Merger strategy to foster diversification and value creation powerpoint presentation slides

Our Merger Strategy To Foster Diversification And Value Creation Powerpoint Presentation Slides are topically designed to provide an attractive backdrop to any subject. Use them to look like a presentation pro.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

This complete deck covers various topics and highlights important concepts. It has PPT slides which cater to your business needs. This complete deck presentation emphasizes Merger Strategy To Foster Diversification And Value Creation Powerpoint Presentation Slides and has templates with professional background images and relevant content. This deck consists of total of fourty five slides. Our designers have created customizable templates, keeping your convenience in mind. You can edit the color, text and font size with ease. Not just this, you can also add or delete the content if needed. Get access to this fully editable complete presentation by clicking the download button below.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide displays title i.e. 'Merger Strategy to Foster Diversification and Value Creation' and your Company Name.

Slide 2: This slide presents agenda.

Slide 3: This slide exhibits table of contents.

Slide 4: This slide shows title for need, objectives, categories of merger.

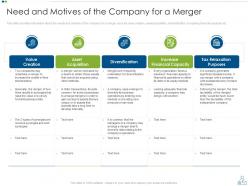

Slide 5: This slide provides information about the needs and motives of the company for a merger such as value creation, etc.

Slide 6: This slide depicts objectives of the company for a merger such as exponential growth, etc.

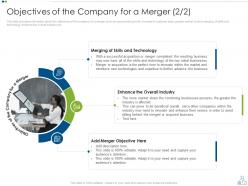

Slide 7: This slide explains objectives of the company for a merger such as increase in customer base, etc.

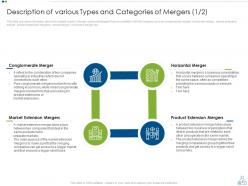

Slide 8: This slide displays multiple types of merger options/strategies that are available with the company.

Slide 9: This slide presents continued content.

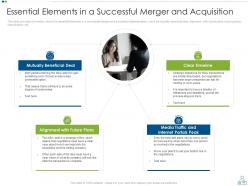

Slide 10: This slide exhibits essential elements in a successful merger and acquisition implementation.

Slide 11: This slide shows title for driving forces influencing Implementation of Merger.

Slide 12: This slide depicts major reasons regarding the happening of the mergers in a company and why do company go for strategic merger deal.

Slide 13: This slide illustrates driving forces/factors that influence a company to go for a merger.

Slide 14: This slide highlights company’s strategic goals behind the implementing of a merger strategy.

Slide 15: This slide explains about the participants and shareholders that are involved in the merger and acquisition process.

Slide 16: This slide showcases continued content.

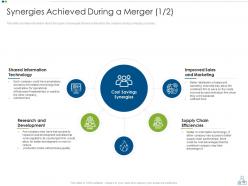

Slide 17: This slide displays title for synergies achieved during a merger.

Slide 18: This slide presents types of synergies that are achieved by the company during a merging process.

