Powerpoint Templates and Google slides for Approaches.

Save Your Time and attract your audience with our fully editable PPT Templates and Slides.

-

Capital Structure Analysis In Technology Industry Capital Structure Approaches For Financial Fin SS

Capital Structure Analysis In Technology Industry Capital Structure Approaches For Financial Fin SSThis slide carries a capital structure analysis for determining levels of debt and equity in the technology industry. It includes assessing fund requirements, optimal capital structure, challenges faced, and impact on the industry. Increase audience engagement and knowledge by dispensing information using Capital Structure Analysis In Technology Industry Capital Structure Approaches For Financial Fin SS. This template helps you present information on three stages. You can also present information on Capital Structure Analysis, Technology Industry, Fund Requirements, Optimal Capital Structure using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Capital Structure And Debt Equity Ratio Capital Structure Approaches For Financial Fin SS

Capital Structure And Debt Equity Ratio Capital Structure Approaches For Financial Fin SSThis slide represents the measurement of capital structure along with the debt or equity ratio. The slide mentions the example of Reliance Industries for clear understanding of the formula. Deliver an outstanding presentation on the topic using this Capital Structure And Debt Equity Ratio Capital Structure Approaches For Financial Fin SS. Dispense information and present a thorough explanation of Capital Structure, Debt Or Equity Ratio, Preferred Stock Weight, Common Equity Weight using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Capital Structure Approaches For Financial Decision Making Table Of Contents Fin SS

Capital Structure Approaches For Financial Decision Making Table Of Contents Fin SSIntroducing Capital Structure Approaches For Financial Decision Making Table Of Contents Fin SS to increase your presentation threshold. Encompassed with one stages, this template is a great option to educate and entice your audience. Dispence information on Capital Structure, Debt Or Equity Ratio, Preferred Stock Weight, Common Equity Weight, using this template. Grab it now to reap its full benefits.

-

Capital Structure Approaches For Financial Determination Of Optimal Capital Structure Fin SS

Capital Structure Approaches For Financial Determination Of Optimal Capital Structure Fin SSThis slide illustrates a practical example of determining an optimal capital structure for the company minimizing the weighted average cost of capital. Additional factors to be considered are tax shield, financial flexibility, etc. Increase audience engagement and knowledge by dispensing information using Capital Structure Approaches For Financial Determination Of Optimal Capital Structure Fin SS. This template helps you present information on four stages. You can also present information on Tax Shield, Financial Flexibility, Cost Of Capital, Optimal Capital Structure using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Capital Structure Decision Making Process Capital Structure Approaches For Financial Fin SS

Capital Structure Decision Making Process Capital Structure Approaches For Financial Fin SSIntroducing Capital Structure Decision Making Process Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with twelve stages, this template is a great option to educate and entice your audience. Dispence information on Capital Structure, Decision Making Process, Identify Optimal Capital Structure, using this template. Grab it now to reap its full benefits.

-

Capital Structure Decision Overview For Financial Capital Structure Approaches For Financial Fin SS

Capital Structure Decision Overview For Financial Capital Structure Approaches For Financial Fin SSThis slide represents an overview of capital structure decisions containing features of ideal capital structure, factors affecting decision-making, and best practices for the right decision-making regarding the appropriate mix of debt and equity. Increase audience engagement and knowledge by dispensing information using Capital Structure Decision Overview For Financial Capital Structure Approaches For Financial Fin SS. This template helps you present information on five stages. You can also present information on Minimize Capital Costs, Lower Business And Financial Risks, Financial Flexibility, Capital Structure Decision using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Capital Structure Overview With Key Components Capital Structure Approaches For Financial Fin SS

Capital Structure Overview With Key Components Capital Structure Approaches For Financial Fin SSThis slide represents the overview of capital structure containing its description and key components such as common equity, preferred stock and debt. Introducing Capital Structure Overview With Key Components Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Common Equity, Hybrid Instruments, Finance Working Capital Requirements, using this template. Grab it now to reap its full benefits.

-

Case Study Application Of Net Income Theory Capital Structure Approaches For Financial Fin SS

Case Study Application Of Net Income Theory Capital Structure Approaches For Financial Fin SSThis slide represents the case study of Apple Inc. indicating the application of Net Income NI theory in the company. It mentions the details of company, problems faced, solutions and impact of using the NI approach. Increase audience engagement and knowledge by dispensing information using Case Study Application Of Net Income Theory Capital Structure Approaches For Financial Fin SS. This template helps you present information on three stages. You can also present information on Technology Based Multinational Company, Consumer Electronics, Online Services, Software using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Case Study Application Of Pecking Order Theory Capital Structure Approaches For Financial Fin SS

