Powerpoint Templates and Google slides for Business Merger

Save Your Time and attract your audience with our fully editable PPT Templates and Slides.

-

Guide Of Business Merger And Acquisition Plan To Expand Market Share Strategy CD

Guide Of Business Merger And Acquisition Plan To Expand Market Share Strategy CDEnthrall your audience with this Guide Of Business Merger And Acquisition Plan To Expand Market Share Strategy CD. Increase your presentation threshold by deploying this well-crafted template. It acts as a great communication tool due to its well-researched content. It also contains stylized icons, graphics, visuals etc, which make it an immediate attention-grabber. Comprising sixty nine slides, this complete deck is all you need to get noticed. All the slides and their content can be altered to suit your unique business setting. Not only that, other components and graphics can also be modified to add personal touches to this prefabricated set.

-

Post Merger Financial Integration To Transform Business Processes CRP CD

Post Merger Financial Integration To Transform Business Processes CRP CDDo not compromise on a template that erodes your messages impact. Introducing our engaging Post Merger Financial Integration To Transform Business Processes CRP CD complete deck, thoughtfully crafted to grab your audiences attention instantly. With this deck, effortlessly download and adjust elements, streamlining the customization process. Whether you are using Microsoft versions or Google Slides, it fits seamlessly into your workflow. Furthermore, it is accessible in JPG, JPEG, PNG, and PDF formats, facilitating easy sharing and editing. Not only that you also play with the color theme of your slides making it suitable as per your audiences preference.

-

6 phase infographic process evaluation management elements marketing business model mergers

6 phase infographic process evaluation management elements marketing business model mergersThis complete deck can be used to present to your team. It has PPT slides on various topics highlighting all the core areas of your business needs. This complete deck focuses on 6 Phase Infographic Process Evaluation Management Elements Marketing Business Model Mergers and has professionally designed templates with suitable visuals and appropriate content. This deck consists of total of thirteen slides. All the slides are completely customizable for your convenience. You can change the colour, text and font size of these templates. You can add or delete the content if needed. Get access to this professionally designed complete presentation by clicking the download button below.

-

Costs Incurred During Merger And Acquisition Process Business Integration Strategy Strategy SS V

Costs Incurred During Merger And Acquisition Process Business Integration Strategy Strategy SS VThis slide showcases percentage of costs involved in different stages of merger and acquisition process. Key stages are strategy, screening of partners, negotiations, due diligence, transaction execution and post merger integration of business Deliver an outstanding presentation on the topic using this Costs Incurred During Merger And Acquisition Process Business Integration Strategy Strategy SS V. Dispense information and present a thorough explanation of Pre Acquisition Expenses, Maximum Amount Of Expenses using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Integration Activities For Post Merger And Acquisition Business Integration Strategy Strategy SS V

Integration Activities For Post Merger And Acquisition Business Integration Strategy Strategy SS VThis slide showcases key integration activities that should be conducted in different areas of business for effective implementation of merger and acquisition. Key areas for integration are governance, legal, finance, human resource, communication plus technology and IT Deliver an outstanding presentation on the topic using this Integration Activities For Post Merger And Acquisition Business Integration Strategy Strategy SS V. Dispense information and present a thorough explanation of Finance, Human Resource, Communication using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Cost Estimation For Effective Due Diligence In M Guide Of Business Merger And Acquisition Plan Strategy SS V

Cost Estimation For Effective Due Diligence In M Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers cost estimation for implementing due diligence of various departments for acquiring another company. It involves key departments such as operational, IT, accounting and legal. Present the topic in a bit more detail with this Cost Estimation For Effective Due Diligence In M Guide Of Business Merger And Acquisition Plan Strategy SS V. Use it as a tool for discussion and navigation on Cost Estimation, Effective Due Diligence. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

KPI Dashboard To Assess M And A Analytics Report Guide Of Business Merger And Acquisition Plan Strategy SS V

KPI Dashboard To Assess M And A Analytics Report Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers KPI dashboard to assess MAndA analytics report. It involves key details such as percentage of total number of MAndA, nature of business acquired and digital focused acquisitions. Present the topic in a bit more detail with this KPI Dashboard To Assess M And A Analytics Report Guide Of Business Merger And Acquisition Plan Strategy SS V. Use it as a tool for discussion and navigation on Digital Focused Acquisitions, Nature Of Business Acquired. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

