Blockchain Technology Applications in Finance Industry Training Ppt

This PowerPoint training module, in detail, covers blockchain technology applications in the finance industry. It includes ppt slides on how blockchain transforms venture capital VC and entrepreneur fundraising, asset management, asset rehypothecation, trade finance, KYC and identity verification, anti-money laundering, regulatory compliance, insurance, and financial products distribution. It also has key takeaways and discussion questions to make the training session more interactive.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

Presenting Training Session on Blockchain Technology Applications in Finance Industry. This presentation deck contains 100 plus well-researched and uniquely designed slides. These slides are 100 percent made in PowerPoint and are compatible with all screen types and monitors. They also support Google Slides. Premium Customer Support available. Suitable for use by managers, employees, and organizations. These slides are easily customizable. You can edit the color, text, icon, and font size to suit your requirements.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 4

This slide describes the concept of Venture Capital. It is a type of financing to businesses and entrepreneurs as an investment. Venture capitalists provide it to businesses which they think have long-term growth potential. This is usually a process that runs in phases.

Instructor’s Notes:

Venture capital has grown from a marginal activity at the end of World War II to a complex business with actors who play a crucial role in fostering innovation.

Slide 5

This slide lists the various benefits of investments made by venture capitalists for start-ups. The advantages include equity participation & capital gains, base for building networks, help in raising additional capital, providing opportunities for expansion of business, and valuable guidance.

Slide 6

This slide lists the two major issues the traditional venture capital industry faces, which makes it highly inefficient. These issues are that the entire fundraising process is highly time-consuming and costly.

Instructor’s Notes:

The traditional venture capital sector has an inefficient structure steeped in secrecy and mystery. A group of investors with access to proprietary deal flow spend a lot of time soliciting and deploying funds that authorized investors (LPs) provide. This causes a lot of unwarranted delay at every stage of the approval process. In the end, it costs both time and money.

Slide 7

This slide discusses the scope of blockchain technology as a solution to the that the traditional venture capital industry is plagued with. Blockchain accelerates the fundraising process as it provides alternatives for raising capital. These are initial coin offerings (ICO), equity token offerings (ETO), initial exchange offerings (IEO), and security token offerings (STO).

Slide 8

This slide gives an overview of Initial Coin Offerings (ICO) and the companies that are using it to raise funds. The ICOs are similar to initial public offerings (IPOs), except that the coins created in an ICO may also be used to purchase a software service or commodity.

Slide 9

This slide depicts the timeline of an unsuccessful ICO that Telegram Open Network launched. The TON ICO came into being in January 2018, before folding up in March 2020.

Instructor’s Notes:

- After the first announcement, the Telegram Open Network (TON) cryptocurrency project around $1.7 billion from private investors in its ICO

- Thanks to the Securities and Exchange Commission (SEC), the TON project came to an abrupt halt. In an inquiry it conducted in October 2019, the SEC concluded that Gram, the cryptocurrency connected with TON, was an unregistered security

- In March 2020, a judge upheld the SEC ruling on not allowing an ICO linked to Gram. The impact of the ruling meant that Gram could no longer be disseminated not only in the US, but across the globe

- The SEC also ordered the Telegram Group to refund more than $1.2 billion to investors and pay $18.5 million in civil penalty

Slide 10

This slide discusses the concept of Equity Token Offerings (ETO) as an implementation of blockchain technology in Venture Capital. An ETO is a security token that holds the contract on a blockchain.

Slide 11

This slide illustrates Equity Token Offering as a hybrid investment model, which combines the advantages of an Initial Public Offering (IPO), an Initial Coin Offering (ICO), and Venture Capital (VC).

Slide 12

This slide discusses the advantages of an ETO and how it can allow firms to quickly reach out to investors and acquire funds for their growth plans.

Slide 13

This slide gives an overview of Initial Exchange Offerings (IEO) that start-ups use to raise funds. These utility tokens confer privileged status with the startup. All this is done on a cryptocurrency exchange platform. This solves the problems of reliability for subscribers and liquidity. In IEO, crypto exchanges assist in token sale as these ensure that the project vetting process has been thoroughly followed, in both letter and spirit.

Slide 14

This slide illustrates the five-step process for the working of initial exchange offerings. The steps include white paper drafting, project submission, vetting process, contract agreement, and security & legality.

Instructor’s Notes:

- White Paper Drafting: Start-ups create a white paper that details how tokens will be supported and the funding sources and payment infrastructure that will be available for transfers and transactions using the new cryptocurrency

- Project Submission: The firm or project registers with a platform that they wish to sell their tokens from

- Vetting Process: Now, crypto exchange platform conducts its own due diligence to ensure that the project and token issuer are creditworthy. This comprises a review of the project's unique selling features, a tokenomics analysis, a team background check, and drawing up projections about the business

- Contract Agreement: If the cryptocurrency exchange platform accepts the IEO, the project is expected to pay a percentage of its utility tokens to the forum and a listing fee before the tokens are put up for sale

- Security & Legality: The Securities and Exchange Commission (SEC) does not supervise IEO investments since they do not provide an investment stake in the firm. This might make the process of selling and issuing IEO tokens easier for organizations looking to raise seed money for their new cryptocurrency

Slide 15

This slide lists the advantages of Initial Exchange Offerings as an application of venture capital. An IEO is simple for users to engage and promises instant user-base. Investor confidence is high as an exchange is allowing its platform to be used to raise IEOs.

Slide 16

This slide gives an overview of Security Token Offerings (STOs) as an application of blockchain technology for venture capital. An STO is a regulated security offering that is built on blockchain.

Slide 17

This slide depicts the typical process that needs to be followed to launch a Security Token Offering. These steps include preparation, designing the offering, selecting service providers, raising capital, and listing of security on the trading platform.

