Navigating The Anti Money Laundering Landscape Fin CD

Check out our professionally designed Navigating the Anti-Money Laundering landscape PPT to fortify your understanding of pivotal financial concepts. This Money Laundering presentation delves into the intricate realms of economic crime, illegal financing, and transaction monitoring. Moreover, this Transaction Monitoring Template provides invaluable insights into money laundering mechanisms. Further, this presentation empowers your team to detect and prevent illicit financial activities. Also, our visually engaging PowerPoint slides break down complex topics and clarify AML protocols and best practices. Lastly, this Suspicious Money Activity module navigates the regulatory landscape confidently, ensuring compliance and safeguarding your institution. Elevate your knowledge and empower your workforce with this indispensable guide, arming your organization against the evolving financial security challenges. Get access to this powerful Template now.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

This complete presentation has PPT slides on wide range of topics highlighting the core areas of your business needs. It has professionally designed templates with relevant visuals and subject driven content. This presentation deck has total of seventy seven slides. Get access to the customizable templates. Our designers have created editable templates for your convenience. You can edit the color, text and font size as per your need. You can add or delete the content if required. You are just a click to away to have this ready-made presentation. Click the download button now.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: The slide introduces Navigating the Anti-Money Laundering Landscape. State Your Company Name and begin.

Slide 2: This is an Agenda slide. State your agendas here.

Slide 3: The slide displays Table of Contents for the presentation.

Slide 4: The slide renders Table of Contents further.

Slide 5: The slide provides an overview of Anti-money laundering along with multiple attributes associated with it.

Slide 6: The slide presents the historical background of AML that helps to understand the rise and development of anti-money laundering for threat prevention.

Slide 7: The slide again renders the historical background of AML that helps to understand the rise and development of anti-money laundering for threat prevention.

Slide 8: The slide provides the various factors that determine the need to implement anti-money laundering to eliminate financial risks.

Slide 9: The slide highlights the difference between AML and terrorist financing based on various components to provide a general understanding of their roles.

Slide 10: The slide illustrates the key components of the AML system that form the basics of its working.

