Economics Of Cryptocurrency Training Module On Blockchain Technology Application Training Ppt

Grab professionally designed content-ready cryptocurrency ppt to have a fast, secure, and transparent peer-to-peer transaction. The economics of cryptocurrency PowerPoint deck covers in-depth topics i.e. block rewards and transaction fees in Bitcoin and Ethereum and utility, operation, examples, and legislation related to cryptocurrency exchanges. It also explains the atomic swap process pros and cons of Bitcoin ATMs along with the advantages, disadvantages, and examples of ICO's Initial Coin Offerings. The PPT training module covers the factors that determine the value of cryptocurrencies supply and demand, node count, cost of production, cryptocurrency exchanges, competition, internal governance, and regulations and legal requirements. It also contains discussion questions and MCQs related to the topic to make the training session interactive. The PowerPoint module also includes additional slides on about us, vision, mission, goal, 30-60-90 days plan, timeline, roadmap, training completion certificate, and energizer activities.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

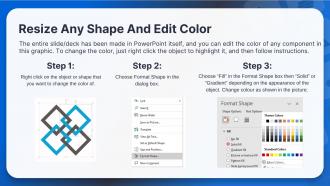

Presenting Training Session on Economics of Cryptocurrency. This presentation deck contains 103 well researched and uniquely designed slides. These slides are 100 percent made in PowerPoint and are compatible with all screen types and monitors. They also support Google Slides. Premium Customer Support available. Suitable for use by managers, employees and organizations. These slides are easily customizable. You can edit the color, text, icon and font size to suit your requirements.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 4

This slide introduces the concept of block rewards. A block reward is a percentage of newly-issued digital tokens given to a user who assists in verifying transactions on the blockchain system. Validators are individuals who validate transactions; however, they can also be referred to as stakers or miners, depending on the Blockchain's consensus mechanism

Slide 5

This slide discusses the importance of block rewards and the logic governing their existence. In order to protect the network and ensure its continued operation, protocols must provide incentives for distributed volunteer users to discover additional blocks. Block rewards serve as major financial incentive for users to join the network.

Slide 6

This slide talks about block rewards of Ethereum and Bitcoin. Ethereum, like bitcoin, uses block rewards to offer incentives to miners. The reward in Ethereum is a digital token known as "ether," which is given to miners who, successfully, provide the mathematical proof of a new block.

Slide 7

This slide discusses the future of bitcoin block rewards. The block reward of bitcoin is expected to hit zero around May 2140; however, mining will most likely cease to be profitable well before that date. Around 99.6% of Bitcoins will have been issued by April 2039, and the block reward will merely be 0.19531250 bitcoin

Slide 9

This slide introduces the concept of transaction fees in cryptocurrency mining. A transaction fee is charged when cryptocurrencies are transferred from one wallet to another. The fee is used to compensate the miners and validators who assist in keeping things running correctly on the blockchain.

Instructor’s Notes:

A user in need of faster payment confirmation can pay more fee to encourage miners to move their transaction to the front of the queue.

Slide 10

This slide discusses the importance of transaction fee in cryptocurrencies. Since their inception, transaction fee has been an integral feature of most blockchain systems. The presence of transaction fee minimizes spam on the network & and large-scale spam attacks are considerably more costly and challenging to implement. It also helps in rewarding users who assist in verifying and validating transactions.

Slide 11

This slide explains the working of bitcoin’s transaction fee. In bitcoin's case, all pending transactions are stored in a memory pool (mempool), awaiting selection by miners and inclusion in the next block. When the mempool is full, miners choose the transactions with the highest fee and save the rest for the next block.

Instructor’s Notes:

When network traffic is heavy and there is a great demand for bitcoin, the transaction price required for quick confirmation rises as other bitcoin users attempt to do the same. This might happen during times of high market volatility.

Slide 12

This slide explains the working of Ethereum’s transaction fee. In comparison to Bitcoin, Ethereum transaction fee function differently. The fee accounts for the amount of computational power required to complete a transaction referred to as gas. Gas has a fluctuating price based on the network's native coin, Ether (ETH).

