Exploring Centralized And Decentralized Finance Training Ppt

This set of slides in detail covers the concept of centralized finance CeFi and decentralized finance DeFi. It also tabulates differences between both on multiple factors such as control over funds,the risk factor involved,and personal information requirements.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

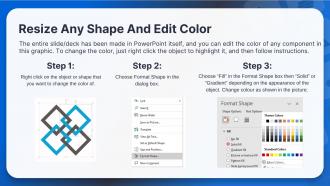

Presenting Exploring Centralized and Decentralized Finance. This slide is well crafted and designed by our PowerPoint specialists. This PPT presentation is thoroughly researched by the experts,and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Download this professionally designed business presentation,add your content,and present it with confidence.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1

This slide illustrates what is centralized finance (CeFi). The centralization process directs an association's planning and decision-making procedures to a single administrator or team.

Instructor Notes:

- In a centralized association, the lead office possesses decision-making control, while all subordinate offices take orders from the main office

- The leaders and specialists who make critical decisions are housed in corporate headquarters

- In centralized finance, all trade orders are channeled through a central exchange (CeFi)

Individuals in-charge of this transaction manage the money, which means that users do not have the permit to their wallet as there is no concept of a confidential key

- Besides, the exchange decides which currencies are available for trading and how much users must pay in exchange

Slide 2

This slide covers advantages and disadvantages of centralized finance(CeFi).

Instructor Notes:

Some of the advantages of centralized finance:

- More Alternatives: Most large financial institutions can provide all of these services in one location, whether you want a private savings or checking account, a trust fund, a certificate of deposit, a Roth IRA, or a corporate checking account. Many traditional banks also provide wealth management and investing services

- Convenience: The nation's most considerable banks, such as Chase, Wells Fargo, and Bank of America, have physical offices and ATMs that are free to visit for customers around the country

- Cash Deposits: Despite advances in fintech, business still have to deal with cash. A conventional bank is an appealing and convenient alternative for banking consumers who frequently deal with cash

- The best of both worlds: Many banks allow consumers to stroll into a branch to deposit cash or transfer money using their smartphones. There is only one option for electronic transfers with online banks or blockchain platforms

Some of the disadvantages of centralized financial services:

- Low or zero interest rates: Compared to online banks, brick-and-mortar banks are infamous for offering lower interest rates on savings accounts

- Wide range of fees: Bank fees may come to mind when you think of a regular bank. Bank of America, for example, imposes a $35 insufficient funds fee

- Poor customer service: According to a Consumer Reports analysis from the year 2015, one of the biggest flaws of large banks is that they do not understand their clients' demands and do not deliver personalized care

Slide 3

This slide showcases an overview of decentralized finance. DeFi is a unique financial system built on secure distributed ledgers, similar to cryptocurrencies. The system eliminates banks' and institutions' control over money, financial products, and financial services.

Instructor Notes:

DeFi is intended to use cryptocurrency for transactions. As technology always keeps evolving, it is difficult to predict how existing cryptocurrencies will be deployed, if at all.

Slide 4

This slide describes advantages and disadvantages of decentralized finance.

Instructor Notes:

The benefits of decentralized finance:

- Decentralized finance lowers the burden of relying on institutions for oversight, data storage, server space, and other considerations. Blockchain networks achieve these goals by ensuring that specific transaction histories may be easily distributed across all members

- The effective use of encryption in conjunction with consensus methods such as proof-of-work has aided blockchain in reaching true immutability. Thanks to immutability, it is nearly impossible to modify any record on the blockchain network

- Decentralization, of course, implies greater transparency, and the distributed ledger contains data on all blockchain network activity

- DeFi has also played an essential role in promoting the development of peer-to-peer lending and borrowing alternatives. Such loan and borrowing options give end-users a variety of potential advantages

- Tokenization is a primary concept that has surfaced only lately in the blockchain arena. Ethereum enables extensive smart contract capabilities, paving the way for the issuance of crypto tokens.

The disadvantages of decentralized finance are as follows:

- DeFi projects have significant challenges in the scalability of the host blockchain from a variety of angles. DeFi transactions require long periods of time for confirmation. At the same time, during a moment of congestion, transactions over DeFi protocols may become extremely expensive

- Liquidity is unquestionably crucial in DeFi-based projects and blockchain technologies. The overall value locked in DeFi projects as of October 2020 was more than $12.5 billion. As a result, the DeFi market size is less than traditional financial systems. Consequently, it may be challenging to place your trust in a sector that does not have as many resources as the specific financial industry

- The DeFi projects accept no responsibility for your errors, and they remove the intermediaries, leaving the users to assume responsibility for their finances and assets. As a result, the DeFi domain requires solutions that can reduce the possibility of human errors and mistakes.Crypto tokens functioned primarily as digital assets on a blockchain, with varying capabilities and applications. Tokens that are unique include utility tokens native to a specific DApp, real estate tokens, and security tokens

Slide 5

This slide lists major points in which decentralized finance differs from centralized finance.

Exploring Centralized And Decentralized Finance Training Ppt with all 21 slides:

Use our Exploring Centralized And Decentralized Finance Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

No second thoughts when I’m looking for excellent templates. SlideTeam is definitely my go-to website for well-designed slides.

-

Huge collection of high-quality templates. Worth each penny.