Case Study Application Of Pecking Order Theory Capital Structure Approaches For Financial Fin SSThis slide represents the case study of Uber company using the Pecking Order theory for sourcing funds for the organization. It includes three type of funding internal financing, debt and external financing. Present the topic in a bit more detail with this Case Study Application Of Pecking Order Theory Capital Structure Approaches For Financial Fin SS. Use it as a tool for discussion and navigation on Application Pecking Order, Internal Financing, Debt And External Financing. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Case Study Manufacturing Company Debt Financing Capital Structure Approaches For Financial Fin SS

Case Study Manufacturing Company Debt Financing Capital Structure Approaches For Financial Fin SSThis slide represents the case study of a manufacturing company using the M and M approach for defining the relation between cost of capital and the value of a firm. It includes current situation, objective, actions taken and their impact. Deliver an outstanding presentation on the topic using this Case Study Manufacturing Company Debt Financing Capital Structure Approaches For Financial Fin SS. Dispense information and present a thorough explanation of Cost Of Capital, Value Of A Firm, Objective, Financial Risks Increased, Capital Structure For Financing using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Case Study Net Income Approach Used In Coca Cola Capital Structure Approaches For Financial Fin SS

Case Study Net Income Approach Used In Coca Cola Capital Structure Approaches For Financial Fin SSThis slide represents the case study of The Coca-Cola Company highlighting the applications of net income theory in balancing debt and equity. It mentions the impact such as tax benefits, stable dividend policy, etc. Introducing Case Study Net Income Approach Used In Coca Cola Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Provides Tax Benefits, Stable Dividend Policy, Maximize Shareholder Value, using this template. Grab it now to reap its full benefits.

-

Case Study Noi Theory Application For Capital Structure Capital Structure Approaches For Financial Fin SS

Case Study Noi Theory Application For Capital Structure Capital Structure Approaches For Financial Fin SSThis slide represents the case study of a mature manufacturing company using the NOI approach for capital structure restructuring. It includes components such as company objective, problems faced, solution and its impact on organization. Increase audience engagement and knowledge by dispensing information using Case Study Noi Theory Application For Capital Structure Capital Structure Approaches For Financial Fin SS. This template helps you present information on four stages. You can also present information on Problems Faced, Capital Structure Restructuring, Mature Manufacturing Firm using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Case Study Tech Company Using M M Theorem Capital Structure Approaches For Financial Fin SS

Case Study Tech Company Using M M Theorem Capital Structure Approaches For Financial Fin SSThis slide carries an overview of a technological startup company applying the approach of Modigliani-Miller to find an optimum capital structure. It includes company current situation, objective, actions taken, solution, and impact. Introducing Case Study Tech Company Using M M Theorem Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Technological Startup, Capital Structure, Analyze Modigliani Miller Approach, using this template. Grab it now to reap its full benefits.

-

Case Study Tech Start Up Using Noi Approach Capital Structure Approaches For Financial Fin SS

Case Study Tech Start Up Using Noi Approach Capital Structure Approaches For Financial Fin SSThis slide represents the case study of a tech startup company using the NOI approach to meet its financial requirements. It includes elements such as the objective, problems faced, solution, and impact on the company. Increase audience engagement and knowledge by dispensing information using Case Study Tech Start Up Using Noi Approach Capital Structure Approaches For Financial Fin SS. This template helps you present information on three stages. You can also present information on Tech Startup Company, Financial Requirements, Captured Potential Growth Opportunities using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Case Study Technological Startup Applying Traditional Capital Structure Approaches For Financial Fin SS

Case Study Technological Startup Applying Traditional Capital Structure Approaches For Financial Fin SSThis slide represents the case study of a technological startup company indicating the applications of traditional approach to balance its capital structure in a strategic manner. It includes aim, actions taken and outcomes achieved by the company. Introducing Case Study Technological Startup Applying Traditional Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Technological Startup, Applying Traditional Approach, Capital Structure, Strategic Manner, using this template. Grab it now to reap its full benefits.

-

Case Study Traditional Approach In Service Oriented Capital Structure Approaches For Financial Fin SS

Case Study Traditional Approach In Service Oriented Capital Structure Approaches For Financial Fin SSThis slide represents the case study of service-oriented company showing the application of a traditional approach for getting various benefits such as tax shield, investment in growth opportunities, and financial risk management. Increase audience engagement and knowledge by dispensing information using Case Study Traditional Approach In Service Oriented Capital Structure Approaches For Financial Fin SS. This template helps you present information on six stages. You can also present information on Service Oriented Company, Traditional Approach, Investment In Growth Opportunities, Financial Risk Management using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Comparable Company Analysis For Capital Structure Capital Structure Approaches For Financial Fin SS

Comparable Company Analysis For Capital Structure Capital Structure Approaches For Financial Fin SSThis slide illustrates an example of a comparable company analysis to select an optimal capital structure. It includes various methods to be considered such as financial health, risk tolerance capacity, etc. Introducing Comparable Company Analysis For Capital Structure Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Financial Health, Risk Tolerance Capacity, Comparable Company Analysis, Capital Structure Decisions, using this template. Grab it now to reap its full benefits.