KPI Dashboard To Track M And A Deal Status Guide Of Business Merger And Acquisition Plan Strategy SS V

KPI Dashboard To Track M And A Deal Status Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers KPI dashboard to track merger And acquisition deals status. It involves key details such as total number of deals in pipeline, deals by country and current status of deals. Deliver an outstanding presentation on the topic using this KPI Dashboard To Track M And A Deal Status Guide Of Business Merger And Acquisition Plan Strategy SS V. Dispense information and present a thorough explanation of Number Of Deals By Status, Deals Count By Country using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Statistics Showcasing Worldwide M And A Guide Of Business Merger And Acquisition Plan Strategy SS V

Statistics Showcasing Worldwide M And A Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers statistics showcasing worldwide rise in merger And acquisition transactions company placed for growth And expansion and to ensure risk diversification through portfolio divergence. Deliver an outstanding presentation on the topic using this Statistics Showcasing Worldwide M And A Guide Of Business Merger And Acquisition Plan Strategy SS V. Dispense information and present a thorough explanation of Statistics Showcasing Worldwide using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Horizontal And Vertical Business Examples Of Companies With Conglomerate Merger Strategy SS V

Horizontal And Vertical Business Examples Of Companies With Conglomerate Merger Strategy SS VThis slide showcases examples of conglomerate merger that have helped companies to diversify business risk and increase brand presence. It highlights example of various companies like Walt Disney, American Broadcasting, Ebay and PayPal Increase audience engagement and knowledge by dispensing information using Horizontal And Vertical Business Examples Of Companies With Conglomerate Merger Strategy SS V. This template helps you present information on two stages. You can also present information on American Broadcasting, Merger Details using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Analyzing Reasons For Merger And Acquisition Failure Business Integration Strategy Strategy SS V

Analyzing Reasons For Merger And Acquisition Failure Business Integration Strategy Strategy SS VThis slide showcases different reasons that results in failure of merger and acquisition strategy. Reasons are insufficient due diligence, lack of management involvement, poor integration process, overestimating synergies and valuation mistakes Introducing Analyzing Reasons For Merger And Acquisition Failure Business Integration Strategy Strategy SS V to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Insufficient Due Diligence, Poor Integration Process, using this template. Grab it now to reap its full benefits.

-

Best Practices For Communication During Merger And Business Integration Strategy Strategy SS V

Best Practices For Communication During Merger And Business Integration Strategy Strategy SS VThis slide showcases best practices that should be adopted by organization to increase the effectiveness and success probability of merger and acquisition process. Its key elements are frequency, consistency, honesty and transparency Increase audience engagement and knowledge by dispensing information using Best Practices For Communication During Merger And Business Integration Strategy Strategy SS V. This template helps you present information on four stages. You can also present information on Frequency, Consistency, Honesty using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Critical Roles Involved In Merger And Acquisition Business Integration Strategy Strategy SS V

Critical Roles Involved In Merger And Acquisition Business Integration Strategy Strategy SS VThis slide showcases critical roles involved in implementation plus management of merger and acquisition strategy. Key roles involved are C suite, investment committee, business unit leadership, corporate development tea, transaction lead and external advisors Present the topic in a bit more detail with this Critical Roles Involved In Merger And Acquisition Business Integration Strategy Strategy SS V. Use it as a tool for discussion and navigation on Business Unit Leadership, Transaction Lead. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Defining Responsibilities For Merger And Acquisition Business Integration Strategy Strategy SS V

Defining Responsibilities For Merger And Acquisition Business Integration Strategy Strategy SS VThis slide showcases responsibilities of different members for management plus implementation of merger and acquisition process. Key roles involved are C suite, investment committee, business unit leadership, corporate development team, transaction lead and external advisors Introducing Defining Responsibilities For Merger And Acquisition Business Integration Strategy Strategy SS V to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Business Unit Leadership, Transaction Lead, using this template. Grab it now to reap its full benefits.