Instructor’s Notes:

Even as the amount of gas required for a single transaction may not change, gas prices may. The cost of gas is directly proportional to network traffic, and miners are more likely to prioritize your transaction if you pay a greater gas price.

Slide 13

This slide lists the two main factors that determine the size of the transaction fee. These are the size of transaction and demand for block space.

Instructor’s Notes:

- Miners and validators are limited in the number of transactions that they may include since some networks are able to hold only a certain amount of data in each block

- When a large number of users submit crypto funds at the same time, demand for block space rises, and more transactions are put in the awaiting confirmation node

- Demand for block space might spike when networks face congestion, and the fee becomes unsustainable

- Larger transactions take up more block space and take longer to validate than smaller transactions

Slide 15

This slide gives an introduction to cryptocurrency exchanges. A cryptocurrency exchange is a portal where you may buy and sell digital currencies. You can use exchanges to trade one cryptocurrency for another — for example, exchanging Bitcoin for Litecoin — or to purchase cryptocurrency with fiat currency, such as the US dollar.

Instructor’s Notes:

The pricing of cryptocurrencies on exchanges is based on current market prices. You can also use an exchange to convert cryptocurrencies back into US dollars or other currencies.

Slide 16

This slide gives an overview of utility of cryptocurrency exchanges. Cryptocurrency can be sent from exchanges to a user's own cryptocurrency wallet. Some people can turn their digital currency balances into anonymous prepaid cards that can be used to withdraw money from ATMs worldwide.

Slide 17

This slide gives an overview of the operation of cryptocurrency exchanges. The process begins with converting fiat currency to cryptocurrency on an exchange, which is followed by cryptocurrency trading and then finally using a wallet for storing the cryptocurrency.

Slide 18

This slide lists a few examples of cryptocurrency exchanges. Binance, Coinbase, and Gemini are the top three cryptocurrency exchanges globally.

Instructor’s Notes:

- Binance: Binance is the world's largest cryptocurrency exchange in daily cryptocurrency trading volume. It was established in 2017 and is based in the Cayman Islands

- Coinbase: Coinbase was formed in 2012 to make it easy for anyone to purchase, sell, and store Bitcoin. Today, Coinbase is a publicly-traded cryptocurrency exchange with over $36 billion in market capitalization

- Gemini: Gemini, founded in 2014, has differentiated itself due to its significant focus on security and compliance. The New York-based exchange provides hot wallet insurance to ensure that user funds are protected in the event of a security breach

Slide 19

This slide highlights the legislative aspect of trading cryptocurrencies on exchanges. Several cryptocurrency exchanges in the European Union had received licenses under the EU Payment Services Directive and the EU Electronic Money Directive by 2016

Instructor’s Notes:

The Commodity Futures Trading Commission has recently approved the public trading of cryptocurrency derivatives

Slide 20

This slide lists some factors that must be considered while choosimg a cryptocurrency exchange to trade on. These factors are accessibility, security, liquidity, coins offered, fees, storage, educational tools, and tax information.

Slide 21

This slide talks about accessibility as a key factor in determining a suitable cryptocurrency exchange for trading. Your state or national rules may prevent you from buying or selling cryptocurrency on specific exchanges depending on your region. Some countries, like China, have prohibited individuals from using cryptocurrency exchanges.

Instructor’s Notes:

It is critical to obtain information on an exchange's geographic constraints as well as related accessibility variables, such as national currencies accepted, on its website or in its terms of service.

Slide 22

This slide talks about security as a key factor in determining a suitable cryptocurrency exchange for trading. Certain exchanges have insurance policies to protect users' digital currencies against hacking or fraud.

Slide 23

This slide talks about liquidity as a key factor in determining a suitable cryptocurrency exchange for trading. If you wish to purchase, sell, or trade cryptocurrency, the exchange you choose should have enough trade volume to keep your assets liquid, which means you can sell these whenever you want

Slide 24

This slide talks about coins offered as a key factor in determining a suitable cryptocurrency exchange for trading. Not all cryptocurrencies are listed on every exchange. Newer altcoins, currencies with a modest market size, and meme coins may necessitate a little more for you to zero in on their exchange.