-

Core Principles Of Net Income Approach Capital Structure Approaches For Financial Fin SS

Core Principles Of Net Income Approach Capital Structure Approaches For Financial Fin SSThis slide highlights the core principles of applying the net income approach. Various principles included are value maximization, cost of capital, investor homogeneity, homemade leverage, etc. Increase audience engagement and knowledge by dispensing information using Core Principles Of Net Income Approach Capital Structure Approaches For Financial Fin SS. This template helps you present information on eight stages. You can also present information on Net Income Approach, Value Maximization, Cost Of Capital, Investor Homogeneity, Homemade Leverage using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Core Principles Of Traditional Approach Capital Structure Approaches For Financial Fin SS

Core Principles Of Traditional Approach Capital Structure Approaches For Financial Fin SSThis slide mentions the core principles along with key takeaways to ensure the implementation of optimal capital structure using the traditional approach. Various principles included are trade-off, risk-return, dynamic decision-making, etc. Introducing Core Principles Of Traditional Approach Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Risk Management And Mitigation, Adapt Market Dynamics, Balance Capital Structure, Customize The Capital Structure, using this template. Grab it now to reap its full benefits.

-

Cost Benefit Analysis Using Trade Off Theory Capital Structure Approaches For Financial Fin SS

Cost Benefit Analysis Using Trade Off Theory Capital Structure Approaches For Financial Fin SSThis slide represents the framework for illustrating a cost-benefit analysis of debt financing with the help of trade-off theory to capital structure. It includes various costs such as financial distress, bankruptcy costs, etc. and benefits. Deliver an outstanding presentation on the topic using this Cost Benefit Analysis Using Trade Off Theory Capital Structure Approaches For Financial Fin SS. Dispense information and present a thorough explanation of Financial Distress, Bankruptcy Cost, Non Bankruptcy Cost, Cost Benefit Analysis using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

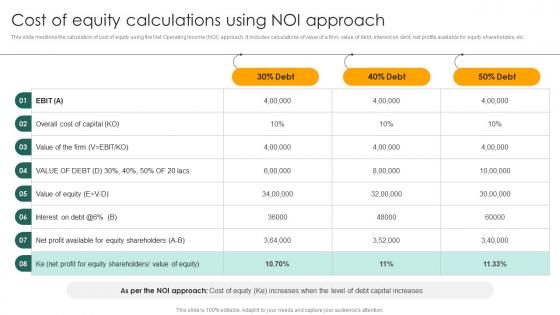

Cost Of Equity Calculations Using Noi Approach Capital Structure Approaches For Financial Fin SS

Cost Of Equity Calculations Using Noi Approach Capital Structure Approaches For Financial Fin SSThis slide mentions the calculation of cost of equity using the Net Operating Income NOI approach. It includes calculations of value of a firm, value of debt, interest on debt, net profits available for equity shareholders, etc. Present the topic in a bit more detail with this Cost Of Equity Calculations Using Noi Approach Capital Structure Approaches For Financial Fin SS. Use it as a tool for discussion and navigation on Cost Of Equity Calculations, Equity Shareholders, Net Operating Income. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

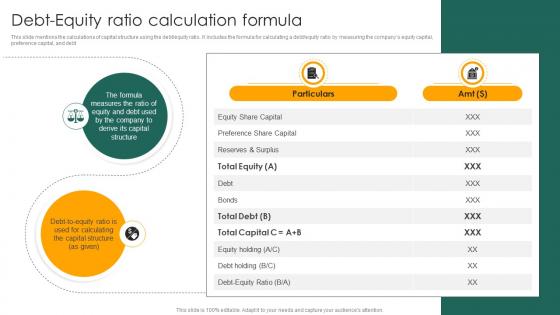

Debt Equity Ratio Calculation Formula Capital Structure Approaches For Financial Fin SS

Debt Equity Ratio Calculation Formula Capital Structure Approaches For Financial Fin SSThis slide mentions the calculations of capital structure using the debt or equity ratio. It includes the formula for calculating a debt or equity ratio by measuring the company equity capital, preference capital, and debt. Deliver an outstanding presentation on the topic using this Debt Equity Ratio Calculation Formula Capital Structure Approaches For Financial Fin SS. Dispense information and present a thorough explanation of Debt Equity Ratio Calculation, Company Equity Capital, Preference Capital And Debt using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Different Acts Regulating Capital Structure Capital Structure Approaches For Financial Fin SS

Different Acts Regulating Capital Structure Capital Structure Approaches For Financial Fin SSThis slide represents various acts governing the capital structure to help and protect the investors. Different acts involved are Securities Act of 1933, Securities Exchange Act of 1934 and Sarbanes-Oxley Act of 2002. Present the topic in a bit more detail with this Different Acts Regulating Capital Structure Capital Structure Approaches For Financial Fin SS. Use it as a tool for discussion and navigation on Regulating Capital Structure, Acts Governing The Capital Structure, Govern Secondary Trading. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Discounted Cash Flow Valuation Methods Capital Structure Approaches For Financial Fin SS

