Everything About Islamic Finance Powerpoint Presentation Slides Fin CD

Discover the comprehensive Everything about Islamic Finance PowerPoint presentation, an indispensable resource for gaining insights into the principles and practices of Islamic Finance. This informative deck provides a detailed overview of the fundamental concepts, principles, and instruments utilized in Islamic Finance. It delves into crucial topics, including the avoidance of interest-based transactions, the emphasis on profit and loss sharing, and the promotion of social and ethical responsibility. The Shariah-compliant module further elucidates the various modes of financing in Islamic Finance, such as Mudarabah, Musharakah, and Murabaha, among others. With its clear and concise explanations, the Islamic Finance Deck caters to finance professionals, entrepreneurs, and anyone interested in expanding their knowledge of this burgeoning field. Enhance your understanding and expertise in Islamic Finance by accessing this invaluable resource today.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

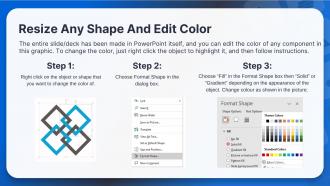

Enthrall your audience with this Everything About Islamic Finance Powerpoint Presentation Slides Fin CD. Increase your presentation threshold by deploying this well-crafted template. It acts as a great communication tool due to its well-researched content. It also contains stylized icons, graphics, visuals etc, which make it an immediate attention-grabber. Comprising one hundred nineteen slides, this complete deck is all you need to get noticed. All the slides and their content can be altered to suit your unique business setting. Not only that, other components and graphics can also be modified to add personal touches to this prefabricated set.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Everything about Islamic Finance. State your company name and begin.

Slide 2: This slide states Agenda of the presentation.

Slide 3: This slide shows Table of Content for the presentation.

Slide 4: This slide highlights title for topics that are to be covered next in the template.

Slide 5: This slide shows Overview of Islamic finance.

Slide 6: This slide presents Historical presence of Islamic finance.

Slide 7: This slide displays Financial prohibitions and permissions in Islamic law.

Slide 8: This slide represents Penalty and compensation in Islamic finance.

Slide 9: This is another slide continuing Penalty and compensation in Islamic finance.

Slide 10: This slide showcases Differences between Islamic and Conventional finance.

Slide 11: This slide shows Investment instruments offered in Islamic finance.

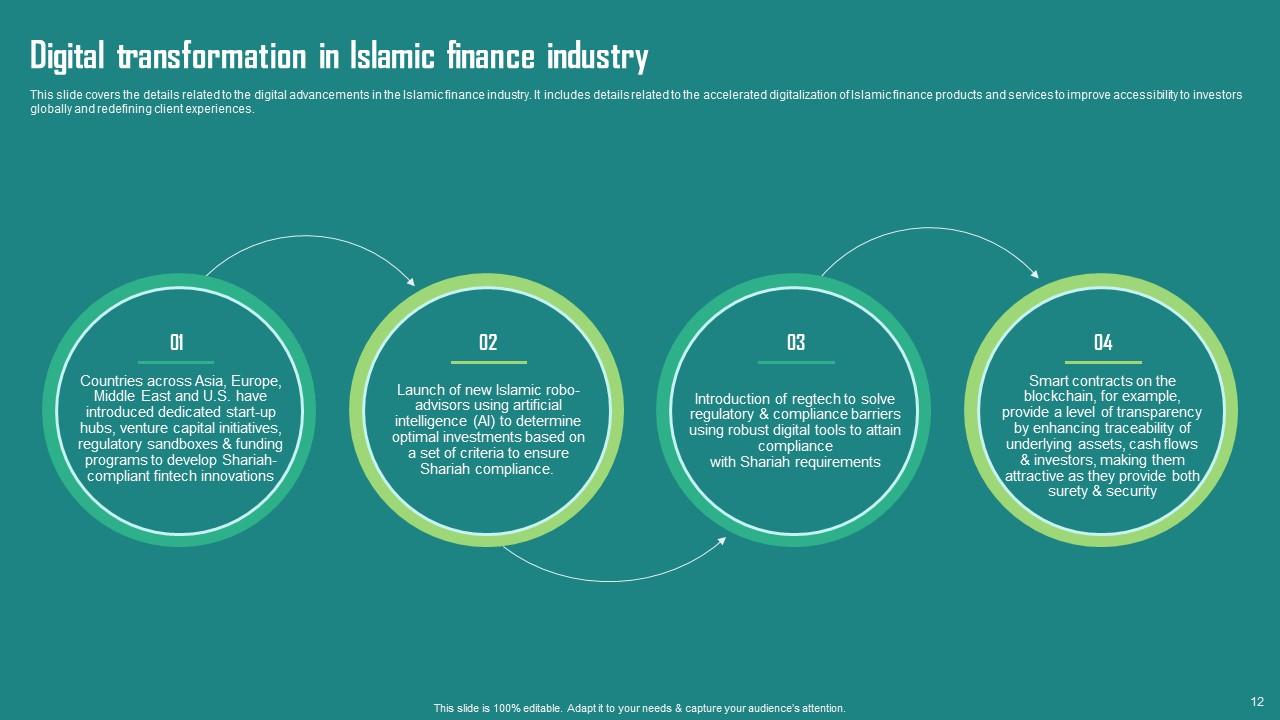

Slide 12: This slide presents Digital transformation in Islamic finance industry.

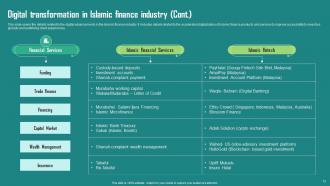

Slide 13: This is another slide continuing Digital transformation in Islamic finance industry.

Slide 14: This slide displays Analysis of global Islamic fintech market.

Slide 15: This slide represents Global Islamic finance industry analysis.