Slide 25

This slide talks about fees as a key factor in determining a suitable cryptocurrency exchange for trading. Trading fees may be fixed, but they are frequently calculated as a percentage of your trade—some exchangers, such as Cash App levy variable fees based on price fluctuations.

Instructor’s Notes:

Before handing over your money, be sure you understand how and when an exchange will charge you for your crypto transactions.

Slide 26

This slide talks about storage as a key factor in determining a suitable cryptocurrency exchange for trading. Among cryptocurrency enthusiasts, storage can be a divisive topic. Many people argue that the owner should keep their crypto holdings instead of putting the public and private keys, linked with their crypto holdings, under the custody of exchange

Instructor’s Notes:

You may decide to retain your crypto in your own wallet later, once you've learned more about storage choices and expanded your holdings.

Slide 27

This slide talks about educational tools as a key factor in determining a suitable cryptocurrency exchange for trading. When it comes to choosing an exchange for crypto beginners, the ability to learn more about different coins, digital assets, and blockchain technology is a top consideration.

Slide 28

This slide talks about tax information as a key factor in determining a suitable cryptocurrency exchange for trading. Crypto traders must record all cryptocurrency trades to help you in filing capital gains tax and comply with relevant taxation laws.

Slide 30

This slide introduces the concept of atomic swaps. An atomic swap is known as an exchange of cryptocurrencies between two separate blockchains. The two parties conduct the transfer without the involvement of a third entity.

Instructor’s Notes:

Smart contracts are used in the majority of atomic swap wallets and blockchains. A smart contract in the trade prevents one party from usurping or staking fraudulent claims on coins of the other.

Slide 31

This slide depicts the journey of an atomic swap and how it came into being. The idea gained currency immediately after altcoins became popular. With the introduction of altcoins, some cryptocurrency owners got interested in transferring funds. An atomic exchange between Decred and Litecoin was the first example of this type of token swap in September 2017.

Instructor’s Notes:

Lightning Labs, a company that utilizes Bitcoin's lightning network for transactions, has used the technology to conduct off-chain swaps.

Special cryptocurrency wallets have also been built to conduct cross-chain atomic swaps, such as Liquality's wallet, which can swap Bitcoin, Ethereum, and other cryptocurrencies.

Slide 32

This slide shows the working of an atomic swap by taking an example of two parties named Jack and Jill. Jack has bitcoins while Jill has litecoins that they want to exchange through an atomic swap.

Instructor’s Notes:

- Jack creates a contract, and when he deposits bitcoins into that contract, a hash is generated

- This hash function does the work of a safe lock. Jack also creates a value in a data string that will be used as a key to open the safe and retrieve the funds. He then sends it to Jill so that he can complete his part of the contract transaction

- Jill does the same steps as Jack and deposits his litecoins in the contract address using the same hash. Both funds are tied to the same key in this fashion.

- The key used by Jack to receive Jill's litecoins from his address is disclosed, allowing Jill to retrieve bitcoins from Jack's address

Slide 33

This slide discusses the importance of atomic swaps. Since atomic swaps eliminate the need for intermediaries like crypto exchanges, it is seen as a fundamental blockchain mechanism. Traders can now execute cross-chain trades without relying on centralized trading platforms' infrastructures.

Slide 35

This slide gives an introduction to Bitcoin ATMs. Robocoin founder Jordan Kelly opened the first bitcoin ATM in the US in 2014. The kiosk, which opened in Austin, Texas, looks like a bank ATM but contains scanners that read government-issued documentation like a driver's license or passport to verify users' identities.

Slide 36

This slide gives an overview of a Bitcoin ATM. Bitcoin ATMs are self-service kiosks where anyone can buy Bitcoin and other cryptocurrencies using cash or a debit card.

Instructor’s Notes:

Bitcoin cash kiosks resemble typical ATMs, except instead of connecting to a bank account, they link the customer directly to a bitcoin wallet or exchange.