-

Framework To Manage Change Post Merger And Business Integration Strategy Strategy SS V

Framework To Manage Change Post Merger And Business Integration Strategy Strategy SS VThis slide showcases framework that can help organization in business integration and increase the effectiveness of merger and acquisition process. Its key elements are management, culture, strategy, operations and synergies Deliver an outstanding presentation on the topic using this Framework To Manage Change Post Merger And Business Integration Strategy Strategy SS V. Dispense information and present a thorough explanation of Management, Strategy using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Key Areas For Post Merger And Acquisition Integration Business Integration Strategy Strategy SS V

Key Areas For Post Merger And Acquisition Integration Business Integration Strategy Strategy SS VThis slide showcases key areas that should be evaluated by organization for conduct integration activities for merger and acquisition. Its key elements are sales and marketing, production, after sales service, synergies, corporate communications, technology, legal, information technology etc Introducing Key Areas For Post Merger And Acquisition Integration Business Integration Strategy Strategy SS V to increase your presentation threshold. Encompassed with twelve stages, this template is a great option to educate and entice your audience. Dispence information on Production, Synergies, Corporate Culture, using this template. Grab it now to reap its full benefits.

-

Overview And Advantages Of Merger Plus Acquisition Business Integration Strategy Strategy SS V

Overview And Advantages Of Merger Plus Acquisition Business Integration Strategy Strategy SS VThis slide showcases merger and acquisition overview that can help organization to combine with other company for market expansion. It also highlights benefits of merger and acquisition that are enhanced distribution capabilities, increased market share, access to financial resources etc Introducing Overview And Advantages Of Merger Plus Acquisition Business Integration Strategy Strategy SS V to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Acquisition, Merger, using this template. Grab it now to reap its full benefits.

-

Process To Conduct Merger And Acquisition Business Integration Strategy Strategy SS V

Process To Conduct Merger And Acquisition Business Integration Strategy Strategy SS VThis slide showcases steps that can help organization to implement merger and acquisition to increase market share plus profitability. Key steps involved in merger and acquisition are pre deal, deal preparation, integration and optimization Introducing Process To Conduct Merger And Acquisition Business Integration Strategy Strategy SS V to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Conduct Due Diligence, Integrate Post Merger, using this template. Grab it now to reap its full benefits.

-

Selecting Partner For Merger And Acquisition Strategy Business Integration Strategy Strategy SS V

Selecting Partner For Merger And Acquisition Strategy Business Integration Strategy Strategy SS VThis slide showcases partner selection on basis of different criteria for implementing merger and acquisition strategy. Key parameters for merger and acquisition partner selection are industry, annual revenue generated, country and operations Present the topic in a bit more detail with this Selecting Partner For Merger And Acquisition Strategy Business Integration Strategy Strategy SS V. Use it as a tool for discussion and navigation on Ownership, Partnership. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Setting Criteria For Selecting Merger And Acquisition Partner Business Integration Strategy Strategy SS V

Setting Criteria For Selecting Merger And Acquisition Partner Business Integration Strategy Strategy SS VThis slide showcases different criteria that can be set by organization to select partner for merger and acquisition process. Criteria for partner selection are strategic combination, target approach, revenue generation, value chain and target countr Deliver an outstanding presentation on the topic using this Setting Criteria For Selecting Merger And Acquisition Partner Business Integration Strategy Strategy SS V. Dispense information and present a thorough explanation of Strategic Combination, Target Approach using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Solutions To Tackle Key Challenges In Merger And Acquisition Business Integration Strategy Strategy SS V

Solutions To Tackle Key Challenges In Merger And Acquisition Business Integration Strategy Strategy SS VThis slide showcases key challenges faced by organization during merger and acquisition process that are employee retention, security threats, unexpected costs and wrong valuation. It also highlights solutions to tackle these hindrances during implementing of strategy Present the topic in a bit more detail with this Solutions To Tackle Key Challenges In Merger And Acquisition Business Integration Strategy Strategy SS V. Use it as a tool for discussion and navigation on Employee Retention Challenges, Security Threats. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Timeline For Post Merger And Acquisition Integration Business Integration Strategy Strategy SS V

Timeline For Post Merger And Acquisition Integration Business Integration Strategy Strategy SS VThis slide showcases timeline that can help organization to conduct plus manage integration after implementing merger and acquisition process. Key areas for integration are organizational, brand, system, product and facilities integration Present the topic in a bit more detail with this Timeline For Post Merger And Acquisition Integration Business Integration Strategy Strategy SS V. Use it as a tool for discussion and navigation on Organizational Integration, Brand Integration. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Timeline For Sell Side Merger And Acquisition Business Integration Strategy Strategy SS V