Instructor’s Notes:

- Preparation: Following the development of an idea/business plan, the issuer provides investor data for its target investors. The investor presentation should include information on the company's operational plan, profit forecast, capital requirements, and independent appraisal

- Designing the Offering: The issuers determine the amount, value of each token, soft capitalization, embedded rights, and duration of the offering

- Selection of Service Providers: Issuers choose a blockchain platform, construct the security token, and reissue it to the intended investors at this point. Investors can store their tokens in digital wallets provided by some blockchain systems. Issuers would also have to evaluate the blockchain platform's listing rules at this stage

- Raising Capital: The issuer determines their target investors with the help of the brokers, holds meetings and distributes the STOs to target investors

- Listing of Security on the Trading Platform: The issued token is, often, sold to a Special Purpose Vehicle ("SPV") and reissued on the trading platform. Issuers may perform additional marketing operations and employ a market maker to boost liquidity

Slide 18

This slide lists various benefits of Security Token Offering to raise venture capital using the blockchain technology. The advantages include improved access to real-world digitized assets, cost reductions, increased liquidity, etc.

Instructor’s Notes:

Security tokens act as a doorway for traditional finance to venture into the blockchain realm due to the regulated structure of Security Token Offerings (STOs). These may be used to raise money from all around the world. As the blockchain environment is decentralized, the post-STO liquidity is greater than tokens that are restricted to a single country.

Slide 19

This slide discusses the challenges to the development of STOs. The barriers include legal protection of assets, regulation over crypto-related intermediaries, and accounting & valuation.

Instructor’s Notes:

- Legal Protection of Assets: Although the investor's name may be documented in the smart contract, the legal stance on whether virtual assets are "property," may be unclear or include overlapping and even contradictory regulations across geographies

- Regulation over Crypto-related Intermediaries: Even though an increasing number of digital asset intermediaries, market infrastructure providers, issuers, and promoters are regulated, critical aspects of the crypto industry remain unregulated

- Accounting & Valuation: Despite the fact that real-world assets, more often that not, back STOs, determining the value of virtual assets is challenging. Accounting professionals have difficulties determining the fair value of STOs

Slide 21

This slide introduces the concept of Records Management as a part of asset. We also internalize the reasons on how it is an essential requirement in the financial sector.

Instructor’s Notes:

- Records Management: Identifying, classifying, storing, retrieving, tracking, and discarding or permanently preserving records is part of this process

- Importance: Effective management of your latest records (both paper and digital); reduced/eliminated record-keeping discrepancies; lower costs for records storage equipment; and creation of more usable office space by eliminating unnecessary file storage are a few benefits of Records Management. The process also ensures institutional accountability and timely information access

Slide 22

This slide showcases the value that asset management brings to the table. It needs to be a top priority for an organization within the finance sector as it ensures that the business is accountable, can manage its risks, has accuracy in tracking its assets and eliminates ghost assets.

Instructor’s Notes:

- Accountability: Successful management of assets makes it simple for businesses to maintain track of their assets. With greater visibility of where assets are situated, how they are being used, and whether they have been modified, asset recovery can be more effective, resulting in higher profits

- Accuracy: As assets are verified continuously, the procedure itself guarantees that they are appropriately recorded in the financial statements, ensuring the accuracy of amortization rates

- Risk Management: Asset management encompasses the process of identifying and managing risks associated with the use and ownership of specific assets

- Elimination of Ghost Assets: There have been occasions where assets that were lost, destroyed, or stolen were documented incorrectly on the books. The organization's owners need to be informed of any assets that have been lost as a result of a strategic asset management plan and these be removed from the live assets book

Slide 23

This slide discusses problems associated with the existing system of asset management it being a slow and complex process, presence of multiple intermediaries, and the inability to meet market demands.

Instructor’s Notes:

- Slow & Complex: The asset management sector has increased significantly in size and complexity during the last few decades. As a result, managing assets in a timely and effective manner can be challenging

- Multiple Intermediaries: The presence of intermediaries at practically every step of the process signals overreliance on people, which can lead to errors and discrepancies, slowing down and complicating the process

- Show to Respond to Market Demand: Institutions are slow to respond to shifting investor demands and stringent financial regulations imposed around legacy systems

Slide 24

This slide discusses the scope of blockchain technology as a solution to problems that the conventional approach to asset management poses within the financial sector.

Slide 25

This slide showcases the step-by-step process for successful implementation of a blockchain-based asset management system that financial institutions may adopt. With this pathway, they can choose a transformative implementation plan that also mitigates risks.

Instructor’s Notes:

- Inspiration: To get inspired about blockchain and choose to gather information from sources that have a better understanding of the technology

- Education: The inspiration phase engages the imagination, while the education phase focuses on the practical. Creativity gives way to the gathering and assimilation of information during the educational phase

- Ideation: When a critical mass of personnel is inspired and educated on blockchain, organizations can move into ideation. Effective ideation yields action and brings order to chaos without ignoring good ideas that may arise

- Collaboration: Asset management organizations might go on to the collaboration stage after their ideas have been tested. Often, companies form alliances with industry groups and blockchain developers during this stage

- Prototyping: At this point, investment management businesses developing a custom solution are ready to construct a functioning prototype of leading projects with the knowledge and relationships gained

- Implementation: Compared to the possible danger involved with solutions, an organization's risk investigating, testing, and prototyping is relatively low. Throughout the development and launch of a product, businesses should be prepared to invest in security and risk mitigation. The system's verification and validation prior to launch are essential steps in the implementation process

Slide 26

This slide discusses the scope of blockchain technology as a tool for asset management. It lists benefits like client onboarding, operational efficiency, regulatory compliance, open collaboration, and improved security that can help forge the future of asset management in the financial sector.

