Mergers And Acquisitions Management Powerpoint Presentation Slides

Design an engrossing presentation with our mergers and acquisitions management PowerPoint presentation slides. This fusion and accession PPT design gives you a detailed view of the key steps involved that includes- understanding your business, requirement for inorganic opportunities, conduct valuation, purchase and sale contracts, and much more. Having a company overview is quite essential to ensure that the workforce runs efficiently, therefore, this unification and accretion PowerPoint template introduces you with the vision as well as mission of the organization. This combination and addition PowerPoint bundle provides you with the detailed figures regarding the financial outlines. To progress and flourish in your line of business, this coalition and possession creative PPT set educates you about the requirements for inorganic opportunities that includes increasing geographical presence and a lot more. Along with the different types, this coupling and purchasing PowerPoint layout teaches you how to set the criterias. Incorporate mergers and acquisitions presentation right now to win the presentation game.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

Presenting our mergers and acquisitions management PowerPoint presentation slides. This PPT layout holds sixty four slides and each slide is accessible in standard as well as wide-screen formats. It is completely editable as per your requirements and preferences as well. You can use it with Microsoft Office, Google slides and many other presentation software.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Mergers And Acquisitions Management.State Your company Name and begin.

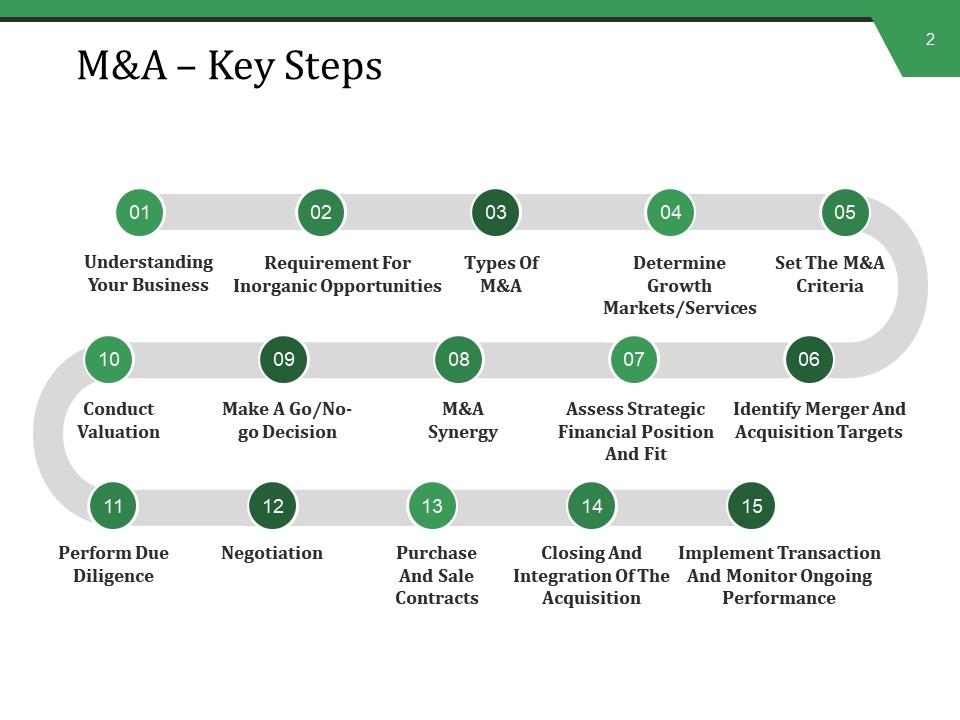

Slide 2: This slide presents M&A – Key Steps with these of the steps- Understanding Your Business, Requirement For Inorganic Opportunities, Types Of M&A, Determine Growth Markets/Services, Set The M&A Criteria, Make A Go/No-go Decision, Assess Strategic Financial Position And Fit, Identify Merger And Acquisition Targets, Conduct Valuation, M&A Synergy, Perform Due Diligence, Negotiation, Purchase And Sale Contracts, Closing And Integration Of The Acquisition, Implement Transaction And Monitor Ongoing Performance.

Slide 3: This slide presents Company Overview.

Slide 4: This slide showcases Business & Financial Overview. To have a better understanding of the business, enter the key service areas, Revenue by geographies, key financials and the technology that is being currently used in the company. These parameters can also be changed as per the requirement.

Slide 5: This slide presents Requirement for Inorganic Opportunity with the four of the parameters- Increase Geographical Presence, Offer New Service, Increase Market Share, Technology Transfer.

Slide 6: This slide presents Determining New Growth Market/Services. After identifying the requirement for inorganic opportunities, this slide goes in detail about each of the discussed parameters.

