Mergers And Acquisitions Framework Powerpoint Presentation Slides

If you are about to execute an M&A, our Mergers And Acquisitions Framework PowerPoint Presentation Slides can help you to focus on the right things. M&A involves buying selling and combing companies. Business valuation comprehensive PowerPoint deck helps you to present each and every aspect in detail as it contains set of professionally designed template such as key steps, company overview, business, and financial overview, determining new growth market, types of inorganic opportunities, M&A criteria, identify targets, balance sheet KPIs, cash flow statement, financial projections, key financial ratios, liquidity and profitability ratios, activity and solvency ratios, M&A synergy framework, company valuation methodologies, valuation results, business due diligence process, post-merger integration framework, challenges and performance tracker etc. The mergers and acquisitions are crucial as organizations moving towards expansion. Download incredible mergers and acquisitions presentation to save time in delivering an exceptional business presentation. Let nothing disturb your concentration. Our Mergers And Acquisitions Framework Powerpoint Presentation Slides will keep you focused.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

Introducing Mergers And Acquisitions Framework PowerPoint Presentation Slides. This presentation includes 64 professionally designed PPT templates. These PPT Slides are 100 % editable. Users can change the fonts, colors, and slide background as per their need. On downloading the presentation, you get the templates in both widescreen and standard screen. The presentation is compatible with Google Slides and can be saved in JPG or PDF format.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Mergers And Acquisitions Framework.State Your Company Name and begin.

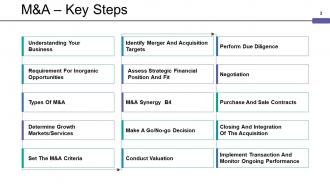

Slide 2: This slide presents M&A – Key Steps with these of the factors- Understanding Your Business, Requirement For Inorganic Opportunities, Types Of M&A, Determine Growth Markets/Services, Set The M&A Criteria, Identify Merger And Acquisition Targets, Assess Strategic Financial Position And Fit, M&A Synergy B4, Make A Go/No-go Decision, Conduct Valuation, Perform Due Diligence, Negotiation, Purchase And Sale Contracts, Closing And Integration Of The Acquisition, Implement Transaction And Monitor Ongoing Performance.

Slide 3: This slide Company Overview. Add the intro, mission and vision.

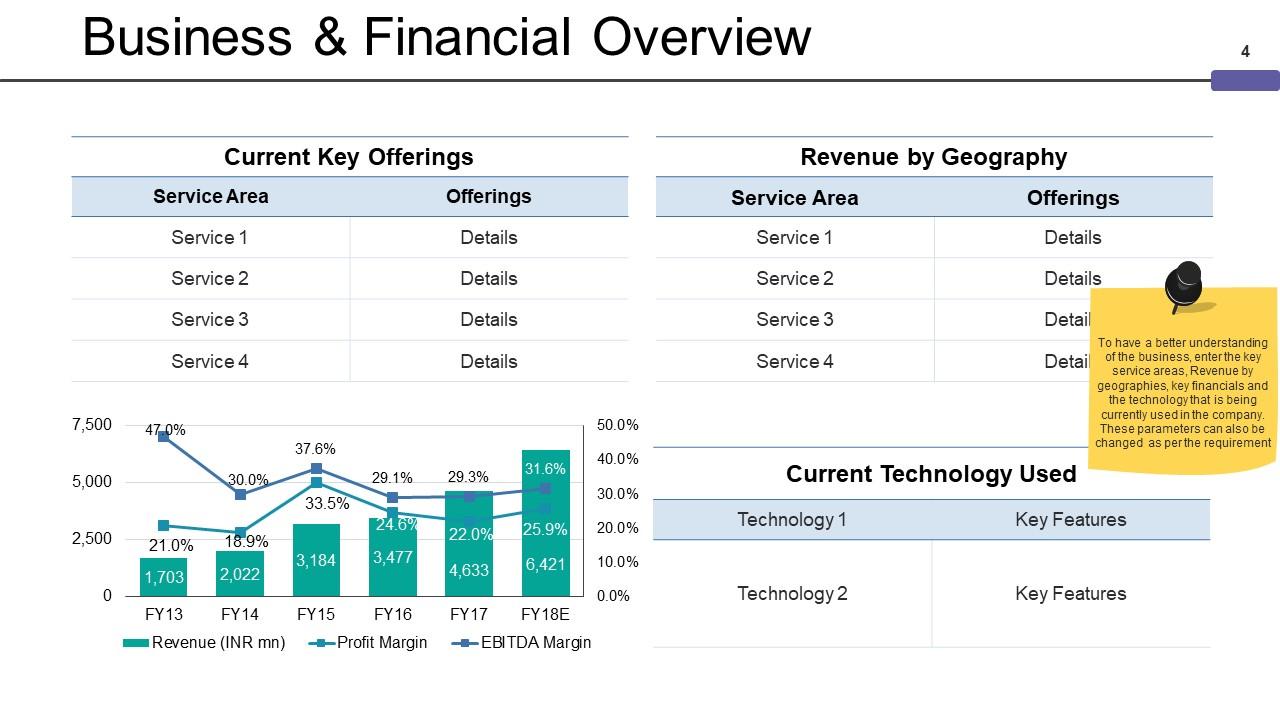

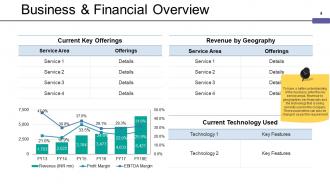

Slide 4: This slide showcases Business & Financial Overview. To have a better understanding of the business, enter the key service areas, Revenue by geographies, key financials and the technology that is being currently used in the company. These parameters can also be changed as per the requirement.

Slide 5: This slide presents Requirement For Inorganic Opportunity with these four of the parameters- Audience’s attention, Increase Geographical Presence, Offer New Service, Increase Market Share, Technology Transfer.

Slide 6: This slide showcases Determining New Growth Market/Services these of the services we have listed- Mention Geographies you want to expand, New technology you want to bring, Product/Service you want to include, Demand and market size for the particular product/service, After identifying the requirement for inorganic opportunities, this slide goes in detail about each of the discussed parameters.

Slide 7: This slide showcases Types of Inorganic Opportunities with these of the parameters- Market Extension Merger, Vertical Merger, Product Extension Merger, Acquisition, Conglomerate, Horizontal Merger, Highlight the relevant opportunity which you would like to opt for among others

Slide 8: This slide presents Types of Inorganic Opportunities with these of the factors- Horizontal Merger, Conglomerate, Acquisition, Market Extension Merger, Product Extension Merger., Vertical Merger, Highlight the relevant opportunity which you would like to opt for among others

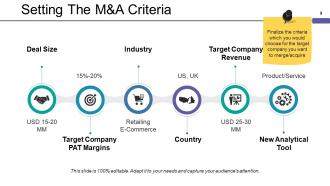

Slide 9: This slide presents Setting The M&A Criteria.Finalize the criteria which you would choose for the target company you want to merge/acquire.