Instructor’s Notes:

- Client Onboarding: Confirming that the persons involved are who they claim they are is the first step in starting any financial relationship. It's becoming increasingly difficult to do so in a method that's both efficient and fool-proof due to data leaks, hacking, and malware attacks. Given that blockchain promises to dramatically decrease, if not eliminate, such problems, identity management or client onboarding and data security are likely to become the most common blockchain applications for asset management organizations

- Operational Efficiency: In an industry where corporations are increasingly investing hundreds of millions of dollars to lower trade execution time from milliseconds to microseconds, data communication speed is critical. Aside from reducing order processing times, faster data transmission speeds mean managers will be alerted to news affecting their clients' portfolios much faster, giving them those precious few additional seconds in dealing with difficulties as they emerge

- Regulatory Compliance: When it comes to investor engagement, management reporting, and regulatory compliance, blockchain's secure and transparent nature of gathering transaction data might be helpful. Using technology rather than teams of people to comply with anti-money laundering programs, information security requirements, and privacy laws can help save costs, enhance efficiency, and lower the chance of individual errors or fraudulent conduct

- Open Collaboration: Blockchain enables you to build a system that combines third-party technology and processes with internal systems to provide one source of truth for asset management activities. This facilitates the addition of new partners using blockchain-assisted transactions

- Improved Security: Blockchain enhances data security. It is simply far superior to traditional security approaches, as it provides an immutable record of all transactions. Before each block is linked to others, it is encrypted, and distributing the records across nodes reduces the impact of a data breach

Slide 27

This slide talks about the barriers to adoption of blockchain technology in asset management. Asset managers and financial services industry are gradually embracing the technology's benefits. Yet, some roadblocks continue to persist in the full-fledged adoption of blockchain for asset management.

Instructor’s Notes:

- Lack of familiarity: Despite the tremendous benefits that blockchain technology offers to the banking industry, it has been reluctant to adopt it. One of the causes is a lack of familiarity of the market with the technology

- Regulatory Framework: Other difficulties include an emerging regulatory framework and a lack of experience in managing vast amounts of data. While there haven't been any verified data breaches of blockchain backbones so far, there have been flaws in smart contract implementation, usually owing to coding errors

Slide 29

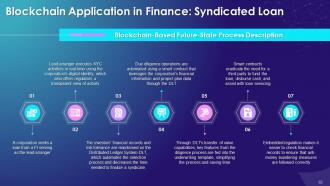

This slide demonstrates provides an overview of syndicated loan as a blockchain application in finance. Syndicated loans enable clients to get large-scale, diverse funding at current market rates. These loans are funded by a group of investors (a Syndicate), with one investor acting as the lead arranger.

Slide 30

This slide depicts the present condition of the syndicate loan procedure. We go through the six steps which start with a company seeking a loan from a financial institution and culminates at a lead arranger assuming administrative responsibility during the loan lifespan.

Slide 31

This slide lists the issues with the present state of syndicated loan.

Instructor Notes:

- Time-consuming procedure: Selecting syndicate members based on financial health and industry experience is time-consuming and inefficient due to the manual assessment procedure

- Inadequate integration of technologies: Team members use tools and data sources, which adds time and increases the possibility of mistakes

- Labor-intensive process: Documenting syndicate member pledges is labor-intensive and inefficient, with manual processes a huge pain-point

- Inefficient money distribution: The lead arranger facilitates principal and interest disbursement, incurring additional fees for investors

- Danger of default: Throughout the loan lifespan, the lead arranger lives under the fear of loan default

- Delayed settlement time: Payments settle in transaction date plus three days, delaying investors' access to funds

- Costly intermediaries: Third-party companies make servicing operations more accessible but at a higher cost to investors

- Siloed systems: Systems of all lenders do not interact, leading to duplication of activities

Slide 32

This slide illustrates how blockchain technology can overcome the current syndicate loan process — starting from a corporation seeking a loan from a FI serving as the lead arranger to embedding regulation. This makes it easier to check financial records to ensure anti-money laundering measures are followed correctly.

Slide 33

This slide expands upon the benefits of blockchain technology implementation in syndicated loan.

Instructor Notes:

- The formation of syndicates is automated: Syndicate creation is automated using programmable selection criteria within a smart contract, shortening the time it takes for a corporation’s loan to be financed

- Embedded controller: Regulators are supplied real-time financial facts throughout the syndicated loan lifecycle to enable Anti-Money Laundering (AML)/ Know Your Customer (KYC) actions

- Due diligence and underwriting automation: Corporation’s financial data assessment and risk screening are automated, lowering execution time and the number of resources necessary to accomplish these tasks

- Integration of technology: Due diligence systems provide relevant financial information to underwriting systems, optimizing process execution and lowering the time taken for the underwriting process

- Reduces closure time: Loan money is made available in real-time, eliminating the need for traditional settlement and centralized lead arranger processes

- Disintermediation of services: Smart contracts are utilized to carry out pre-fed actions, removing the requirement for third-party intermediaries

- Decreased counterparty risk: The disbursement of principal and interest payments is automated throughout the lifespan, eliminating operational risk.

Slide 35

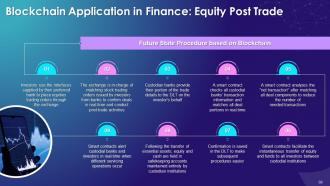

This slide gives an introduction to post-trade processing, which takes place after a deal is completed. At this stage, the buyer and seller examine trade facts, ratify the agreement, modify ownership records, and arrange for the transfer of securities and cash.

Slide 36

This slide lists the present process of equity post-trade. Starting from an investor using interfaces offered by his/her preferred bank to placing equities trade orders on the exchange to a third party interacting directly with the CSD during servicing stages to serve an assurance of trust for custodian banks and investors.

Instructor Notes:

- CSD: Central Securities Depository

- CCP: Central Clearing Counterparty

Slide 37

This slide illustrates present problems associated with equity post-trade.

Instructor Notes:

- Time difference between transaction execution and settlement: Even though investors may view traded assets in their accounts quickly after obtaining confirmation, settlement takes place only after t+3 days, limiting activities that investors can perform in the meantime

- Data inconsistency: As counterparty bank data changes often, CSDs must manually authenticate many transactions prior to settlement

- Counterparty danger: Custodians must plan for the potential risk that a counterparty will be unable to settle the transaction when the time comes

- Operational danger: CCPs must plan for the risk that technological or human faults will result in incorrect settlement

- Settlement ambiguity: Investors are not always alerted when their trades settle, depending on custodial protocols

- Account complexity in safekeeping: Custodians have limited flexibility in storing assets since securities settlement systems connect safeguarding accounts across custodian banks at the CSD

- Costly intermediaries: To begin asset servicing, corporations must enlist the help of third parties and intermediaries

Slide 38

This slide illustrates how blockchain technology can overcome the current equity post-trade process — starting from investors utilizing interfaces supplied by their preferred banks. The technology offers solutions to issues that arise in all stages.