Discounted Cash Flow Valuation Methods Capital Structure Approaches For Financial Fin SSThis slide illustrates an example indicating the evaluation of an ideal capital structure using the discounted cash flow DCF method. It assess three options 100 percent equity, 100 percent equity, and 50 percent debt-50 percent equity. Increase audience engagement and knowledge by dispensing information using Discounted Cash Flow Valuation Methods Capital Structure Approaches For Financial Fin SS. This template helps you present information on one stages. You can also present information on Discounted Cash Flow Valuation, Ideal Capital Structure, Terminal Value using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Dynamic Trade Off Theory With Assumptions Capital Structure Approaches For Financial Fin SS

Dynamic Trade Off Theory With Assumptions Capital Structure Approaches For Financial Fin SSThis slide represents an overview of dynamic approach for the trade-off theory to select the right balance of debt and equity. Various assumptions included are information asymmetry, dynamic market conditions, time-varying costs, etc. Introducing Dynamic Trade Off Theory With Assumptions Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with four stages, this template is a great option to educate and entice your audience. Dispence information on Economic Conditions, Internal Factors, Management Decisions, External Shocks, using this template. Grab it now to reap its full benefits.

-

Factors Influencing Capital Structure Decisions Capital Structure Approaches For Financial Fin SS

Factors Influencing Capital Structure Decisions Capital Structure Approaches For Financial Fin SSThis slide mentions the key determinants of capital structure for selecting the debt, equity or combination for funding. Various factors involved are business risks, industry standards, growth phase, stability, etc. Deliver an outstanding presentation on the topic using this Factors Influencing Capital Structure Decisions Capital Structure Approaches For Financial Fin SS. Dispense information and present a thorough explanation of High Financial Risks, Less Financial Risks, Moderate Risk, Combination Of Debt And Equity using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

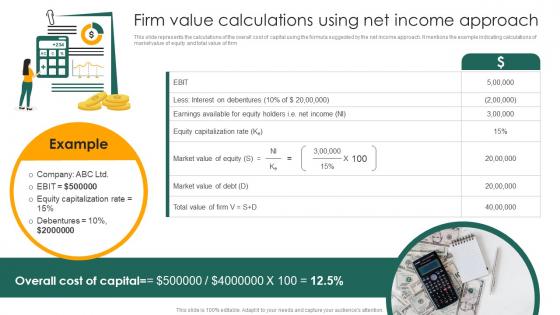

Firm Value Calculations Using Net Income Approach Capital Structure Approaches For Financial Fin SS

Firm Value Calculations Using Net Income Approach Capital Structure Approaches For Financial Fin SSThis slide represents the calculations of the overall cost of capital using the formula suggested by the net income approach. It mentions the example indicating calculations of market value of equity and total value of firm. Introducing Firm Value Calculations Using Net Income Approach Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with one stages, this template is a great option to educate and entice your audience. Dispence information on Firm Value Calculations, Net Income Approach, Market Value Of Equity, Earnings Available For Equity Holders, using this template. Grab it now to reap its full benefits.

-

Icons Slide Capital Structure Approaches For Financial Decision Making Fin SS

Icons Slide Capital Structure Approaches For Financial Decision Making Fin SSPresenting our well crafted Icons Slide Capital Structure Approaches For Financial Decision Making Fin SS set of slides. The slides include icons that are innovatively designed by our team of experts. The icons are easy to edit so you can conveniently increase or decrease their size without any loss in resolution. Therefore, grab them instantly.

-

Key Assumptions Of Net Income Theory Capital Structure Approaches For Financial Fin SS

Key Assumptions Of Net Income Theory Capital Structure Approaches For Financial Fin SSThis slide highlights the major assumptions of the net income theory. It includes assumptions such as no corporate taxes, constant business risks, no transaction costs, fixed operating income, investor homogeneity, etc. Increase audience engagement and knowledge by dispensing information using Key Assumptions Of Net Income Theory Capital Structure Approaches For Financial Fin SS. This template helps you present information on nine stages. You can also present information on No Corporate Taxes, Constant Business Risks, No Transaction Costs, Fixed Operating Income, Investor Homogeneity using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Key Assumptions Of Pecking Order Theory Capital Structure Approaches For Financial Fin SS

Key Assumptions Of Pecking Order Theory Capital Structure Approaches For Financial Fin SSThis slide highlights the key assumptions of the pecking order theory. Various assumptions included are information symmetry, management acting rationally, no pre-determined capital structure, firms prefer internal financing, etc. Introducing Key Assumptions Of Pecking Order Theory Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with six stages, this template is a great option to educate and entice your audience. Dispence information on Prefer Internal Financing, Markets React To Financial, Stable Dividend Policies, Management Act Rationally, using this template. Grab it now to reap its full benefits.

