Application of merger strategy to increase financial capacity and increase customer base complete deck

Our Application Of Merger Strategy To Increase Financial Capacity And Increase Customer Base Complete Deck are topically designed to provide an attractive backdrop to any subject. Use them to look like a presentation pro.

You must be logged in to download this presentation.

Impress your

Impress your audience

Editable

of Time

PowerPoint presentation slides

Deliver this complete deck to your team members and other collaborators. Encompassed with stylized slides presenting various concepts, this Application Of Merger Strategy To Increase Financial Capacity And Increase Customer Base Complete Deck is the best tool you can utilize. Personalize its content and graphics to make it unique and thought provoking. All the fourty six slides are editable and modifiable, so feel free to adjust them to your business setting. The font, color, and other components also come in an editable format making this PPT design the best choice for your next presentation. So, download now.

People who downloaded this PowerPoint presentation also viewed the following :

Content of this Powerpoint Presentation

Slide 1: Here is the introductory slide of the “Application of merger strategy to increase financial capacity and increase customer base” PowerPoint presentation. Add your company name here.

Slide 2: This is the slide to share the agenda of your PPT presentation. Focus on identifying the need and objective of the company for the merger, identification of essential elements in a successful merger, etc.

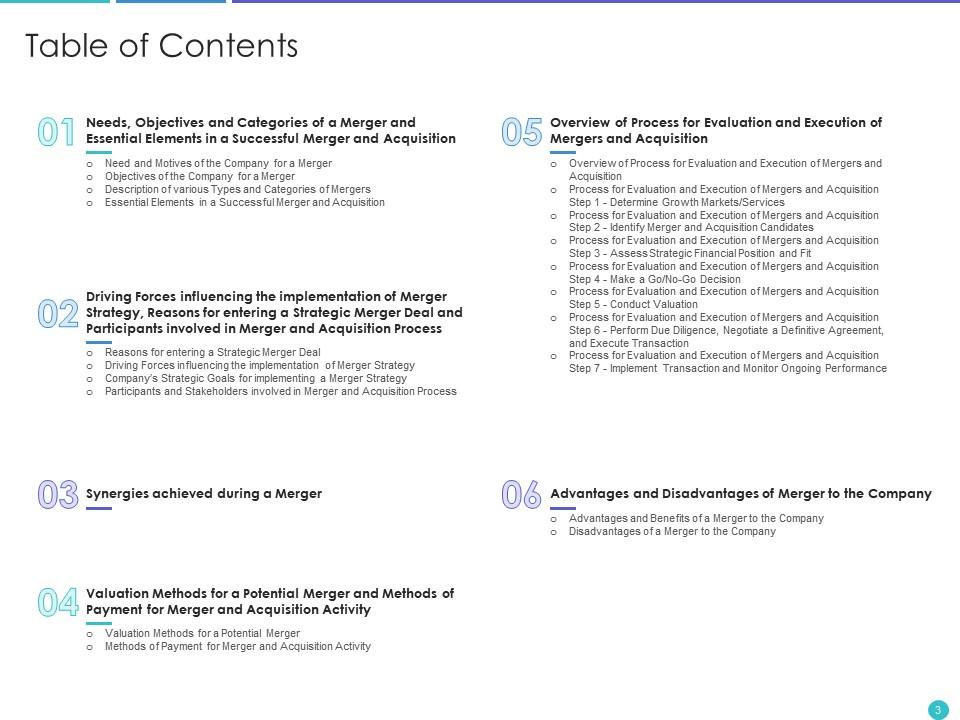

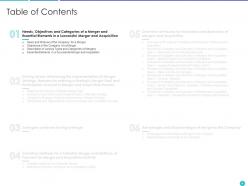

Slide 3: Share the table of contents for your presentation in this slide. Focus on the aspects like the needs and objectives of a merger, driving forces, participants, synergies, etc.

Slide 4: Highlight the first heading for your PPT presentation in this slide, i.e. the needs, objectives, and categories of a merger and the essential elements in a successful merger and acquisition.

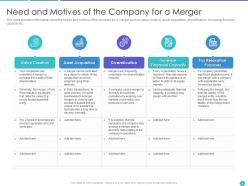

Slide 5: This slide provides information about the needs and motives of the company for a merger, such as value creation, asset acquisition, diversification, increasing financial capacity, etc.