Slide 38

This slide depicts the two types of Bitcoin ATMs. These are Unidirectional machines and Bi-directional machines.

Instructor’s Notes:

- Unidirectional Machines: Machines that support either the purchasing or selling of cryptocurrencies in a one-way transaction

- Bi-directional Machines: Both purchasing and selling of cryptocurrencies are supported through two-way machines

Slide 39

This slide highlights the advantages and disadvantages of Bitcoin Teller Machines or BTMs. The advantages include an easy and quick way to trade bitcoin, no requirement of bank cards, etc. The disadvantages are that the transaction fee is high, presence of a withdrawal limit, etc.

Slide 40

This slide shows the number of Bitcoin ATMs in the world. With close to 25,000 BTMs, North America has most of the Bitcoin ATMs present in the world; Europe and Asia follow in this order.

Slide 41

This slide talks about the compliance requirements that Bitcoin ATMs have to follow. Bitcoin ATM operators must change deposit and withdrawal limitations per AML/KYC regulations in the country where their machines are located. In some countries/states, this necessitates the acquisition of a money transmitter license.

Instructor’s Notes:

The Financial Crimes Enforcement Network regulates Bitcoin ATMs, which must be registered as Money Service Businesses.

Slide 42

This slide gives an introduction to an Initial Coin Offering (ICO). The cryptocurrency industry's equivalent of an IPO is an Initial Coin Offering (ICO). A firm can use an ICO to acquire funding to develop a new coin, app, or service

Slide 43

This slide discusses the types of ICO structures. When a cryptocurrency startup seeks to raise funds through an ICO, the first step is to determine how the project will be structured. These structures are static supply & static price, static supply & dynamic price, and dynamic supply & static price.

Instructor’s Notes:

- Static supply & static price: A company can establish a specified financial goal or limit, which means that the price of each token sold in the ICO is predetermined, and the total token supply is fixed

- Static supply & dynamic price: An ICO can have a fixed supply of tokens and a dynamic financing goal, which means that the overall price per token is determined by the amount of money raised in the ICO

- Dynamic supply & dynamic price: Sometimes ICOs have a dynamic token supply but a fixed price, which means that the supply is determined by the money to be raised

Slide 44

This slide showcases the step-by-step process of how an ICO works. The first step involves the identification of investment targets, followed by creation of tokens, promotion campaigns, and finally the initial offering.

Instructor’s Notes:

- Identification of Investment Targets: Each ICO begins with a company's desire to raise funds. The company decides the fundraising campaign's target audience and prepares the required material for potential investors to learn more about the company

- Creation of Tokens: The generation of tokens is the next step in ICO. In other words, the tokens are blockchain representations of an asset or utility, and are tradeable and fungible

- Promotion Campaign: A corporation will typically undertake a promotion campaign at the same time to attract possible investors. It's worth noting that most campaigns are run online to reach as many investors as possible. ICO advertising is now prohibited on significant web platforms, including Facebook and Google

- Initial Offering: The tokens are then offered to investors. It is possible that the offering may be divided into numerous rounds. The company can then use the ICO money to create a new product or service. At the same time, investors may use the tokens they bought to benefit from this product or service or wait for the tokens' value to increase

Slide 45

This slide discusses prerequisites for launching an ICO. Anyone with access to technology can launch an ICO. Since ICOs are currently unregulated in the United States, anyone with access to the necessary technology is allowed to float a new cryptocurrency.

Slide 46

This slide depicts the difference between an Initial Coin Offering and an Initial Public Offering based on parameters such as regulatory framework, track record, investors, duration of offering, and utility.

Slide 47

This slide showcases the procedure of participating in an ICO. The first step is registering with a cryptocurrency exchange, followed by exchanging fiat currency for cryptocurrency, setting up your wallet, transferring cryptocurrency to your wallet, buying ICO tokens, and finally securing your tokens.