Slide 39

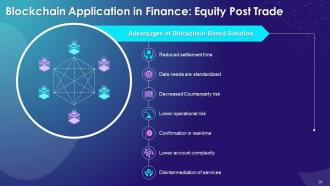

This slide covers the benefits that application of blockchain technology brings to Equity post-trade.

Instructor Notes:

- Reduced settlement time: The settlement could be decreased to real-time settlement, trade date plus one day, or trade date plus two days through downstream, post-transaction automation, and improved efficiency

- Data needs are standardized: Standardizing data fields for trade matching increases the efficiency of the current clearing process

- Decreased Counterparty risk: Risk of any counterparty not settling is reduced due to automatic validation

- Lower operational risk: Using a smart contract to transfer equity and cash reduces the possibility of technological snags or manual mistakes

- Confirmation in real-time: By keeping trade confirmations on Distributed Ledger Technology (DLT), investors can receive settlement notifications without depending on a custodian

- Lower account complexity: Since connectivity with securities settlement systems is no longer essential, custodians will handle assets with greater freedom

- Disintermediation of services: Smart contracts reduce the need for third-party mediators in activities related to servicing

Slide 41

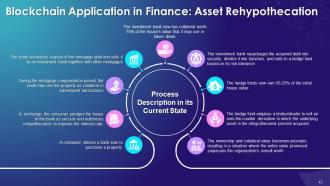

This slide provides an overview of asset rehypothecation, a typical technique in which FIs securitize existing collateral to lower pledging security costs in future deals. Due to the lack of traceable transaction and ownership history, ownership structures and asset composition can become confusing when assets are rehypothecated, increasing counterparty risk and asset valuation uncertainty.

Slide 42

This slide lists the present process of asset rehypothecation. A consumer obtains a bank loan to purchase a property. In exchange, the consumer pledges the house to the bank as security and authorizes rehypothecation to get a lower interest rate on the loan.

Slide 43

This slide provides issues that plague the current process of asset rehypothecation.

Instructor Notes:

- Inadequate reporting to the regulator: Reporting standards in secondary trading marketplaces do not specify the transaction history of the asset

- Counterparty dangers: Investors are unaware of any additional counterparties with ownership rights to the asset

- Inadequate transparency: Regulators lack the capacity to trace securities when they are rehypothecated in the market. Enforcing compliances then becomes near-impossible to execute, as the regulator has been blindsided

- Uncertainty about the security value: With transaction history not kept, each deal leveraging a percentage of the collateral makes determining the asset's underlying worth more difficult

- A pattern of failure: If any of the participants fail, a portion or possibly the entire transaction chain is impacted, which may have undesired implications on related activities in the financial system

Slide 44

This slide illustrates how blockchain technology can overcome the current asset rehypothecation process — starting from the bank obtaining tokenized collateral to record the underlying asset's transaction history on DLT. Once predefined regulatory rehypothecation constraints are met, the smart contract allows/executes subsequent hypothecation of the asset.

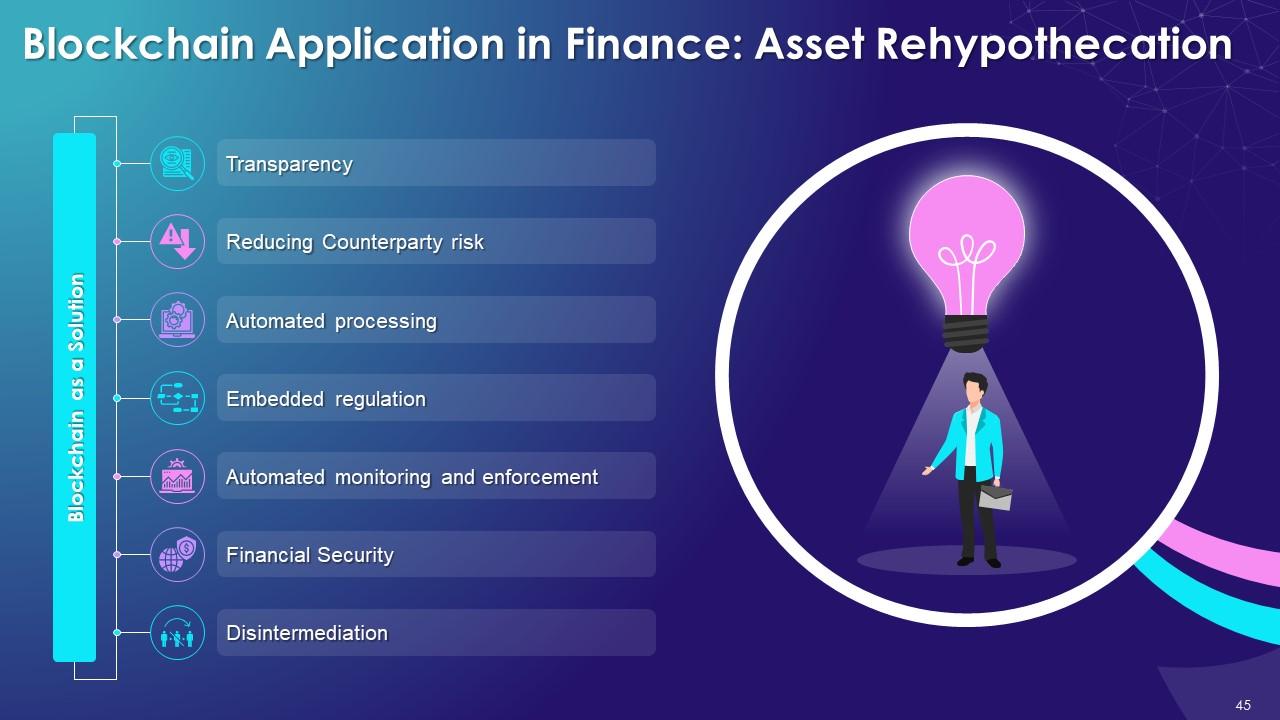

Slide 45

This slide lists seven advantages of blockchain technology implementation in asset rehypothecation