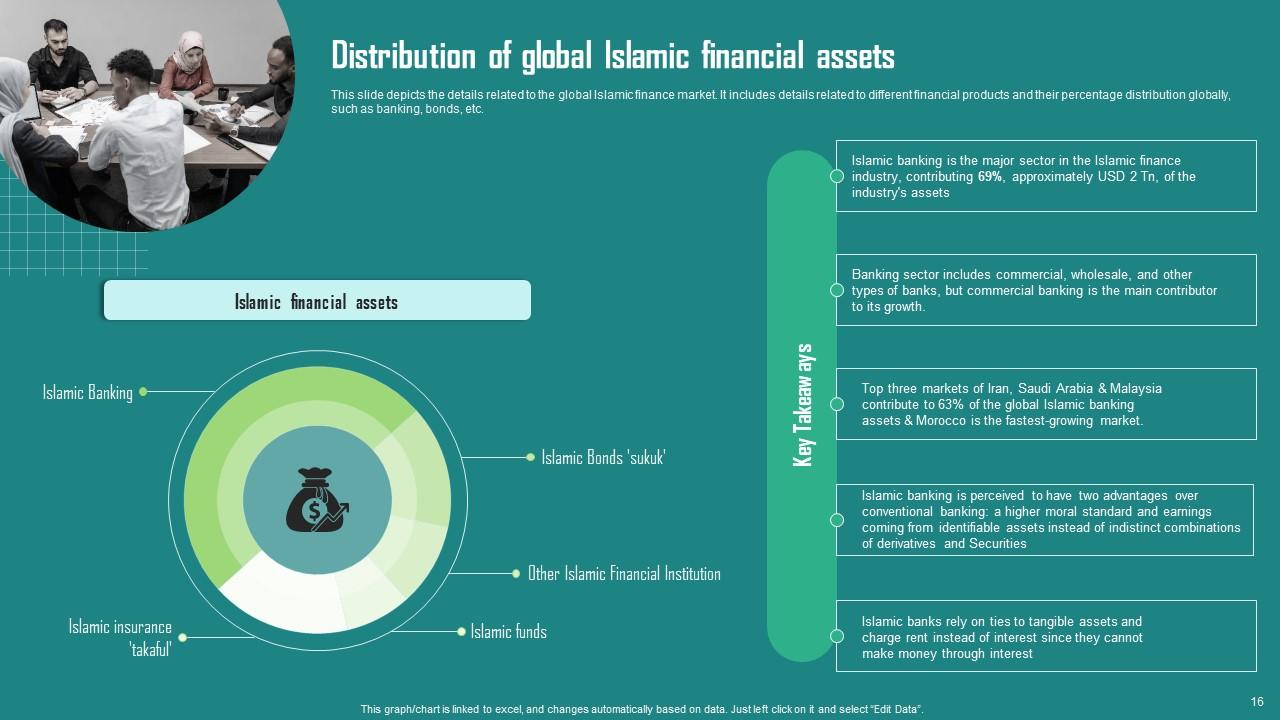

Slide 16: This slide showcases Distribution of global Islamic financial assets.

Slide 17: This is another slide continuing Distribution of global Islamic financial assets.

Slide 18: This slide highlights title for topics that are to be covered next in the template.

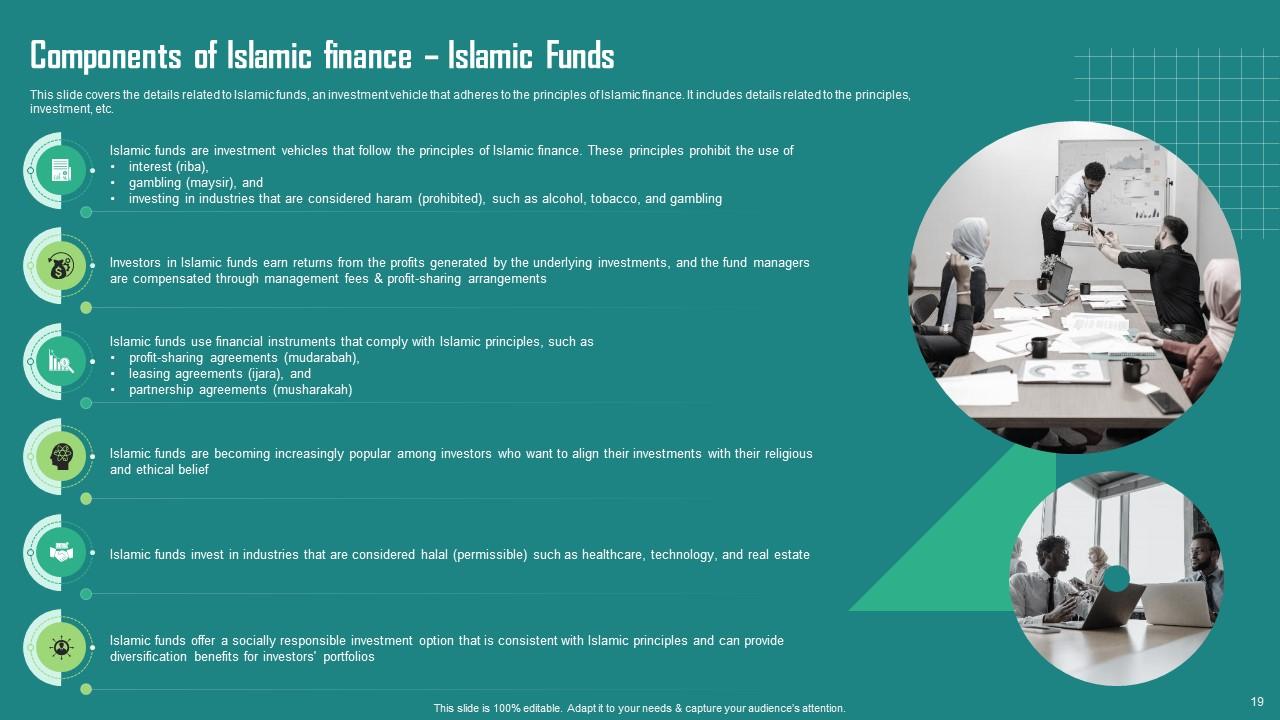

Slide 19: This slide covers the details related to Islamic funds, an investment vehicle that adheres to the principles of Islamic finance.