Timeline For Sell Side Merger And Acquisition Business Integration Strategy Strategy SS VThis slide showcases sell side timeline that can help organization to manage plus implement the merger plus acquisition process for market expansion. Its key elements are process preparation, marketing activities and due diligence of buyer Deliver an outstanding presentation on the topic using this Timeline For Sell Side Merger And Acquisition Business Integration Strategy Strategy SS V. Dispense information and present a thorough explanation of Contact Potential Buyers, Formulate Data Room using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Major Historical Mergers And Acquisitions Of Nestle Corporate And Business Level Strategy SS V

Major Historical Mergers And Acquisitions Of Nestle Corporate And Business Level Strategy SS VThis slide provides glimpse about various mergers, acquisitions and alliances of Nestle corporation done in the past with signing huge business deals. It includes merger with Dreyers Grand Ice Cream Holdings in 2010, alliance with PepsiCo 1994, etc. Increase audience engagement and knowledge by dispensing information using Major Historical Mergers And Acquisitions Of Nestle Corporate And Business Level Strategy SS V. This template helps you present information on nine stages. You can also present information on Mergers, Acquisitions, Alliances using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Multiple Merger And Acquisition Strategies Of Nestle Corporate And Business Level Strategy SS V

Multiple Merger And Acquisition Strategies Of Nestle Corporate And Business Level Strategy SS VThis slide provides glimpse about multiple M and A Mergers and Acquisitions strategies adopted by Nestle corporation that boosted its global presence. It includes market entry, portfolio expansion, cost synergies, tech acquisition, brand acquisition, etc. Increase audience engagement and knowledge by dispensing information using Multiple Merger And Acquisition Strategies Of Nestle Corporate And Business Level Strategy SS V. This template helps you present information on five stages. You can also present information on Acquisition, Synergies, Portfolio using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Mergers And Acquisition Strategy Of Microsoft Business Strategy To Stay Ahead Strategy SS V

Mergers And Acquisition Strategy Of Microsoft Business Strategy To Stay Ahead Strategy SS VThis slide shows how Microsoft used mergers and acquisition to stay ahead and generate huge in the business. It includes information about key acquisitions by Microsoft over the past years. Increase audience engagement and knowledge by dispensing information using Mergers And Acquisition Strategy Of Microsoft Business Strategy To Stay Ahead Strategy SS V. This template helps you present information on three stages. You can also present information on Organization, Strategy, Corporations using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Different Methods For Horizontal Business Merger And Acquisition For Horizontal Strategy SS V

Different Methods For Horizontal Business Merger And Acquisition For Horizontal Strategy SS VThis slide showcases different types of methods that can help organization to implement horizontal integration strategy and expand the market share. Different methods for vertical integration are merger, acquisition and internal expansion of business Introducing Different Methods For Horizontal Business Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Merger, Acquisition, Internal, using this template. Grab it now to reap its full benefits.

-

Framework To Restructure Business Vertical Merger And Acquisition For Horizontal Strategy SS V

Framework To Restructure Business Vertical Merger And Acquisition For Horizontal Strategy SS VThis slide showcases framework that can help organization to restructure the vertical integration and implement other strategies for business. It can help to evaluate the probability of vertical market failure and analyze the business strength to defend against market power Deliver an outstanding presentation on the topic using this Framework To Restructure Business Vertical Merger And Acquisition For Horizontal Strategy SS V. Dispense information and present a thorough explanation of Organization, Market, Arrangements using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Key Levels Of Business Vertical Integration Merger And Acquisition For Horizontal Strategy SS V

Key Levels Of Business Vertical Integration Merger And Acquisition For Horizontal Strategy SS VThis slide showcases different levels of business integration that can help organization to integrate vertically and expand the market share plus profitability. Different levels include- quasi, taper and full scale vertical business integration. Introducing Key Levels Of Business Vertical Integration Merger And Acquisition For Horizontal Strategy SS V to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Integration, Vertical, Quasi, using this template. Grab it now to reap its full benefits.