Slide 10: This slide showcases Identifying Targets. For each target company, mention the name of country, product, Industry, size of the deal, revenue and profit margins. These parameters can be altered as per the criteria set by the company

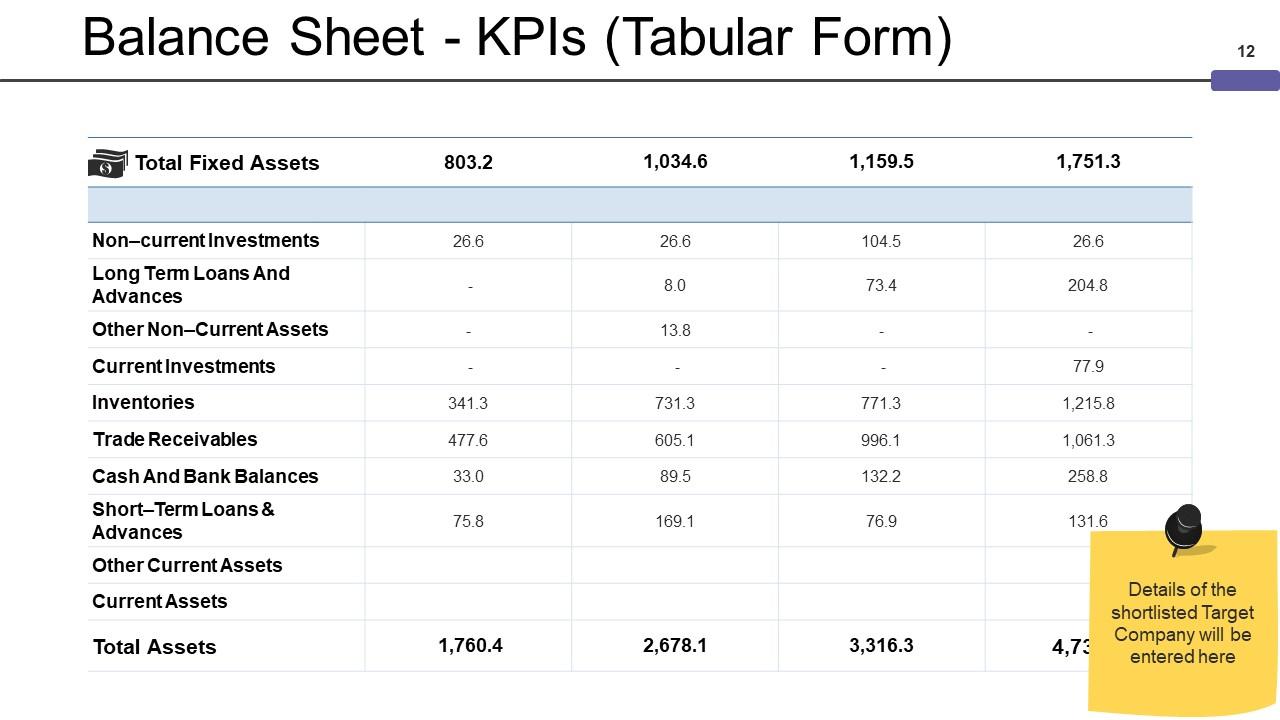

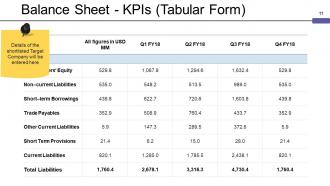

Slide 11: This slide Balance Sheet - KPIs (Tabular Form). Details of the shortlisted Target Company will be entered here.

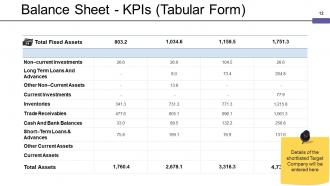

Slide 12: This slide showcases Balance Sheet - KPIs (Tabular Form). Details of the shortlisted Target Company will be entered here

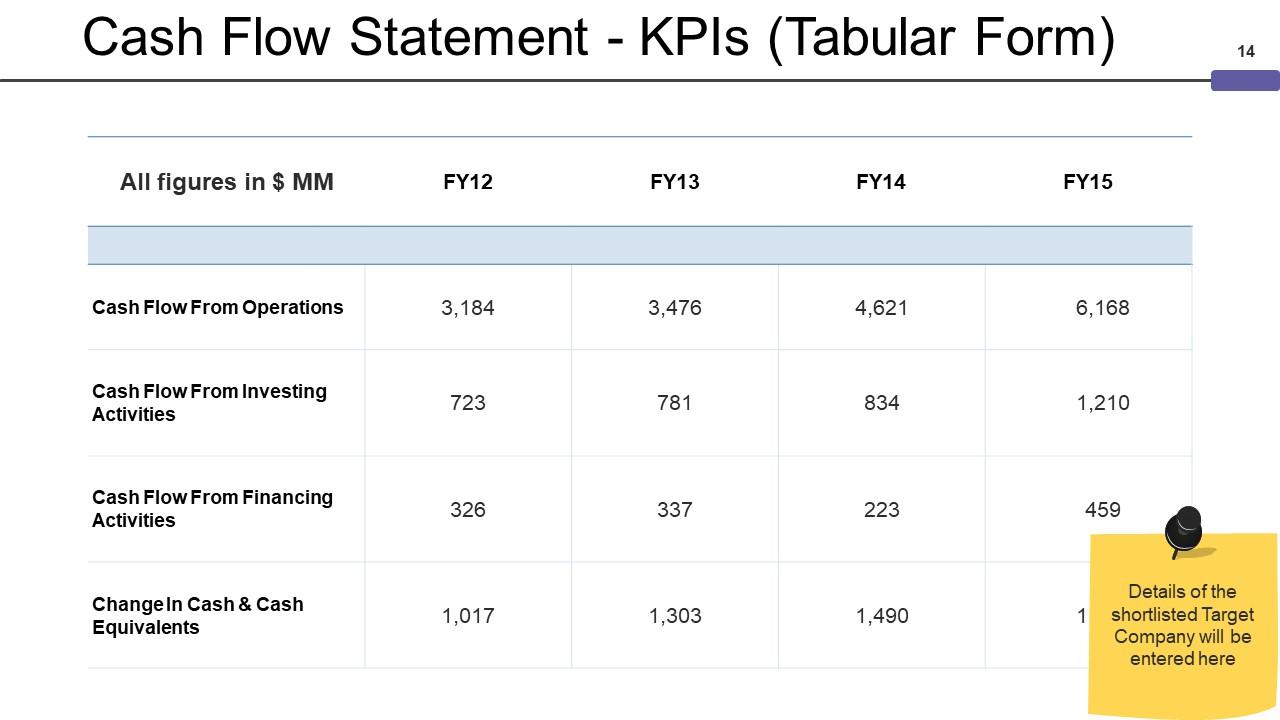

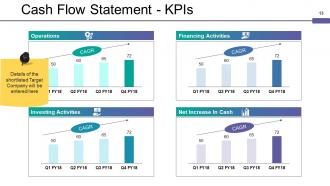

Slide 13: This slide showcases Cash Flow Statement - KPIs. Details of the shortlisted Target Company will be entered here

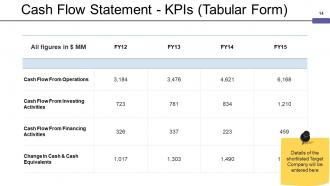

Slide 14: This slide presents Cash Flow Statement - KPIs (Tabular Form). Details of the shortlisted Target Company will be entered here