Slide 20: This slide presents types of Islamic funds used in investment vehicles that adhere to the principles of Islamic finance.

Slide 21: This is another slide continuing Types of Islamic Funds.

Slide 22: This slide displays Components of Islamic finance – Specialized Financial Institutions.

Slide 23: This is another slide continuing Components of Islamic finance – Specialized Financial Institutions.

Slide 24: This slide represents Components of Islamic finance – Islamic Banking.

Slide 25: This is another slide continuing Components of Islamic finance – Islamic Banking.

Slide 26: This slide showcases Overview of Islamic banking.

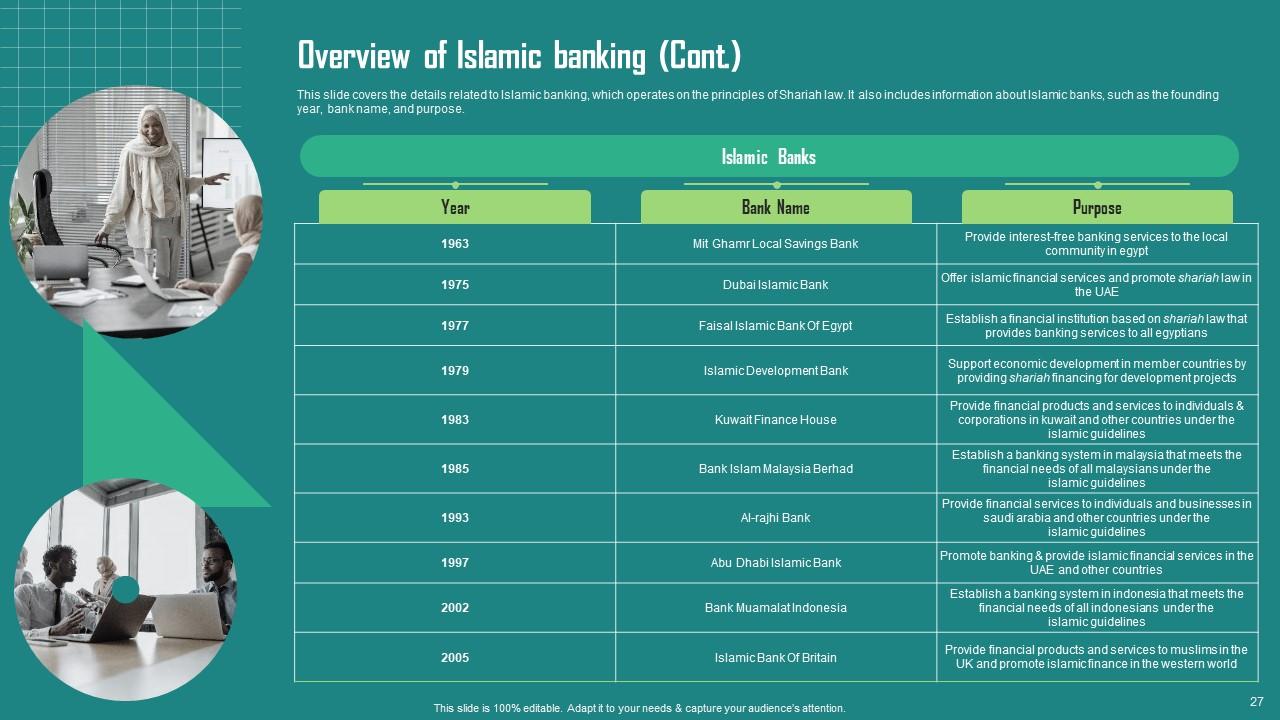

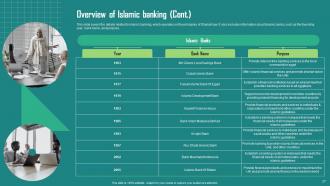

Slide 27: This is another slide continuing Overview of Islamic banking.

Slide 28: This slide shows Types of Islamic banking and finance.

Slide 29: This slide presents Different Islamic banking products and services.