-

Overview And Advantages Of Business Merger And Acquisition For Horizontal Strategy SS V

Overview And Advantages Of Business Merger And Acquisition For Horizontal Strategy SS VThis slide showcases overview of business integration that can help organization to take control over different areas of supply chain and reduce reliance on third party suppliers. It also showcases benefits of business integration that are increased profit margins, smooth raw material supply and gain competitiveness. Increase audience engagement and knowledge by dispensing information using Overview And Advantages Of Business Merger And Acquisition For Horizontal Strategy SS V. This template helps you present information on three stages. You can also present information on Margins, Competitiveness, Material using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Acquisition Planning To Enhance Due Diligence Guide Of Business Merger And Acquisition Plan Strategy Ss V

Acquisition Planning To Enhance Due Diligence Guide Of Business Merger And Acquisition Plan Strategy Ss VThis slide covers acquisition planning to enhance process. It involves key activities such as negotiation, build teams, create master plan and maintain project control and prioritize tasks. Introducing Acquisition Planning To Enhance Due Diligence Guide Of Business Merger And Acquisition Plan Strategy Ss V to increase your presentation threshold. Encompassed with Four stages, this template is a great option to educate and entice your audience. Dispence information on Deal Making, Day One, Post Merger Alliance, using this template. Grab it now to reap its full benefits.

-

Agenda For Guide Of Business Merger And Acquisition Plan To Expand Market Share Strategy SS V

Agenda For Guide Of Business Merger And Acquisition Plan To Expand Market Share Strategy SS VIncrease audience engagement and knowledge by dispensing information using Agenda For Guide Of Business Merger And Acquisition Plan To Expand Market Share Strategy SS V. This template helps you present information on Four stages. You can also present information on Growth And Development, Tax Benefits, Business Effectively using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

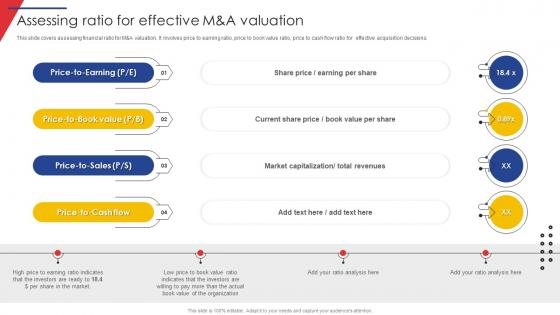

Assessing Ratio For Effective M And A Valuation Guide Of Business Merger And Acquisition Plan Strategy SS V

Assessing Ratio For Effective M And A Valuation Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers assessing financial ratio for MAndA valuation. It involves price to earning ratio, price to book value ratio, price to cash flow ratio for effective acquisition decisions. Introducing Assessing Ratio For Effective M And A Valuation Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Four stages, this template is a great option to educate and entice your audience. Dispence information on Price To Earning, Price To Sale, Price To Cash Flow, using this template. Grab it now to reap its full benefits.

-

Best Practices For Implementing M And A Process Guide Of Business Merger And Acquisition Plan Strategy SS V

Best Practices For Implementing M And A Process Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers best practices for successful and effective implementation of MAndA process. It Involves best practices such as develop clear strategy, conduct due diligence and monitor progress. Increase audience engagement and knowledge by dispensing information using Best Practices For Implementing M And A Process Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Three stages. You can also present information on Develop Clear Strategy, Conduct Due Diligence, Monitor Progress using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Communication Levels During M And A Integration Guide Of Business Merger And Acquisition Plan Strategy SS V

Communication Levels During M And A Integration Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers communication levels during MAndA integration. It involves key stages such as due diligence, design and ramp up, merger announcements and integration implementation. Introducing Communication Levels During M And A Integration Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Five stages, this template is a great option to educate and entice your audience. Dispence information on Announcement, Planning And Implementation, Integration Implementation, using this template. Grab it now to reap its full benefits.