Slide 7: This slide shows Types of Inorganic Opportunities with these of the types we have listed- Horizontal Merger, Conglomerate Acquisition, Vertical Merger, Product Extension Merger, Market Extension Merger, Highlight the relevant opportunity which you would like to opt for among others

Slide 8: This slide shows Types of Inorganic Opportunities with these of the types we have listed- Conglomerate, Acquisition, Horizontal Merger, Product Extension Merger, Market Extension Merger, Vertical Merger, Highlight the relevant opportunity which you would like to opt for among others

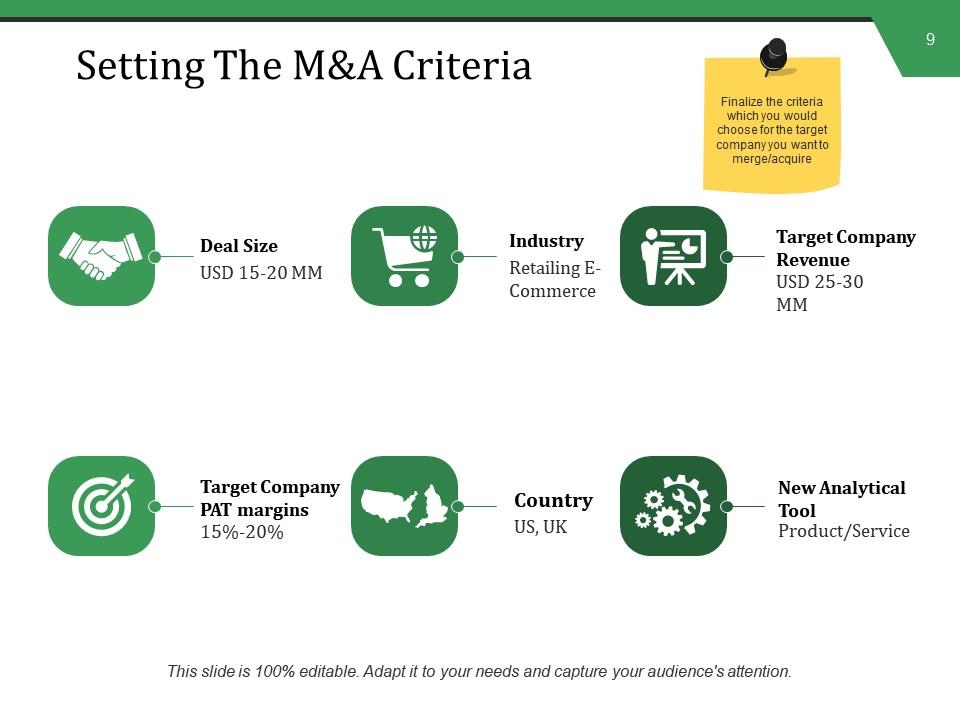

Slide 9: This slide showcases Setting The M&A Criteria.Finalize the criteria which you would choose for the target company you want to merge/acquire.

Slide 10: This slide presents Identifying Targets. For each target company, mention the name of country, product, Industry, size of the deal, revenue and profit margins. These parameters can be altered as per the criteria set by the company.

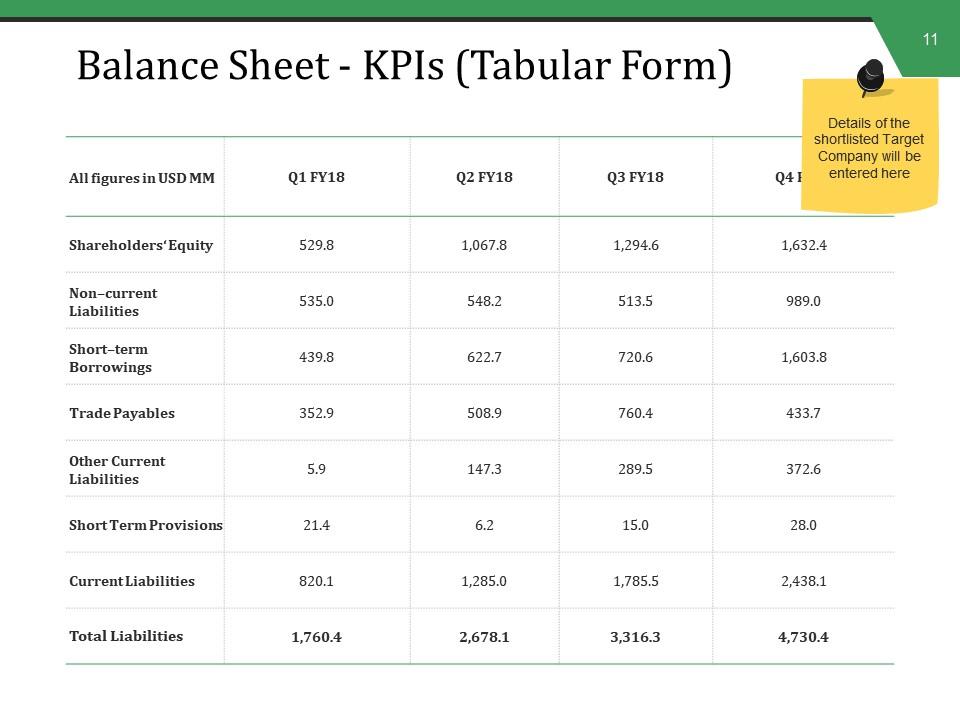

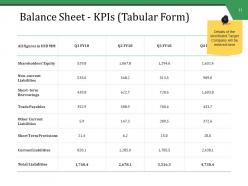

Slide 11: This slide shows Balance Sheet - KPIs (Tabular Form).Details of the shortlisted Target Company will be entered here.