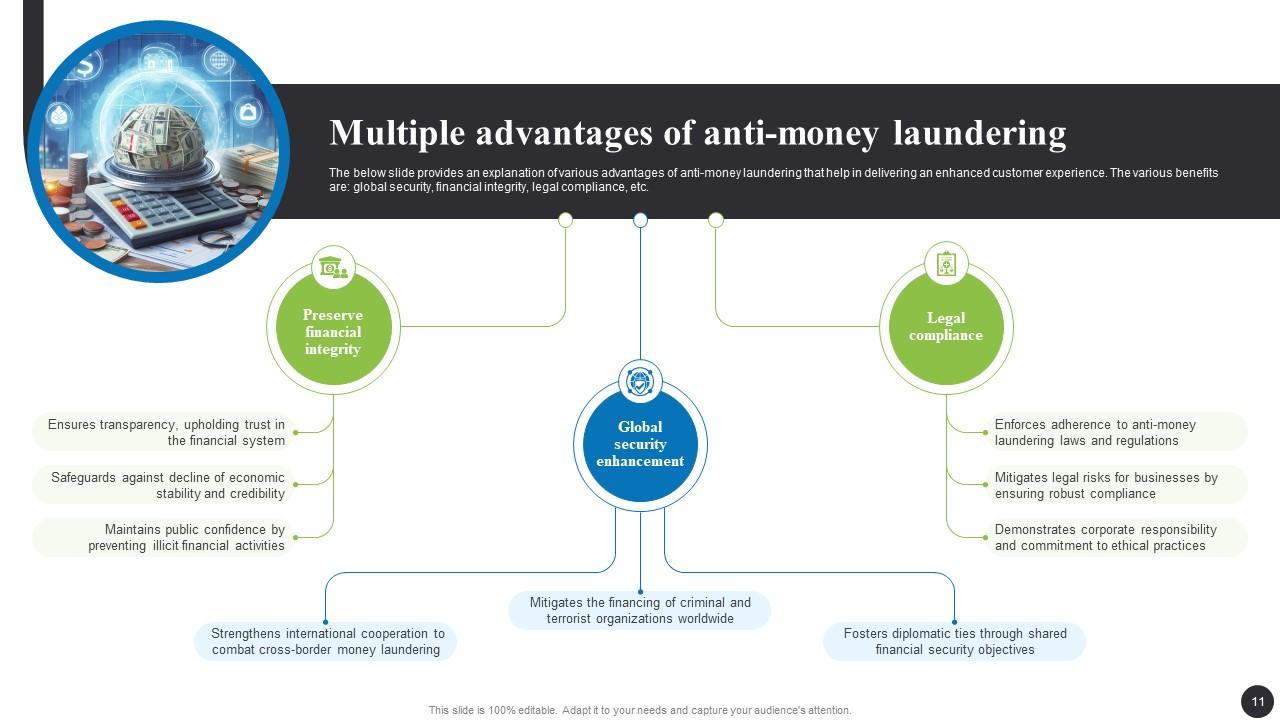

Slide 11: The slide provides an explanation of various advantages of anti-money laundering that help in delivering an enhanced customer experience.

Slide 12: The slide displays an explanation of various advantages of anti-money laundering that help in delivering an enhanced customer experience.

Slide 13: The slide showcases the multiple challenges for anti-money laundering compliance and regulation that hinders the scrutiny process.

Slide 14: This slide illustrates the statistical data for the international market size of AML based on product type and end-users.

Slide 15: The slide renders Title of Contents further.

Slide 16: This slide explains the regulatory framework components of AML systems that provides an understanding of operational tasks and functions.

Slide 17: The slide highlights the working step of AML policy that helps banks and financial institutes combat threats and crimes.

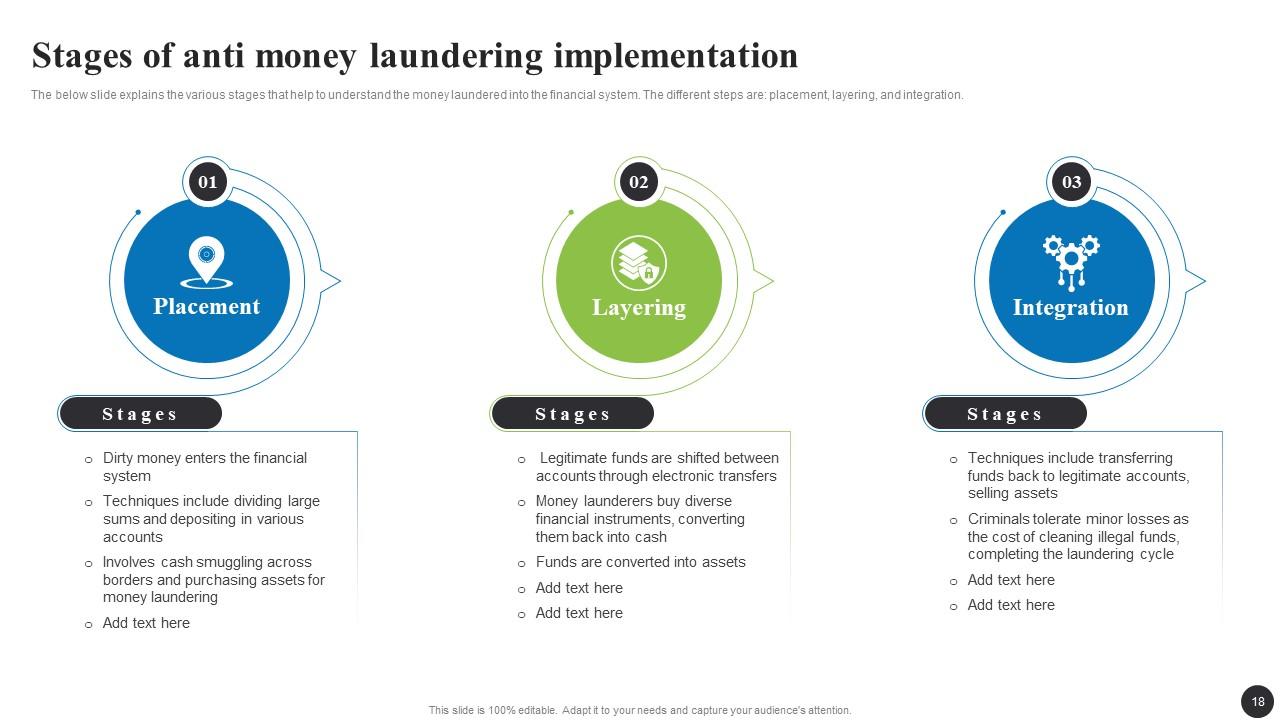

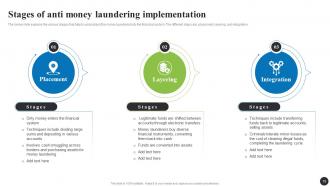

Slide 18: The slide explains the various stages that help to understand the money laundered into the financial system.