Slide 6: This slide provides information about the company's objectives for a merger such as exponential growth, increase in customer base, greater market control, merging of skills and technology, enhancing the overall industry, etc.

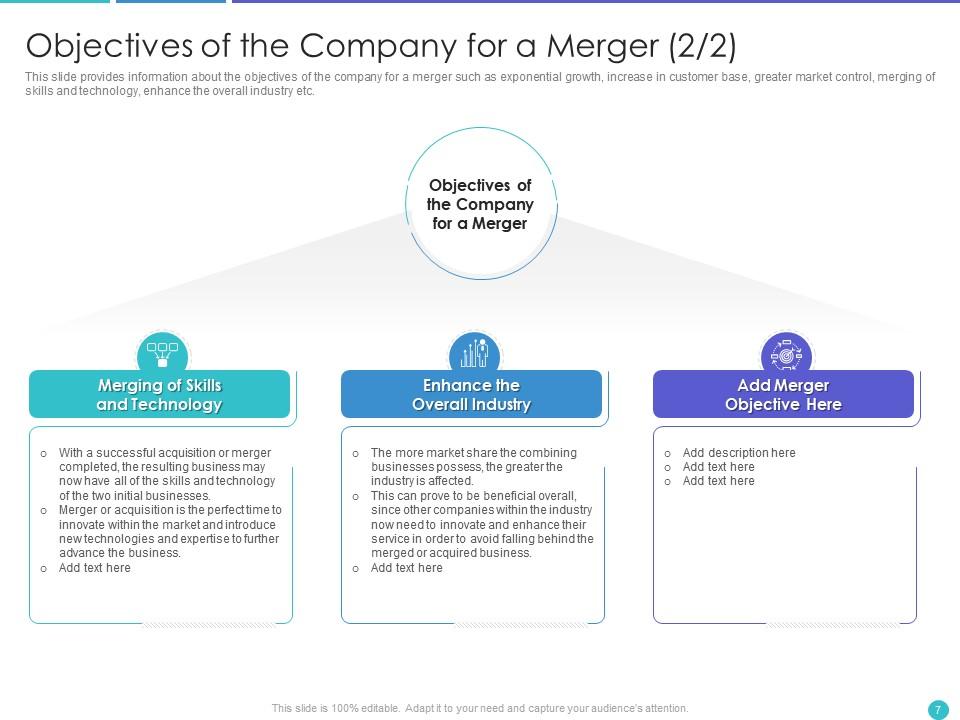

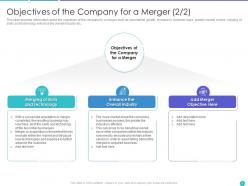

Slide 7: This slide provides information about the company's objectives for a merger, such as exponential growth, increase in customer base, greater market control, merging of skills and technology, enhancing the overall industry, etc.

Slide 8: This slide provides information about the multiple types of merger options/strategies available with the company, such as a conglomerate merger, horizontal merger, market extension merger, product extension mergers, vertical merger, concentric merger, etc.

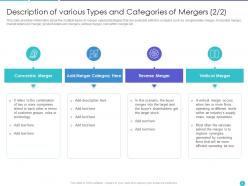

Slide 9: This slide provides information about the multiple types of merger options/strategies available with the company, such as a conglomerate merger, horizontal merger, market extension merger, product extension mergers, vertical merger, concentric merger, etc.

Slide 10: This slide provides information about the essential elements of a successful merger and acquisition implementation, such as mutually beneficial deals, plan alignment, backup plans, a clear timeline, etc.

Slide 11: Share the next heading for your PPT presentation in this slide, i.e. driving forces influencing the implementation of the merger strategy, reasons for entering a strategic merger deal, and participants involved in the merger and acquisition process.

Slide 12: This slide provides information about the major reasons for the mergers in a company and why the company goes for a strategic merger deal.

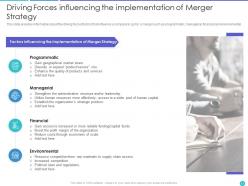

Slide 13: This slide provides information about the driving forces/factors that influence a company to go for a merger, such as programmatic, managerial, financial, and environmental.

Slide 14: This slide provides information about the company's strategic goals behind implementing a merger strategy.

Slide 15: This slide provides information about the participants and shareholders involved in the merger and acquisition process.

Slide 16: This slide provides information about the participants and shareholders involved in the merger and acquisition process.

Slide 17: Share the third heading for your presentation, i.e. synergies achieved during a merger.