Instructor Notes:

- Transparency: Investors can see the collateral value, risk position, and ownership history. All of these help people make better investment decisions

- Reducing Counterparty risk: Counterparties are graded based on transaction history, allowing investors to hedge their risk by picking the best counterparty for risk profile

- Automated processing: DLT improves processing efficiency by eliminating manual operations and their related expenses

- Embedded regulation: Regulators have a clear perspective of the asset history, allowing them to enforce regulatory limits

- Automated monitoring and enforcement: Smart contracts prevent assets from being rehypothecated without regulatory oversight

- Financial Security: With effective regulatory oversight and the availability of a clear transaction history, the risk of a systemic failure is significantly lowered, in case of a loan default in the event of a default

- Disintermediation: A smart contract simplifies fund transfer as expensive intermediaries are removed from the system

Slide 47

This slide gives an overview of trade finance. Businesses' financial tools and products to facilitate international trade and commerce are referred to as trade finance. It helps importers and exporters streamline their dealings with both efficiency and speed.

Slide 48

This slide discusses the working of trade finance. Conventional finance and credit issuance are not the same as trade financing. General finance is used to maintain solvency or liquidity, although trade financing does not always mean a buyer is short on cash. Trade finance may be used to safeguard against risks unique to international commerce, such as currency fluctuations, political instability, non-payment concerns, or credit worthiness of one of the parties.

Instructor’s Notes:

There are multiple players in the trade finance ecosystem. These are Importers, Exporters, Banks, Insurers, Trade Finance Companies, and Export Credit Companies.

Slide 49

This slide lists benefits of trade finance. These advantages include improved efficiency of operations, increased revenue & earnings, and reduced financial risk.

Instructor’s Notes:

- Improves Efficiency of Operations: Importers and exporters can manage their operations and organize their cash flow with trade financing, as it leads to curbing delays in payments and final delivery of shipments. Trade finance can be considered a way to fund a company's expansion with the collateral on offer being the shipment of products

- Increases Revenue & Earnings: Trade finance enables businesses to grow their revenue and income as the managements can focus on increasing the trade. Continuous cash flow provides businesses with the working capital they require, allowing them to operate more effectively. This comes from the knowledge that their business can meet overheads and other such expenses with ease. Ultimately, this results in more revenue

- Reduces the Risk of Financial Hardship: A firm that does not have trade finance may fall behind on payments and lose a large proportion of clients of suppliers, which might have long-term consequences for the organization. Options such as revolving credit and accounts receivables factoring can assist businesses in transacting abroad, even in times of financial difficulty

Slide 50

This slide lists the pain-points of Trade Finance. The limitations include manual processes, delayed payments, invoice factoring, multiple communication channels, document duplication, and tampering with financial records.

Instructor’s Notes:

- Manual Processes: The issuing bank's manual processes for examining sales contracts and import paperwork, ensuring that there are no irregularities, and providing financials to the exporter's bank or correspondent bank can take time and are prone to human error

- Delayed Payments: Payments are delayed due to financial intermediaries checking to determine if the documents supplied comply with the documentary credit or guarantee requirements. This procedure might take a long time depending on the number of intermediates in the correspondent banking network

- Invoice Factoring: Invoice factoring, which exporters use to present their invoices to banks to get financial leverage, increases the risk profile in the case of a failure on products delivery

- Multiple Communication Channels: Communication routes, techniques, and formats are routinely utilized for trade finance, with underlying papers supplied either electronically or on paper. Businesses and banks are vulnerable to misinterpretation and fraud due to this

- Document Duplication: Duplicate paperwork can be given to banks, this process results in the same transaction being processed twice or more, as well as difficulty in determining whether another financial institution has previously insured a trade

- Tampering with Financial Records: Financial records might be tampered with when the communication route is not verified or safeguarded against unauthorized access

Slide 51

This slide discusses the scope of blockchain technology as a solution for problems that mark trade financing. Companies can use this technology to safely and digitally prove their country of origin, product, and transaction data

Slide 53

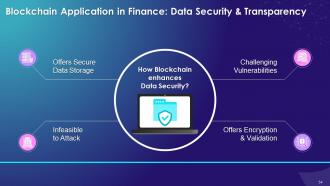

This slide gives an overview of data security basics and its importance in the finance sector since banking institutions are top targets as their databases are of value to hackers and cyber criminals.

Slide 54

This slide lists advantages that blockchain technology offers in terms of data security. These benefits include challenging vulnerabilities, offering encryption & validation, infeasible to attack, and secure data storage.

Instructor’s Notes:

- Challenging Vulnerabilities: A distributed ledger system such as blockchain with its high level of security is beneficial in constructing a secure data network. It enables you to stay competitive without relying on a third party

- Offers Encryption & Validation: Blockchain technology is equipped to handle data security and ensure that data is not tampered with. Since blockchain is encrypted by nature, it can provide sufficient validation

- Infeasible to Attack: The data may be trusted since blockchain is decentralized, encrypted, and cross-checked. As blockchain is so densely packed with nodes, hacking the majority of them simultaneously is almost impossible

- Secure Data Storage: The best method to encrypt the data of a shared community will be to use blockchain. Nobody can access or tamper with any sensitive data that is maintained using blockchain's capabilities. Handling data that is spread over a network of individuals is always an advantage

Slide 55

This slide gives an overview of transparency in finance. It explains the process as it manifests within a financial institution to underscore its importance.

Slide 56

This slide highlights the enhanced transparency that blockchain introduces in the conventional financial system. Transparency in blockchain refers to the ability to examine public addresses from which you may obtain transaction history, assets, and other information without any restrictions or constraints. This level of transparency has never been seen before in any financial system.

Slide 57

This slide talks about the Wells Fargo scandal that involved the creation of around 2 million unauthorized customer accounts that employees created to meet sale targets. Transparency was non-existent, and blockchain technology could have prevented this; at the very least, the fraud could have been detected earlier.

Slide 59

This slide describes payments as a blockchain application in financial systems. Payments in banking are one of the areas where blockchain usage has gathered steam.