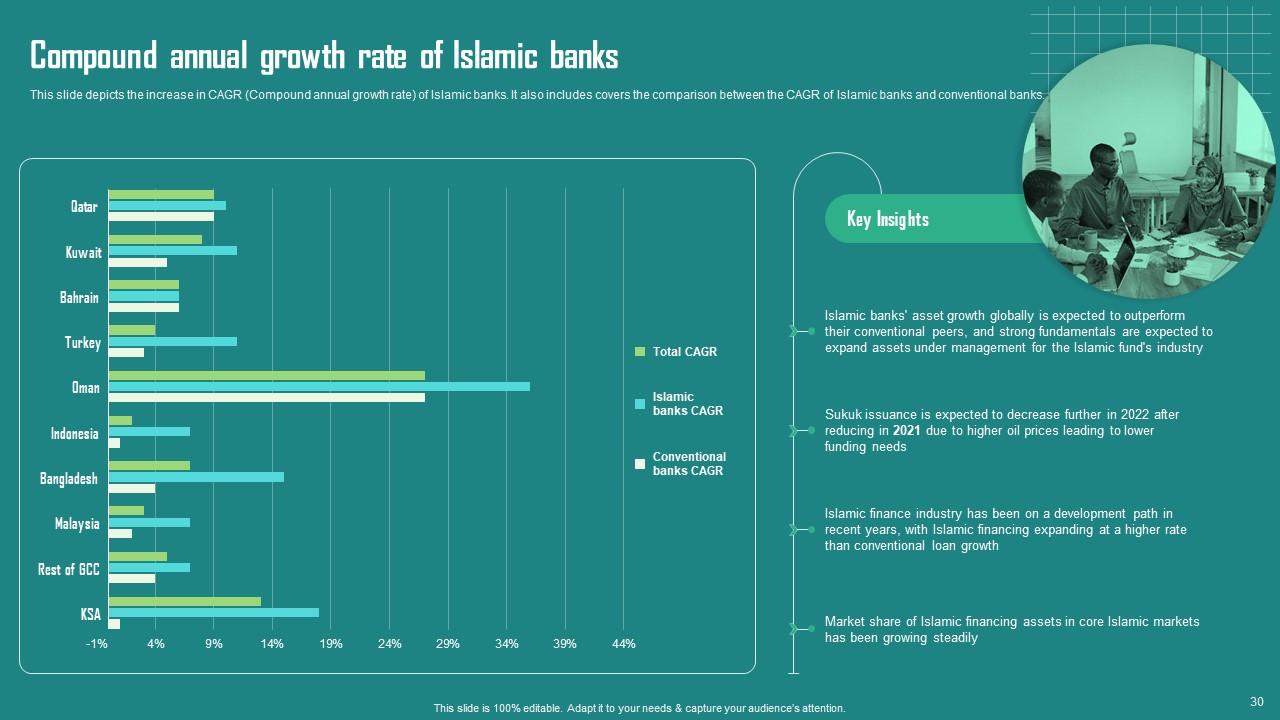

Slide 30: This slide displays Compound annual growth rate of Islamic banks.

Slide 31: This slide represents Components of Islamic finance – Islamic Insurance.

Slide 32: This slide showcases Islamic Insurance- Principles of Takaful.

Slide 33: This slide shows Features of different Takaful model.

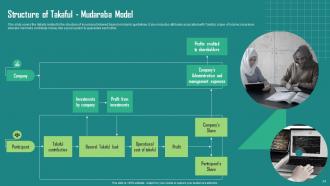

Slide 34: This slide presents Structure of Takaful - Mudaraba Model.

Slide 35: This slide displays Structure of Takaful - Wakala Model.

Slide 36: This is another slide continuing Structure of Takaful - Wakala-Waqf Model.

Slide 37: This slide covers the details related to the Islamic capital market, where investment activities do not contradict the principles of Shariah.

Slide 38: This slide displays Components of Islamic finance – Islamic Capital Markets.

Slide 39: This slide represents Components of Islamic finance – Islamic Money Market.

Slide 40: This slide showcases Components of Islamic finance – Islamic Money Market (Cont.).

Slide 41: This slide shows Table of Content for the presentation.

Slide 42: This slide covers the details related to the Murabaha, a type of Islamic financing transaction that is widely used in the Islamic finance industry.

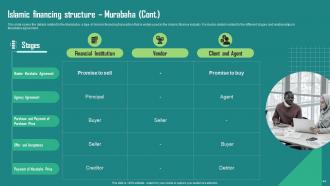

Slide 43: This is another slide continuing Islamic financing structure – Murabaha.

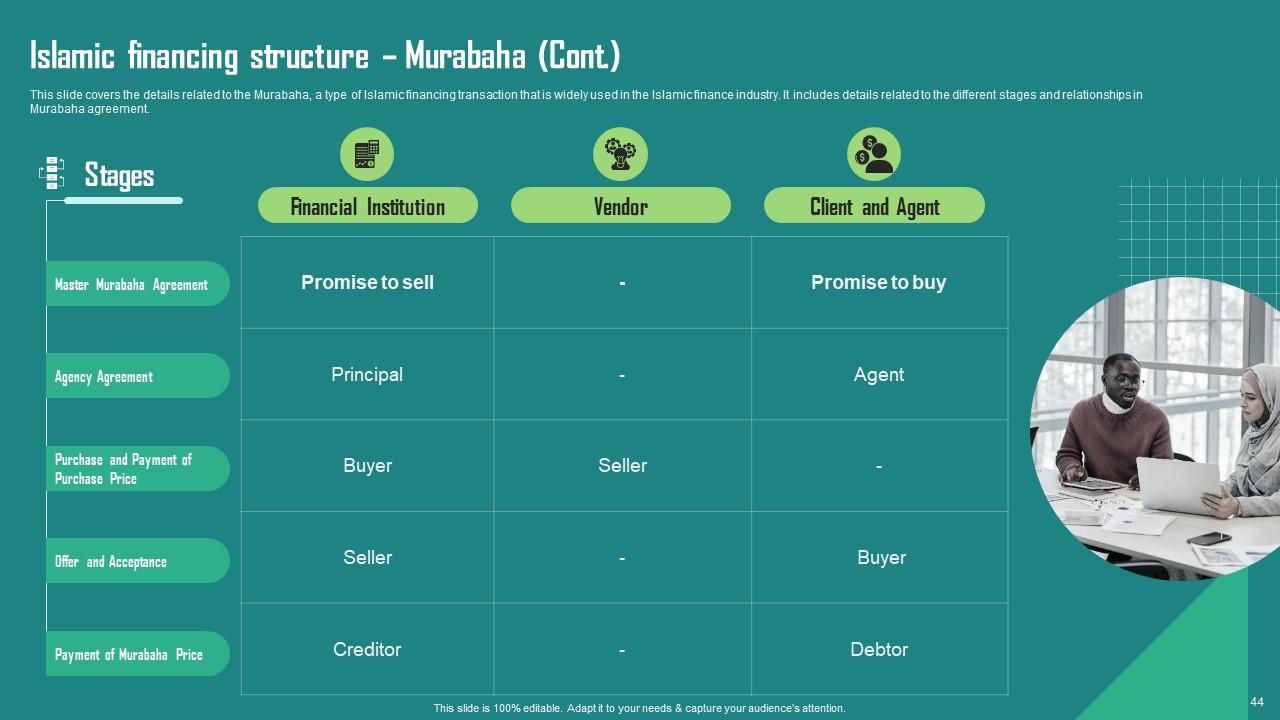

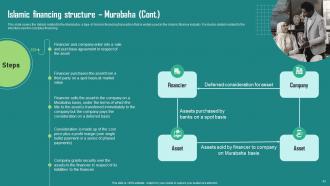

Slide 44: This is another slide continuing Islamic financing structure – Murabaha.

