Financial asset management through mitigating risks and diversifying investment portfolio complete deck

Our Financial Asset Management Through Mitigating Risks And Diversifying Investment Portfolio Complete Deck are topically designed to provide an attractive backdrop to any subject. Use them to look like a presentation pro.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

This complete deck can be used to present to your team. It has PPT slides on various topics highlighting all the core areas of your business needs. This complete deck focuses on Financial Asset Management Through Mitigating Risks And Diversifying Investment Portfolio Complete Deck and has professionally designed templates with suitable visuals and appropriate content. This deck consists of total of thirty four slides. All the slides are completely customizable for your convenience. You can change the colour, text and font size of these templates. You can add or delete the content if needed. Get access to this professionally designed complete presentation by clicking the download button below.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: This slide introduces Financial Asset Management Through Mitigating Risks and Diversifying Investment Portfolio. State Your Company name and start.

Slide 2: This slide displays Content of the presentation.

Slide 3: This slide displays Content of the presentation.

Slide 4: This slide shows Objectives for Asset Management

Slide 5: This slide depicts the purposes for the asset management like reaching financial goals or saving for retirement

Slide 6: This slide displays Content of the presentation.

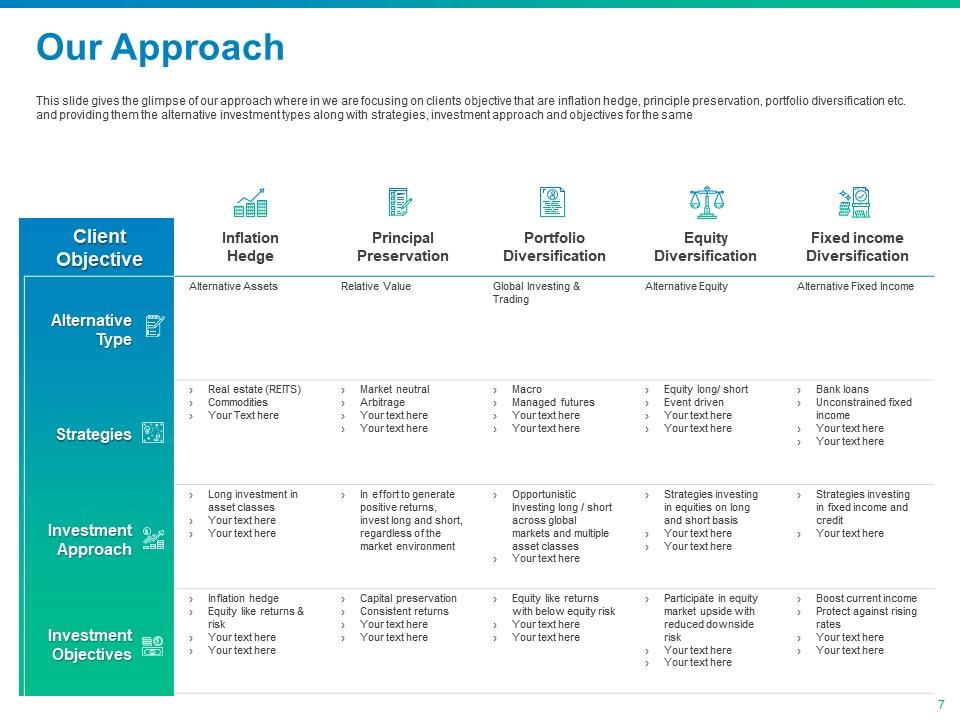

Slide 7: This slide gives the glimpse of our approach where in we are focusing on clients objective that are inflation hedge, principle preservation, portfolio diversification etc. and providing them the alternative investment types along with strategies, investment approach and objectives for the same

Slide 8: This slide lists the characteristics like annualized return, standard deviation, maximum decline, correlation to equities and correlation to fixed income on basis of which strategies are being evaluated. Where S&P 500 is the Index of the share market

Slide 9: This slide displays Content of the presentation.