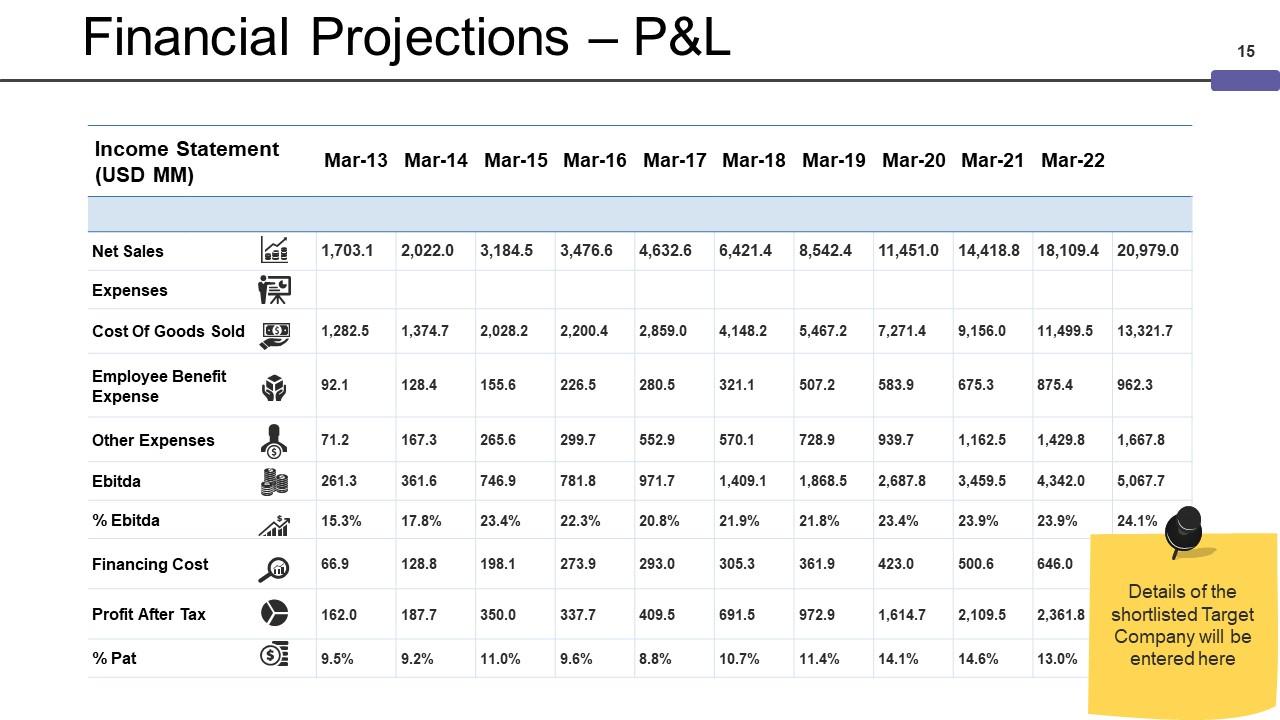

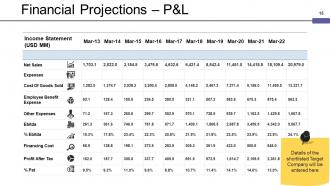

Slide 15: This slide showcases Financial Projections – P&L. Details of the shortlisted Target Company will be entered here

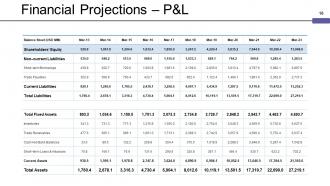

Slide 16: This slide presents Financial Projections – P&L.

Slide 17: This slide showcases Key Financial Ratios (1/2). You can use this for further showing of the finacial figures.

Slide 18: This slide presents Key Financial Ratios (2/2) with these of the four factors- Liquidity Ratio, Profitability Ratio, Activity Ratio, Solvency Ratio.

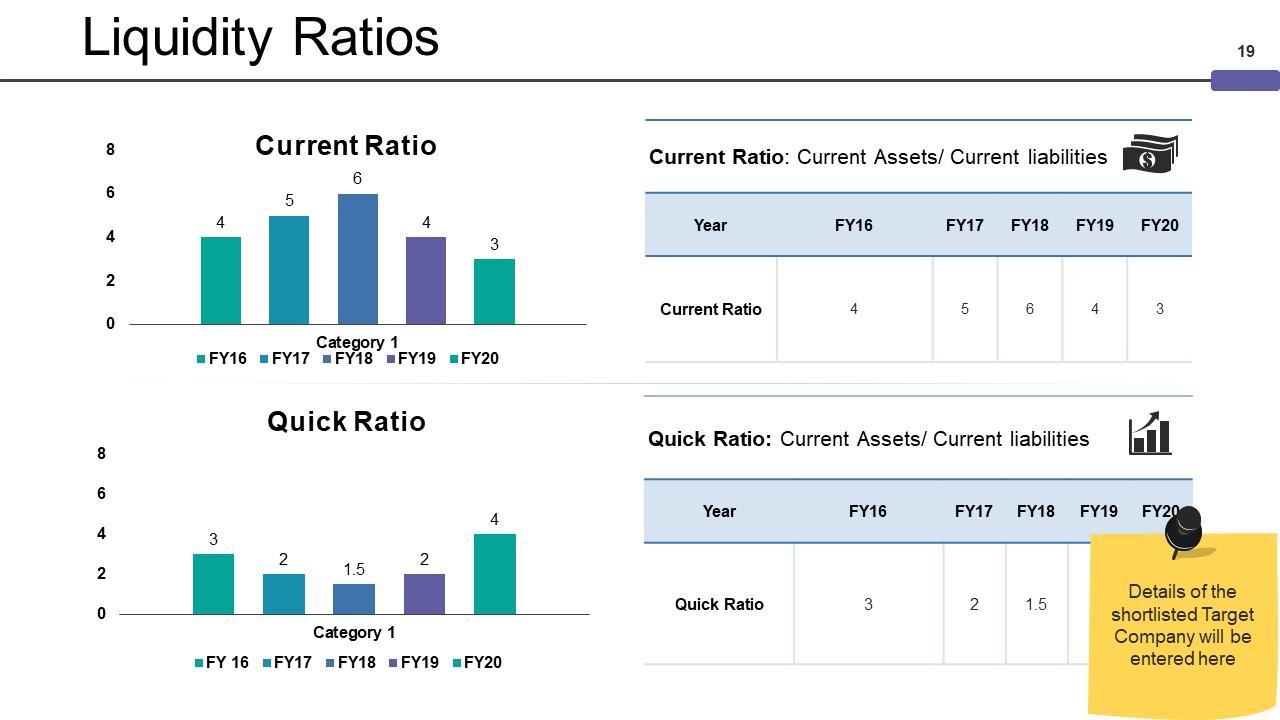

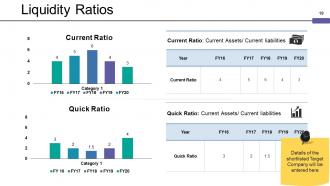

Slide 19: This slide shows Liquidity Ratios. Details of the shortlisted Target Company will be entered here.

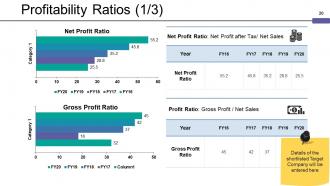

Slide 20: This slide showcases Profitability Ratios (1/3).Details of the shortlisted Target Company will be entered here.

Slide 21: This slide shows Profitability Ratios (2/3).Details of the shortlisted Target Company will be entered here.

Slide 22: This slide presents Profitability Ratios (3/3). Details of the shortlisted Target Company will be entered here

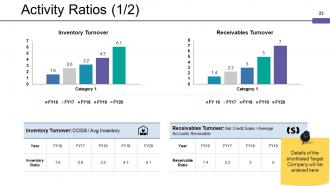

Slide 23: This slide showcases Activity Ratios (1/2) with these of the parameter- Inventory Turnover, Receivables Turnover, Details of the shortlisted Target Company will be entered here.