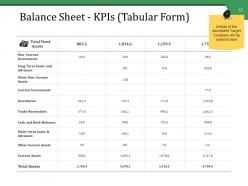

Slide 12: This slide presents Balance Sheet - KPIs (Tabular Form). Details of the shortlisted Target Company will be entered here.

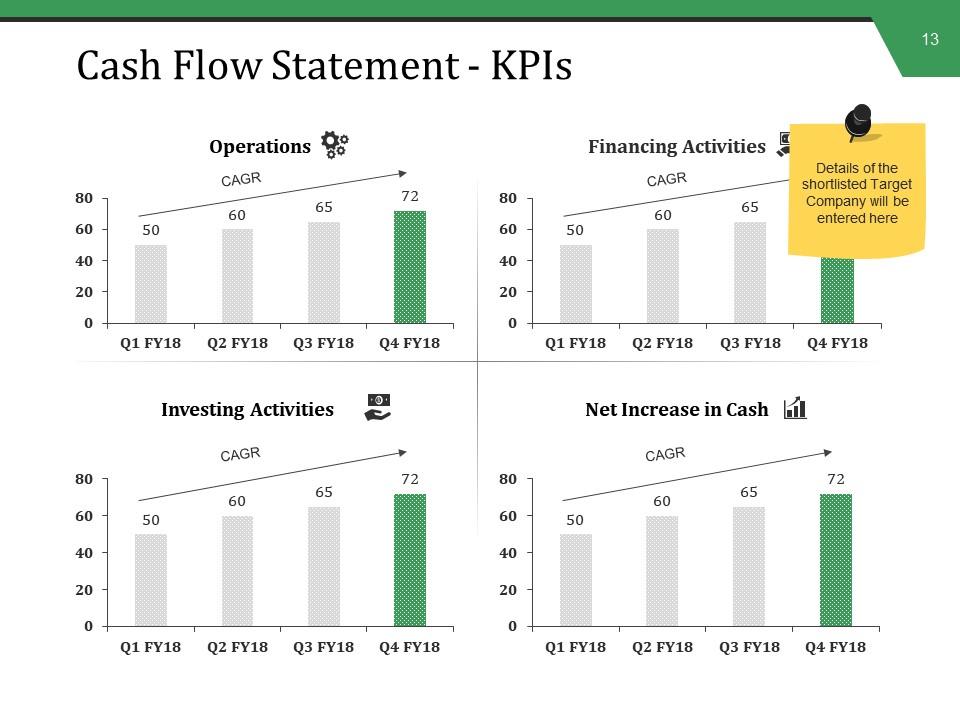

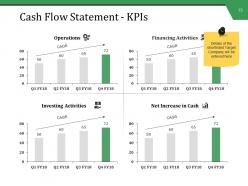

Slide 13: This slide showcases Cash Flow Statement - KPIs with these of the following categories- Operations, Financing Activities, Investing Activities, Net Increase in Cash, Details of the shortlisted Target Company will be entered here

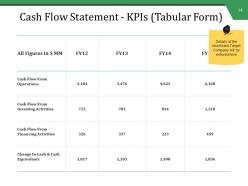

Slide 14: This slide presents Cash Flow Statement - KPIs (Tabular Form).Details of the shortlisted Target Company will be entered here.