-

Key Elements Of Organizational Capital Structure Capital Structure Approaches For Financial Fin SS

Key Elements Of Organizational Capital Structure Capital Structure Approaches For Financial Fin SSThis slide represents various components of capital structure for raising funds to finance the company operations and growth opportunities. Various elements included are equity capital, debt capital and hybrid instruments. Present the topic in a bit more detail with this Key Elements Of Organizational Capital Structure Capital Structure Approaches For Financial Fin SS. Use it as a tool for discussion and navigation on Instruments, Preferred Convertible Stocks, Equity Capital, Convertible Bonds. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Key Features Of Optimal Capital Structure Capital Structure Approaches For Financial Fin SS

Key Features Of Optimal Capital Structure Capital Structure Approaches For Financial Fin SSThis slide represents the main features of an optimal capital structure to be used by the company to maximize its value. Various features involved are ideal mix of equity and debt, minimize financial risk and cost of capital, etc. Increase audience engagement and knowledge by dispensing information using Key Features Of Optimal Capital Structure Capital Structure Approaches For Financial Fin SS. This template helps you present information on five stages. You can also present information on Minimize Financial Risks, Maximize The Value, Dynamic And Flexible, Minimum Possible Cost using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

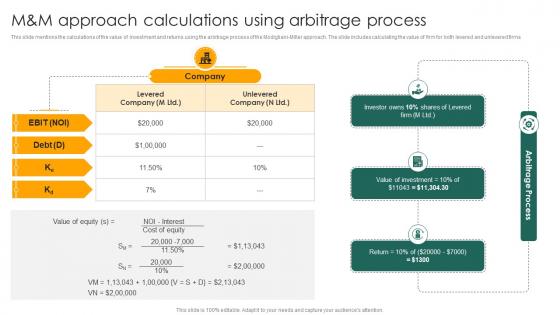

M And M Approach Calculations Using Arbitrage Process Capital Structure Approaches For Financial Fin SS

M And M Approach Calculations Using Arbitrage Process Capital Structure Approaches For Financial Fin SSThis slide mentions the calculations of the value of investment and returns using the arbitrage process of the Modigliani-Miller approach. The slide includes calculating the value of firm for both levered and unlevered firms. Deliver an outstanding presentation on the topic using this M And M Approach Calculations Using Arbitrage Process Capital Structure Approaches For Financial Fin SS. Dispense information and present a thorough explanation of Arbitrage Process, Levered And Unlevered Firms, Value Of Investment And Returns using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

M And M Theory Propositions With Taxes Capital Structure Approaches For Financial Fin SS

M And M Theory Propositions With Taxes Capital Structure Approaches For Financial Fin SSThis slide mentions the propositions of theory considering taxes are paid by the companies highlighting the relation between cost of capital and the value of firm. The slide includes two propositions for deriving the value of levered firms. Introducing M And M Theory Propositions With Taxes Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Determine Potential Risks, Developing Interest Tax Shield, Defines Cost Associated, Financial Distress, using this template. Grab it now to reap its full benefits.

-

M And M Theory Propositions Without Taxes Capital Structure Approaches For Financial Fin SS

M And M Theory Propositions Without Taxes Capital Structure Approaches For Financial Fin SSThis slide mentions the propositions of theory considering no taxes are paid by the companies due to perfectly efficient markets. The slide includes two propositions for deriving the value of firms. Increase audience engagement and knowledge by dispensing information using M And M Theory Propositions Without Taxes Capital Structure Approaches For Financial Fin SS. This template helps you present information on five stages. You can also present information on Evaluate Cost Of Capital, Funding Decisions, Practical Decision Making, Propositions Without Taxes using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Major Assumptions Of Modigliani Miller Approach Capital Structure Approaches For Financial Fin SS

Major Assumptions Of Modigliani Miller Approach Capital Structure Approaches For Financial Fin SSThis slide mentions the propositions of theory considering no taxes are paid by the companies due to perfectly efficient markets. The slide includes two propositions for deriving the value of firms. Introducing Major Assumptions Of Modigliani Miller Approach Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Investor Behaves In A Rational Manner, Homogeneous Risk Class, Modigliani Miller Approach, using this template. Grab it now to reap its full benefits.

-

Major Assumptions Of Net Operating Income Approach Capital Structure Approaches For Financial Fin SS

Major Assumptions Of Net Operating Income Approach Capital Structure Approaches For Financial Fin SSThis slide represents the key assumptions on which the Net Operating Income approach is based. Various assumptions included are corporate taxes exist, costs of debt remain constant, no agency costs, fully efficient markets, etc. Increase audience engagement and knowledge by dispensing information using Major Assumptions Of Net Operating Income Approach Capital Structure Approaches For Financial Fin SS. This template helps you present information on twelve stages. You can also present information on Operating Environment, Markets Are Fully Efficient, Changes In Leverage, No Transaction Costs using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Major Capital Structure Decision Theories And Approaches Capital Structure Approaches For Financial Fin SS

Major Capital Structure Decision Theories And Approaches Capital Structure Approaches For Financial Fin SSThis slide highlights the different capital structure theories used by the companies to balance equity and debt capital. Various theories involved are capital structure relevance, capital structure irrelevance and other theories. Introducing Major Capital Structure Decision Theories And Approaches Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Capital Structure Other Theory, Capital Structure Irrelevance Theory, Capital Structure Relevance Theory, using this template. Grab it now to reap its full benefits.