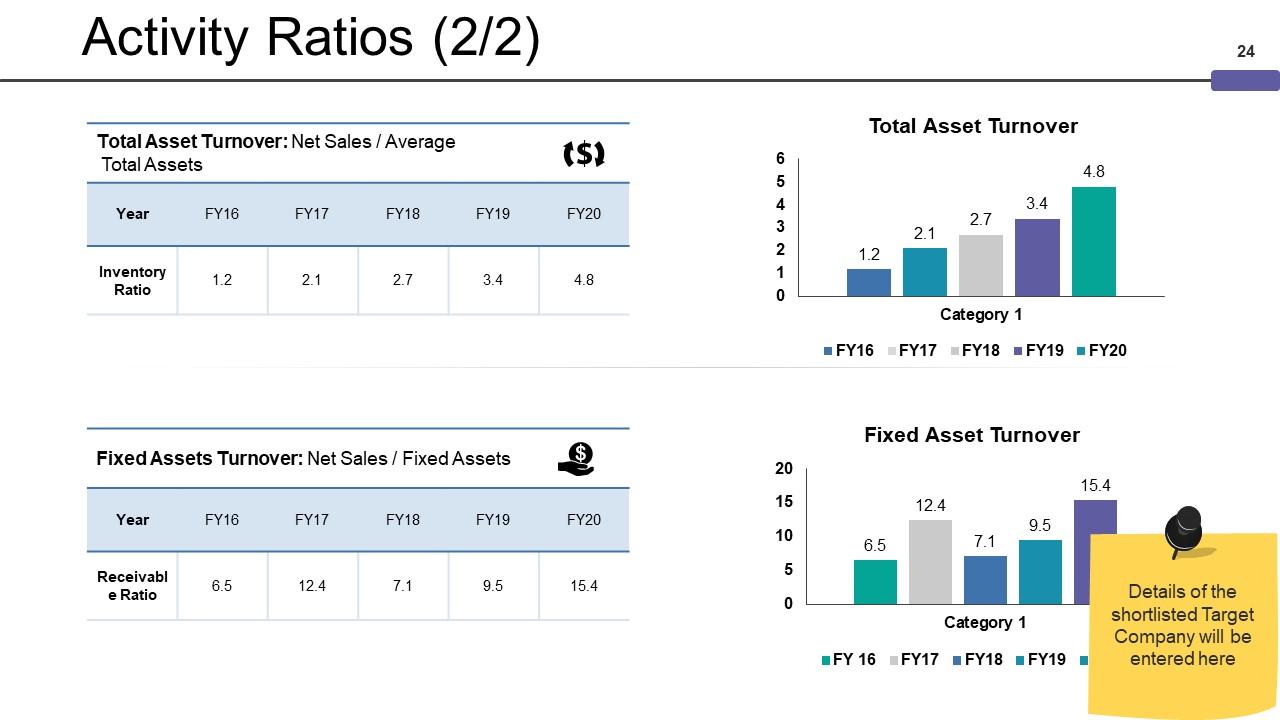

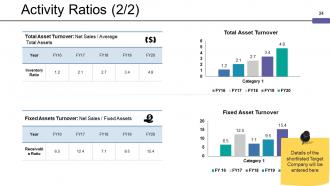

Slide 24: This slide presents Activity Ratios (2/2) with these two of the parameters- Fixed Asset Turnover, Total Asset Turnover, Details of the shortlisted Target Company will be entered here.

Slide 25: This slide shows Solvency Ratios which further showcases- Debt-Equity Ratio, TIE Ratio, Details of the shortlisted Target Company will be entered here.

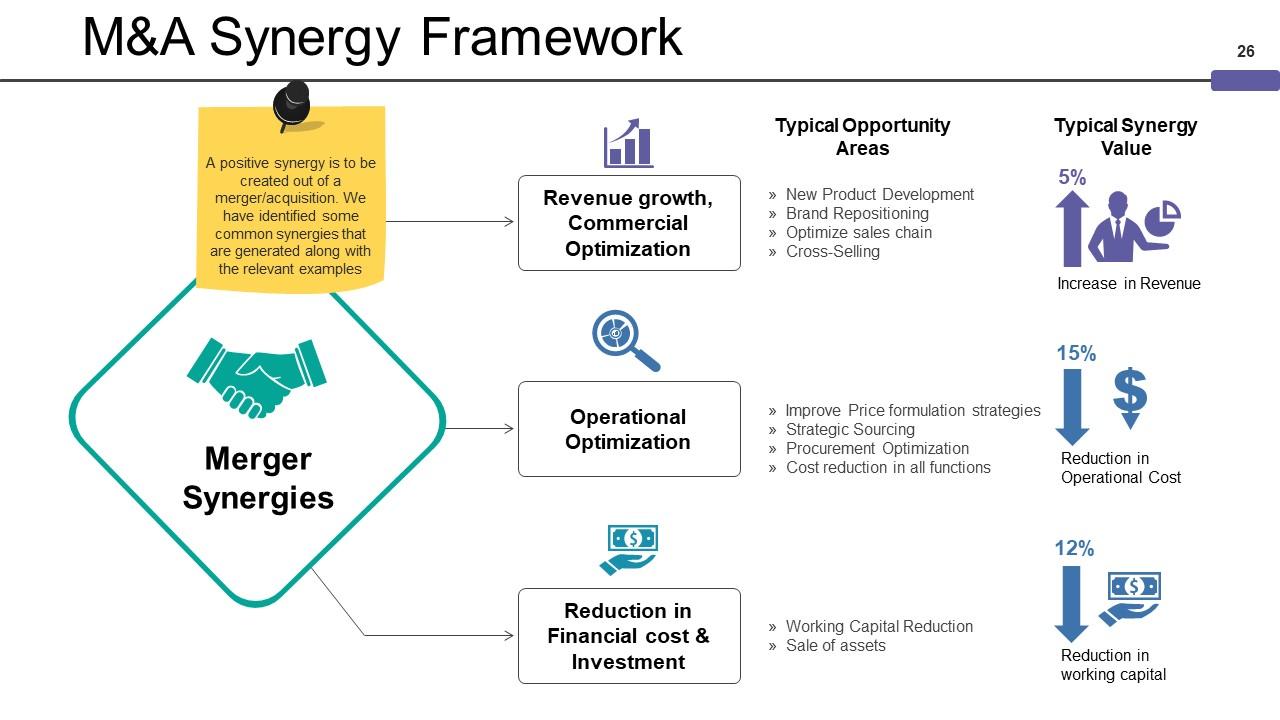

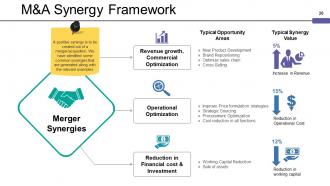

Slide 26: This slide presents M&A Synergy Framework. A positive synergy is to be created out of a merger/acquisition. We have identified some common synergies that are generated along with the relevant examples.

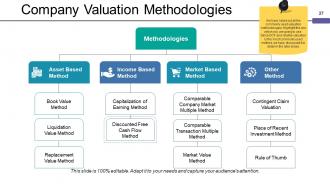

Slide 27: This slide shows Company Valuation Methodologies.

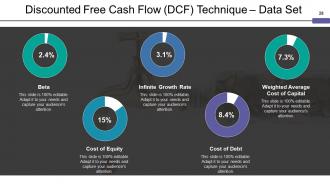

Slide 28: This slide presents Discounted Free Cash Flow (DCF) Technique – Data Set Beta, Infinite Growth Rate, Weighted Average Cost of Capital Cost of Debt, Cost of Equity.

