available for vertical integration are - joint venture licensing, franchising and short term contracts Present the topic in a bit more detail with this Different Alternatives For Vertical Integration Merger And Acquisition For Horizontal Strategy SS V. Use it as a tool for discussion and navigation on Venture, Licensing, Franchising. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Different Methods For Horizontal Business Merger And Acquisition For Horizontal Strategy SS V

Different Methods For Horizontal Business Merger And Acquisition For Horizontal Strategy SS VThis slide showcases different types of methods that can help organization to implement horizontal integration strategy and expand the market share. Different methods for vertical integration are merger, acquisition and internal expansion of business Introducing Different Methods For Horizontal Business Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Merger, Acquisition, Internal, using this template. Grab it now to reap its full benefits.

-

Examples Of Companies With Vertical Merger And Acquisition For Horizontal Strategy SS V

Examples Of Companies With Vertical Merger And Acquisition For Horizontal Strategy SS VThis slide showcases case study of companies that have implemented vertical integration strategy in their business for market expansion. It showcases examples of three different type of integration that are forward, backward and balanced vertical integration Increase audience engagement and knowledge by dispensing information using Examples Of Companies With Vertical Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on three stages. You can also present information on Integration, Balanced, Forward using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.