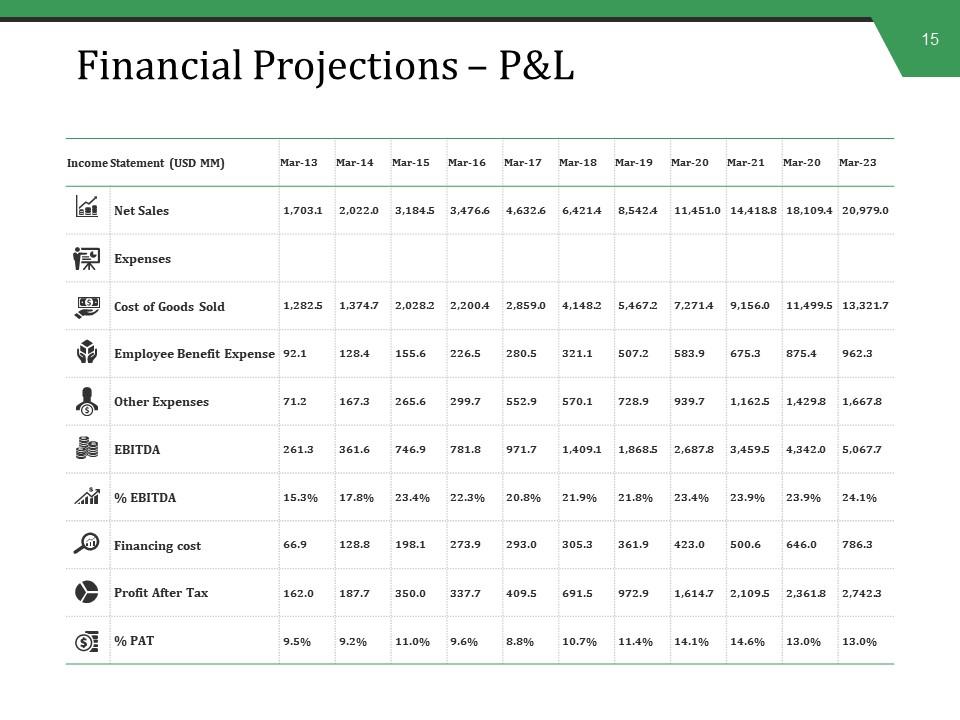

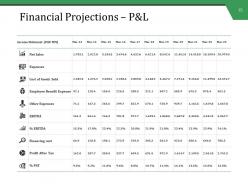

Slide 15: This slide showcases Financial Projections – P&L table.

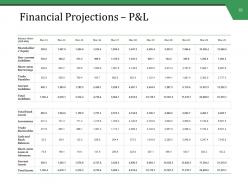

Slide 16: This slide presents Financial Projections – P&L.

Slide 17: This slide showcases Key Financial Ratios (1/2). Details of the shortlisted Target Company will be entered here.

Slide 18: This slide shows Key Financial Ratios (2/2).

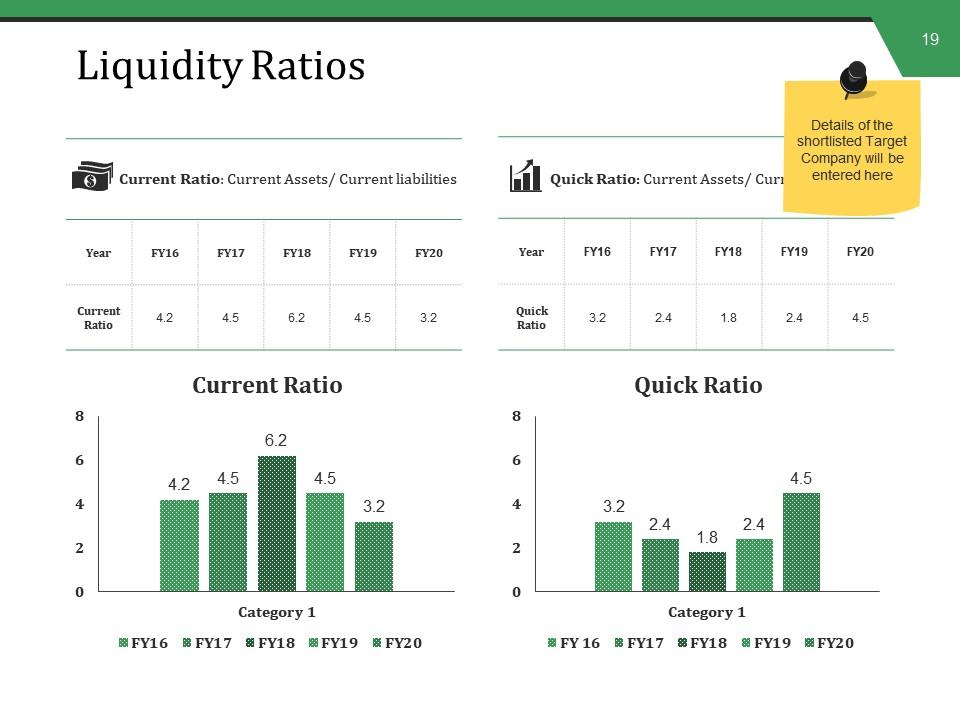

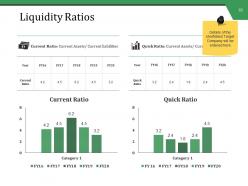

Slide 19: This slide presents Liquidity Ratios. Details of the shortlisted Target Company will be entered here.

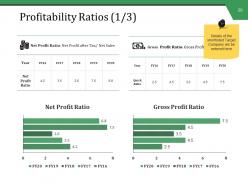

Slide 20: This slide showcases Profitability Ratios (1/3). Details of the shortlisted Target Company will be entered here.