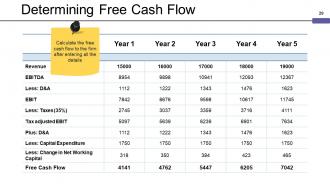

Slide 29: This slide presents Determining Free Cash Flow. Calculate the free cash flow to the firm after entering all the details.

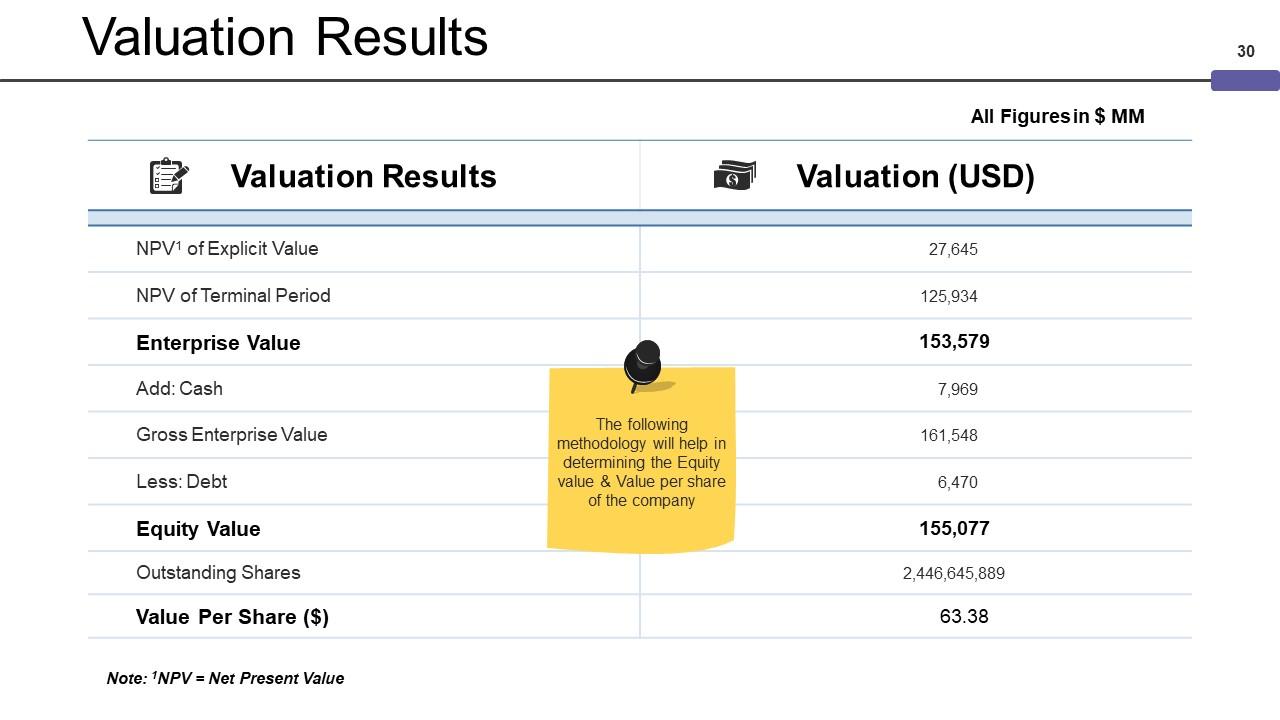

Slide 30: This slide shows Valuation Results. The following methodology will help in determining the Equity value & Value per share of the company.

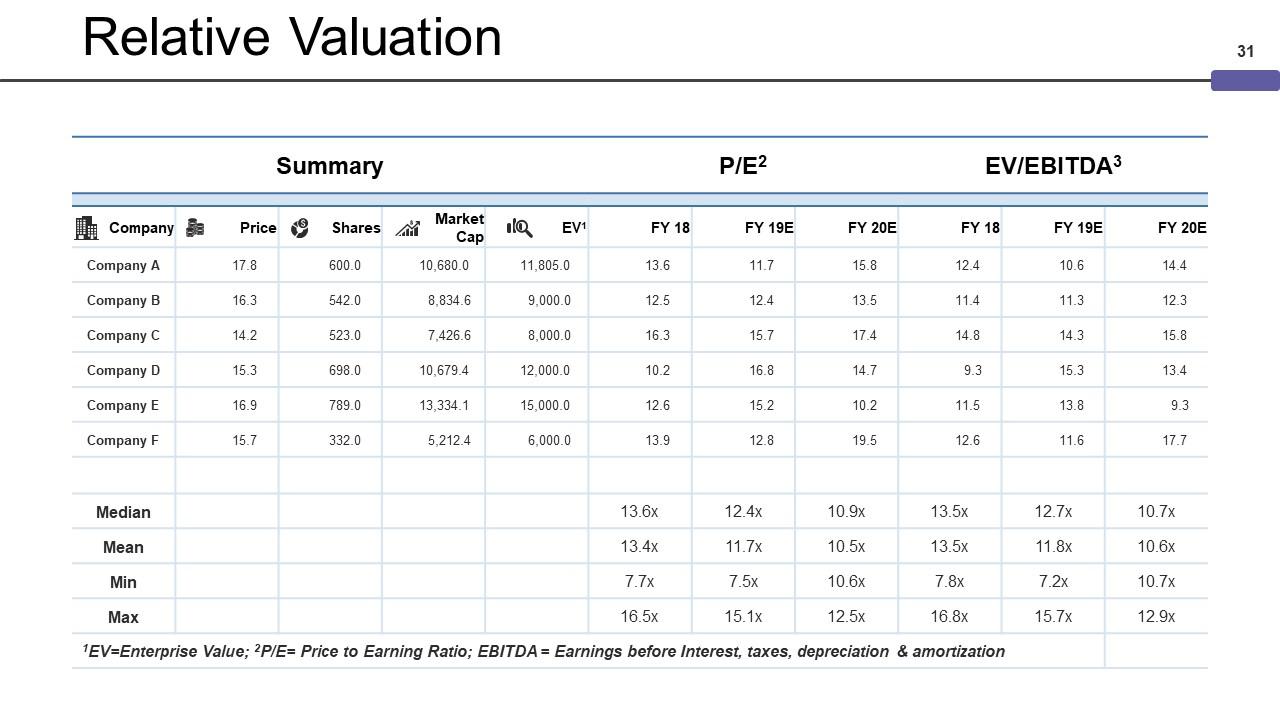

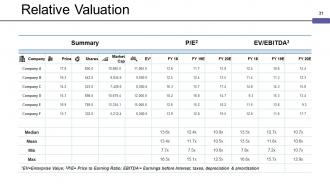

Slide 31: This slide shows Relative Valuation.

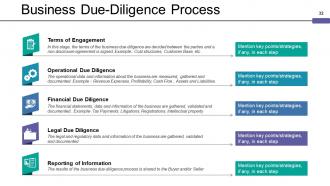

Slide 32: This slide presents Business Due-Diligence Process Terms of Engagement, Operational Due Diligence, Financial Due Diligence, Legal Due Diligence, Reporting of Information.

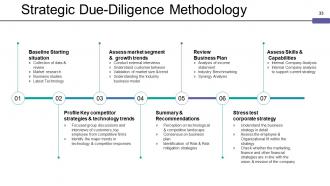

Slide 33: This slide presents Strategic Due-Diligence Methodology with seven of the different stages we have mentioned.