Slide 45: This slide presents Different types of Murabaha.

Slide 46: This slide covers the details related to the commodity murabaha also known as Tawarruq Arrangement a part of Islamic financing transactions.

Slide 47: This slide displays Structure of Commodity Murabaha.

Slide 48: This slide represents Structure of Commodity Murabaha.

Slide 49: This slide showcases Parallel Commodity Murabaha.

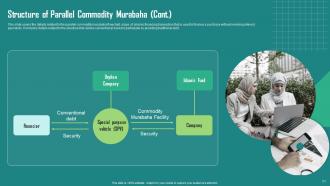

Slide 51: This is another slide continuing Structure of Parallel Commodity Murabaha .

Slide 52: This slide covers the details related to the equity murabaha Islamic financing structure.

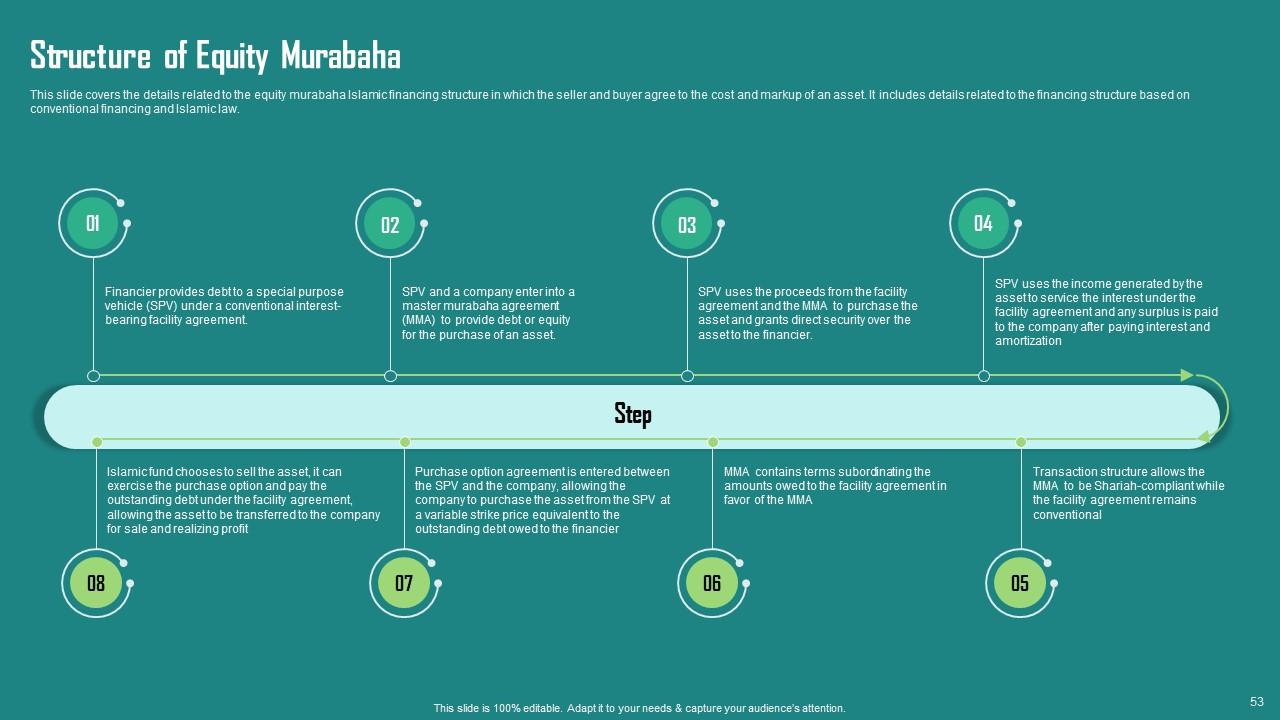

Slide 53: This slide showcases Structure of Equity Murabaha.

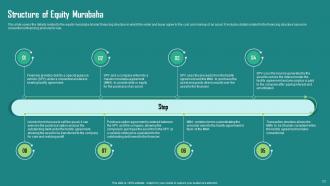

Slide 54: This is another slide continuing Structure of Equity Murabaha.

Slide 55: This slide covers the details related to the ijara lease.

Slide 56: This slide presents Structure of Ijara Lease.

Slide 57: This is another slide continuing Structure of Ijara Lease.

Slide 58: This slide covers the details related to the istisna a sales contract whereby a manufacturer agrees to deliver a made-to-order asset at a pre-determined future time at an agreed price.

Slide 59: This slide covers the details related to the istisna a sales contract whereby a manufacturer agrees to deliver a made-to-order asset.

Slide 60: This slide covers the details related to the istisna a sales contract.

Slide 61: This slide covers the details related to the Islamic derivatives also known as Shariah-compliant derivatives.

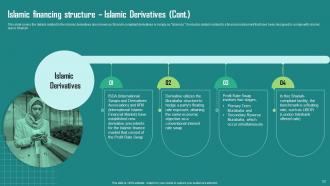

Slide 62: This is another slide continuing Islamic financing structure – Islamic Derivatives.

Slide 63: This slide displays Structure for Islamic Derivatives.

Slide 64: This slide represents Islamic Derivatives - Primary Term Murabaha.