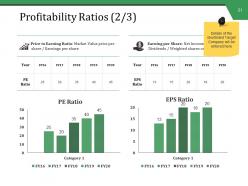

Slide 21: This slide shows Profitability Ratios (2/3). Details of the shortlisted Target Company will be entered here.

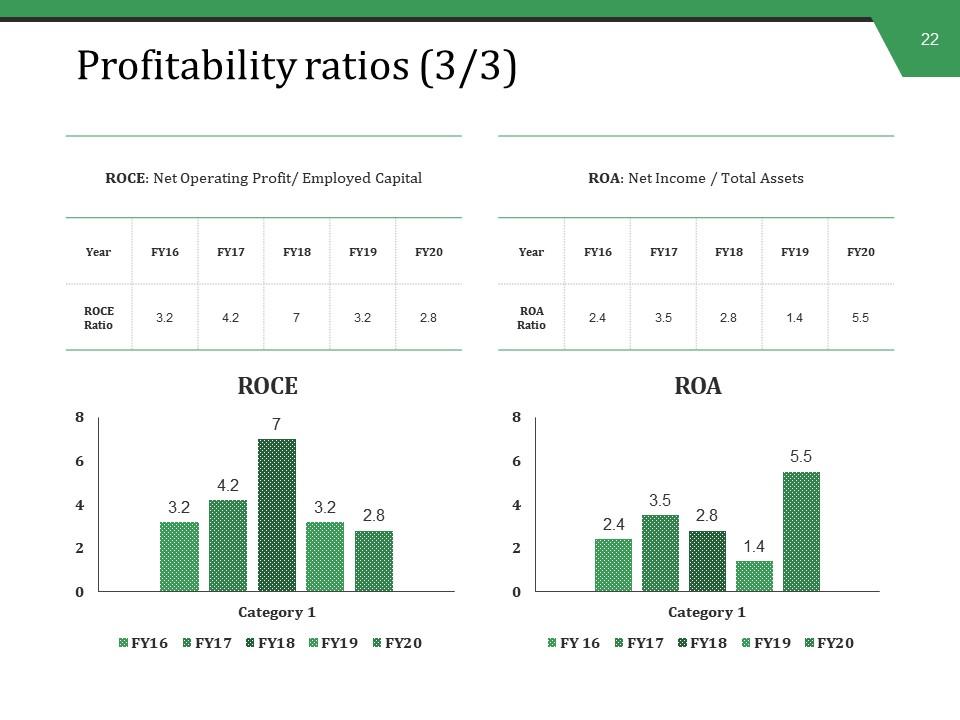

Slide 22: This slide shows Profitability ratios (3/3).

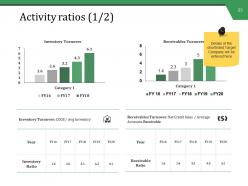

Slide 23: This slide presents Activity ratios (1/2) with these factors- Inventory Turnover, Receivables Turnover, Details of the shortlisted Target Company will be entered here.

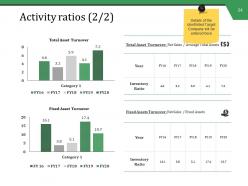

Slide 24: This slide shows Activity ratios (2/2) with these of the factors- Fixed Asset Turnover, Total Asset Turnover, Details of the shortlisted Target Company will be entered here.