Instructor’s Notes:

- Register with a crypto exchange: Cryptocurrencies, such as Ether or Bitcoin, are required to participate in an ICO. Fiat currency cannot be used to participate in an ICO, and online exchanges are the most convenient way to buy Bitcoin

- Exchange fiat currency for cryptocurrency: You can swap EUR, USD, and other currencies for the cryptocurrency you wish to buy once you've created an account with an exchange

- Setup your wallet: The Ethereum network hosts the majority of today's token sales. As a result, you'll need an Ethereum wallet to participate in the token sale. Not all wallets are appropriate for ICOs, and MetaMask and MyEtherWallet are the most user-friendly and generally approved Ethereum wallets

- Transfer cryptocurrency from exchange to your wallet: Your cryptocurrencies will be transferred to an online wallet the exchange you registered with for token sale participation will provide. Move your funds to a wallet that is under your control

- Buy ICO tokens: When the token sale begins, you must pay ETH to the company's designated address. You'll need to set an appropriate gas limit, which the MetaMask interface will govern

- Secure your tokens: Make sure to move your tokens from your MetaMask – or MyEtherWallet, or Parity – address to a safer wallet after you receive your tokens. You'll need some additional ETH (a little amount) in your wallet to cover the fees of transmitting money from one wallet to another

Slide 48

This slide lists the types of ICO scams such as bounty scam, exit/rug pull scam, white paper plagiarism scam, exchange scam, URL scam, and ponzi scheme.

Slide 49

This slide talks about bounty scam as a type of ICO scam. In this very often scam, the ICO fails to pay out promoters who were promised monetary benefits for their public relations efforts.

Slide 50

This slide talks about exit/rug pull scam as a type of ICO scam. An exit scam is a fraudulent activity perpetrated by unethical cryptocurrency promoters who collect funds for an ICO and then vanish without providing investors with any information.

Slide 51

This slide talks about white paper plagiarism as a type of ICO scam. In a white paper plagiarism scam, a scammer attempts to copy a prospective ICO's white paper and launch it under a similar or different name.

Slide 52

This slide talks about exchange scam as a type of ICO scam. An "exchange scam" occurs when scamsters intend to deceive investors into believing that their ICO has been launched on an authentic exchange, whereas it is fake.

Slide 53

This slide talks about URL scam as a type of ICO scam. Another common technique is to create fraudulent ICO websites and advise consumers to deposit money into a compromised wallet. Due to such phony websites, naive investors, ignorant of legitimate websites are misled and lose their ICOs.

Slide 54

This slide talks about the ponzi scheme as a type of ICO scam. Scamsters lure new investors to invest funds in high-return possibilities, claiming that there is little or no risk. Such fraudsters offer unrealistic returns and at a later time to entice more investors.

Slide 55

This slide talks about the advantages of Initial Coin Offering. These include online accessibility, high liquidity, high return on investment, and less paperwork.

Instructor’s Notes:

- Online accessibility: A significant benefit of an ICO is that all transactions are completed online, and everything can be easily researched and traced via the internet

- High liquidity: The quality of an item to be promptly bought or sold in the market without significantly influencing its value is referred to as high liquidity. Crypto coins are comparatively more liquid than other assets and can move faster because they are safe and do not require a physical form to be swapped

- High return on investment: Most successful ICOs began with a low market value and progressively gained more value. What makes these ICOs so successful is that they were able to offer investors something different and exciting that other ICOs couldn't

- Negligible paperwork: Traditional assets like Initial Public Offerings (IPOs), stocks, bonds, and other exchange forms rely on different regulatory filings, taking up a lot of time and effort. ICOs rely on blockchain technology to keep a ledger of their transactions, making them more attractive than IPOs and other traditional assets

Slide 56

This slide talks about the disadvantages of an Initial Coin Offering. These include volatility, lack of accountability, and potential fraud.