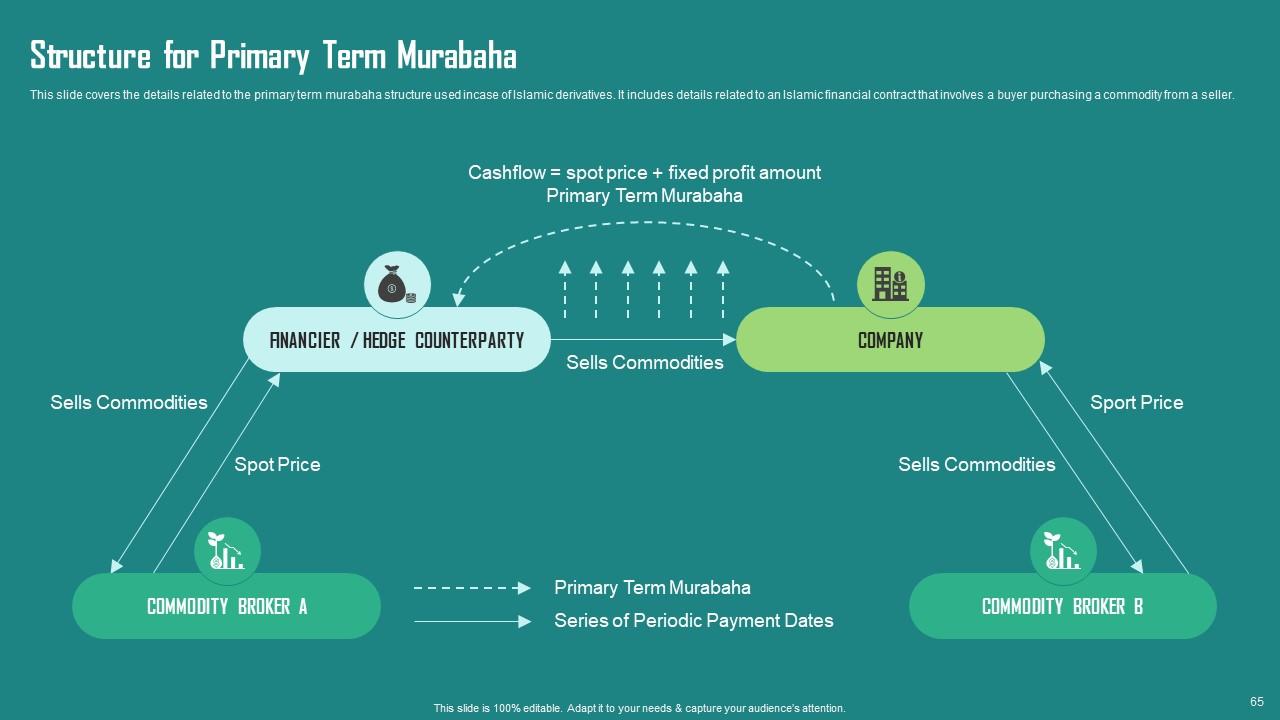

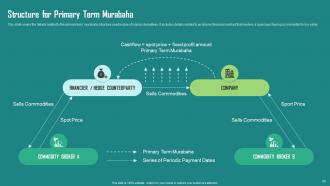

Slide 65: This slide showcases Structure for Primary Term Murabaha.

Slide 66: This slide shows Islamic Derivatives - Secondary Reverse Murabaha.

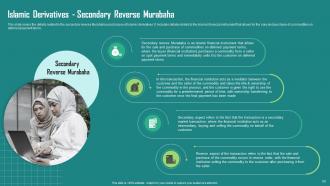

Slide 67: This is another slide continuing Islamic Derivatives - Secondary Reverse Murabaha.

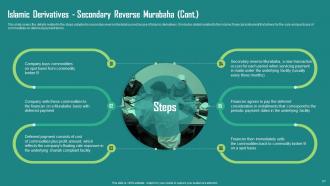

Slide 68: This slide presents Structure for Secondary Reverse Murabaha.

Slide 69: This slide highlights title for topics that are to be covered next in the template.

Slide 70: This slide displays Fixed income investments in Islamic finance.

Slide 71: This is another slide continuing Fixed income investments in Islamic finance.

Slide 72: This is another slide continuing Fixed income investments in Islamic finance.

Slide 73: This slide covers the details related to the sukuk, a Shariah-compliant bond-like instrument used in Islamic finance.

Slide 74: This is another slide continuing Fixed income investments in Islamic finance – Sukuk.

Slide 75: This slide shows Fixed income investments in Islamic finance – Structure of Sukuk.

Slide 76: This slide presents Fixed income investments in Islamic finance – Structure of Sukuk.

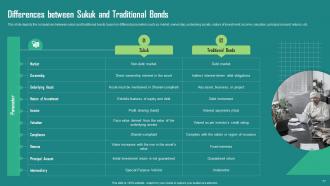

Slide 77: This slide displays Differences between Sukuk and Traditional Bonds.

Slide 78: This slide represents Types of Islamic Capital Markets – Sukuk Al Murabaha.

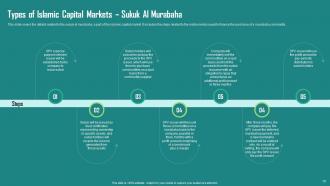

Slide 79: This slide showcases Types of Islamic Capital Markets – Sukuk Al Murabaha.

Slide 80: This slide shows Structure of Sukuk Al Murabaha.

Slide 81: This slide presents Types of Islamic Capital Markets – Sukuk Al Ijara.

Slide 82: This slide displays Structure of Sukuk Al Ijara.

Slide 83: This slide represents Structure of Sukuk Al Ijara.

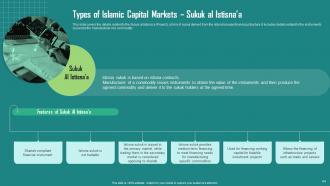

Slide 84: This slide showcases Types of Islamic Capital Markets – Sukuk al Istisna’a.

Slide 85: This slide covers the details related to the steps followed by Sukuk al Istisna’a (Project) a form of sukuk derived from the istisna'a lease financing structure.