Slide 60

This slide explains payments through blockchain in financial systems. Cryptocurrencies such as Ethereum and Bitcoin are built on transparent blockchains that anybody can use to send and receive money. As a result, public blockchains reduce the need for trusted third parties to validate transactions and provide individuals worldwide with access to rapid, inexpensive, and borderless payments.

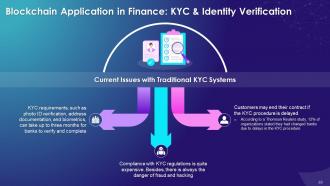

Slide 62

This slide provides an overview of KYC which an essential component in the battle against financial crime and money laundering. Customer identification is critical as it is the first step in participating in the subsequent phases of the process

Slide 63

This slide lists current issues with the traditional KYC systems. KYC requirements, such as photo ID verification, address documentation, and biometrics, can take up to three months for banks to verify and complete. Compliance with KYC regulations is, thus, quite expensive. Besides, there is a danger of fraud and hacking

Slide 64

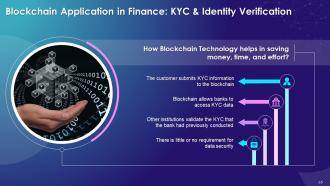

This slide depicts the advantages of using blockchain systems for KYC.

Instructor Notes:

- Distributed Data Collection: Blockchain in KYC places data on a decentralized network, where only those authorization can access it

- Enhanced Efficiency: Capabilities such as an unhackable digital procedure and the exchange of user information over a permissioned network can significantly reduce the effort and time required in the early stages of the KYC process

- Validation of Data Accuracy: Blockchain-based KYC technologies provide transparency and immutability, allowing financial institutions to assess data reliable on the DLT(Distributed Ledger Technology) platform. The decentralized KYC procedure streamlines acquiring safe and timely access to updated user data

- Real-Time Updated User Information: When a KYC transaction is completed at a financial institution, the data is shared on a distributed ledger. This blockchain technology KYC system allows other participating institutions to access real-time updated information with the assurance that they will be alerted if there is a new addition or change made to the record

- Decreased Manual Labour: KYC on Blockchain reduces the need for paperwork

Slide 65

This slide illustrates how Blockchain Technology helps save money, time, and effort. The customer submits KYC information to the blockchain. Blockchain allows banks to access KYC data, and other institutions validate the KYC that the bank had previously conducted.

Slide 67

This slide gives an overview of Inclusive Finance which means that individuals and enterprises have easy access to useful financial goods and services that fulfill their requirements such as transactions, payments, etc.

Slide 68

This slide highlights the importance of inclusive finance in a society by listing the advantage it provides such as economic growth, empowerment of communities, reduction in inequality, and individual benefits.

Instructor’s Notes:

- Drives Economic Growth: Financial inclusion benefits individuals, families, and entire communities and contributes to economic growth of the poor population

- Enables & Empowers Communities: It enables and empowers people by providing them with the knowledge and tools to manage and save their money along with the information they need to make sound financial decisions

- Reduces Inequality in Society: Financial services assist the poorest and most vulnerable members of society in escaping a life of penury, while also alleviating social inequality

- Individual Benefits: Participation in the financial system leads to a host of individual benefits, including the ability to establish and build a business, which allows people to improve their long-term prospects through micro-financing programs. This also enables some of those helped to pay for education of their children; overall, there is the emergence of an educated and informed citizenry

Slide 69

This slide highlights the problem with the current situation of financial inclusion. There are approximately 1.7 billion unbanked individuals due to their inability to prove their identity through documents like a valid passport or birth certificate.

Instructor’s Notes:

These 1.7 billion individuals who traditional banking system does not include. Many of these 1.7 billion are already economically disadvantaged — have few options for sending and receiving money, building a savings account, obtaining credit, or obtaining insurance. Without any kind of financial safety net, any kind of unexpected event related to money spells disaster for this large section of society. No one is really isolated, as we are all interconnected today.

Slide 70

This slide discusses how blockchain technology can be used to promote financial inclusion. It can help in payment services, savings, credit, and insurance.

Instructor’s Notes:

- Payment Services: Unbanked people have a more challenging time sending and receiving money, and they typically lack the necessary documents to create an account, such as a passport or evidence of income. Blockchain applications are becoming a popular choice of technology for remittances, especially for transfer of small amounts of money, since they offer quick, inexpensive, traceable transactions that can store many currencies and be sent across numerous mobile networks, nationally and globally

- Saving: Xcapit, located in Argentina, uses blockchain's decentralized ledger to create an alternative platform that makes savings and investing more accessible for individuals without a bank account, credit, or financial literacy. The blockchain enables Xcapit to create a simple investing interface where consumers can depend on the network's security to know their funds are secure, while benefiting from a faster and affordable investment procedure

- Credit: Credit scores, which banks have historically used to assess credit eligibility, significantly impact economic growth. Grassroots Economics, a blockchain-based initiative established in Kenya and financed by UNICEF's Innovation Fund, attempts to bridge the credit gap in low-income areas

Slide 72

This slide illustrates peer-to-peer transactions. The trade-off or sharing of information, data, or assets between parties without the involvement of a central authority is referred to as peer-to-peer. Peer-to-peer (P2P) interactions include decentralized interactions between people and groups.

Slide 73

This slide demonstrates a few of the significant issues related to current peer-to-peer transaction systems like refunds are difficult to get or, in certain situations, non-existent. Human mistakes are common, such as depositing funds in the wrong account.

Slide 74

This slide showcases the benefits of blockchain technology in peer-to-peer financial transactions. Adopting blockchain technology might serve as a replacement for goods such as cash, credit cards, vouchers, checks, and gift cards by providing digital wallets through which instant completion of global transactions. Other benefits include low-cost currency exchange and an overall easier system to navigate for all stakeholders.

Slide 76

This slide gives an overview of an asset lifecycle and discusses its importance. It is essential for financial products to have an effective and efficient life cycle or asset life cycle to resonate well with the customer.

Slide 77

This slide lists the problems associated with the management of a traditional financial product lifecycle. These issues include lifecycle’s reliance on manual procedures, the presence of multiple layers of intermediaries, and its susceptibility to human error and possible fraud.