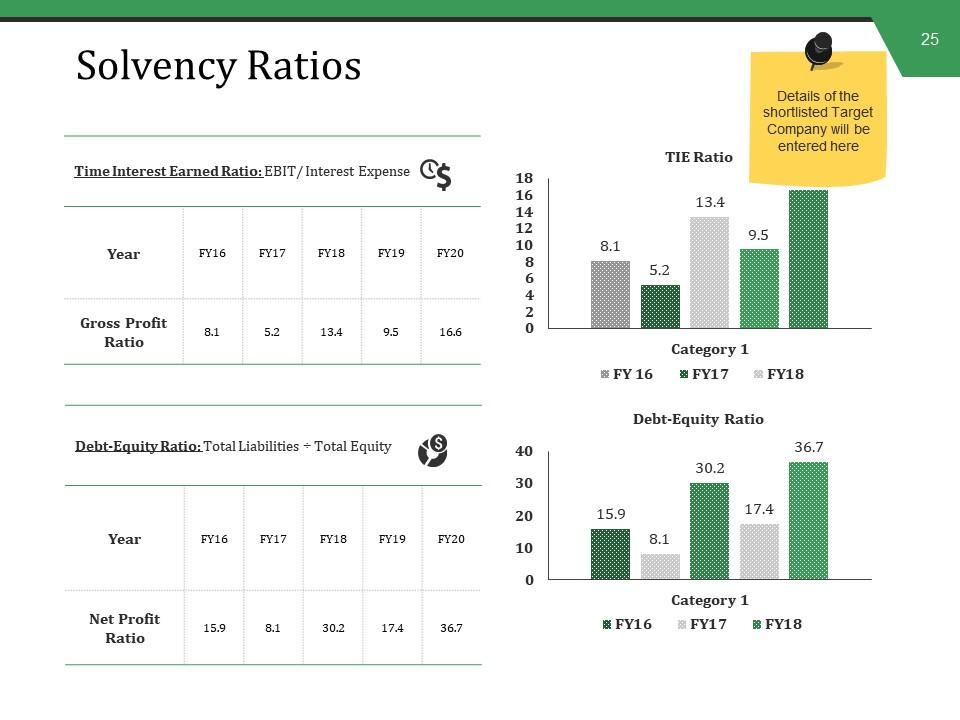

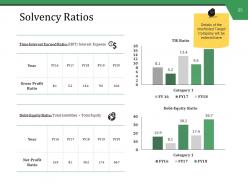

Slide 25: This slide presents Solvency Ratios- Debt-Equity Ratio, TIE Ratio, Details of the shortlisted Target Company will be entered here.

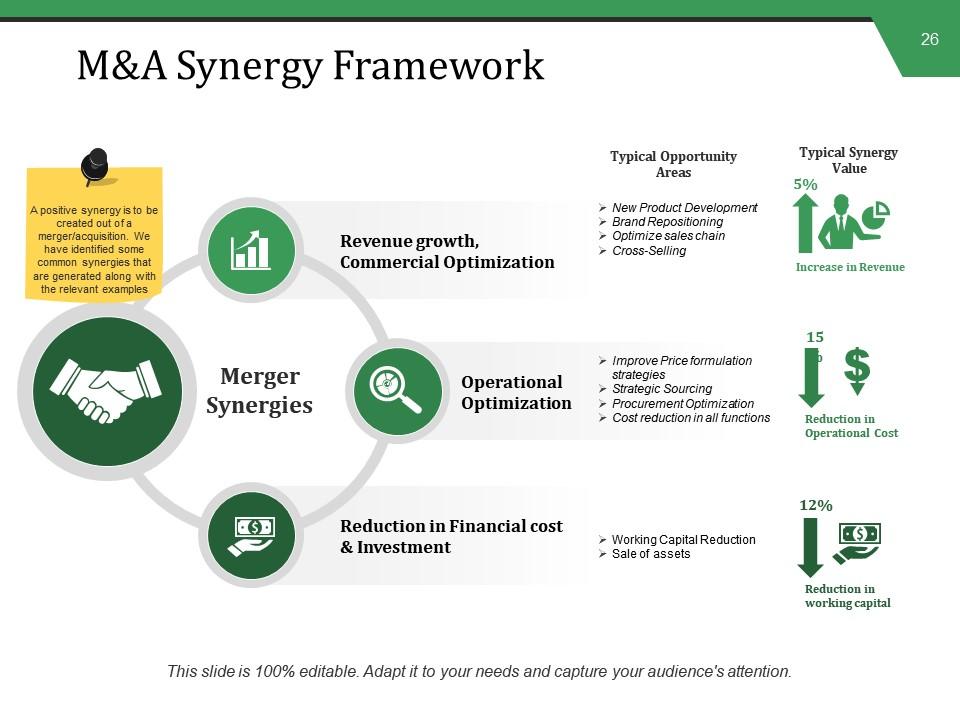

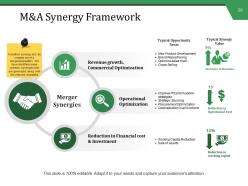

Slide 26: This slide showcases M&A Synergy Framework. A positive synergy is to be created out of a merger/acquisition. We have identified some common synergies that are generated along with the relevant examples.

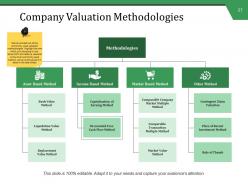

Slide 27: This slide presents Company Valuation Methodologies.We have listed out all the commonly used valuation methodologies. Highlight the one which you are going to use. Since DCF and relative valuation is the most commonly used method, we have discussed it in detail in the later slides.

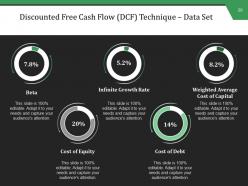

Slide 28: This slide showcases Discounted Free Cash Flow (DCF) Technique – Data Set Beta, Infinite Growth Rate, Weighted Average Cost of Capital, Cost of Debt, Cost of Equity.