Instructor’s Notes:

- Volatility: Blockchain in a dynamic technology and evolves dramatically. This means that the value of the asset fluctuates very fast

- Lack accountability: Many ICOs are the result of start-up enterprises and other private entities lacking the capital to launch their potential ideas. While investors can anticipate significant investment returns, there is no guarantee that the companies in question will be able to deliver on their promises

- Potential fraud: Many ICOs are not regulated in the same way that IPOs and other traditional assets are. This makes them easier to get and more accessible, but it also makes them more open to fraud and other nefarious acts. All of this means that unlawful players may defraud unsuspecting investors

Slide 57

This slide highlights successful ICOs. The ICO of Ethereum in 2014 was an early and now a well-known example of an Initial Coin Offering. Over a period of 42 days, the Ethereum ICO raised $18 million. A two-phase ICO was launched in 2015 for a firm called Antshares, which was eventually rebranded as Neo. This ICO had two phases, the first of which finished in October 2015 and the second of which ran until September 2016. Neo made around $4.5 million. Another example is Dragon Coin, which raised $13 million in a one-month ICO that closed in March 2018.

Slide 59

This slide lists factors affecting the value of cryptocurrencies. These are supply & demand, node count, cost of production, cryptocurrency exchanges, competition, internal governance, and regulations & legal requirements.

Slide 60

This slide talks about the first factor that impacts the value of a cryptocurrency, which is demand. Cryptocurrencies get their social significance from widespread acceptance and use as a means of exchange. As a coin's utility improves, so does its demand, which boosts its worth.

Slide 61

This slide depicts Node Count as a factor to determine the value of a cryptocurrency. Node count refers to the number of active wallets on the network that can be seen on the internet or a currency's webpage.

Slide 62

This slide depicts the cost of production as a key factor in determining the value of cryptocurrency. To mine cryptocurrency, participants invest in costly equipment and electricity. The cost of mining cryptocurrency rises as more powerful equipment is needed to complete the task. As mining expenses increase, the value of the cryptocurrency must increase to make mining a viable activity.

Slide 63

This slide demonstrates the role of cryptocurrency exchanges in determining the value of a cryptocurrency. More exchanges listing a cryptocurrency can increase the number of investors ready and able to acquire it, increasing demand and leading to an increase in price as well.

Slide 64

This slide highlights competition as a key factor in impacting value of a cryptocurrency. If a new cryptocurrency develops momentum, it reduces the value of the incumbent, causing its price to fall as the new currency's price rises.

Slide 65

This slide depicts the role of internal governance in determining the value of a cryptocurrency. Cryptocurrency networks don't usually follow a set of rigid rules. Developers tailor projects according to the needs of the community.

Instructor’s Notes:

Ethereum, for example, is attempting to switch from a proof-of-work to proof-of-stake system, thereby rendering most of the expensive mining equipment in data centers and people's basements worthless. Ether's value will be hit as a result.

Slide 66

This slide showcases the importance of regulations in determining the value of a cryptocurrency. Regulation makes it possible for investors to take short positions or bet against the price of cryptocurrencies via futures contracts. This should improve price discovery and lower the procing volatility of cryptocurrencies.

Instructor’s Notes:

Regulations may also have a negative impact on cryptocurrency demand. If a regulatory agency modifies its laws to discourage cryptocurrency investment or use, the price of cryptocurrencies are also liable to fall.

Slide 67

This slide talks about the price trends of cryptocurrency. The price of a coin is multiplied by the number of coins in circulation to determine its market cap.

Instructor’s Notes:

In the case of bitcoin, speculation and technological factors determine its value. Special schemes like blockchain incentives are coded into the architecture of the currency itself.

Slide 68

This slide discusses databases of cryptocurrency. These are centralized databases that store crypto market data outside of the blockchain. The distinction between traditional databases and the blockchain is that the former is centralized while the latter is decentralized.

Instructor’s Notes:

Databases are faster than blockchains as there is no verification process.

Slide 89 to 103

These slides include energizer activities to engage the audience of the training session.

Economics Of Cryptocurrency Training Module On Blockchain Technology Application Training Ppt with all 108 slides:

Use our Economics Of Cryptocurrency Training Module On Blockchain Technology Application Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

I am a big fan of their newsletters because that is how I found my perfect requirement at the time of urgency. Thank God, I kept opening those.

-

“Love it! I was able to grab an exciting proposal because of SlideTeam.”