-

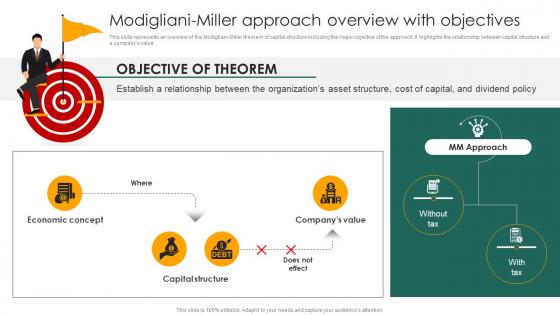

Modigliani Miller Approach Overview With Objectives Capital Structure Approaches For Financial Fin SS

Modigliani Miller Approach Overview With Objectives Capital Structure Approaches For Financial Fin SSThis slide represents an overview of the Modigliani-Miller theorem of capital structure including the major objective of the approach. It highlights the relationship between capital structure and a company value. Increase audience engagement and knowledge by dispensing information using Modigliani Miller Approach Overview With Objectives Capital Structure Approaches For Financial Fin SS. This template helps you present information on one stages. You can also present information on Establish A Relationship, Organizations Asset Structure, Cost Of Capital, Dividend Policy using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Multiple Features Of Sound Capital Structure Capital Structure Approaches For Financial Fin SS

Multiple Features Of Sound Capital Structure Capital Structure Approaches For Financial Fin SSThis slide illustrates the key features to be added in an appropriate capital structure to gain maximum benefits. Various features included are profitability, solvency, flexibility, conservatism, and control. Introducing Multiple Features Of Sound Capital Structure Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with five stages, this template is a great option to educate and entice your audience. Dispence information on Profitability, Solvency, Flexibility, Conservatism, Appropriate Capital Structure, using this template. Grab it now to reap its full benefits.

-

Multiple Ratios For Defining Capital Structure Capital Structure Approaches For Financial Fin SS

Multiple Ratios For Defining Capital Structure Capital Structure Approaches For Financial Fin SSThis slide mentions various metrics and ratios for determining an optimal capital structure for the firm. Various key performance indicators included are debt ratio, debt-equity ratio and equity ratio. Deliver an outstanding presentation on the topic using this Multiple Ratios For Defining Capital Structure Capital Structure Approaches For Financial Fin SS. Dispense information and present a thorough explanation of Interest Coverage Ratio, Debt Service Coverage Ratio, Financial Leverage Ratio, Equity Ratio using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Net Income Theory Implication Areas Capital Structure Approaches For Financial Fin SS

Net Income Theory Implication Areas Capital Structure Approaches For Financial Fin SSThis slide indicates the various application areas of the net income theory by the organizations. Different implication areas involved are financial analysis, business valuation, creditworthiness, and taxation. Increase audience engagement and knowledge by dispensing information using Net Income Theory Implication Areas Capital Structure Approaches For Financial Fin SS. This template helps you present information on four stages. You can also present information on Financial Analysis, Business Valuation, Creditworthiness, Lending, Decisions using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Net Income Theory Of Capital Structure Capital Structure Approaches For Financial Fin SS

Net Income Theory Of Capital Structure Capital Structure Approaches For Financial Fin SSThis slide represents the concept of net income theory by explaining the diagram. It indicates the relation of debt with the weighted average cost of capital WACC and show the conclusion of this approach. Introducing Net Income Theory Of Capital Structure Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with three stages, this template is a great option to educate and entice your audience. Dispence information on Equity And Debt Capitalization, Rate Remains Constant, Assumed Capital Structure, Debt Is Indirectly Proportional, using this template. Grab it now to reap its full benefits.

-

Net Income Theory Of Capital Structure Overview Capital Structure Approaches For Financial Fin SS

Net Income Theory Of Capital Structure Overview Capital Structure Approaches For Financial Fin SSThis slide mentions an overview of net income theory containing various information such as description, purpose of theory, theory basis and what is measured under this approach such as value of assets, liabilities, revenue and expenses. Increase audience engagement and knowledge by dispensing information using Net Income Theory Of Capital Structure Overview Capital Structure Approaches For Financial Fin SS. This template helps you present information on three stages. You can also present information on Fundamental Concept Of Accounting, Financial Performance, Systematic Manner, Value Of Assets using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Net Operating Income Approach Capital Structure Approaches For Financial Fin SS

Net Operating Income Approach Capital Structure Approaches For Financial Fin SSThis slide represents the concept of the net operating income approach to highlight the relation between capital structure and the value of the firm. It indicates two cases when leverage is zero and when leverage increases. Introducing Net Operating Income Approach Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with two stages, this template is a great option to educate and entice your audience. Dispence information on Overall Cost, Cost Of Equity Capital, Net Operating Income Approach, Capital Structure, using this template. Grab it now to reap its full benefits.