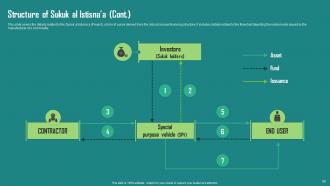

Slide 86: This is another slide continuing Structure of Sukuk al Istisna’a.

Slide 87: This slide shows Types of Islamic Capital Markets – Sukuk al Musharaka.

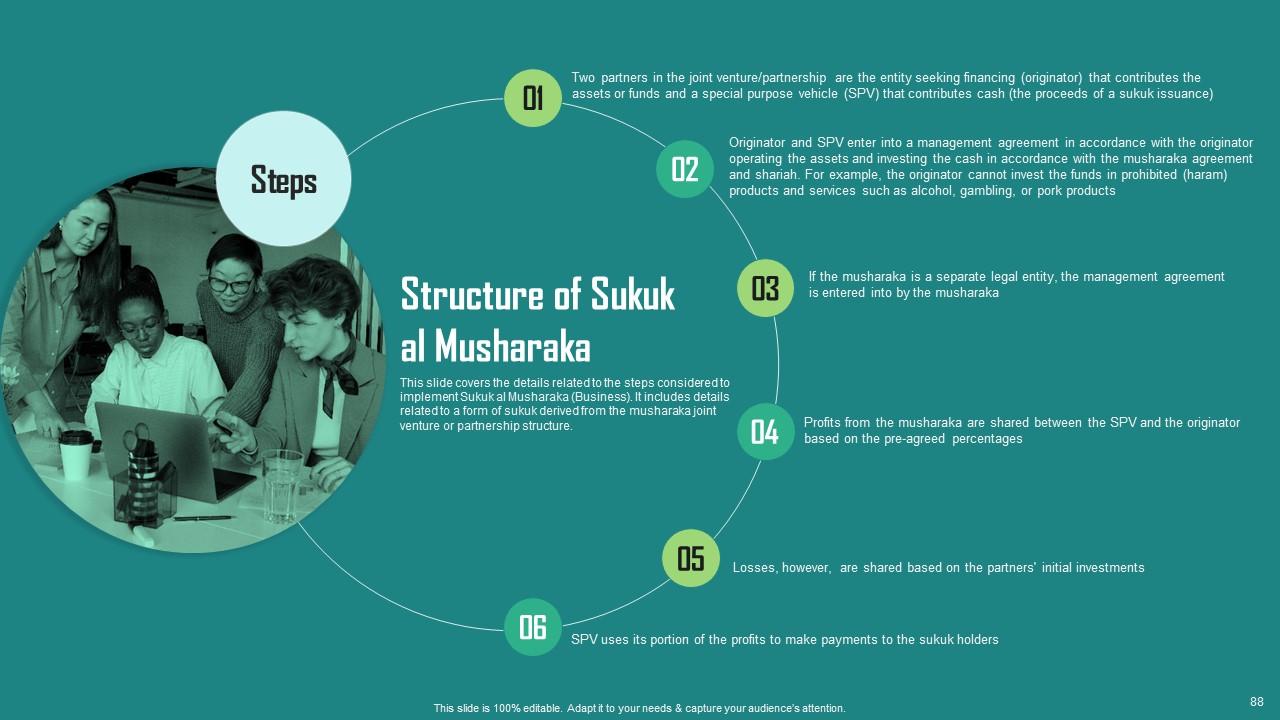

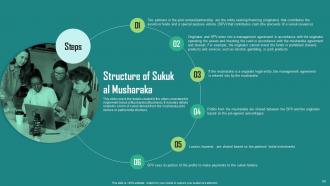

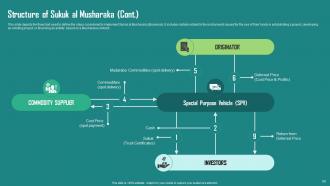

Slide 88: This slide presents Structure of Sukuk al Musharaka.

Slide 89: This is another slide continuing Structure of Sukuk al Musharaka.

Slide 90: This slide displays Types of Islamic Capital Markets – Sukuk al Istithmar.

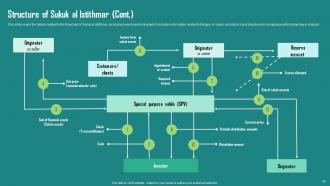

Slide 91: This slide represents Structure of Sukuk al Istithmar.

Slide 92: This is another slide continuing Structure of Sukuk al Istithmar.

Slide 93: This slide highlights title for topics that are to be covered next in the template.

Slide 94: This slide covers the details related to equity-based investments and funds provided based on Islamic law guidelines.

Slide 95: This slide presents Profit and loss sharing – Equity based investments and funds.

Slide 96: This slide displays Differences between Mudarabah and Musharakah.

Slide 97: This slide represents Profit and loss sharing – Structure of Mudarabah.

Slide 98: This slide showcases Profit and loss sharing – Structure of Musharakah.

Slide 99: This slide highlights title for topics that are to be covered next in the template.

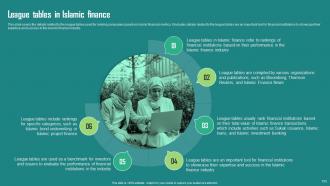

Slide 100: This slide covers the details related to the league tables used for ranking companies based on Islamic financial metrics.

Slide 101: This slide presents League tables in Islamic debt.

Slide 102: This slide displays League tables in Islamic debt - Sukuk & Islamic Financing.

Slide 103: This is another slide continuing League tables in Islamic debt - Sukuk & Islamic Financing.

Slide 104: This slide highlights title for topics that are to be covered next in the template.

Slide 105: This slide represents Challenges and opportunities in Islamic financing.

Slide 106: This slide showcases Standardization and harmonization of Islamic finance practices.

Slide 107: This slide shows Regulatory organizations for Islamic finance.

