Blockchain Technology To Counter Terrorist Financing Training Ppt

These slides provide information on blockchain technology use cases to combat anti-money laundering AML and counter-terrorist financing with a proper loan application and KYC verification.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

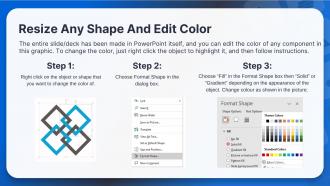

Presenting Blockchain Technology to Counter Terrorist Financing. This slide is well crafted and designed by our PowerPoint specialists. This PPT presentation is thoroughly researched by the experts,and every slide consists of appropriate content. All slides are customizable. You can add or delete the content as per your need. Download this professionally designed business presentation,add your content,and present it with confidence.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1

This slide demonstrates that money laundering is an illegal method of obtaining large significant sums of money through criminal activities, such as terrorist support or drug trafficking. In contrast, Anti-Money Laundering (AML) refers to financial institutions' efforts to comply with regulatory requirements to proactively monitor and report suspicious activity.

Slide 2

This slide illustrates how blockchain can combat money laundering. Every transaction on the blockchain produces a permanent trail of data that cannot be changed. As a result, authorities can track down the source of the funds without difficulty.

Slide 3

This slide showcases blockchain applications in anti-money laundering and counter-terrorist financing.

Instructor Notes:

- Loan application: Law mandates KYC for a loan application. Other checks are also made on credit worthiness. A Blockchain ledger enables the institution's numerous service divisions to evaluate the applicant’s genuineness and creditworthiness

- KYC verification: Financial institutions will not need to ask current consumers to disclose their certificates again for KYC if the institutions adopt blockchain. The blockchain ledger will contain all necessary papers, data, activities, and analyses. The automated KYC verification procedure pulls out expiry dates and automatically sends reminders to the consumer to provide updated documents

- Opening a bank account: To prevent terrorist or money-laundering threats, every bank must verify an individual's identification and complete the KYC due diligence before opening a bank account. The advantages of blockchain are eliminating data silos, risk classification, and time-stamped records. The AML/KYC platform runs checks to know if the authorized owners are bona fide persons or entities when a company account is opened

Blockchain Technology To Counter Terrorist Financing Training Ppt with all 19 slides:

Use our Blockchain Technology To Counter Terrorist Financing Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Great product with effective design. Helped a lot in our corporate presentations. Easy to edit and stunning visuals.

-

If you have visited their site and failed to find the products, try reaching the customer service because it will be the case that you didn't use the search bar well.