-

Net Operating Income Theory Overview Capital Structure Approaches For Financial Fin SS

Net Operating Income Theory Overview Capital Structure Approaches For Financial Fin SSThis slide carries an overview of the net operating income approach including core principles such as irrelevance of capital structure, whole firm principle, tax benefit of debt, arbitrage process principle, debt financing, etc. Increase audience engagement and knowledge by dispensing information using Net Operating Income Theory Overview Capital Structure Approaches For Financial Fin SS. This template helps you present information on eight stages. You can also present information on Irrelevance Of Capital Structure, Whole Firm Principle, Arbitrage Process Principle, Tax Benefit Of Debt using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Optimal Capital Structure For Value Maximization Capital Structure Approaches For Financial Fin SS

Optimal Capital Structure For Value Maximization Capital Structure Approaches For Financial Fin SSThis slide represents the financing decision process for getting an optimal capital structure to maximize the value of the firm. It includes steps such as deciding the financing requirements, analyzing the existing capital structure, etc. Present the topic in a bit more detail with this Optimal Capital Structure For Value Maximization Capital Structure Approaches For Financial Fin SS. Use it as a tool for discussion and navigation on Capital Structure Decision, Fund Requirements, Capital Financing Decision, Effect On Cost Of Capital. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Organizational Capital Structure Decision Framework Capital Structure Approaches For Financial Fin SS

Organizational Capital Structure Decision Framework Capital Structure Approaches For Financial Fin SSThis slide highlights the framework for capital structure decisions. It contains explanatory variables such as company size, profitability, asset tangibility, growth opportunities, tax, etc. and dependent variable leverage. Deliver an outstanding presentation on the topic using this Organizational Capital Structure Decision Framework Capital Structure Approaches For Financial Fin SS. Dispense information and present a thorough explanation of Explanatory Variables, Dependent Variable, Explanatory Variables, Organizational Capital Structure, Decision Framework using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Pecking Order Theory Application Example Capital Structure Approaches For Financial Fin SS

Pecking Order Theory Application Example Capital Structure Approaches For Financial Fin SSThis slide mentions the example of ABC Company to showcase the application of pecking orders theory. It includes three options available to the company for fundraising along with the calculation of cost of capital. Present the topic in a bit more detail with this Pecking Order Theory Application Example Capital Structure Approaches For Financial Fin SS. Use it as a tool for discussion and navigation on Application Of Pecking Orders Theory, Fundraising, Cost Of Capital, Debt Financing. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Pecking Order Theory Financial Hierarchy Capital Structure Approaches For Financial Fin SS

Pecking Order Theory Financial Hierarchy Capital Structure Approaches For Financial Fin SSThis slide represents the financial hierarchy as given by the pecking order theory to understand the preferences of management while selecting a source of funds. It includes three preferences such as debt, internal, and external finance. Increase audience engagement and knowledge by dispensing information using Pecking Order Theory Financial Hierarchy Capital Structure Approaches For Financial Fin SS. This template helps you present information on three stages. You can also present information on Internal Finance, Financial Hierarchy, External Finance, Pecking Order Theory using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Regulations Issued By Securities And Exchange Capital Structure Approaches For Financial Fin SS

Regulations Issued By Securities And Exchange Capital Structure Approaches For Financial Fin SSThis slide exhibits various regulations issued by the SEC to govern and control activities related to capital structure. Various regulations included are Regulation D, Regulation S-K, Regulation crowdfunding, etc. Introducing Regulations Issued By Securities And Exchange Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with six stages, this template is a great option to educate and entice your audience. Dispence information on Regulation Crowdfunding, Regulations Issued By Securities, Exchange Commission, using this template. Grab it now to reap its full benefits.

-

Regulatory Agencies Governing Capital Structure Capital Structure Approaches For Financial Fin SS

Regulatory Agencies Governing Capital Structure Capital Structure Approaches For Financial Fin SSThis slide illustrates various agencies responsible for enforcing laws and regulations regarding capital structure. Different agencies included are the SEC, Federal Reserve System, Environmental Protection Agency, Federal Trade Commission, etc. Increase audience engagement and knowledge by dispensing information using Regulatory Agencies Governing Capital Structure Capital Structure Approaches For Financial Fin SS. This template helps you present information on fifteen stages. You can also present information on Food And Drug Administration, Federal Communications Commission, Federal Reserve System, Drug Enforcement Administration using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Regulatory Authorities For Capital Structure In Different Capital Structure Approaches For Financial Fin SS

Regulatory Authorities For Capital Structure In Different Capital Structure Approaches For Financial Fin SSThis slide demonstrates various authorities responsible for regulating capital structure in different countries such as United States, India, United Kingdom, European Union, Japan, China South Africa, Canada, Brazil, and Australia. Introducing Regulatory Authorities For Capital Structure In Different Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with ten stages, this template is a great option to educate and entice your audience. Dispence information on European Securities And Markets Authority, European Banking Authority, Financial Conduct Authority, Prudential Regulation Authority, using this template. Grab it now to reap its full benefits.