-

Comparative Analysis Of Revenue Criteria For M Guide Of Business Merger And Acquisition Plan Strategy SS V

Comparative Analysis Of Revenue Criteria For M Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers comparative analysis on basis of revenue criteria for selecting company for MAndA deal. It involves key reasons such as company liquidity ratio is stable and net profit margin is higher. Present the topic in a bit more detail with this Comparative Analysis Of Revenue Criteria For M Guide Of Business Merger And Acquisition Plan Strategy SS V. Use it as a tool for discussion and navigation on Criteria, Company. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Concentric Merger Strategy To Reduce Risks Guide Of Business Merger And Acquisition Plan Strategy SS V

Concentric Merger Strategy To Reduce Risks Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers implementing concentric merger strategy to improve financial profits. It involves key benefits such as reduced risks, increases new customer and market share. Introducing Concentric Merger Strategy To Reduce Risks Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Three stages, this template is a great option to educate and entice your audience. Dispence information on Business, Concentric Integration, using this template. Grab it now to reap its full benefits.

-

Conglomerate Merger Strategy For Financial Gain Guide Of Business Merger And Acquisition Plan Strategy SS V

Conglomerate Merger Strategy For Financial Gain Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers conglomerate merger strategy to optimize financial benefits. It involves best practices such as effective integration analysis, assess talent requirements to help in capturing revenue synergies. Increase audience engagement and knowledge by dispensing information using Conglomerate Merger Strategy For Financial Gain Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Three stages. You can also present information on Business, Conglomerate Integration using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Developing Strategies To Identify Right Target Guide Of Business Merger And Acquisition Plan Strategy SS V

Developing Strategies To Identify Right Target Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers key strategies to identify right target acquisition to enhance market share and enhance credibility. It involves approaches such as determine acquisition criteria, conduct market research and evaluate financial performance. Increase audience engagement and knowledge by dispensing information using Developing Strategies To Identify Right Target Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Five stages. You can also present information on Determine Acquisition Criteria, Conduct Market Research, Monitor Industry Trends using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Due Diligence Checklist For Successful M And A Guide Of Business Merger And Acquisition Plan Strategy SS V

Due Diligence Checklist For Successful M And A Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers checklist for effective due diligence process for successful merger and acquisition implementation. It involves financial matters, intellectual property, material contracts, litigation and tax matters. Present the topic in a bit more detail with this Due Diligence Checklist For Successful M And A Guide Of Business Merger And Acquisition Plan Strategy SS V. Use it as a tool for discussion and navigation on Particulars, Owner, Priority. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Due Diligence Process In M And A To Enhance Guide Of Business Merger And Acquisition Plan Strategy SS V

Due Diligence Process In M And A To Enhance Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers due diligence process in merger And acquisition to enhance its effectiveness. It involves key steps such as prepare documents, share And review, due diligence Q A and post diligence reporting. Increase audience engagement and knowledge by dispensing information using Due Diligence Process In M And A To Enhance Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Four stages. You can also present information on Prepare Documents, Review Documents, Post Diligence Reporting using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Essential M And A Valuation Methods To Enhance Guide Of Business Merger And Acquisition Plan Strategy SS V

Essential M And A Valuation Methods To Enhance Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers essential merger And acquisition valuation methods to determine value of acquiring. It involves four methods such as net assets, EBITDA, price earning ratio and revenue multiple. Introducing Essential M And A Valuation Methods To Enhance Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Four stages, this template is a great option to educate and entice your audience. Dispence information on Net Assets, Price Earning Ratio, Revenue Multiple, using this template. Grab it now to reap its full benefits.

-

Five Phases Of Due Diligence Process To Increase Guide Of Business Merger And Acquisition Plan Strategy SS V

Five Phases Of Due Diligence Process To Increase Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers five phases of due diligence for gaining competitive advantage to increase market share. It involves five key phases such as developing MAndA strategy, target screening, due dillligence, transaction execution And integration. Increase audience engagement and knowledge by dispensing information using Five Phases Of Due Diligence Process To Increase Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Five stages. You can also present information on Target Screening, Due Diligence, Transaction Execution using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Hierarchy Chart For Integrating Merger Guide Of Business Merger And Acquisition Plan Strategy SS V

Hierarchy Chart For Integrating Merger Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers hierarchy chart for merger And acquisition process. It involves key activities such as product strategy, product technology And operations, sales and client retention, treasury And tax and internal audit. Increase audience engagement and knowledge by dispensing information using Hierarchy Chart For Integrating Merger Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on One stages. You can also present information on Product Strategy, Information Technology, Legal using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Horizontal Merger To Reduce Supply Chain Cost Guide Of Business Merger And Acquisition Plan Strategy SS V

Horizontal Merger To Reduce Supply Chain Cost Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers implementing horizontal merger strategy to expand customer base and reduce supply chain cost. It involves key reasons such as reduced competition, gain ideas And products and economies of scale. Introducing Horizontal Merger To Reduce Supply Chain Cost Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Three stages, this template is a great option to educate and entice your audience. Dispence information on HP And Compaq, Exon And Mobil, Amazon And Whole Foods, using this template. Grab it now to reap its full benefits.

