Implementing Bank Transaction Monitoring Tool Powerpoint Presentation Slides

Transaction monitoring is keeping track of client transactions while examining past and present facts, patterns, and actions. Grab our Implementing Bank Transaction Monitoring Tool template. Quickly evaluating risk levels helps financial organizations know their customers and take legal action against any money laundering or financial crime risk. Our AML System deck details the timetable for implementation and the significance, advantages, and process flow of transaction monitoring. Additionally, it compares and contrasts manual and automated methods of transaction monitoring. Our TM System deck provides tips for improving transaction monitoring systems that can assist financial organizations and businesses lower risks and reducing money laundering and other financial crimes. Examples include customer segmentation, suspicious activity reporting SAR, anti-money laundering strategies, threshold management, behavioral analytics, alerts management, etc. The complete deck details the financial security departments roles, responsibilities, training plan, communication plan, etc. Finally, our Automatic Transaction Monitoring module highlights KPI dashboards, metrics, impact analysis, costs, and other aspects of transaction monitoring. Get access now.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

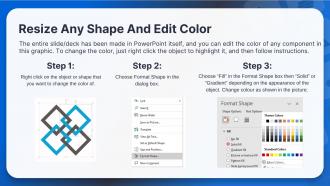

This complete presentation has PPT slides on wide range of topics highlighting the core areas of your business needs. It has professionally designed templates with relevant visuals and subject driven content. This presentation deck has total of seventy two slides. Get access to the customizable templates. Our designers have created editable templates for your convenience. You can edit the color, text and font size as per your need. You can add or delete the content if required. You are just a click to away to have this ready-made presentation. Click the download button now.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Implementing Bank Transaction Monitoring Tool. Commence by stating Your Company Name.

Slide 2: This slide depicts the Agenda of the presentation.

Slide 3: This slide incorporates the Table of contents.

Slide 4: This slide continues the Table of contents.

Slide 5: This is yet another slide continuing the Table of contents.

Slide 6: This slide highlights the Title for the Topics to be discussed next.

Slide 7: This slide showcases global scenario of financial crimes and frauds.

Slide 8: This slide deals with Analyzing impact of money laundering on global economy.

Slide 9: This slide states the reasons why transaction monitoring is essential.

Slide 10: This slide depicts the Key trends of transaction monitoring across US.

Slide 11: This slide shows difference between traditional and automated transaction monitoring method.

Slide 12: This slide exhibits the Importance of regular financial activity observation.

Slide 13: This slide illustrates the TMS and data analytics process flow.

Slide 14: This slide continues the TMS and data analytics process flow.

Slide 15: This slide displays the Heading for the Contents to be covered further.

Slide 16: This slide showcases timeline to introduce transaction monitoring system.

Slide 17: This slide incorporates the Title for the Ideas to be discussed in the following template.

Slide 18: This slide presents the Risks identified during transaction monitoring.

Slide 19: This slide talks about Enhancing identification process through customer segmentation.

Slide 20: Checklist for validating transaction monitoring system.

Slide 21: This slide displays the Suspicious transaction monitoring and threshold management.

Slide 22: This slide shows machine learning cycle for checking financial transactions.

Slide 23: This slide exhibits the Heading for the Ideas to be covered further.

Slide 24: The following slide illustrates usage of behavioral analytics for multiple transactions and profiles.

Slide 25: This slide depicts Using behavioral analytics for multiple transactions and profiles.

Slide 26: This slide talks about Blockchain technology for AML transactions and alerts.

Slide 27: This slide presents the Fraud alert and case management approach.

Slide 28: The following slide shows control actions for anti money laundering (AML).

Slide 29: This slide highlights the Title for the Components to be discussed in the upcoming template.

Slide 30: This slide exhibits the Customer onboarding framework through KYC approach.

Slide 31: The following slide illustrates real time onboarding, processing an monitoring.

Slide 32: This slide showcases identifying inherent risk factors and measures.

Slide 33: This slide deals with Determining residual risks through assessment matrix.

Slide 34: This slide indicates mitigating transaction risks through policies and procedures.

Slide 35: This slide mentions the Heading for the Topics to be covered further.

Slide 36: The following slide depicts effective strategies to report fraudulent transactions.

Slide 37: This slide reveals MIS report highlighting risk and fraud metrics.

Slide 38: This slide displays the Title for the Topics to be discussed next.

Slide 39: This slide showcases best practices to effectively deploy transaction monitoring software.

Slide 40: This slide illustrates transaction monitoring and fraud detection software framework.

Slide 41: This slide presents working of a transaction monitoring software.

Slide 42: This slide depicts working of a transaction monitoring software.

Slide 43: This slide shows real time crime and fraud detection process flow for ATMS.

Slide 44: This slide highlights the Heading for the Components to be covered further.

Slide 45: This slide displays the Key members of financial security department.

Slide 46: This slide states the Major roles and responsibilities of financial security team.

Slide 47: The following slide represents training program for transaction monitoring and anti money laundering (AML).

Slide 48: This slide showcases communication plan for strengthening finance and compliance teams.

Slide 49: This slide indicates the Title for the Ideas to be discussed in the following template.

Slide 50: This slide portrays the Overall costs for developing transaction monitoring system.

Slide 51: This slide deals with Selecting suitable solution for monitoring transactions.

Slide 52: This slide depicts the Heading for the Ideas to be covered in the upcoming template.

Slide 53: This slide focuses on Analyzing impact of advanced transaction monitoring system.

Slide 54: This slide emphasizes on Analyzing impact on key operations and workflows.

Slide 55: This slide mentions the Title for the Topics to be discussed further.

Slide 56: This slide showcases dashboard for monitoring fraudulent and money laundering transactions.

Slide 57: This slide elucidates the Dashboard to monitor bank transactions and activities.

Slide 58: This is the Icons slide containing all the Icons used in the plan.

Slide 59: This slide is used for depicting Additional information.

Slide 60: This slide talks about Cryptocurrency transaction monitoring with alerts status.

Slide 61: This slide illustrates various types of transaction monitoring technologies.

Slide 62: This slide showcases process flow of suspicious activity reporting (SAR).

Slide 63: This slide reveals the Column chart.

Slide 64: This slide displays the Timeline.

Slide 65: This is the Puzzle slide with related imagery.

Slide 66: This is the Venn diagram slide.

Slide 67: This is the 30 60 90 days plan slide for effective planning.

Slide 68: This slide contains the Post it notes for reminders and deadlines.

Slide 69: This slide presents information related to the Financial topic.

Slide 70: This slide is used for defining the organization's Target.

Slide 71: This slide is used for the purpose of Comparison.

Slide 72: This is the Thank you slide for acknowledgement.

Implementing Bank Transaction Monitoring Tool Powerpoint Presentation Slides with all 77 slides:

Use our Implementing Bank Transaction Monitoring Tool Powerpoint Presentation Slides to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Loved the collection. Editing the presentation was seamless with their templates.

-

“There is so much choice. At first, it seems like there isn't but you have to just keep looking, there are endless amounts to explore.”