Slide 78

This slide showcases solutions for problems associated with the management of traditional financial product life cycle. The solution that blockchain offers includes the possibility of monetization for a number of assets, fulfillment of investor requirements, omission of intermediaries, and enhancement of investor relationships.

Slide 80

This slide introduces the concept of loans in a financial institution along with its key features such as the time period of a loan and the size of the loan. These are dependent on the borrower's need and creditworthiness.

Slide 81

This slide illustrates the process that governs that sanction of a traditional consumer loan. The steps include the filling of application form, document submission, document verification by bank, and loan disbursal.

Instructor’s Notes:

- When you apply for a loan at a bank, the bank must assess the risk that you may default on your payments

- They look at factors such as your debt-to-income ratio, credit score, and property ownership status, among other things

- To obtain this information, they must consult your credit report, which a credit bureau issues

- Depending on this information, banks factor the probability of default into the fee and interest to be charged on loans

- This makes the entire process of loans costly and time consuming and also leads to issues of how accurate the risk assessment has been

Slide 82

This slide showcases how blockchain can transform the traditional lending process. Blockchain addresses gaps created in the traditional lending process due to banks’ inability to assess credit-worthiness. It also tackles the issues of time-consuming documentation and evaluation

Slide 84

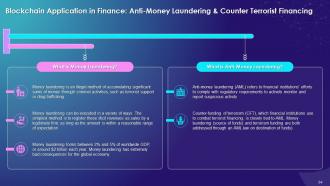

This slide demonstrates that money laundering is an illegal method of obtaining large significant sums of money through criminal activities, such as terrorist support or drug trafficking. In contrast, Anti-Money Laundering (AML) refers to financial institutions' efforts to comply with regulatory requirements to proactively monitor and report suspicious activity.

Slide 85

This slide illustrates how blockchain can combat money laundering. Every transaction on the blockchain produces a permanent trail of data that cannot be changed. As a result, authorities can track down the source of the funds without difficulty.

Slide 86

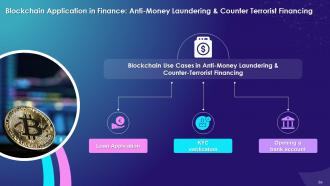

This slide showcases blockchain applications in anti-money laundering and counter-terrorist financing.

Instructor Notes:

- Loan application: Law mandates KYC for a loan application. Other checks are also made on credit worthiness. A Blockchain ledger enables the institution's numerous service divisions to evaluate the applicant’s genuineness and creditworthiness

- KYC verification: Financial institutions will not need to ask current consumers to disclose their certificates again for KYC if the institutions adopt blockchain. The blockchain ledger will contain all necessary papers, data, activities, and analyses. The automated KYC verification procedure pulls out expiry dates and automatically sends reminders to the consumer to provide updated documents

- Opening a bank account: To prevent terrorist or money-laundering threats, every bank must verify an individual's identification and complete the KYC due diligence before opening a bank account. The advantages of blockchain are eliminating data silos, risk classification, and time-stamped records. The AML/KYC platform runs checks to know if the authorized owners are bona fide persons or entities when a company account is opened

Slide 88

This slide introduces the concept of regulatory compliance in financial institutions. Data protection requirements may not cover the entire breadth of financial services compliance, but these are an essential element of the industry.

Slide 89

This slide represents problems with the conventional approach of regulatory compliance.

Slide 90

This slide discusses blockchain technology as a solution to problems with the conventional approach of regulatory compliance in financial institutions. Blockchain ledgers are ideal for sharing information because of their features like immutability and extremely low probability of errors, if any

Instructor’s Notes:

The goal is to create compliant digital assets that behave like traditional asset models while also providing transparent information to relevant parties, lowering investor and regulatory uncertainty

Slide 92

This slide illustrates the unbanked as a financial services opportunity for the unbanked. The term "unbanked" applies to adults who do not use banks or banking institutions in any capacity. Unbanked people typically use cash or purchase money orders or prepaid debit cards.

Slide 93

This slide lists major issues that the unbanked face. They turn to unfriendly lenders with exploitative interest rates and fees because they do not have access to regular banking or lack the know-how to use the service. It restricts their capacity to build history and get micro-loans.

Slide 94

This slide depicts how blockchain can solve the problems of the unbanked. Blockchain-powered banking solutions provide in-built security and the opportunity to construct a decentralized lending network. Blockchain and cryptocurrency-based solutions might fully replace exploitative businesses like check cashing and payday loans with fairer, more transparent systems.

Slide 96

This slide defines Non-Fungible Tokens (NFTs, which means that these cannot be replaced or exchanged due to its unique features. NFTs are used for specific applications that require unique digital items such as Art Work, Music, Trading Cards, Virtual Worlds, and Domain names.

Slide 97

This slide differentiates fungible tokens from NFTs. Fungible tokens are not one-of-a-kind and can be easily traded for another of the same sort, while non-fungible tokens are one-of-a-kind and non-transferable.

Slide 98

This slide illustrates that Financial NFTs comprise everything from insurance and bonds to unique baskets of tokens and tokenized real-world assets. They're on track to become the most extensive single-use of NFT technology to date. A significant example just appeared in Uniswap v3, which began issuing liquidity provision tokens (claims on tokens supplied by market makers) as NFTs.

Instructor Notes:

- Aside from Uniswap, NFTs have already begun to be used for financial reasons as given below

- Yearn. Finance insurance contracts insured by Nexus Mutual are being offered on Rarible as NTFs

- Solve Protocol is programming investment contracts into NFTs to improve transparency and transfer of project tokens

Slide 100

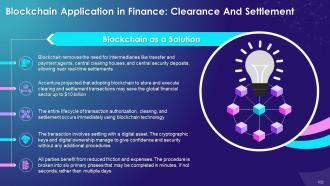

This slide illustrates an overview of clearance and settlement as blockchain applications in finance. Clearance begins with financial institutions sending payment messages over the payment network. The payment network distributes these messages and other associated information to the participating financial institutions for accurate processing of payment instructions. In contrast, the settlement process is needed as financial institutions of the payer and the payee may be different and have different clearing procedures.