-

Introduction To Business Acquisition Overview Guide Of Business Merger And Acquisition Plan Strategy SS V

Introduction To Business Acquisition Overview Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers overview to business acquisition strategy to gain control and expand business. It involves four types of acquisition strategies such as horizontal, vertical, congeneric and conglomerate acquisition. Introducing Introduction To Business Acquisition Overview Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Two stages, this template is a great option to educate and entice your audience. Dispence information on Introduction, Business Acquisition, using this template. Grab it now to reap its full benefits.

-

Introduction To Financing Acquisition Overview Guide Of Business Merger And Acquisition Plan Strategy SS V

Introduction To Financing Acquisition Overview Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers overview to acquisition financing to enhance market share. It involves sources of financing such as cash transaction, stock swaps, debt financing, equity investment And leveraged buy out. Increase audience engagement and knowledge by dispensing information using Introduction To Financing Acquisition Overview Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Two stages. You can also present information on Overview, Sources Of Business Acquisition using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Introduction To M And A Due Diligence Overview Guide Of Business Merger And Acquisition Plan Strategy SS V

Introduction To M And A Due Diligence Overview Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers overview to merger And acquisition due diligence to identify risk involved in transaction. It involves key benefits such as reduces buyer risks, enables effective valuation and decision making. Introducing Introduction To M And A Due Diligence Overview Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Three stages, this template is a great option to educate and entice your audience. Dispence information on Reduces Buyer, Enables Effective, Making For Implementing, using this template. Grab it now to reap its full benefits.

-

Introduction To Manda Communication Strategy Guide Of Business Merger And Acquisition Plan Strategy SS V

Introduction To Manda Communication Strategy Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers overview to MAndA communication strategy to align and communicate new strategies to concerned stakeholders of company. It involves acquisition design, internal and external announcements and HR updates. Increase audience engagement and knowledge by dispensing information using Introduction To Manda Communication Strategy Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Two stages. You can also present information on Overview, Involves using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Key Considerations For Assessing Geographica Guide Of Business Merger And Acquisition Plan Strategy SS V

Key Considerations For Assessing Geographica Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers key considerations for assessing geographical aspects before implementing MAndA strategy. It involves increased market share, tax benefits and political And social factor. Introducing Key Considerations For Assessing Geographica Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Three stages, this template is a great option to educate and entice your audience. Dispence information on Increased Market Share, Tax Benefits, Political And Social Factors, using this template. Grab it now to reap its full benefits.

-

Key Reasons To Pursue Merger And Acquisition Guide Of Business Merger And Acquisition Plan Strategy SS V

Key Reasons To Pursue Merger And Acquisition Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers reasons that why companies pursue merger and acquisition strategy. It involves three main reasons such as acquiring expertise or new technology, gain maximum market share and avail tax benefits. Increase audience engagement and knowledge by dispensing information using Key Reasons To Pursue Merger And Acquisition Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Three stages. You can also present information on New Technology, Market Share, Avail Tax Benefits using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Key Strategies For Implementing Merger Guide Of Business Merger And Acquisition Plan Strategy SS V

Key Strategies For Implementing Merger Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers MAndA strategies to attain organizational growth and development. It involves key strategies such as geographic expansion, talent acquisition and asset acquisition. Introducing Key Strategies For Implementing Merger Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Three stages, this template is a great option to educate and entice your audience. Dispence information on Geographic Expansion, Talent Acquisition, Asset Acquisition, using this template. Grab it now to reap its full benefits.