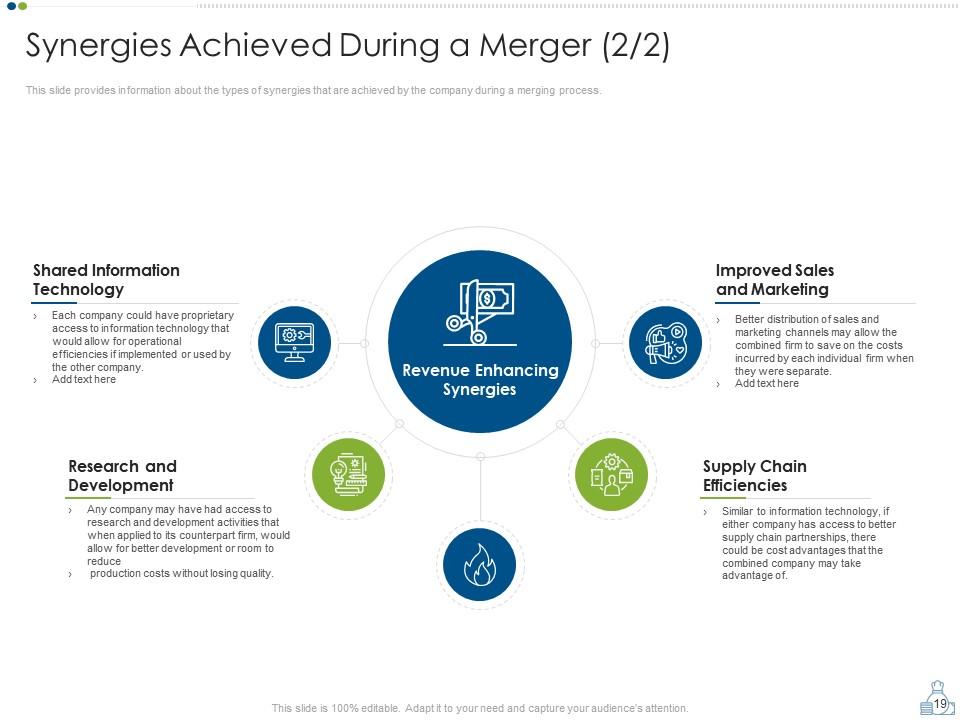

Slide 19: This slide exhibits continued content.

Slide 20: This slide shows title for valuation methods for a potential merger & methods of payment.

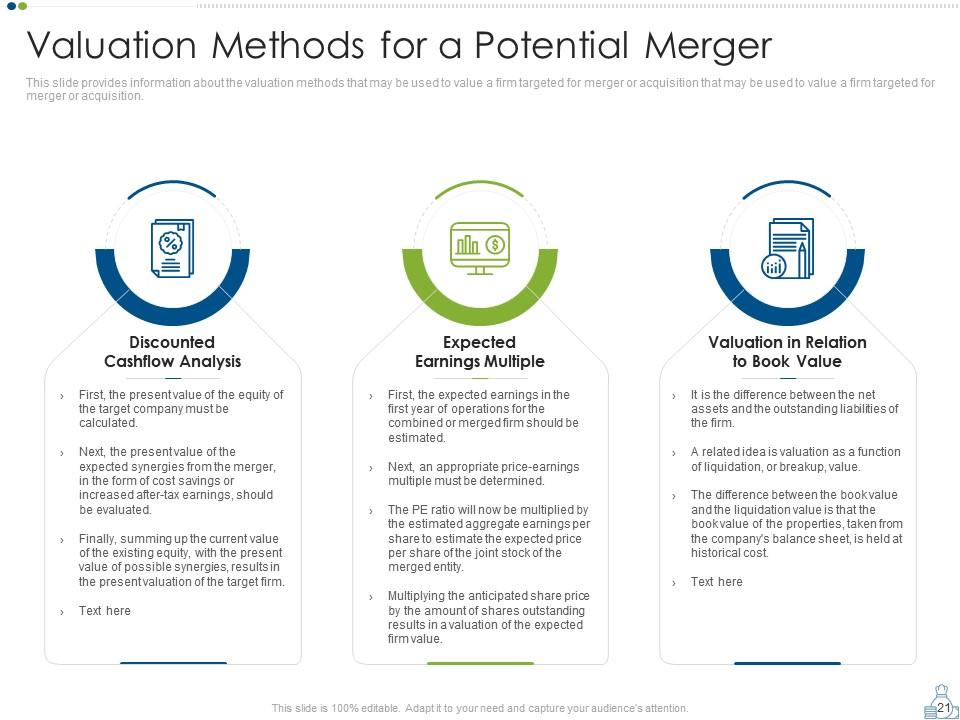

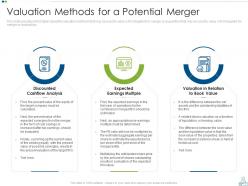

Slide 21: This slide depicts valuation methods that may be used to value a firm targeted for merger or acquisition.

Slide 22: This slide explains payment methods for an M&A activity/transaction such as stock purchase, cash offering, security offerings, etc.

Slide 23: This slide highlights title for overview of process for evaluation & execution of merger.

Slide 24: This slide illustrates overview of the process that is followed by the company for evaluation and execution of successful merger and acquisition.

Slide 25: This slide displays first step followed by the company for evaluation and execution i.e., determining growth markets/services.