Slide 101

This slide depicts current problems with the traditional clearance and settlement systems as a part of blockchain applications in finance. Transaction cycles might take several working days to complete after the transaction date, and multiple intermediates are involved. Data silos also add to the delay

Slide 102

This slide illustrates how blockchain technology solves the problem of traditional clearance and settlement system in finance. Blockchain removes the need for intermediaries like transfer and payment agents, central clearing houses, and central security deposits, allowing near real-time settlements.

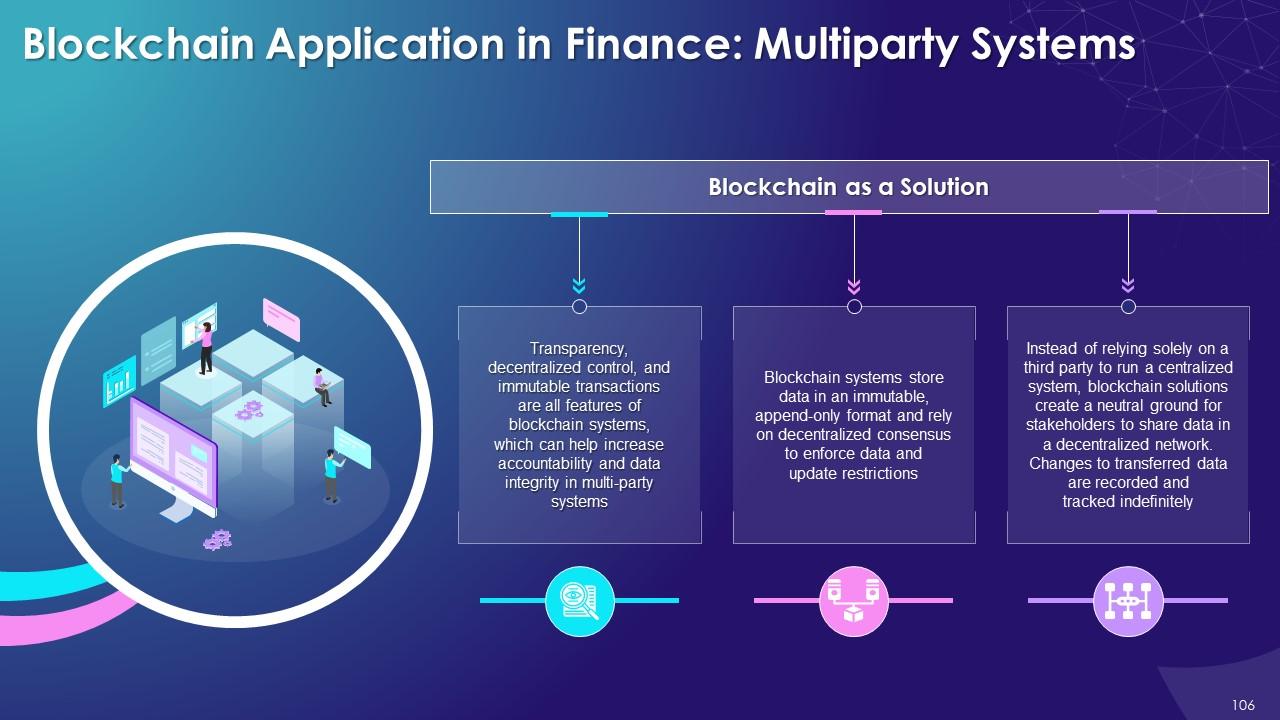

Slide 104

This slide gives an overview of Multi-Party Systems within the finance industry. It also discusses the meaning of the concept along with its importance for collaboration between different organizations.

Slide 105

This slide lists the two major issues that traditional multiparty systems face within the finance sector. The issues are data integrity and process integrity.

Instructor’s Notes:

- Data Integrity: Stakeholders and their business operations may face cost or quality issues due to a lack of faith in data. If data is not trusted, stakeholders may be forced to engage in a lengthy, supplementary procedure with third parties to secure independent validation of documents

- Process Integrity: Due to a significant lack of process integrity, tasks such as authorization and payment may be skipped or performed in the wrong sequence

Slide 106

This slide discusses the scope of blockchain technology as a solution to the problems with conventional multiparty systems. Its features of transparency and immutability can prove to be very useful in this scenario.

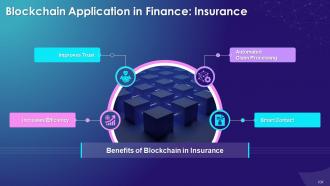

Slide 108

This slide illustrates an overview of insurance as a blockchain application in financial systems and the current problem faced by the insurance sector. Insurance can be done via blockchain accounts using Ethereum smart contracts and decentralized apps, offering increased automation and tamper-proof audit trails. The inexpensive nature of smart contracts and associated transactions means that many items may be made more competitive in underdeveloped markets in developing countries.

Slide 109

This slide lists advantages of blockchain application in the financial system under the insurance sector.

Instructor Notes:

- Increases efficiency: Many operations in the insurance industry are manual and time-consuming, blockchain can help simplify paperwork and reconciliation

- Improves trust: Blockchain cryptography guarantees that transactions are safe, verified, and verifiable while protecting client privacy

- Automated claim processing: Blockchain provides real-time data gathering and analysis, it can significantly accelerate claim processing and reimbursements

- Smart contracts: These programmable contracts include logic executed automatically when certain circumstances are satisfied

Slide 111

This slide highlights issues that financial product distribution faces in today's world. It also provides answers to those problems that blockchain technology makes possible.

Slide 112 to 113

These slides summarize the session on blockchain as a financial system by listing the key takeaways.

Blockchain Technology Applications in Finance Industry Training Ppt with all 120 slides:

Use our Blockchain Technology Applications in Finance Industry Training Ppt to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

SlideTeam is my one-stop solution for all the presentation needs. Their templates have beautiful designs that are worth every penny!

-

I was never satisfied with my own presentation design but SlideTeam has solved that problem for me. Thank you SlideTeam!