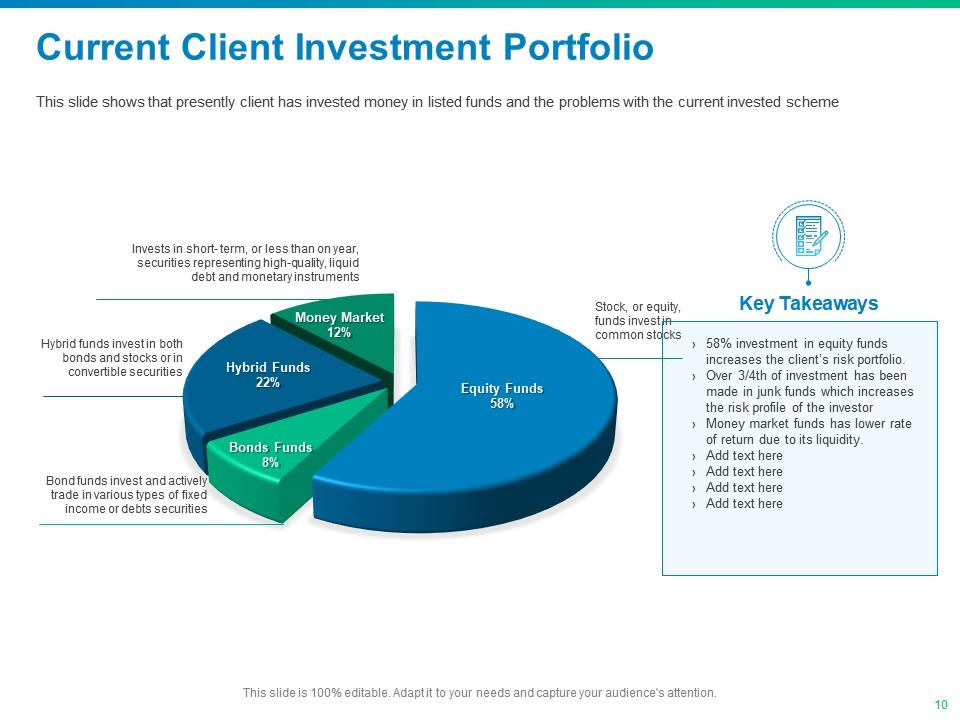

Slide 10: This slide shows that presently client has invested money in listed funds and the problems with the current invested scheme

Slide 11: This slide shows Content of the presentation.

Slide 12: This slide covers snapshot of all the investment options with associated risk, tenure, liquidity and 5 years returns

Slide 13: In this template we are covering the top performing funds with different categories and their estimate returns over 1 to 5 years

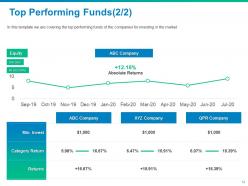

Slide 14: In this template we are covering the top performing funds of the companies for investing in the market

Slide 15: This slide shows the Content of the presentation.

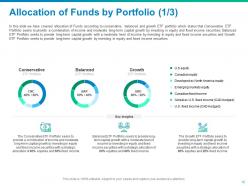

Slide 16: In this slide we have covered allocation of Funds according to conservative, balanced and growth ETF portfolio which states that Conservative ETF Portfolio seeks to provide a combination of income and moderate long-term capital growth by investing in equity and fixed income securities, Balanced ETF Portfolio seeks to provide long-term capital growth with a moderate level of income by investing in equity and fixed income securities and Growth ETF Portfolio seeks to provide long-term capital growth by investing in equity and fixed income securities

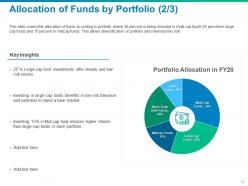

Slide 17: This slide covers the allocation of funds according to portfolio where 30 percent is being invested in multi cap funds 25 percent in large cap funds and 15 percent in midcap funds. This allows diversification of portfolio and minimize the risk

Slide 18: This slide describes Asset allocation strategy on long term performance and short term volatility with annual return percentage.

Slide 19: This slide displays Content.

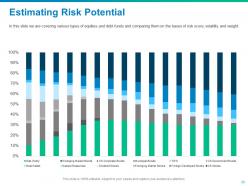

Slide 20: In this slide we are covering various types of equities and debt funds and comparing them on the bases of risk score, volatility and weight

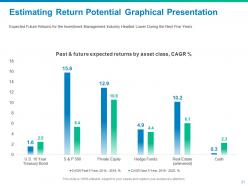

Slide 21: This slide is about Estimating Return Potential Graphical Presentation

Slide 22: This slide shows a period of extremely strong Returns per unit of risk across almost all asset classes

Slide 23: This is Icon Slide for Financial Asset Management.

Slide 24: This slide is titled as Additional Slides for moving forward.

Slide 25: This slide shows that exchange traded funds grew at a 21.7% CAGR and mutual fund growth is beginning to stall, ETF growth continues to expand.

Slide 26: This slide shows Wealth Industry Trends.

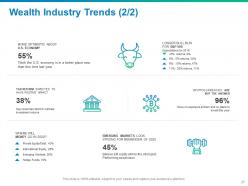

Slide 27: This slide depicts Wealth Industry Trends.

Slide 28: This slide depicts Types of Assets Investment. Here we are covering types of assets in which users can invest like domestic and international equities, fixed income and bonds

Slide 29: This slide displays Types of Assets Investment.

Slide 30: This slide shows Return on Investment.

Slide 31: This slide displays Our Mission, Vision and Goals.

Slide 32: This slide shows Timeline process.

Slide 33: This is Quotes slide to highlight inspirational quotes.

Slide 34: This is Thank you slide with Contact details.

Financial asset management through mitigating risks and diversifying investment portfolio complete deck with all 34 slides:

Use our Financial Asset Management Through Mitigating Risks And Diversifying Investment Portfolio Complete Deck to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Commendable slides with attractive designs. Extremely pleased with the fact that they are easy to modify. Great work!