-

Relationship Between Financial Leverage And Wacc Capital Structure Approaches For Financial Fin SS

Relationship Between Financial Leverage And Wacc Capital Structure Approaches For Financial Fin SSThis slide represents an illustration showing the relation between company financial leverage and weighted average cost of capital. It includes particulars such as weight of debt and equity, cost of debt and equity and WACC. Deliver an outstanding presentation on the topic using this Relationship Between Financial Leverage And Wacc Capital Structure Approaches For Financial Fin SS. Dispense information and present a thorough explanation of Financial Leverage, Cost Of Capital, Cost Of Debt, Weight Of Equity using the slides given. This template can be altered and personalized to fit your needs. It is also available for immediate download. So grab it now.

-

Risk Return Trade Off In Capital Structure Decisions Capital Structure Approaches For Financial Fin SS

Risk Return Trade Off In Capital Structure Decisions Capital Structure Approaches For Financial Fin SSPresent the topic in a bit more detail with this Risk Return Trade Off In Capital Structure Decisions Capital Structure Approaches For Financial Fin SS. Use it as a tool for discussion and navigation on Risk Return Trade Off, Capital Structure Decisions, Combination Of Debt And Equity. This template is free to edit as deemed fit for your organization. Therefore download it now.

-

Static Trade Off Theory With Assumptions Capital Structure Approaches For Financial Fin SS

Static Trade Off Theory With Assumptions Capital Structure Approaches For Financial Fin SSThis slide represents the static trade-off theory for selecting an optimal capital structure for maximizing a firms value. It includes key assumptions such as tax shield, reduction in financial distress costs, etc. Increase audience engagement and knowledge by dispensing information using Static Trade Off Theory With Assumptions Capital Structure Approaches For Financial Fin SS. This template helps you present information on four stages. You can also present information on Reduced Financial Distress Costs, Maximized Value Of Firm, Improved Profitability, Lower Agency Costs using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Three Stages Of Traditional Approach Capital Structure Approaches For Financial Fin SS

Three Stages Of Traditional Approach Capital Structure Approaches For Financial Fin SSThis slide represents the three major stages of balancing debt and equity financing as per the traditional approach for getting an optimum capital structure. The stages indicate relation between the cost of capital and the degree of leverage. Increase audience engagement and knowledge by dispensing information using Three Stages Of Traditional Approach Capital Structure Approaches For Financial Fin SS. This template helps you present information on three stages. You can also present information on Balancing Debt, Equity Financing, Traditional Approach, Capital Structure using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Trade Off Theory Of Capital Structure Overview Capital Structure Approaches For Financial Fin SS

Trade Off Theory Of Capital Structure Overview Capital Structure Approaches For Financial Fin SSThis slide represents an overview of the trade-off theory for balancing the advantages and disadvantages of using debt and equity in the capital structure. It includes factors affecting the theory, different approaches static and dynamic, etc. Introducing Trade Off Theory Of Capital Structure Overview Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with one stages, this template is a great option to educate and entice your audience. Dispence information on Financial Distress Costs, Bankruptcy Expenses, Market Conditions And Trends, Investor Preferences, using this template. Grab it now to reap its full benefits.

-

Traditional Approach Assumptions For Capital Structure Capital Structure Approaches For Financial Fin SS

Traditional Approach Assumptions For Capital Structure Capital Structure Approaches For Financial Fin SSThis slide highlights the key assumptions for identifying the optimum capital structure using the traditional approach. Major assumptions involved are interest rate dent remains constant, the expected rate for shareholders is fixed, etc. Increase audience engagement and knowledge by dispensing information using Traditional Approach Assumptions For Capital Structure Capital Structure Approaches For Financial Fin SS. This template helps you present information on four stages. You can also present information on Traditional Approach Assumptions, Capital Structure, Interest Rate On The Debt, Specific Period Of Time using this PPT design. This layout is completely editable so personaize it now to meet your audiences expectations.

-

Traditional Approach To Capital Structure Overview Capital Structure Approaches For Financial Fin SS

Traditional Approach To Capital Structure Overview Capital Structure Approaches For Financial Fin SSThis slide represents an overview of the traditional approach to capital structure for managing financial risks and distress. The slide includes theory suggestions and key findings for balancing the debt and equity levels in capital structure. Introducing Traditional Approach To Capital Structure Overview Capital Structure Approaches For Financial Fin SS to increase your presentation threshold. Encompassed with two stages, this template is a great option to educate and entice your audience. Dispence information on Traditional Approach, Capital Structure Overview, Theory Suggestions, Financial Risks And Distress, using this template. Grab it now to reap its full benefits.