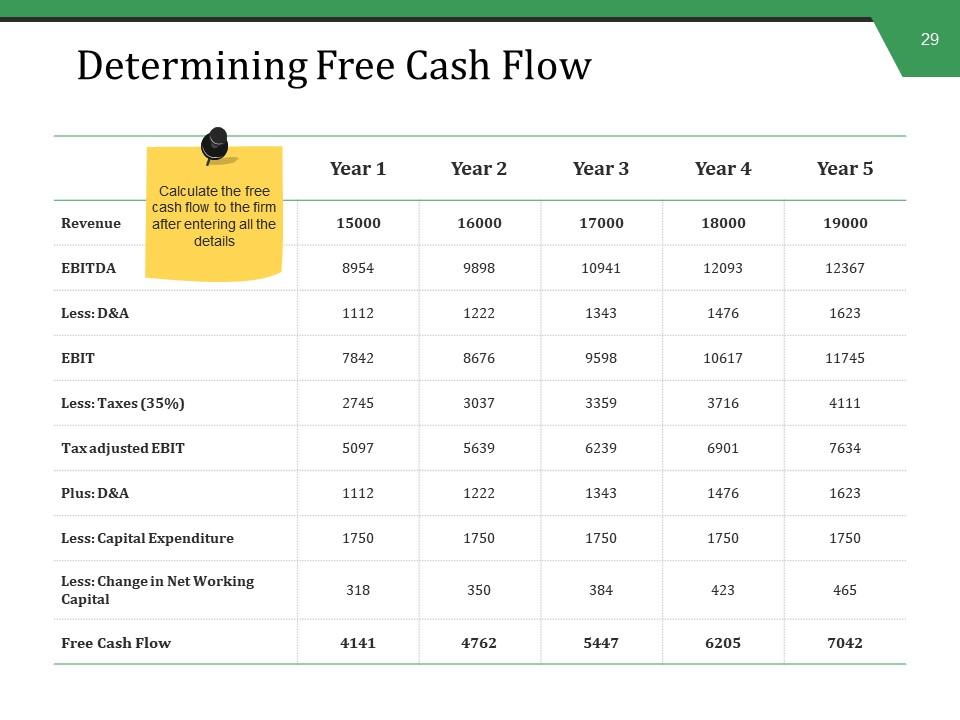

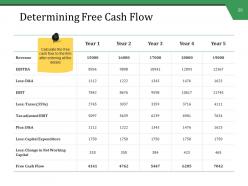

Slide 29: This slide showcases Determining Free Cash Flow. Calculate the free cash flow to the firm after entering all the details.

Slide 30: This slide presents Valuation Results.

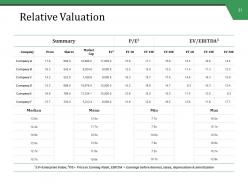

Slide 31: This slide showcases Relative Valuation.

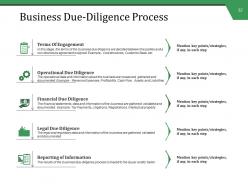

Slide 32: This slide presents Business Due-Diligence Process.

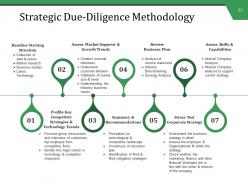

Slide 33: This slide showcases Strategic Due-Diligence Methodology.