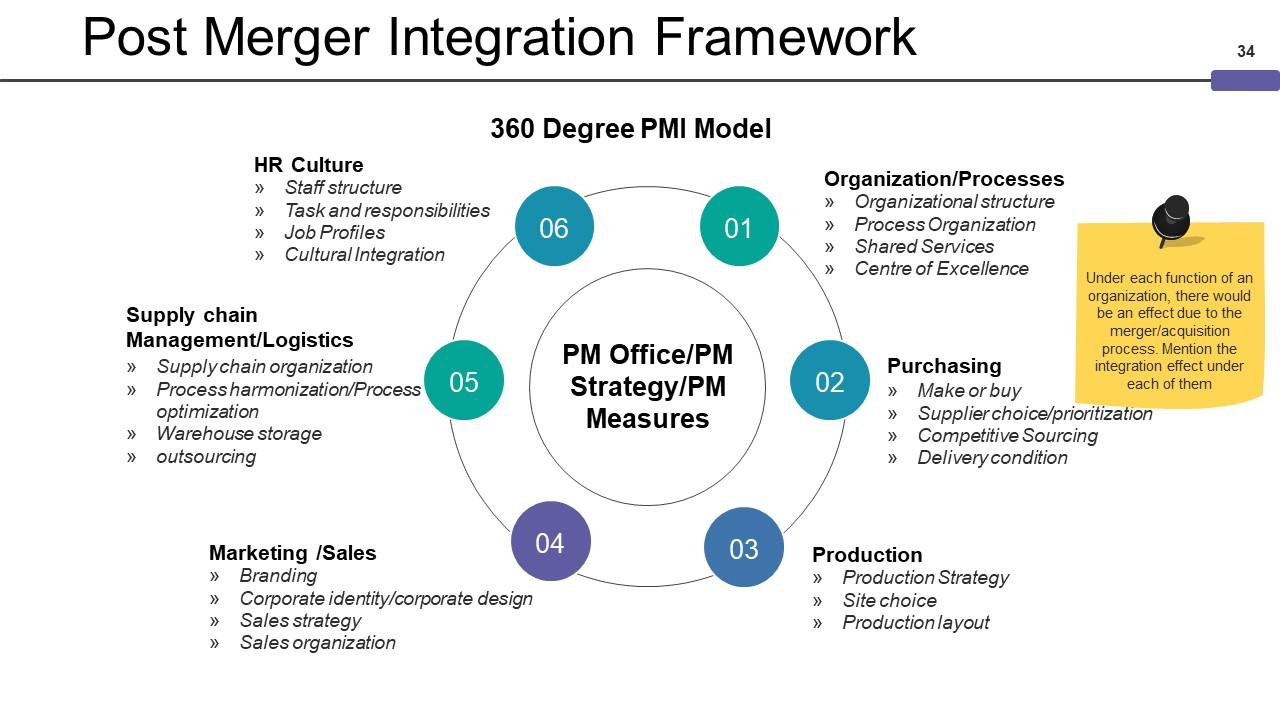

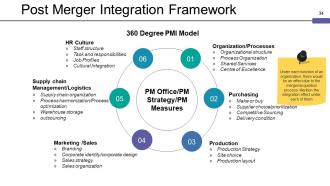

Slide 34: This slide showcases Post Merger Integration Framework. Under each function of an organization, there would be an effect due to the merger/acquisition process. Mention the integration effect under each of them

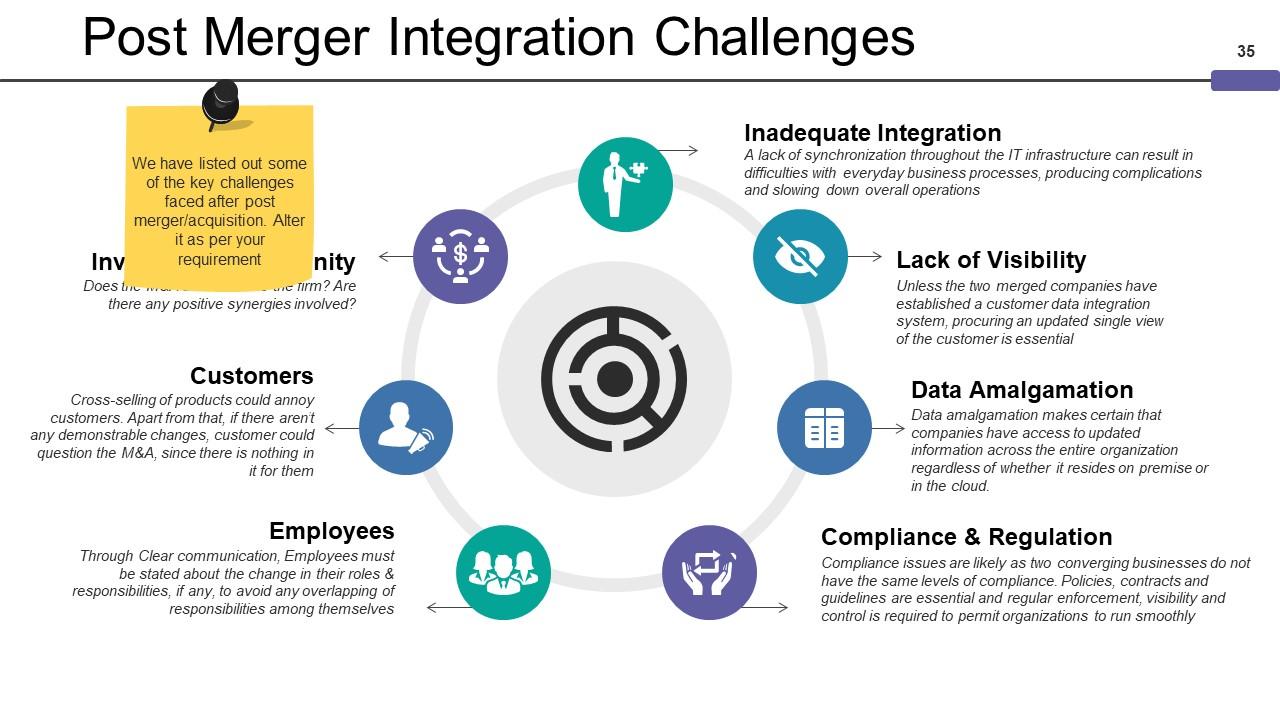

Slide 35: This slide presents Post Merger Integration Challenges. We have listed out some of the key challenges faced after post merger/acquisition. Alter it as per your requirement.

