AML Risk Management Framework Training Ppt

The PPT Training Module on AML CFT Risk Management Framework offers a detailed guide on managing risks associated with Anti Money Laundering and Combating the Financing of Terrorism AML CFT within organizations. It begins by outlining the Objectives of AML CFT Risk Management, setting the stage for a comprehensive understanding of the Frameworks goals. An Overview of Risk Management Framework introduces the audience to the structure and components of risk management in the context of AML CFT. The major constituents of the Framework are Risk Identification, Risk Evaluation, Risk Treatment, and Risk Monitoring and Review. The PowerPoint Deck then outlines a Three Step Approach to Build an AML Program, starting with creating an appropriate organizational environment. It includes Three Steps to Perform an AML Risk Assessment, and implementing organizational measures. The core of the Framework is structured around four pillars Policies, Procedures and Controls Compliance AML Function Independent Audit and Employee Training Program. It concludes with insights into the Foundation of an Effective Compliance Program. The Presentation also has Key Takeaways and Discussion Questions related to the topic to make the training session more interactive. The Deck contains PPT slides on About Us, Vision, Mission, Goal, 30 60 90 Days Plan, Timeline, Roadmap, Training Completion Certificate, Energizer Activities, Client Proposal, and Assessment Form.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

Presenting Training Deck on AML Risk Management Framework. This deck comprises of 27 slides. Each slide is well crafted and designed by our PowerPoint experts. This PPT presentation is thoroughly researched by the experts, and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Not just this, you can also make the required changes in the charts and graphs. Download this professionally designed business presentation, add your content, and present it with confidence.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 3

This slide highlights the objectives of AML & CFT risk management. The effectiveness of an AML & CFT program depends on the accurate assessment of the relevant danger, vulnerability, and risk. It is also dependent on the placement of essential tools for countering ML&TF hazards following the results of the assessment.

Slide 4

This slide gives an overview of the AML/CFT risk management framework. The steps are: Risk identification, risk evaluation, risk treatment, and risk monitoring & review.

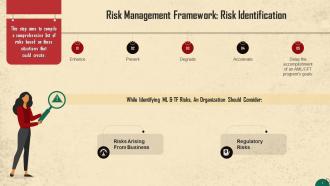

Slide 5

This slide discusses the risk management framework's first step: Risk identification. This step aims to establish a comprehensive list of risks based on those situations that could create, enhance, prevent, degrade, accelerate, or delay the accomplishment of an AML/CFT program's goals.

Slide 6

This slide lists types of risks that an organization should consider while identifying risks associated with money laundering or terrorist financing. These risks can arise from business or can be regulatory risks.

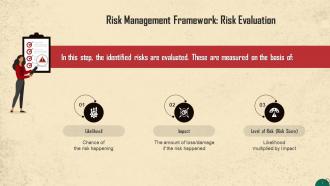

Slide 7

This slide discusses the risk management framework's second step: risk evaluation. In this step, the identified risks are evaluated. They are measured on the basis of likelihood, impact, and level of risk.

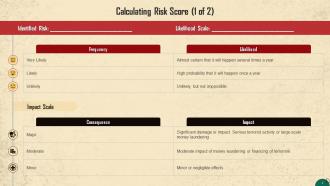

Slide 8

This slide depicts the likelihood and impact scales for calculating the risk score for money laundering and terrorist financing.

Slide 9

This slide showcases risk matrix for calculating the risk score for money laundering and terrorist financing in an organization.

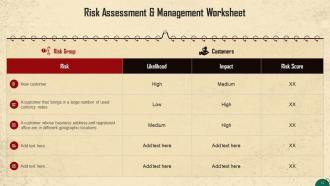

Slide 10

This slide showcases a money laundering and terrorist financing risk assessment and management worksheet for organizations.

Slide 11

This slide discusses the risk management framework's third step: Risk treatment. In this step, an organization tests the methods to manage the risks associated with terrorist financing and money laundering.

Slide 12

This slide discusses the country risk that may encourage money laundering and terrorist financing. Country risk can be defined as the assessment of a country's or jurisdiction's susceptibility to money laundering, terrorist financing, and targeted financial sanctions.

Slide 13

This slide discusses the risk management framework's fourth step: Risk monitoring and review.

Slide 14

This slide depicts a three-step guide for building an AML compliance program for organizations. The steps are: Forming an organizational environment, conducting a risk assessment, and implementing organizational measures.

Slide 15

This slide highlights the three necessary elements for creating an organizational environment. These elements are: corporate culture, corporate strategy, and management support.

Instructor’s Notes:

- Corporate Culture: To effectively build an AML compliance culture and integrate it into daily operations, it is essential for the leadership of the organization to communicate corporate culture and expected behavior. The senior management must deal with money laundering regularly, and significant instances of non-compliance in money laundering violations should be brought to their notice

- Corporate Strategy: The second component is to include AML in the business or risk strategy of the organization. This strategy should clearly emphasize the risks to the organization along with corporate culture and expected behavior towards achieving their risk management goals

- Management Support: This is vital since the organization's managers are responsible for ensuring that the tone set at the top is followed in day-to-day operations. Management communication should be clear and presented in such a way that everyone can understand

Slide 16

This slide discusses the steps to conduct an AML Risk Assessment. These steps are identifying inherent risks, evaluating the internal measures, and determining the residual risk.

Instructor’s Notes:

- Identifying the inherent risk: The inherent risk is the vulnerability to the risk of money laundering in the absence of a controlled environment. Assessments are done across categories to determine the inherent risk. Common categories include clients, products & services offered, distribution channels, geographies, etc.