Slide 19: This slide provides the operational workflow for the AML system that helps to understand the steps involved in managing the source of funds.

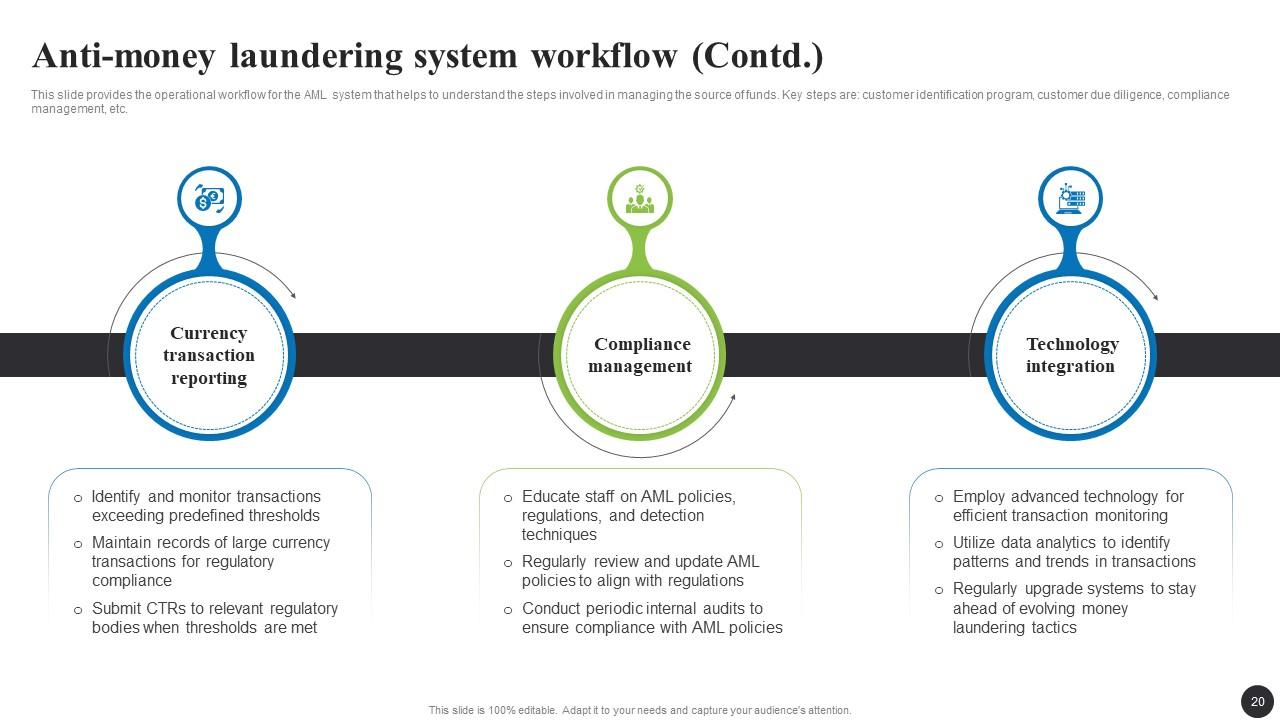

Slide 20: This slide continues the operational workflow for the AML system that helps to understand the steps involved in managing the source of funds.

Slide 21: The slide represents Title of Contents further.

Slide 22: This slide highlights the various components covered under AML international standards that provides an understanding of laws.

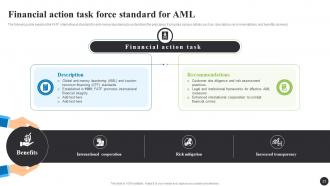

Slide 23: The slide renders the FATF international standard for anti-money laundering to understand the principles.

Slide 24: The slide explains the Basel committee on banking supervision international standard for anti-money laundering.