Slide 18: This slide provides information about the cost saving synergies achieved by the company during a merging process.

Slide 19: This slide provides information about the revenue enhancing synergies achieved by the company during a merging process.

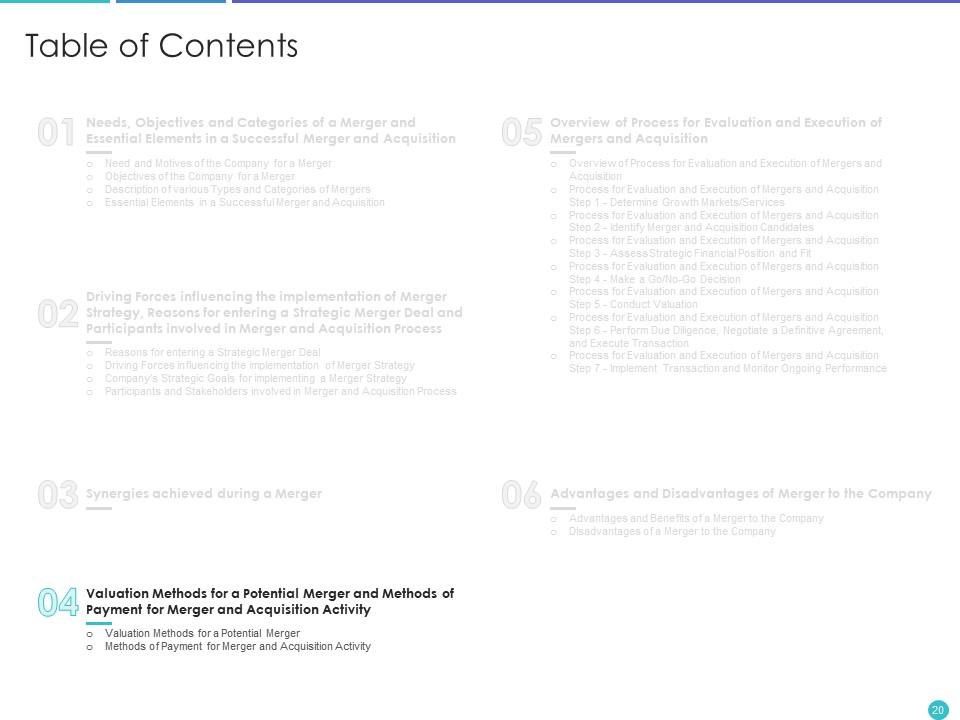

Slide 20: This is the slide to focus on the fourth heading of this presentation, i.e. the valuation methods for a potential merger and methods of payment for merger and acquisition activity.

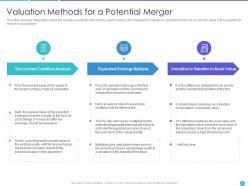

slide 21: This slide provides information about the valuation methods that may be used to value a firm targeted for merger or acquisition that may be used to value a firm targeted for merger or acquisition.

Slide 22: Share the fifth heading for your PPT presentation, i.e. overview of process for evaluation and execution of mergers and acquisition.

Slide 23: This slide provides information about the payment methods for an M&A activity/transaction, such as stock purchase, asset purchase, cash offers, and security offerings.

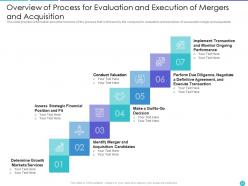

Slide 24: This slide provides information about the overview of the company's process for the evaluation and execution of successful mergers and acquisitions.

Slide 25: This slide provides information about the first and foremost step that the company follows for evaluation and execution of successful merger and acquisition, i.e. determining growth markets/services.