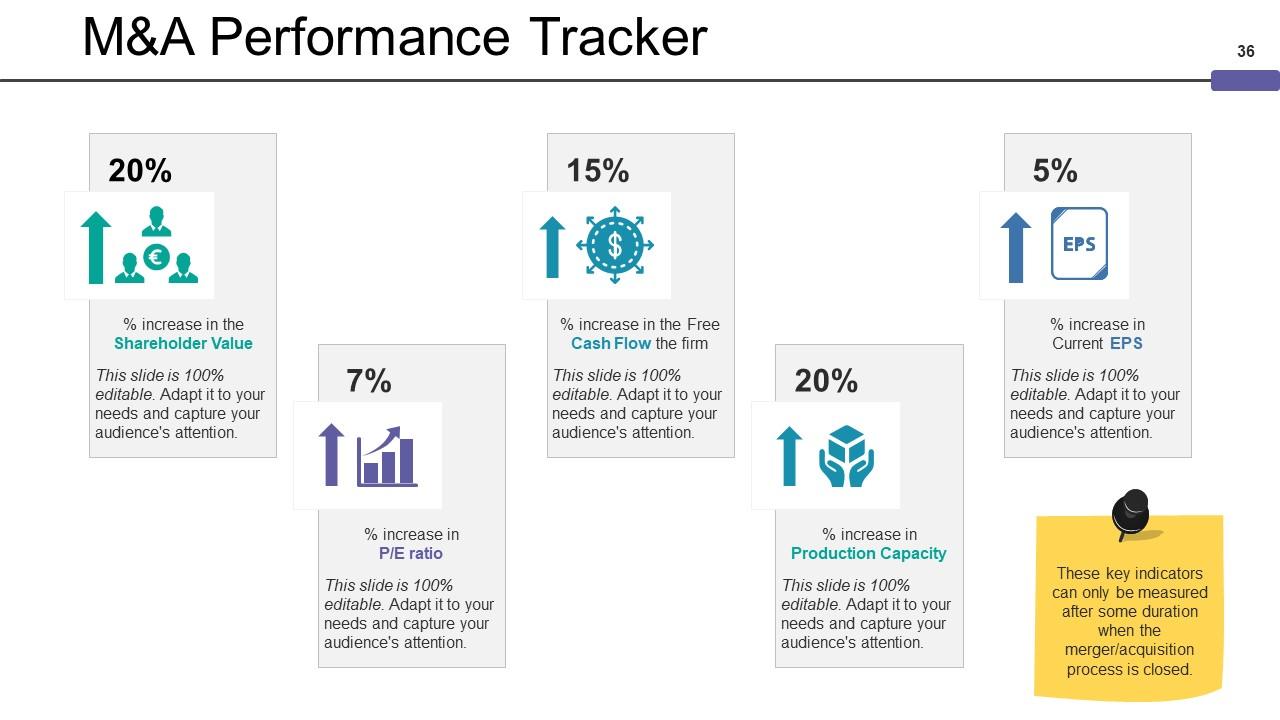

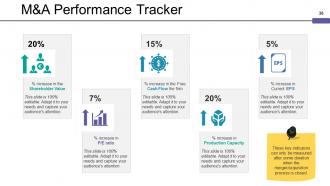

Slide 36: This slide presents M&A Performance Tracker.These key indicators can only be measured after some duration when the merger/acquisition process is closed.

Slide 37: This slide presents Mergers And Acquisitions Framework Icon Slide.

Slide 38: This is a Coffee Break slide to halt. You may change it as per requirement.

Slide 39: This slide is titled Charts & Graphs to move forward.

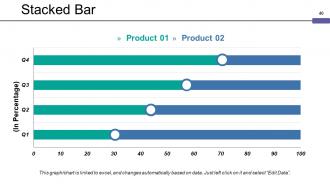

Slide 40: This slide shows a Stacked Line graph in terms of percentage and years for comparison of Product 01, Product 02, Product 03 etc.

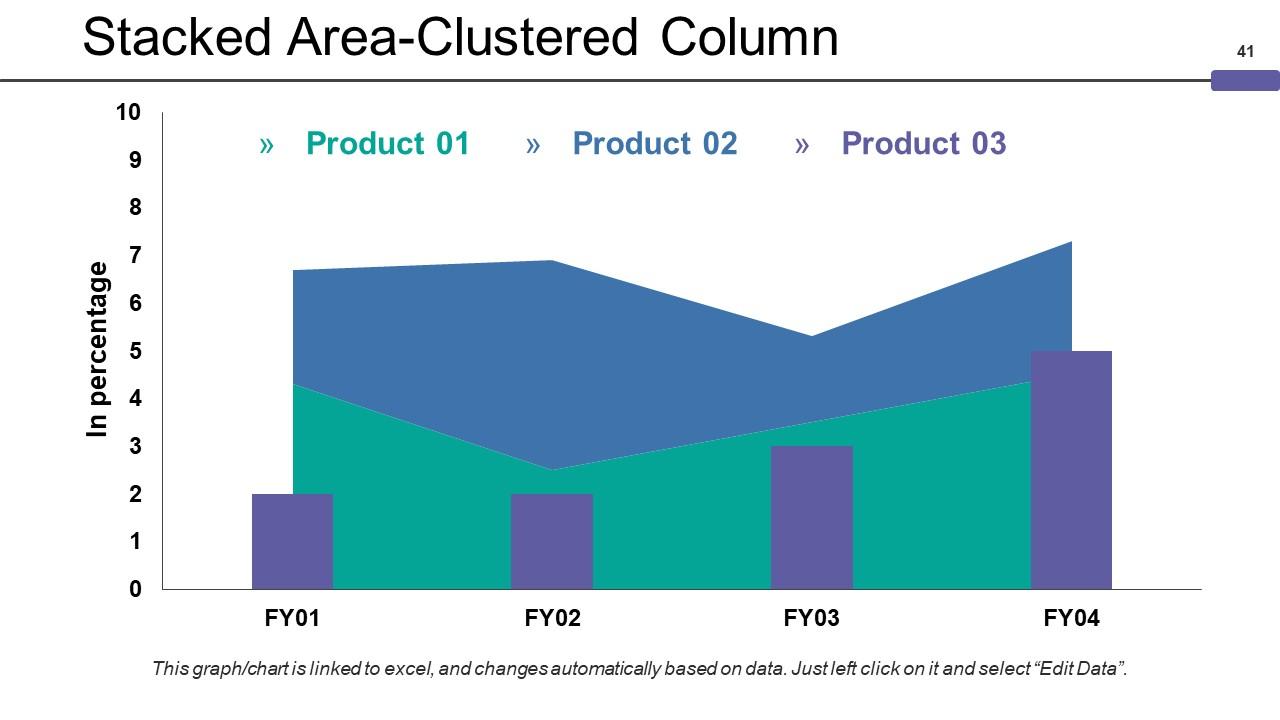

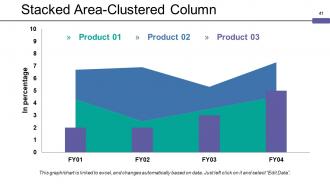

Slide 41: This slide presents Stacked Area-Clustered Column.