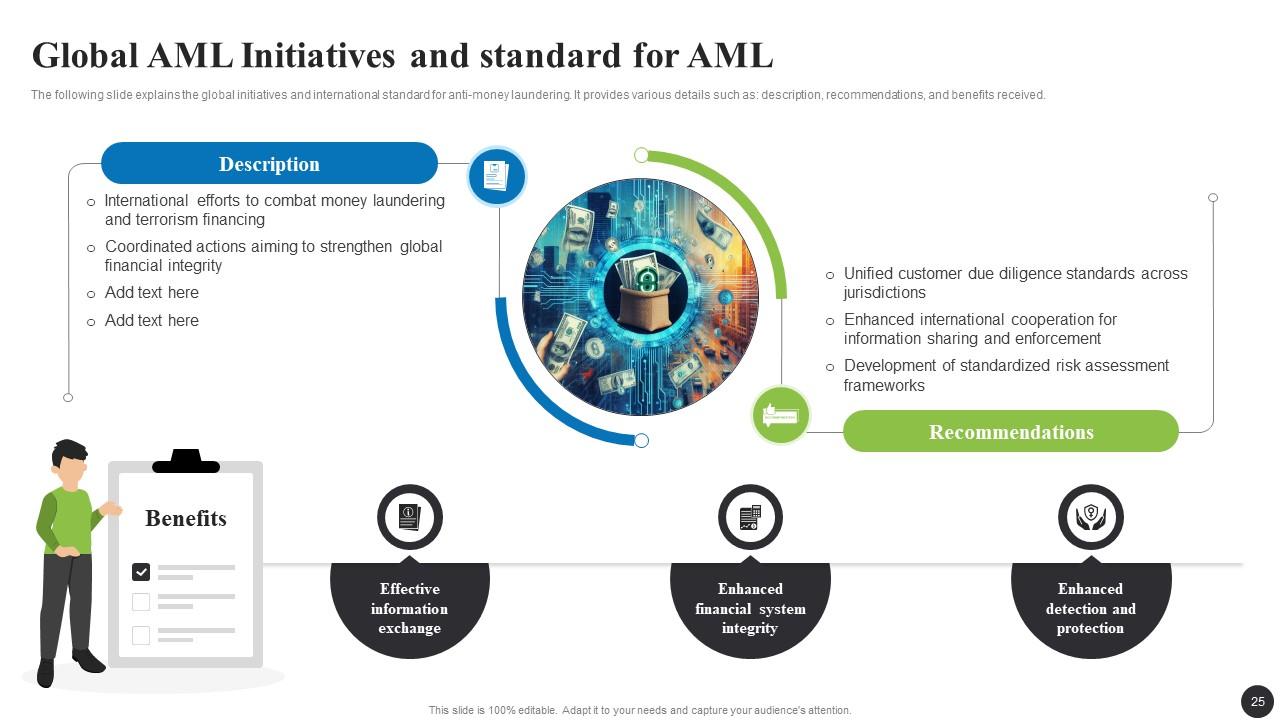

Slide 25: The slide exhibits the global initiatives and international standard for anti-money laundering.

Slide 26: The slide displays Title of Contents further.

Slide 27: The below slide provides the compliance framework for AML policies that explains the regulatory part of implementation.

Slide 28: The slide presents the compliance framework for AML policies that explains the regulatory part of implementation.

Slide 29: The slide highlights the multiple roles and responsibilities of regulatory authorities for effective functioning of operations.

Slide 30: The slide continues the multiple roles and responsibilities of regulatory authorities for effective functioning of operations.

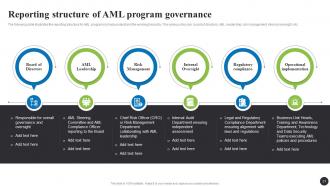

Slide 31: The slide illustrates the reporting structure for AML programs to help understand the working hierarchy.

Slide 32: The slide displays Title of Contents further.

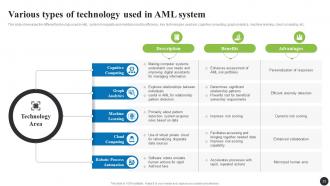

Slide 33: This slide showcases the different technology used in AML system to regulate and maintain scrutiny efficiency.

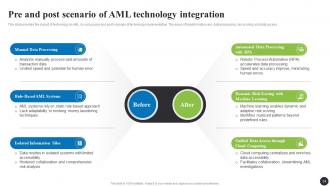

Slide 34: This slide provides the impact of technology on AML by using a pre and post-scenario of technology implementation.

Slide 35: This slide represents the various advantages of technology integration with AML that leads to effective and efficient operations.