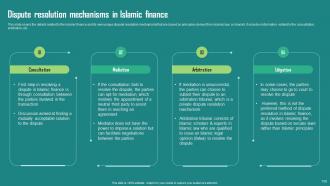

Slide 108: This slide presents Dispute resolution mechanisms in Islamic finance.

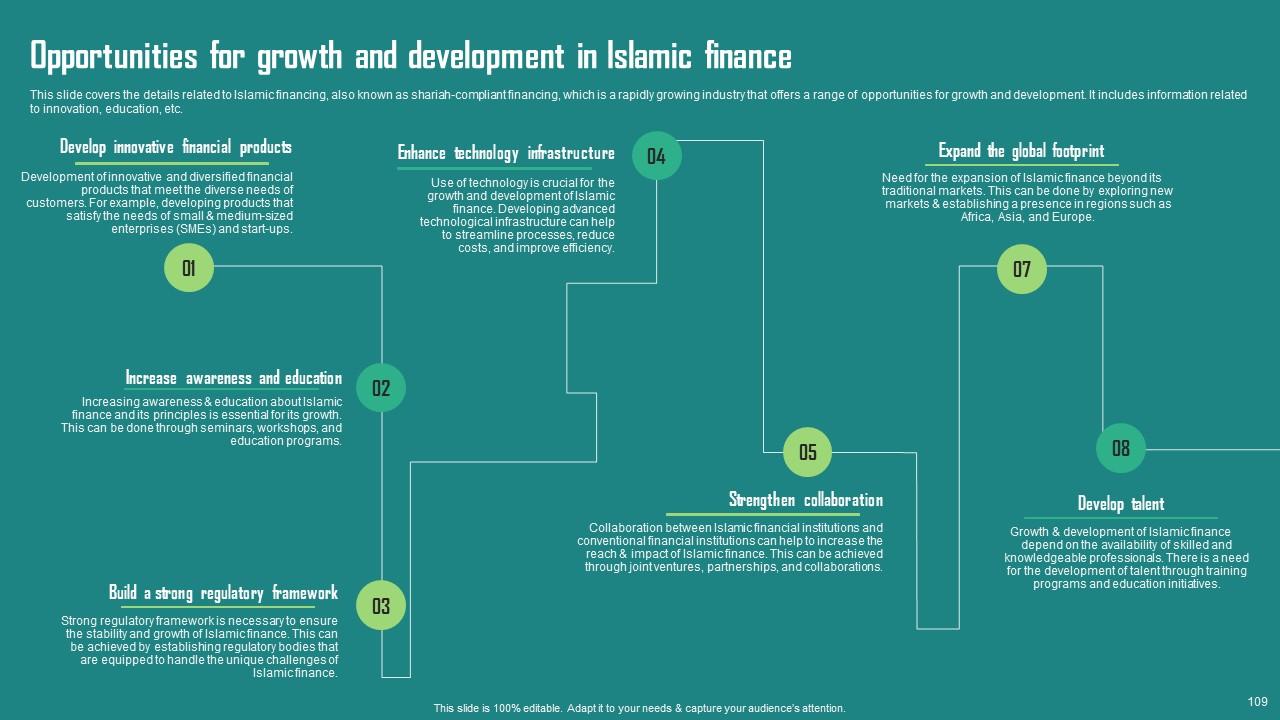

Slide 109: This slide displays Opportunities for growth and development in Islamic finance.

Slide 110: This slide represents Future outlook for Islamic financing.

Slide 111: This is another slide continuing Future outlook for Islamic financing.

Slide 112: This slide contains all the icons used in this presentation.

Slide 113: This slide is titled as Additional Slides for moving forward.

Slide 114: This slide provides Clustered Column chart with two products comparison.

Slide 115: This slide provides 30 60 90 Days Plan with text boxes.

Slide 116: This is an Idea Generation slide to state a new idea or highlight information, specifications etc.

Slide 117: This slide presents Roadmap with additional textboxes.

Slide 118: This slide showcases Magnifying Glass to highlight information, specifications etc

Slide 119: This is a Thank You slide with address, contact numbers and email address.

Everything About Islamic Finance Powerpoint Presentation Slides Fin CD with all 124 slides:

Use our Everything About Islamic Finance Powerpoint Presentation Slides Fin CD to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

FAQs

Islamic Finance refers to the financial services following Shariah Islamic law, principles, and rules. The key principles of Islamic Finance are the prohibition of interest; excessive uncertainty and gambling; risk sharing; the requirement that finance supports actual economic activities; and the adherence to ethical standards.

The general rule of Islam is the permissibility of all that is done by humanity; however, certain undertakings are considered harmful, so they become prohibited. The most known are Riba (interest for money lent), Gharar (excessive uncertainty in contracts), and Maysir/Qimar (Gambling).

Banks are the most prominent players in Islamic Finance — some are exclusively Islamic, while others offer Sharia-compliant products but remain primarily conventional. Key concept of Islamic Finance is risk sharing between parties in all operations. Here are some of the critical Shariah-compliant products offered by banks — Murabaha (cost plus selling), Ijara (leasing), Mudarabah (profit share), Musharakah (joint venture), and Takaful (insurance)

The Islamic finance industry mainly includes banking and the Sukuk or Islamic bond market, which account for 80 percent and 15 percent of total Islamic financial assets, respectively. The balance is accounted for by equities, investment funds, insurance (Takaful), and microfinance. Islamic Finance is growing rapidly in terms of assets and geographical reach, although the assets are concentrated in Southeast Asia and the Middle East, particularly the Gulf Cooperation Countries (GCC).

Islamic banking is a financial system following the principles of Islamic law (Shariah). It prohibits the payment or receipt of interest. Islamic banks use profit-sharing & risk-sharing models to generate returns for their customers. Islamic banking is growing in popularity worldwide, and it is located in more than 75 countries.

-

Excellent template with unique design.

-

I was really impressed with the presentation I created with their templates. I’ll be using their services moving forward.