-

M And A Stakeholder Communication Plan Status Guide Of Business Merger And Acquisition Plan Strategy SS V

M And A Stakeholder Communication Plan Status Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers plan for communicating MAndA activities to concerned stakeholders. It involves major announcements such as HR updates, internal announcement email, newsletter, closing and welcome letter. Present the topic in a bit more detail with this M And A Stakeholder Communication Plan Status Guide Of Business Merger And Acquisition Plan Strategy SS V. Use it as a tool for discussion and navigation on Announcement, Status, Stakeholder. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

M And A Synergy Analysis To Increase Effectiveness Guide Of Business Merger And Acquisition Plan Strategy SS V

M And A Synergy Analysis To Increase Effectiveness Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers MAndA synergy analysis to increase process effectiveness. It involves synergies such as revenue, COGS, OpEx synergies and post combined financial details such as acquirer and target revenue for 4 years. Deliver an outstanding presentation on the topic using this M And A Synergy Analysis To Increase Effectiveness Guide Of Business Merger And Acquisition Plan Strategy SS V. Dispense information and present a thorough explanation of Revenue Synergies, Cost Synergies using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Merger And Acquisition Model For Successful Guide Of Business Merger And Acquisition Plan Strategy SS V

Merger And Acquisition Model For Successful Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers merger And acquisition model to gain competitive advantage and enhance market share. It involves making presumptions, formulating projections, valuation of target company, business combination and deal dilution. Increase audience engagement and knowledge by dispensing information using Merger And Acquisition Model For Successful Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Five stages. You can also present information on Making Projections, Valuation Of Target Company, Deal Dilution using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Methods Of Acquisition Financing For Effective Guide Of Business Merger And Acquisition Plan Strategy SS V

Methods Of Acquisition Financing For Effective Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers methods of financing business acquisition for effective business valuation. It involves key methods such as bank loan, equity financing and leveraged buy out. Introducing Methods Of Acquisition Financing For Effective Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Four stages, this template is a great option to educate and entice your audience. Dispence information on Bank Loan, Equity Financing, Mezzanine Financing, using this template. Grab it now to reap its full benefits.

-

Need Of Effective Due Diligence In M And A Guide Of Business Merger And Acquisition Plan Strategy SS V

Need Of Effective Due Diligence In M And A Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers key benefits of implementing due diligence in merger And acquisition implementation. It involves key benefits such as helps in effective negotiation, transparency for both parties and provide financial information. Increase audience engagement and knowledge by dispensing information using Need Of Effective Due Diligence In M And A Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Three stages. You can also present information on Effective Negotiation, Transparency For Both Parties, Provide Financial Information using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Need To Implement Effective Acquisition Funding Guide Of Business Merger And Acquisition Plan Strategy SS V

Need To Implement Effective Acquisition Funding Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers need to implement effective acquisition funding to enhance market share. It involves key benefits such as increases profitability, provides competitive advantage and improves collaboration. Introducing Need To Implement Effective Acquisition Funding Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Three stages, this template is a great option to educate and entice your audience. Dispence information on Increases Profitability, Provides Competitive Advantage, Improves Collaboration, using this template. Grab it now to reap its full benefits.

-

Overview To Acquisition Valuation Introduction Guide Of Business Merger And Acquisition Plan Strategy SS V

Overview To Acquisition Valuation Introduction Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers overview to acquisition valuation to determine financial value for mAnda implementation. It involves key metrics such as price to earning ratio, enterprise value to sales ratio, discounted cash flow and replacement costs. Increase audience engagement and knowledge by dispensing information using Overview To Acquisition Valuation Introduction Guide Of Business Merger And Acquisition Plan Strategy SS V. This template helps you present information on Two stages. You can also present information on Introduction, Key Metrics using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Process To Evaluate Potential Business Acquisition Guide Of Business Merger And Acquisition Plan Strategy SS V

Process To Evaluate Potential Business Acquisition Guide Of Business Merger And Acquisition Plan Strategy SS VThis slide covers three steps to process to evaluate potential business acquisition. It involves key steps such as determine level of valuation, assess business information and apply effective valuation method. Introducing Process To Evaluate Potential Business Acquisition Guide Of Business Merger And Acquisition Plan Strategy SS V to increase your presentation threshold. Encompassed with Three stages, this template is a great option to educate and entice your audience. Dispence information on Determine Level Of Valuation, Assess Business Information, Apply Effective Valuation Method, using this template. Grab it now to reap its full benefits.