Slide 36: The slide presents various challenges faced during AML and technology integration that hinders the operational process.

Slide 37: This slide illustrates the aspects of different software and tools for AML operations that help to detect and operate tasks accordingly.

Slide 38: The slide renders the global market size of AML software that provides an understanding of growth factors and highest revenue share by region.

Slide 39: The slide depicts Title of Contents further.

Slide 40: This slide provides the general explanation and components of AML and cryptocurrency to understand the basic concept of crypto in AML system.

Slide 41: This slide shows the operational strategy of anti-money laundering and crypto in simple steps.

Slide 42: The slide highlights the money laundering risks associated with crypto transactions that hinders the operational process.

Slide 43: The slide presents the cryptocurrency value laundered globally.

Slide 44: This slide highlights the anti-money laundering regulation for crypto transactions for smooth and effective operational process.

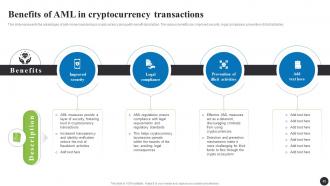

Slide 45: This slide represents the advantages of anti-money laundering in cryptocurrency along with benefit description.

Slide 46: The slide represents Ttitle of Contents which is to be discussed further.

Slide 47: This slide explains the steps involved in banking money laundering that help to understand the workings of money laundered.

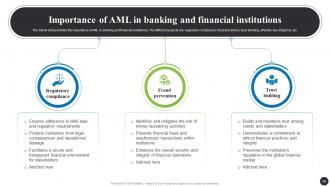

Slide 48: The below slide provides the importance of AML in banking and financial institutions.

Slide 49: The slide again renders the importance of AML in banking and financial institutions.

Slide 50: This slide illustrates the anti-money laundering regulators globally to provide an overview of operations.

Slide 51: The slide explains the working of AML in banking and financial institutions along with a description, working mechanism, and benefits.

Slide 52: This slide showcases the impact of AML compliance in banking and financial institutions.

Slide 53: The slide again highlights Title of Contents.

Slide 54: This slide provides a general overview of AML risk assessment to understand the working process, types, and business benefits.

Slide 55: The slide shows the multiple risk indicators for money laundering through which a business can conduct a strategic assessment.

Slide 56: This slide provides the risk assessment process for AML with the steps involved for effective management.

Slide 57: This slide continues the risk assessment process for AML with the steps involved for effective management.

Slide 58: The slide highlights the major challenges of the AML risk management program that hinder effective management.

Slide 59: The slide highlights the major challenges of the AML risk management program that hinder effective management.

Slide 60: The slide displays Title of Contents further.

Slide 61: This slide highlights the various emerging trends of AML that organizations can identify and implement according to requirement.

Slide 62: This slide continues the various emerging trends of AML that organizations can identify and implement according to requirement.

Slide 63: This slide provides the technological trends for AML that enhances the scrutiny and management process.

Slide 64: The slide illustrates the global market size of AML which helps to understand the opportunities and rising potential of online payments.

Slide 65: The slide presents the various growth factors that leads to the rise in AML adoption in business operations.

Slide 66: This slide illustrates the future market opportunities for AML adoption along with market description.

Slide 67: The slide depicts Title of Contents further.

Slide 68: The slide provides the financial institution compliance case study that helps to understand the various challenges and solutions of AML implementation.

Slide 69: The slide continues the financial institution compliance case study that helps to understand the various challenges and solutions of AML implementation.

Slide 70: The slide again highlights the financial institution compliance case study that helps to understand the challenges and solutions of AML implementation.

Slide 71: This slide shows all the icons included in the presentation.

Slide 72: This slide is titled as Additional Slides for moving forward.

Slide 73: This is an Idea Generation slide to state a new idea or highlight information, specifications etc.

Slide 74: This is a Timeline slide. Show data related to time intervals here.

Slide 75: This slide shows SWOT describing- Strength, Weakness, Opportunity, and Threat.

Slide 76: This slide presents Roadmap with additional textboxes.

Slide 77: This is a Thank You slide with address, contact numbers and email address.

Navigating The Anti Money Laundering Landscape Fin CD with all 86 slides:

Use our Navigating The Anti Money Laundering Landscape Fin CD to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

They had the topic I was looking for in a readymade presentation…helped me meet my deadline.

-

SlideTeam’s readymade presentations have landed my unique images with my bosses in the past and it continues to reward me.