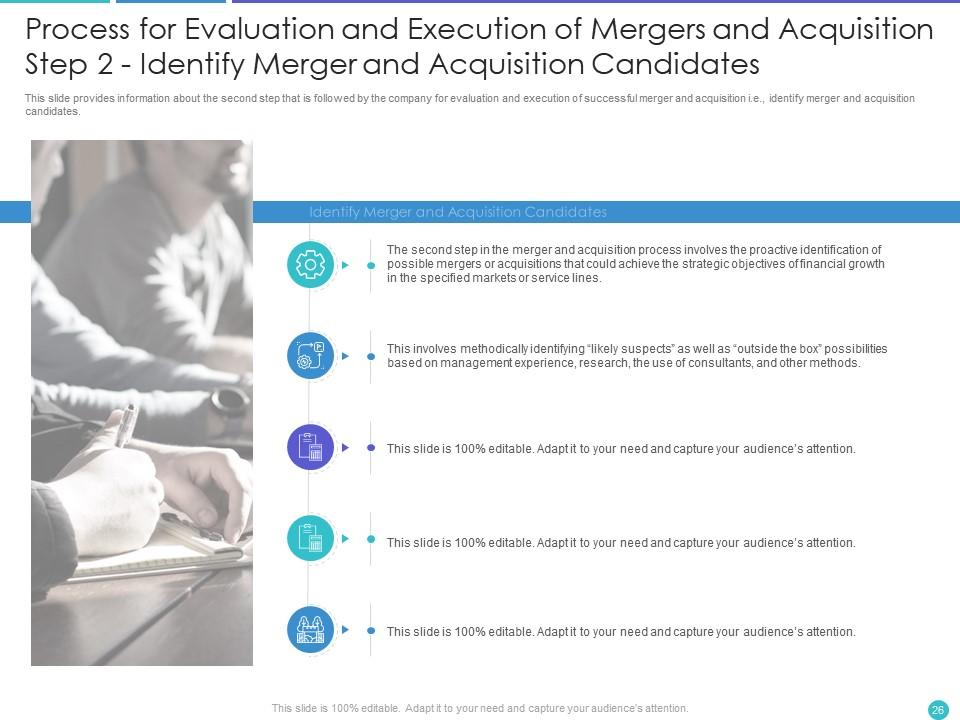

Slide 26: This slide provides information about the company's second step for evaluation and execution of successful merger and acquisition, i.e. identifying merger and acquisition candidates.

Slide 27: This slide provides information about the company's third step for evaluating and executing successful mergers and acquisitions, i.e. assessing the strategic financial position and fit.

Slide 28: This slide provides information about the company's fourth step for evaluating and executing successful mergers and acquisitions, i.e. making a go/no-go decision.

Slide 29: This slide provides information about the fifth step that the company follows for evaluation and execution of successful merger and acquisition, i.e. conduct valuation.

Slide 30: This slide provides information about the sixth step that the company follows for evaluation and execution of successful merger and acquisition, i.e. performing due diligence, negotiating a definitive agreement, and executing transactions.

Slide 31: This slide provides information about the company's seventh and last step for evaluation and execution of successful merger and acquisition, i.e. implementing transactions and monitoring ongoing performance.

Slide 32: In this slide, focus on the sixth heading for your presentation, i.e. the advantages and disadvantages of merger to the company.

Slide 33: This slide provides information about the advantages and benefits of a merger to the company, such as increased market share, reduced operational costs, expansion into new geographic areas, etc.

Slide 34: This slide provides information about the disadvantages and demerits of a merger, such as increased market share, reduced operational costs, expansion into new geographic areas, etc.

Slide 35: This is the Icons' slide for the application of merger strategy to increase financial capacity and increase customer base PowerPoint presentation.

Slide 36: This slide marks the beginning of the additional slides to follow.

Slide 37: This is the 'About Us' slide. Highlight your characteristic features, target audience, and distinct clients in this slide.

Slide 38: Share your 30, 60, and 90 Days plans in this PPT slide.

Slide 39: This is a comparison-based slide to visualize the gender proportion involved in this project.

Slide 40: Share the culminating goals that you aspire to attain with this project.

Slide 41: This is the Post-It Notes slide to share any additional information related to this project.

Slide 42: This slide provides a Venn diagram that can show interconnectedness and overlap between various departments, projects, etc.

Slide 43: This is the roadmap for the process flow slide to share the framework of your project.

Slide 44: This is a timeline slide to share your growth and milestones creatively.

Slide 45: This is another handy additional slide to highlight the four essential aspects of your company that complete it in a creative puzzle format.

Slide 46: This is a "Thank You for watching" slide where details such as the address, contact number, and email address are added.

Application of merger strategy to increase financial capacity and increase customer base complete deck with all 46 slides:

Use our Application Of Merger Strategy To Increase Financial Capacity And Increase Customer Base Complete Deck to effectively help you save your valuable time. They are readymade to fit into any presentation structure.

-

Great designs, really helpful.

-

Qualitative and comprehensive slides.

-

Editable templates with innovative design and color combination.

-

Content of slide is easy to understand and edit.

-

Excellent design and quick turnaround.