Slide 26: This slide presents second step followed by the company i.e., identify merger and acquisition candidates.

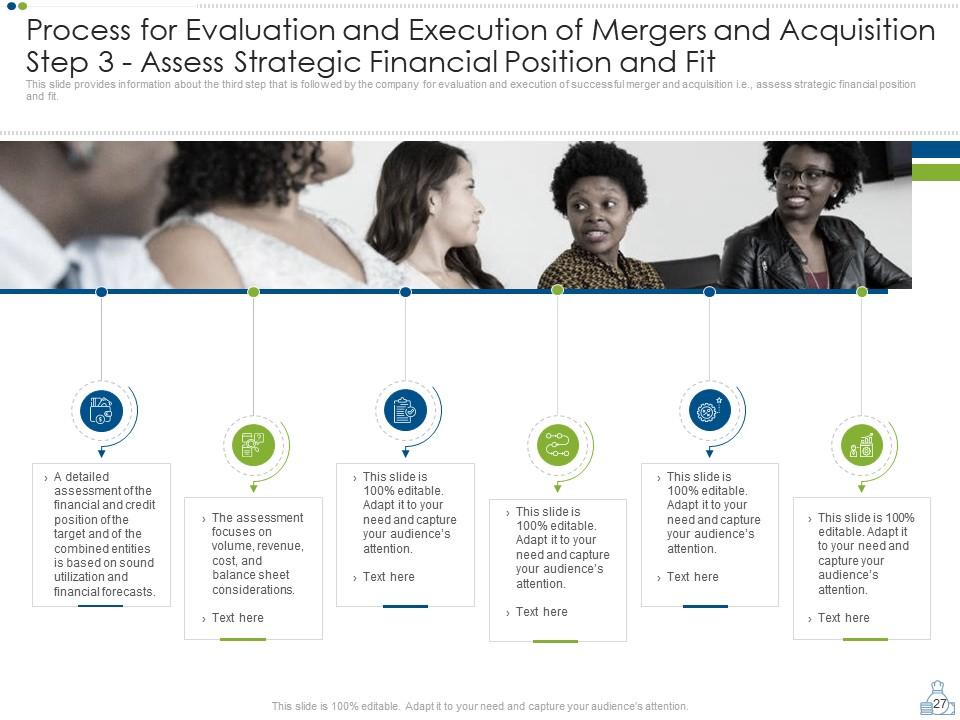

Slide 27: This slide exhibits third step followed by the company i.e., assess strategic financial position and fit.

Slide 28: This slide shows fourth step followed by the company i.e., making a go/no-go decision.

Slide 29: This slide depicts fifth step followed by the company i.e., conduct valuation.

Slide 30: This slide highlights sixth step followed by the company i.e., performing due diligence, negotiating a definitive agreement, and executing transaction.

Slide 31: This slide displays seventh and last step followed by the company i.e., implementing transaction and monitoring ongoing performance.

Slide 32: This slide presents title for advantages & disadvantages of merger to the company.

Slide 33: This slide exhibits advantages and benefits of a merger to the company such as increased market share, reduced operational costs, etc.

Slide 34: This slide shows disadvantages and demerits of a merger to the company.

Slide 35: This is the icons slide.

Slide 36: This slide presents title for additional slides.

Slide 37: This slide presents 30-60-90 days plan for projects.

Slide 38: This slide depicts ideas generated.

Slide 39: This slide highlights comparison of products based on selects.

Slide 40: This slide displays venn.

Slide 41: This slide depicts posts for past experiences of clients.

Slide 42: This slide displays puzzle.

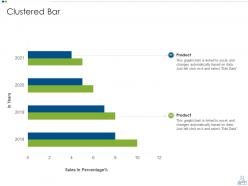

Slide 43: This slide displays yearly sales clustered bar graph for different products. The graphs are linked to Excel.

Slide 44: This slide presents yearly sales area charts for different products. The charts are linked to Excel.

Slide 45: This is thank you slide & contains contact details of company like office address, phone no., etc.

Merger strategy to foster diversification and value creation powerpoint presentation slides with all 45 slides:

Use our Merger Strategy To Foster Diversification And Value Creation Powerpoint Presentation Slides to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Colors used are bright and distinctive.