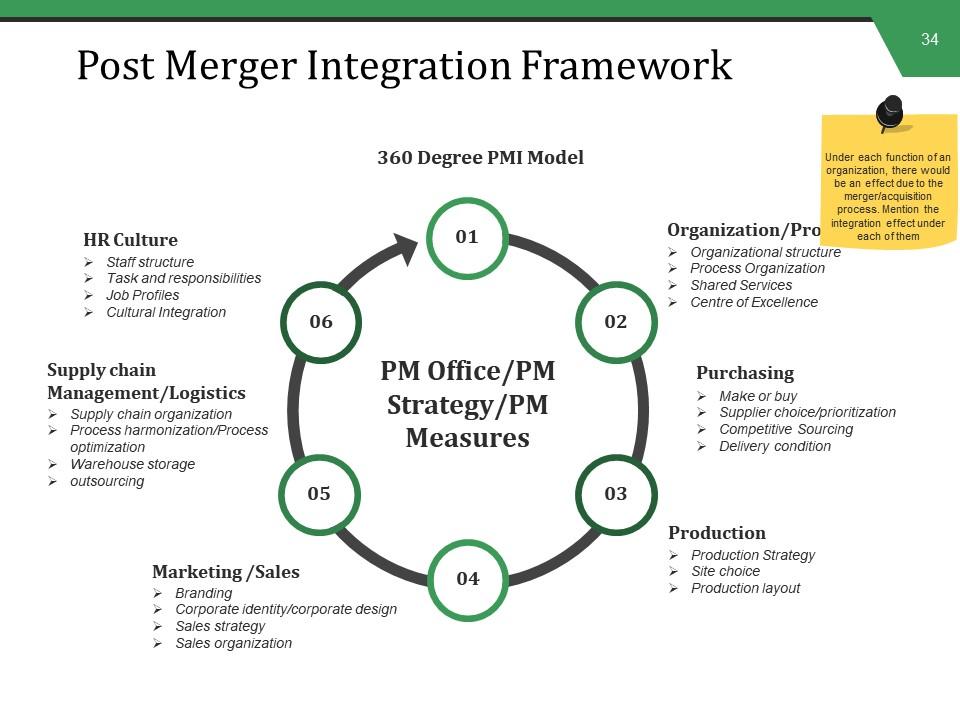

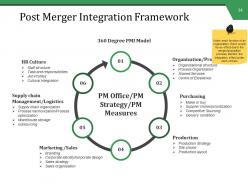

Slide 34: This slide presents Post Merger Integration Framework.Under each function of an organization, there would be an effect due to the merger/acquisition process. Mention the integration effect under each of them

Slide 35: This slide shows Post Merger Integration Challenges.We have listed out some of the key challenges faced after post merger/acquisition. Alter it as per your requirement

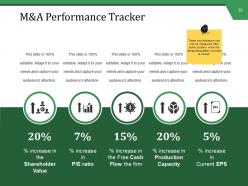

Slide 36: This slide presents M&A Performance Tracker.These key indicators can only be measured after some duration when the merger/acquisition process is closed.

Slide 37: This is a Coffee Break slide to halt. You may change it as per requirement.

Slide 38: This slide shows Mergers And Acquisitions Management Icon Slide.

Slide 39: This slide is titled Charts & Graphs to move forward.

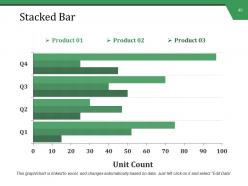

Slide 40: This slide shows Stacked Bar with ehich you can compare the product.

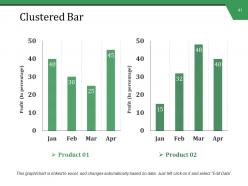

Slide 41: This slide presents Clustered Bar.

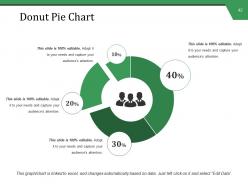

Slide 42: This slide showcases Donut Pie Chart.

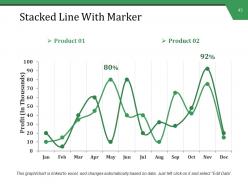

Slide 43: This slide presents Stacked Line With Marker. Add the data and use it.

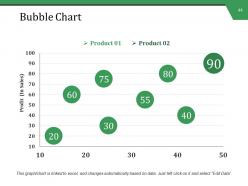

Slide 44: This slide showcases Bubble Chart.

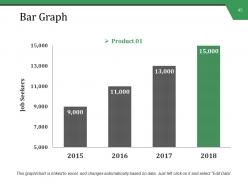

Slide 45: This slide presents Bar Graph. You can add the comparison.

Slide 46: This slide showcases Additional Slides.

Slide 47: This slide shows our Mission. Add the company mission and use it.

Slide 48: This slide presents Our Team. Add the company details and use it.

Slide 49: This slide showcases About Us.

Slide 50: This is an Our Goal slide. State them here.

Slide 51: This slide shows Comparison of Positive Factors v/s Negative Factors with thumbs up and thumb down imagery.

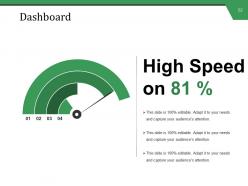

Slide 52: This is a Dashboard slide to show- Strategic System, Success, Goal Process, Sales Review, Communication Study.

Slide 53: This slide is titled as Financials. Show finance related stuff here.

Slide 54: This is a Quotes slide to highlight, or state anything specific.

Slide 55: This slide presents a PUZZLE slide with the following subheadings- Integrity and Judgment, Critical and Decision Making, Leadership, Agility.

Slide 56: This is a Target slide. State your targets here.

Slide 57: This is a Location slide of World map to show global presence, growth etc.

Slide 58: This is a Circular image slide to show information, specifications etc.

Slide 59: This is a Venn diagram image slide to show information, specifications etc.

Slide 60: This slide shows a Mind map for representing entities

Slide 61: This is a Silhouettes slide to show people specific information etc.

Slide 62: This slide displays a Magnifying Glass with icon imagery.

Slide 63: This is a Bulb or Idea slide to state a new idea or highlight specifications/information etc.

Slide 64: This is a Thank You slide with Address# street number, city, state, Contact Number, Email Address.

Mergers And Acquisitions Management Powerpoint Presentation Slides with all 64 slides:

Our Mergers And Acquisitions Management Powerpoint Presentation Slides allow the facts to flow in. All doubts begin to crumble.

-

Enough space for editing and adding your own content.

-

Presentation Design is very nice, good work with the content as well.