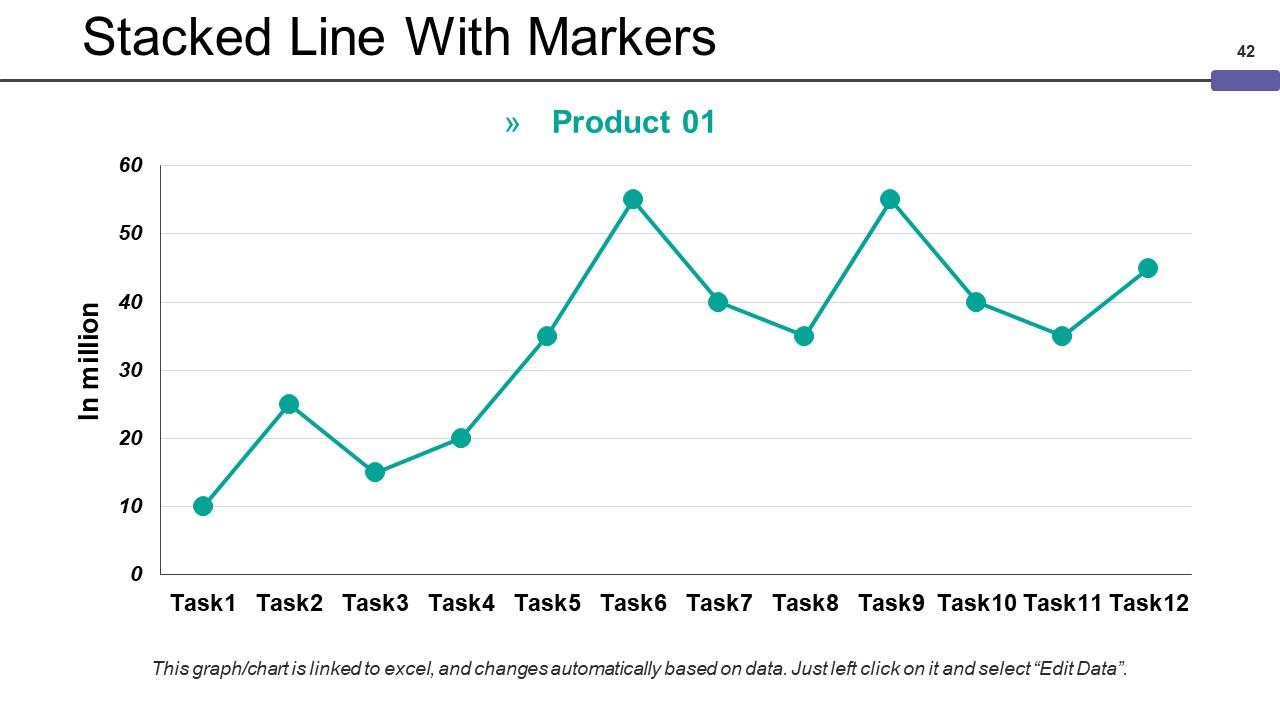

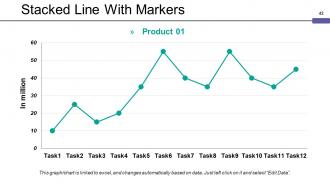

Slide 42: This slide showcases Stacked Line With Markers.

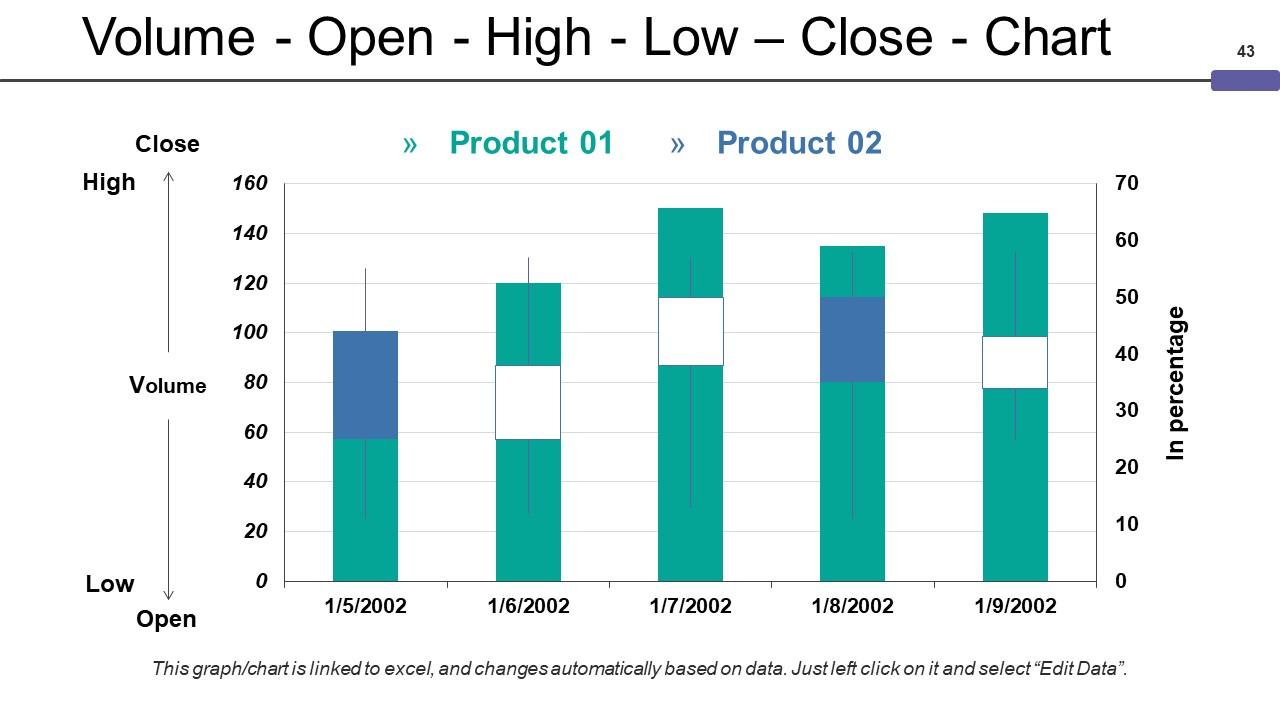

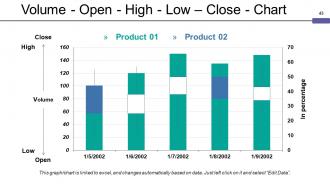

Slide 43: This slide presents Volume - Open - High - Low – Close - Chart.

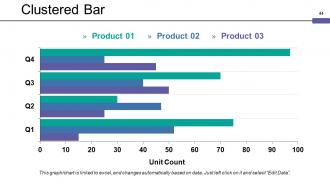

Slide 44: This slide shows Clustered Bar.

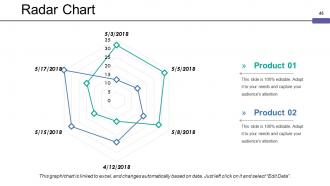

Slide 45: This slide showcases Radar Chart.

Slide 46: This slide is titled Additional Slides.

Slide 47: This slide represents Our Mission. State your mission, goals etc.

Slide 48: This slide showcases Our Team with Name and Designation to fill.

Slide 49: This slide helps show- About Our Company. The sub headings include- Creative Design, Customer Care, Expand Company .

Slide 50: This slide shows Our Goals for your company.

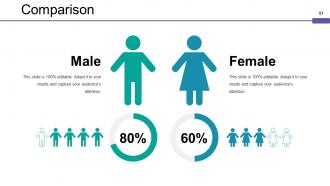

Slide 51: This slide shows Competitive Analysis in the form of a Comparison Table.

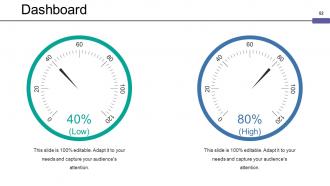

Slide 52: This is Dashboard slide to show information in percentages etc.

Slide 53: This slide presents Financial scores to display.

Slide 54: This is a Quotes slide to highlight, or state anything specific.

Slide 55: This slide presents a PUZZLE slide with the following subheadings- Integrity and Judgment, Critical and Decision Making, Leadership, Agility.

Slide 56: This is a Target slide. State your targets here.

Slide 57: This is a Location slide of World map to show global presence, growth etc.

Slide 58: This is a Circular image slide to show information, specifications etc.

Slide 59: This is a Venn diagram image slide to show information, specifications etc.

Slide 60: This slide shows a Mind map for representing entities

Slide 61: This is a Silhouettes slide to show people specific information etc.

Slide 62: This slide displays a Magnifying Glass with icon imagery.

Slide 63: This is a Bulb or Idea slide to state a new idea or highlight specifications/information etc.

Slide 64: This is a Thank You slide with Address# street number, city, state, Contact Number, Email Address.

Mergers And Acquisitions Framework Powerpoint Presentation Slides with all 64 slides:

Gravitate to the classy with our Mergers And Acquisitions Framework Powerpoint Presentation Slides. Your brand will acquire an exclusive aura.

-

Innovative and attractive designs.

-

Excellent work done on template design and graphics.