- Evaluating the internal measures: Internal controls must be analyzed to see how well they mitigate overall risks. To ensure compliance with the relevant AML regulation, controls are used. AML controls are typically evaluated in relation to many control areas, including employee training, corporate governance, policies and procedures, monitoring and controls, and detecting & submitting SARs (Suspicious Activity Reports)

- Determining the residual risk: The risk that is still present after the inherent risk has been mitigated is known as residual risk. It is arrived at by establishing a balance between the degree of inherent risk and the overall effectiveness of the risk management procedures. A three-tier rating system is generally used to assess the residual risk on a scale of high, moderate, and low

Slide 17

This slide discusses the last step of building an AML compliance program which entails the implementation of organizational measures. There are four main pillars that should be considered, which are: Policies, procedures, & controls, AML compliance function, independent audit, and employee training program.

Slide 18

This slide talks about the policies, procedures, and controls to implement organizational measures as a part of building their AML compliance program. Organizations should formalize an overall AML policy in a written document.

Slide 19

This slide discusses the importance of AML compliance function to implement organizational measures. AML programs should appoint a compliance officer to oversee their organization's general implementation of the AML policy.

Slide 20

This slide represents the third pillar to implement organizational measures: Independent Audit. An effective AML compliance program must have independent testing and auditing schedules, and independent testing should occur every 12-18 months.

Slide 21

This slide talks about the importance of an employee training program to implement organizational measures. All employees within an organization should have a working knowledge of AML procedures. Organizations should implement a base level of training for all employees and add further, targeted training to those with more AML-specific responsibilities.

Slide 22

This slide lists important things to keep in mind while building an AML compliance program.

Slide 39 to 54

These slides contain energizer activities that a trainer can employ to make the training session interactive and engage the audience.

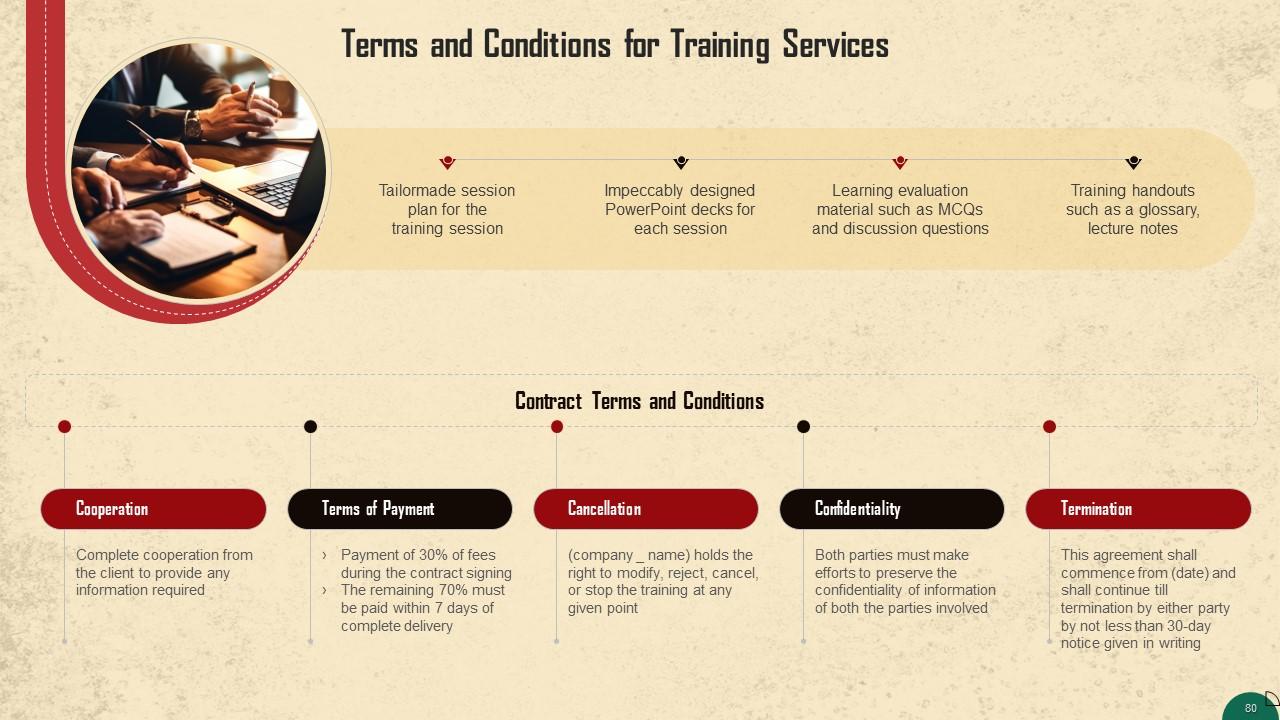

Slide 55 to 82

These slides contain a training proposal covering what the company providing corporate training can accomplish for prospective clients.

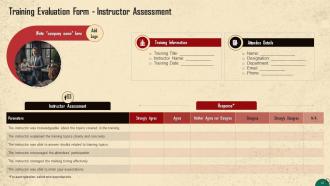

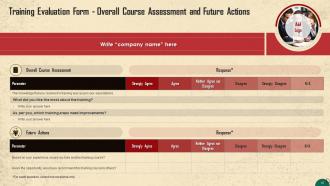

Slide 83 to 85

These slides include a training evaluation form for the instructor, content, and course assessment to assess the effectiveness of the coaching program.

AML Risk Management Framework Training Ppt with all 94 slides:

Use our AML Risk Management Framework Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Every time I ask for something out-of-the-box from them and they never fail in delivering that. No words for their excellence!

-

I loved the hassle-free signup process. A few minutes and, I had this giant collection of beautiful designs.